Bitcoin

Trump signs order for U.S. Bitcoin Reserve—But there’s a catch…

Credit : ambcrypto.com

- The chief order of Trump requires an American Bitcoin reserve, with the assistance of present cryptocurrency belongings introduced by the federal government.

- Dalende Change reserves Sign Bullish Sentiment, however expressed concern concerning the liquidity of the market.

In a groundbreaking step, US President Donald Trump has taken an vital step to combine cryptocurrencies into the monetary technique of the nation.

Trump’s Bitcoin Reserve plan takes form

On March 6, Trump signed an government order to arrange a strategic reserve of digital belongings, with the assistance of tokens which can be already in authorities possession as an alternative of buying new ones – who’re insufficient for market expectations for brand spanking new purchases.

Trump organized an unique high of the White Home with high cryptocurrency leaders, constructing on this initiative and his imaginative and prescient of a crypto inventory supported by the federal government.

This unprecedented dedication alerts a shifting regulation panorama, with potential implications for Bitcoin [BTC] And the broader marketplace for digital belongings.

As well as, the US has a Bitcoin reserve, through which market forecasts shifted from 24% to 32%, in keeping with polymarket facts.

This rising hypothesis has already led conversations in numerous states, through which Utah, Arizona and Ohio actively focus on the potential implications of a Bitcoin reserve supported by the federal government.

Nonetheless, not all states have been rejected on board – Zuid -Dakota, Montana and others.

Because the views proceed to diverge, the expectation about an American Bitcoin reserve turns into intensive.

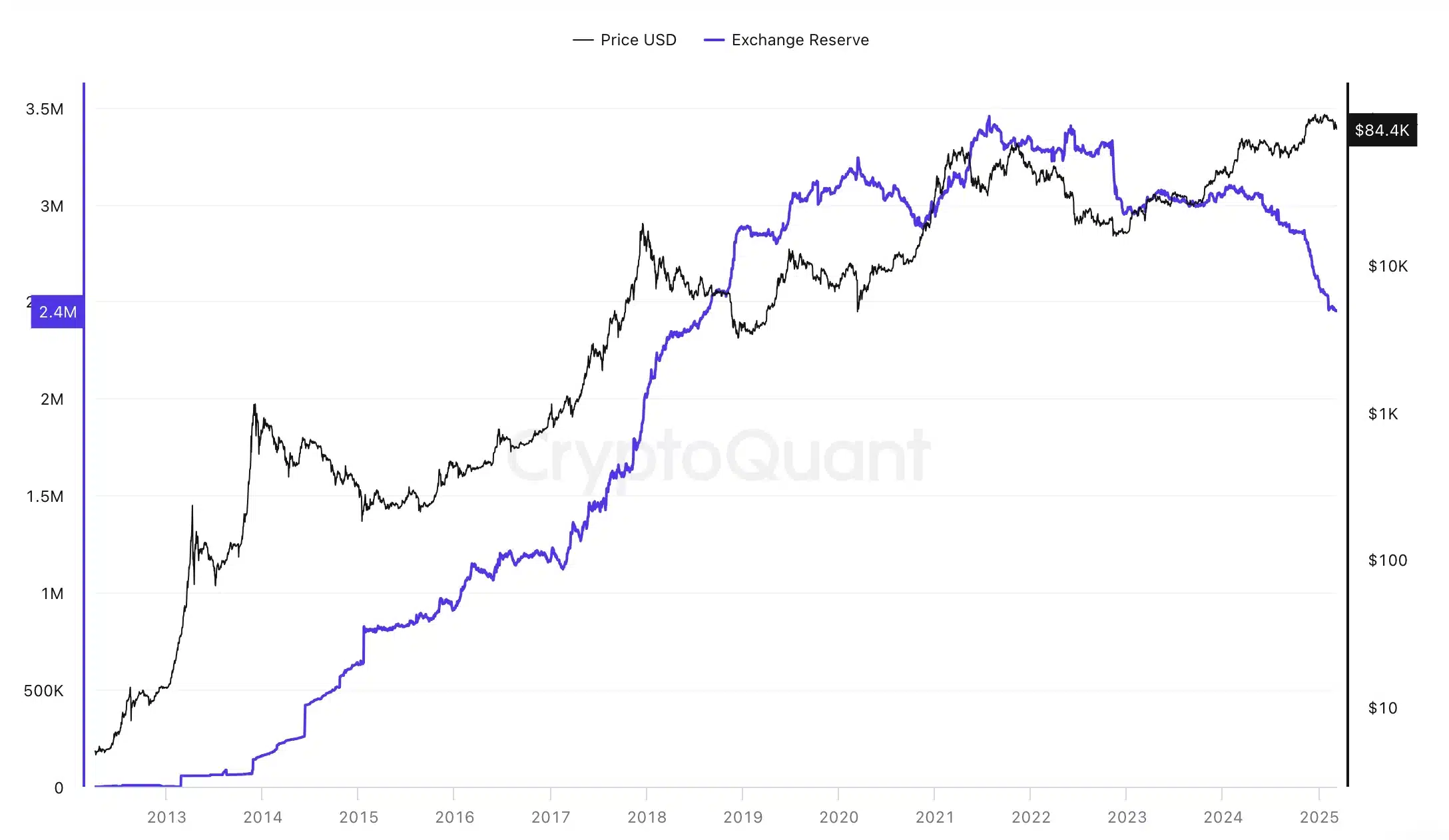

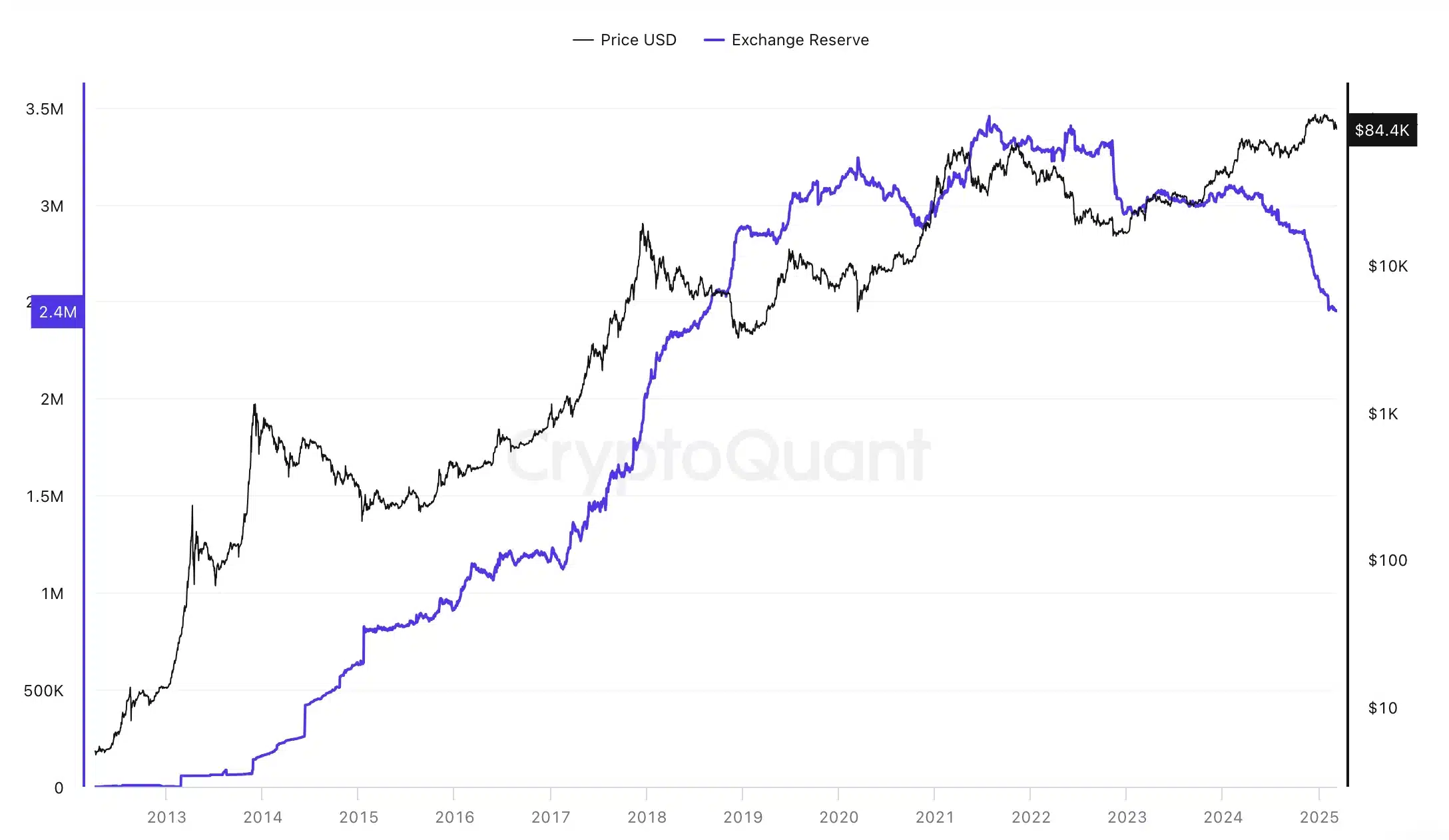

Why do the alternate reserves fall?

Within the meantime, alternate reserves are falling, which signifies a possible provide squeeze, as marked by Moon whales.

“The US creates a strategic #bitcoin reserve. Within the meantime, alternate reserves are in free fall. “

Supply: Maanwalvissen/X

Cryptoquant information additional strengthens this development and divulges that the alternate reserves will proceed to fall.

Supply: Cryptuquant

Traders are more and more transferring their property to non-public portfolios and exhibit a choice for lengthy -term storage over rapid sale.

A shrinking alternate reserve typically signifies bullish sentiment, as a result of a diminished supply can create a possible supply if demand will increase.

This development additionally displays the rising curiosity in deficiency, deployment and chilly storage options for improved safety and different yield choices.

Though decrease reserves can enhance costs, they will additionally scale back the liquidity of the market, which will increase volatility as a result of much less tradable belongings.

What’s ready for us?

Within the meantime, the value of Bitcoin stays below stress, buying and selling at $ 84,557.57, on a interval, after a lower of 1.89% within the final 24 hours, in keeping with Mint market cap.

Furthermore, some segments of the market proceed to point out bullish optimism, anticipating the lengthy -term revenue, however the normal momentum appears susceptible.

As anticipated, these shifts have stored merchants on sharply, with the following step of Bitcoin in all probability depending on broader adoption developments and institutional curiosity.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024