Altcoin

The ENA price is confronted with key resistance at $ 0.5 – will bulls break through?

Credit : ambcrypto.com

- Ethena had a bearish construction on the every day graph

- On the idea of native highlights, but it surely appeared unlikely that the prize might comply with

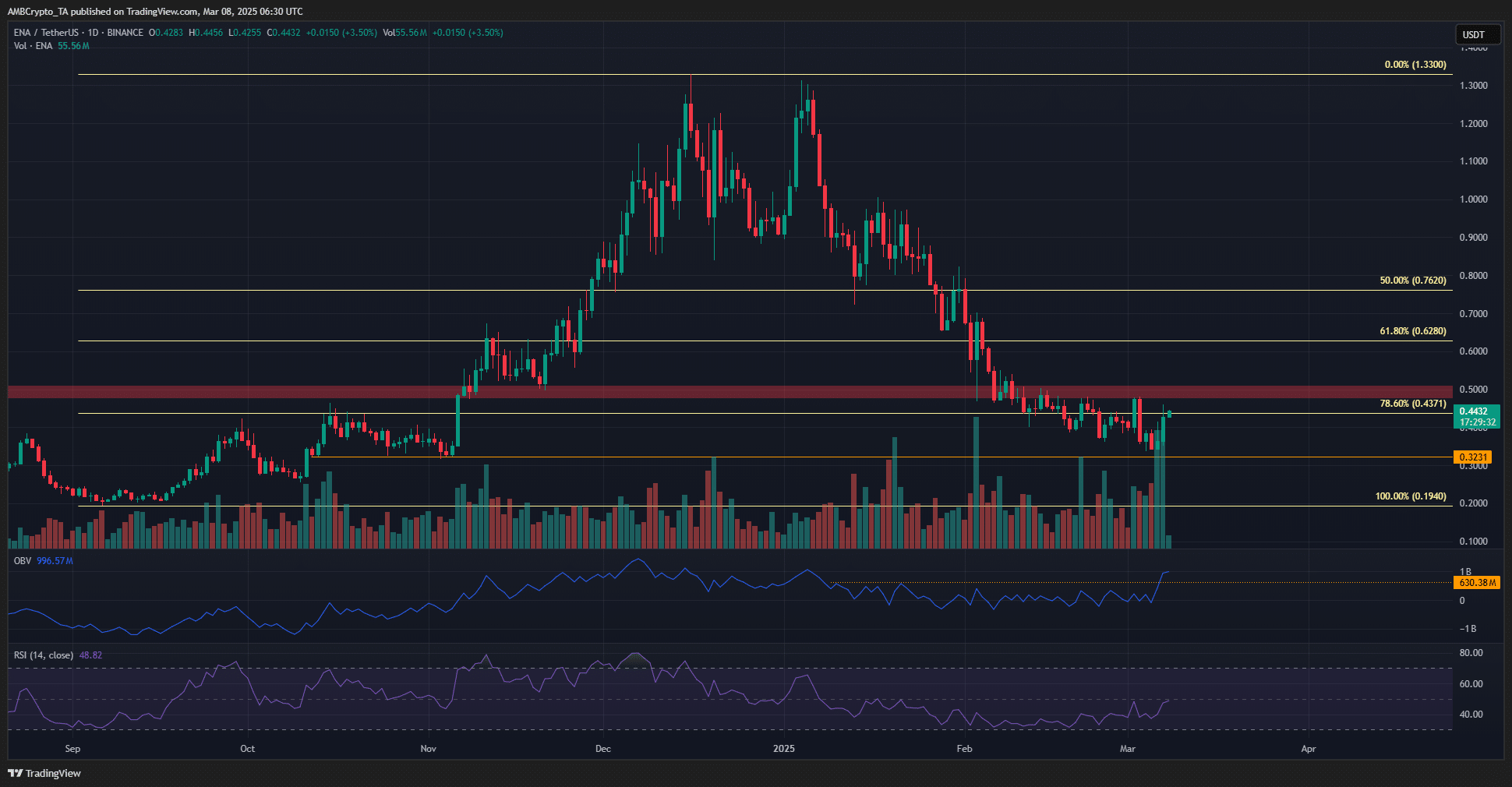

Ethena’s value [ENA] Fell below the $ 0.5 assist zone in February, however the decline appeared to have stopped on the time of the press. The truth is, a spread of attain was noticed below the $ 0.5 resistance. This may supply merchants worthwhile alternatives.

Bitcoin’s [BTC] Volatility may also play a job to play. The main crypto on the planet visited the resistance of $ 92.8K on Thursday 6 March and was once more confronted with rejection. Will Ena additionally see a downward route through the weekend?

Ena -buyers now appear to have the higher hand

Supply: Ena/USDT on TradingView

The market construction on the every day graph was Beerarish. In 2025, the prize solely made decrease highlights and decrease lows. The latest decrease excessive was $ 0.48, and a every day session that will be near it that will point out a market construction shift.

The commerce quantity has been excessive in current days, with the identical mirrored by the amount bars beneath the worth. This consumption of quantity ensured that the BBV broke out after the native highlights of the previous two months.

On the time of the press, the RSI additionally examined impartial 50 as a resistance, with a possible momentum shift across the nook. Collectively they lay on a bullish within the charts.

Supply: Ena/USDT on TradingView

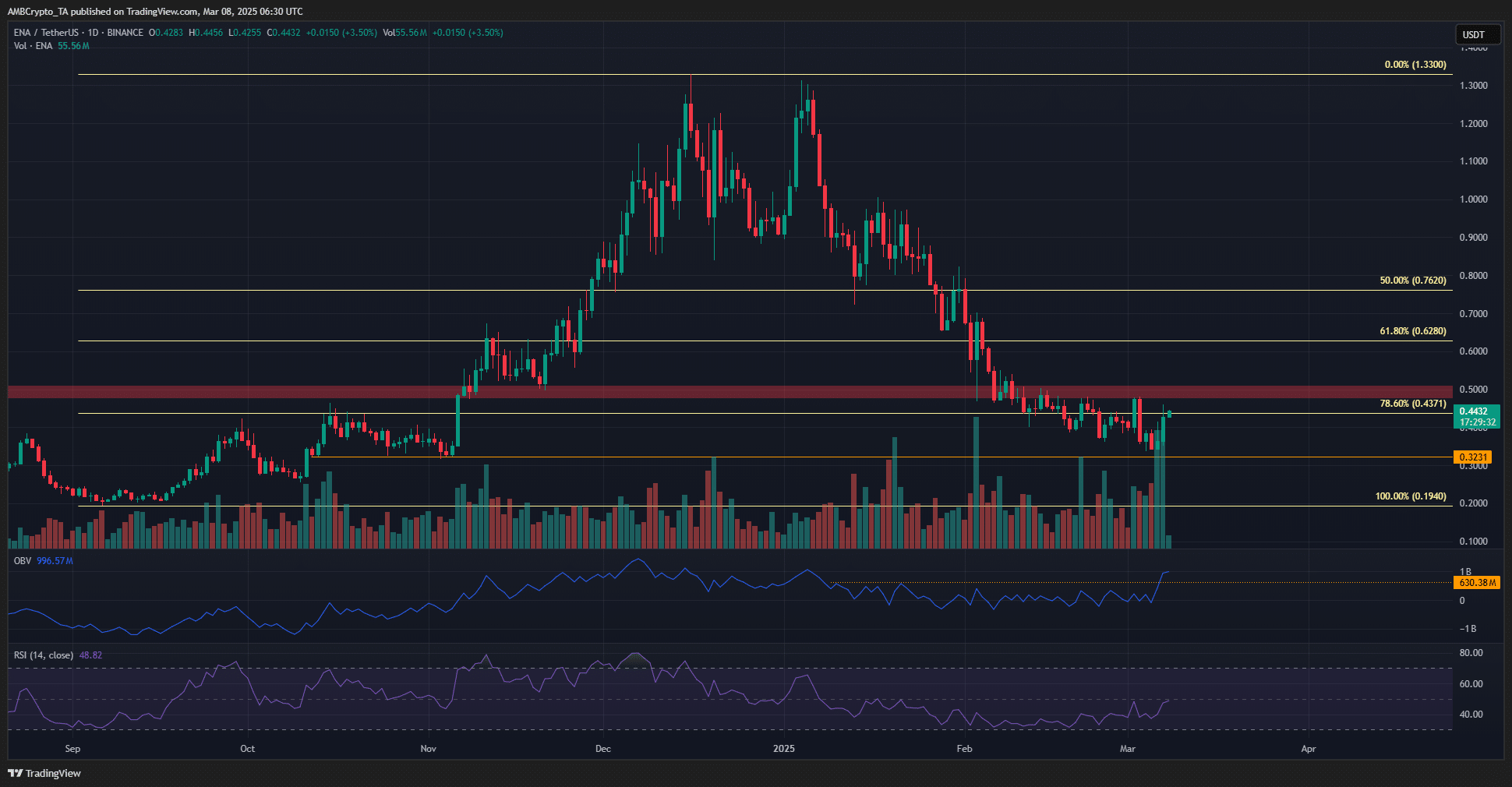

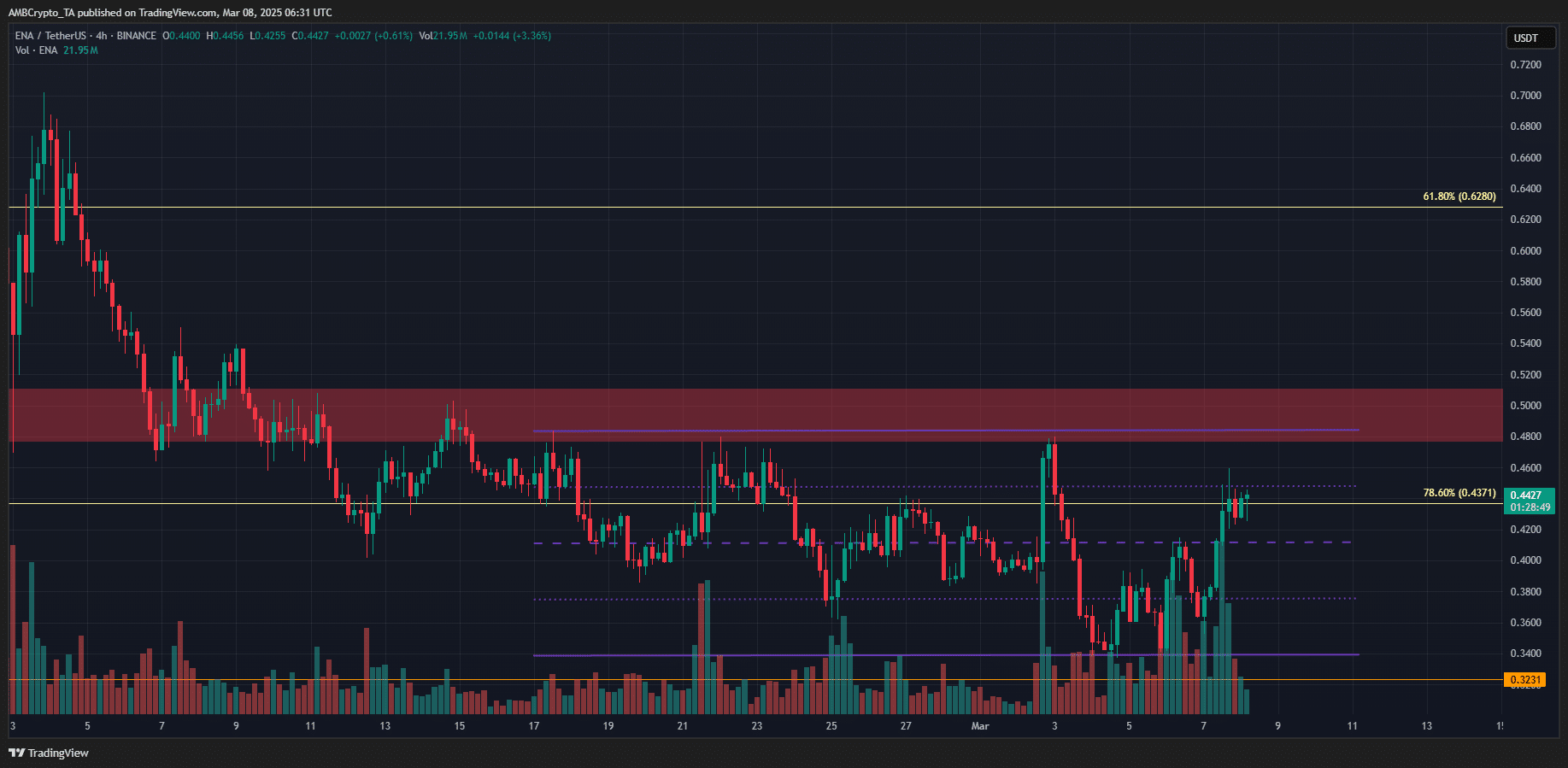

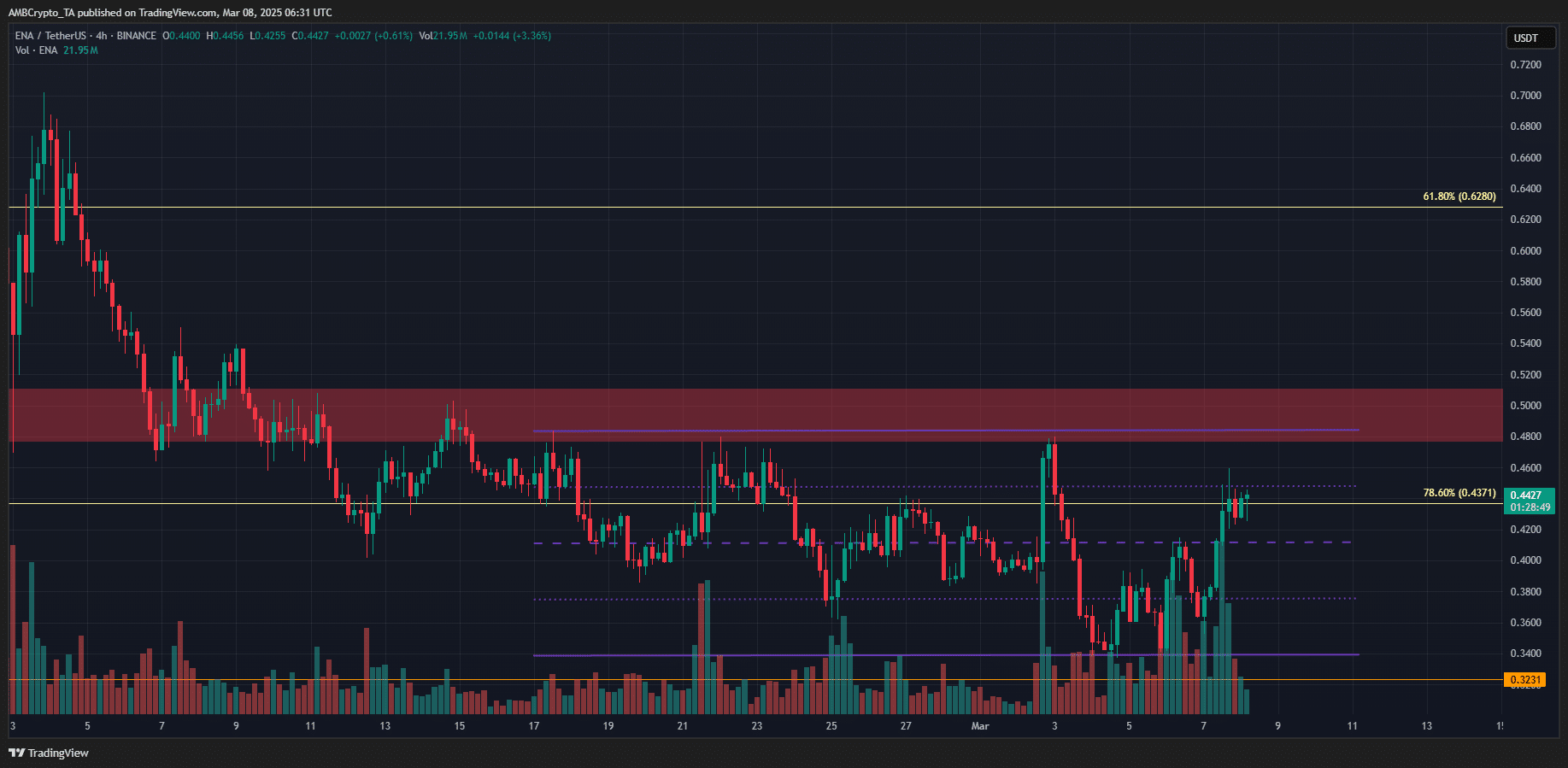

Zooming in on the 4-hour graph, we are able to see a spread (purple) with the highlights inside the $ 0.5 resistance zone. On the time of the press, ENA Bulls struggled with the 25% stage of the vary of $ 0.448.

Even when they achieve overcoming it, a breakout is probably not at hand. Regardless of the OBV-Breakout, merchants should stay Beerarish and so they need to promote the retest of $ 0.48- $ 0.5. It is because the upper bias remained for the Tijderish.

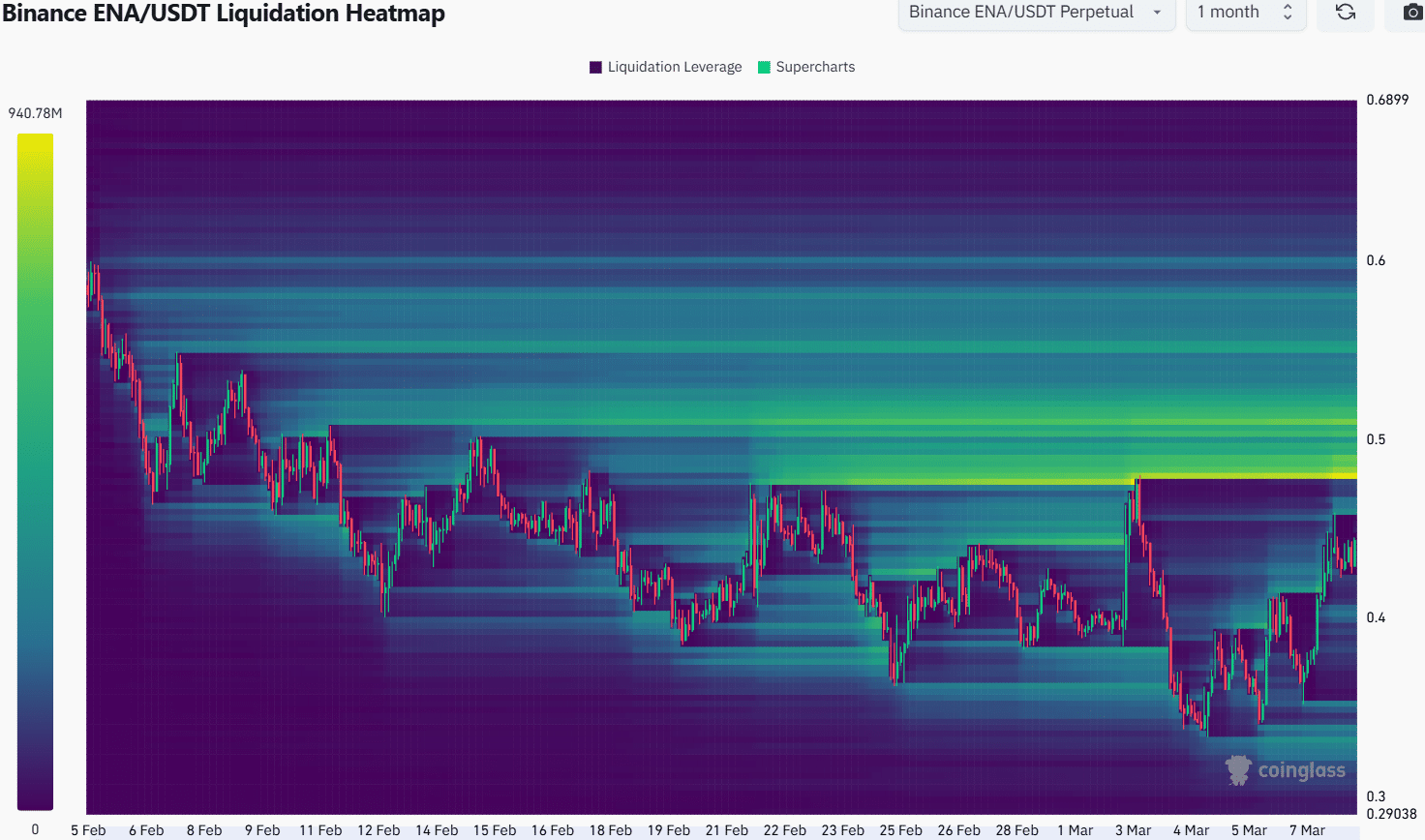

The liquidation of the previous month emphasised the $ 0.48- $ 0.515 as a robust magnetic zone. That’s the reason it is vitally doubtless that the worth would check this area quickly, as a result of the worth is attracted by liquidity. These liquidity clusters additionally shaped prime changing areas.

Swing merchants can use a motion than $ 0.515- $ 0.52 to arrange a stop-loss in the event that they needed to promote. A step additional than $ 0.52, the bearish thought would find yourself right here. The center vary stage at $ 0.412 and the lows of $ 0.34 could be the Bearish targets.

Disclaimer: The offered data doesn’t kind monetary, investments, commerce or different forms of recommendation and is just the opinion of the author

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024