Bitcoin

Bitcoin’s latest whale trends and what they mean for traders like you

Credit : ambcrypto.com

- Whales collected greater than 22,000 BTC and pushed the whole variety of whale corporations additional than 3.44 million BTC

- The Netflows of Bitcoin weakened in March and fell by -27.69% for seven days

Giant Bitcoin holders and retail traders have lately gathered at an aggressive tempo, which signifies robust market confidence.

In reality, knowledge on chains revealed that whales took over greater than 22,000 BTC in simply three days, in order that the whole variety of whale corporations went past 3.44 million BTC. The rise in demand coincided with a aggressive value enhance, pushing Bitcoin [BTC] From $ 82,000 to nearly $ 98,000.

Value to level out that the cryptocurrency was again from lower than $ 80,000 on the time of writing.

Supply: X

Nonetheless, that’s not all, with a historic peak within the retail commerce. Particularly with accumulator addresses climb to a document excessive of 320,000.

This double accumulation by each massive -scale traders and smaller holders hinted on a coordinated bullish momentum. Therefore the query – is the buys -spree sustainable?

Supply: X

“Purchase the dip” or whale manipulation?

An additional consideration of Ali’s knowledge on the chain confirmed a gentle stroll in Whale Bitcoin Holdings in February and early March. Up to now month, whales acquired round 60,000 BTC – which marked probably the most aggressive accumulative phases in current historical past.

The correlation between whale exercise and value actions additionally appeared clear.

The worth of Bitcoin fluctuated between $ 82,000 and $ 98,000, with a dip on the finish of February, adopted by a robust restoration initially of March. The timing of those purchases urged that giant holders had been often strategically collected throughout corrections.

Do the most important gamers depart the desk?

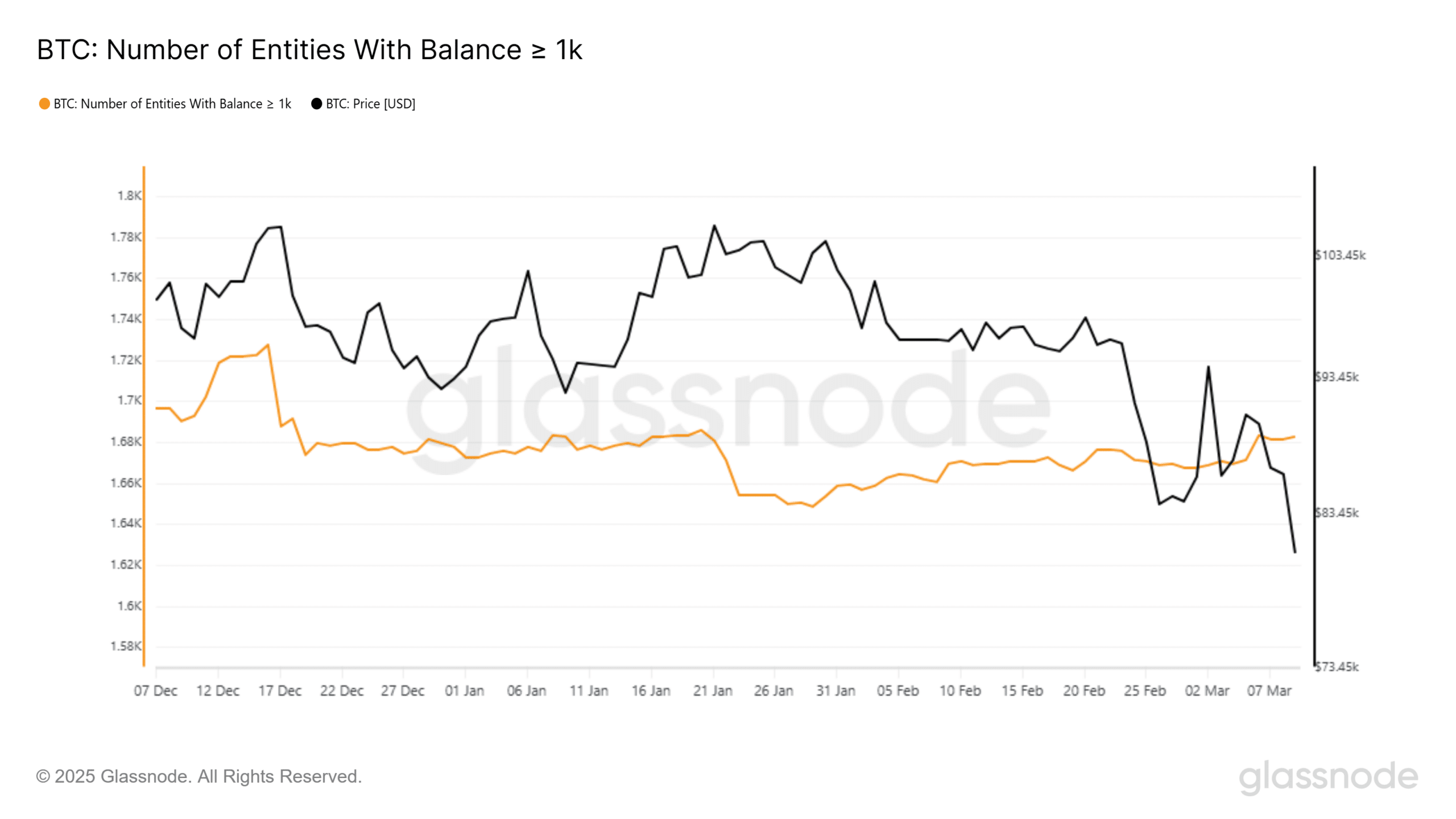

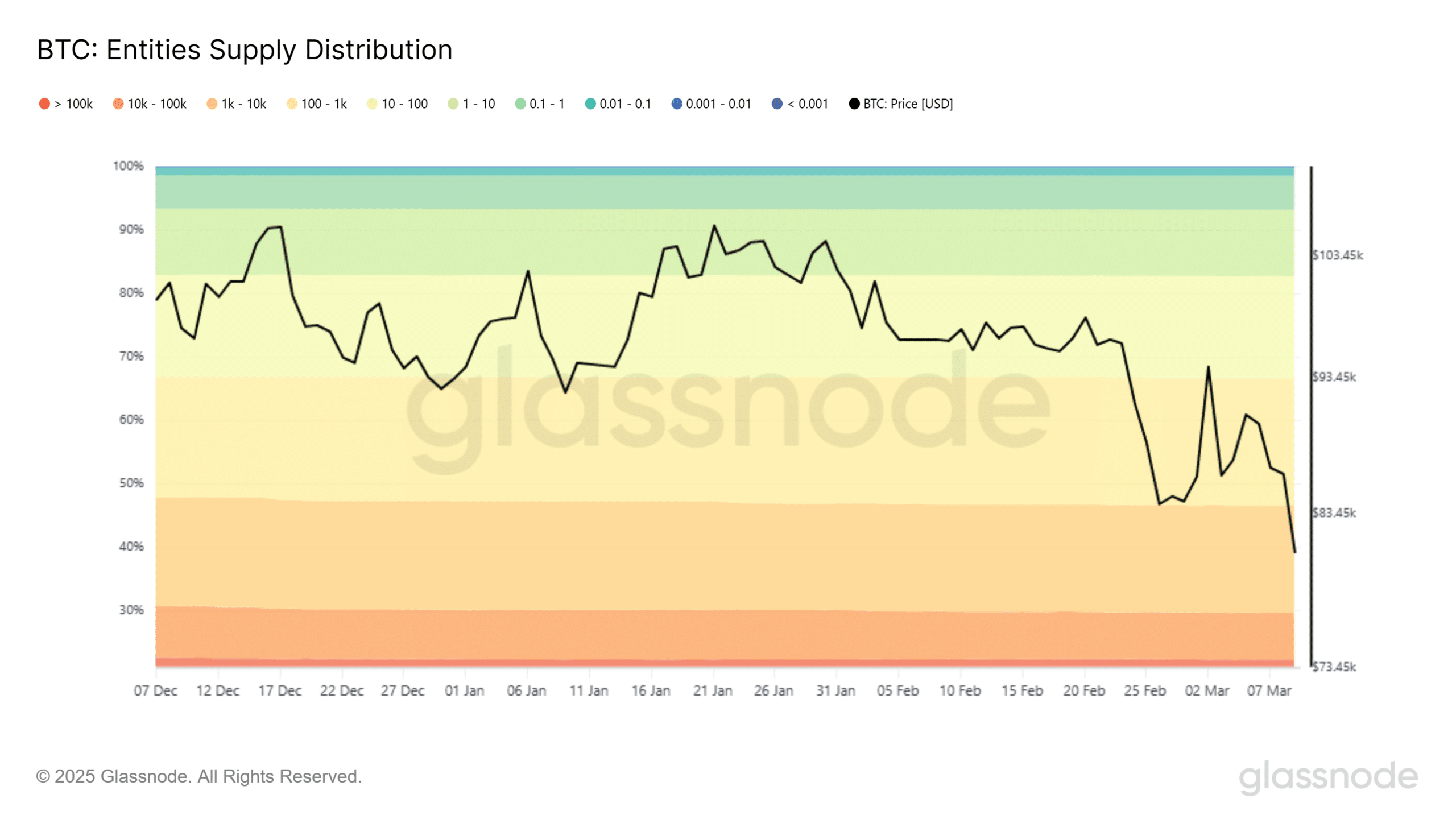

Possibly, sure. Information from Glassnode and Intotheblock revealed essential patterns in accumulation and distribution, which emphasised their affect on the value promotion.

Supply: Glassnode

Entities with ≥1,000 BTC have lowered their participations since Bitcoin reached a peak in January at $ 106,159. The variety of such entities fell from 1,720+ in December to 1,683 by March – a lower of roughly 2.14% for 3 months.

This gave the impression to be according to the value of Bitcoin and fell from $ 106k in January to $ 80k in March. Such a discount urged that whales took a revenue or reinvented their participations.

Supply: Glassnode

A pointy fall within the whalevistities befell between 7-9 March, which was associated to the value of Bitcoin that dropped from $ 84,197 to $ 80,795. Traditionally, such falls point out important sale or capital rotation in different belongings.

The December stability in whale corporations, tailor-made to a value vary of $ 68k – $ 72k, which exhibits minimal volatility earlier than the January -rally.

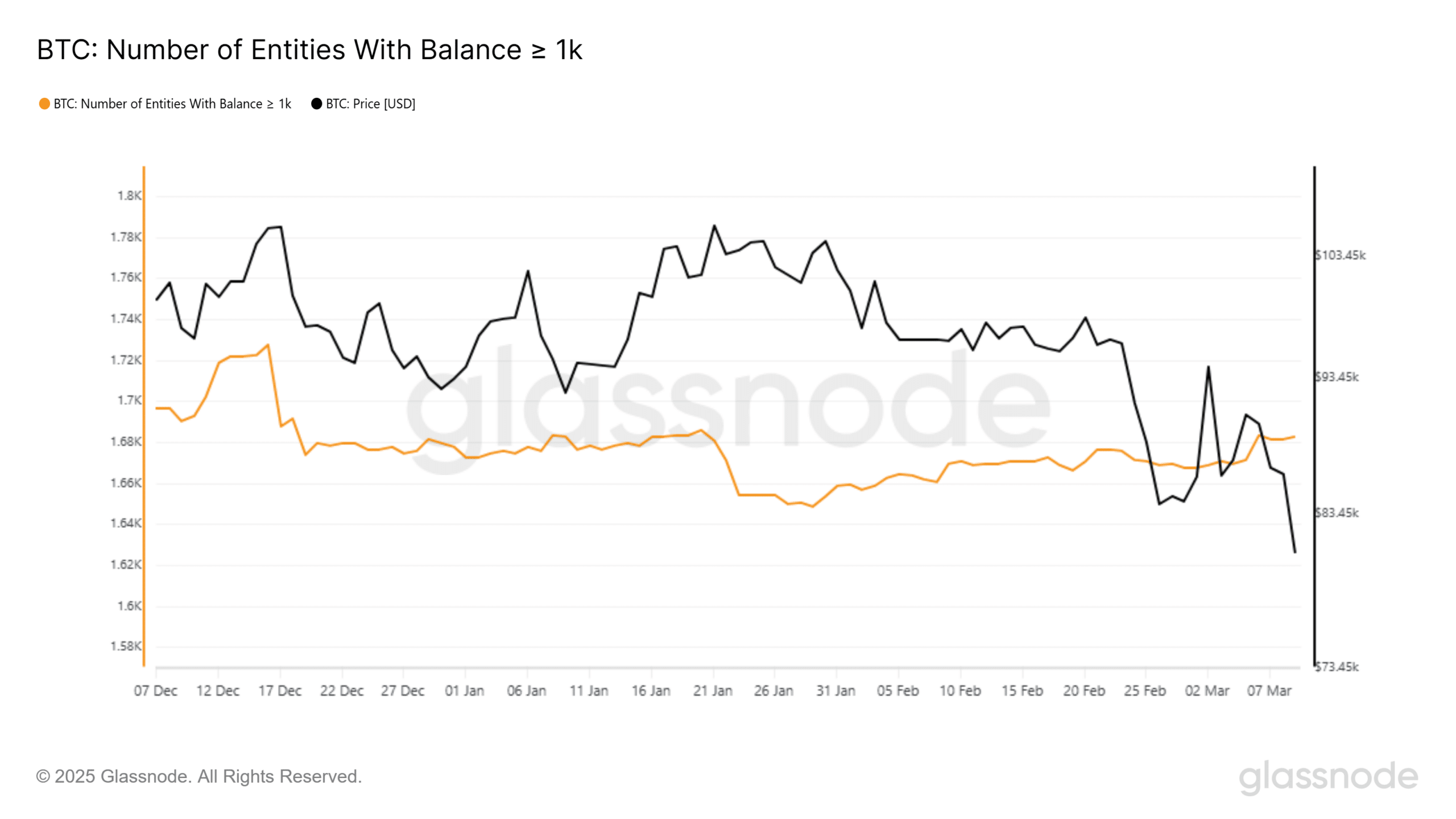

The inventory within the arms of whales (≥100k btc) various from 22.261% in February to 22.173% in March – a small however noticeable discount.

Who actually has management?

The 1K-10K BTC-COHORT noticed a bigger shift, which in February fell to 16.192% from 16.963% in March, which means that medium-sized whales have bought extra aggressively.

Bitcoin continued to gather retail addresses (<1 BTC), which confirmed constant development regardless of the volatility. The ten-100 BTC class remained steady, indicating that holders of medium-sized measurement are much less reactive to cost adjustments than whales.

The info confirmed a conventional accumulation distribution cycle, wherein massive whales took revenue after the rally and smaller gamers who enter.

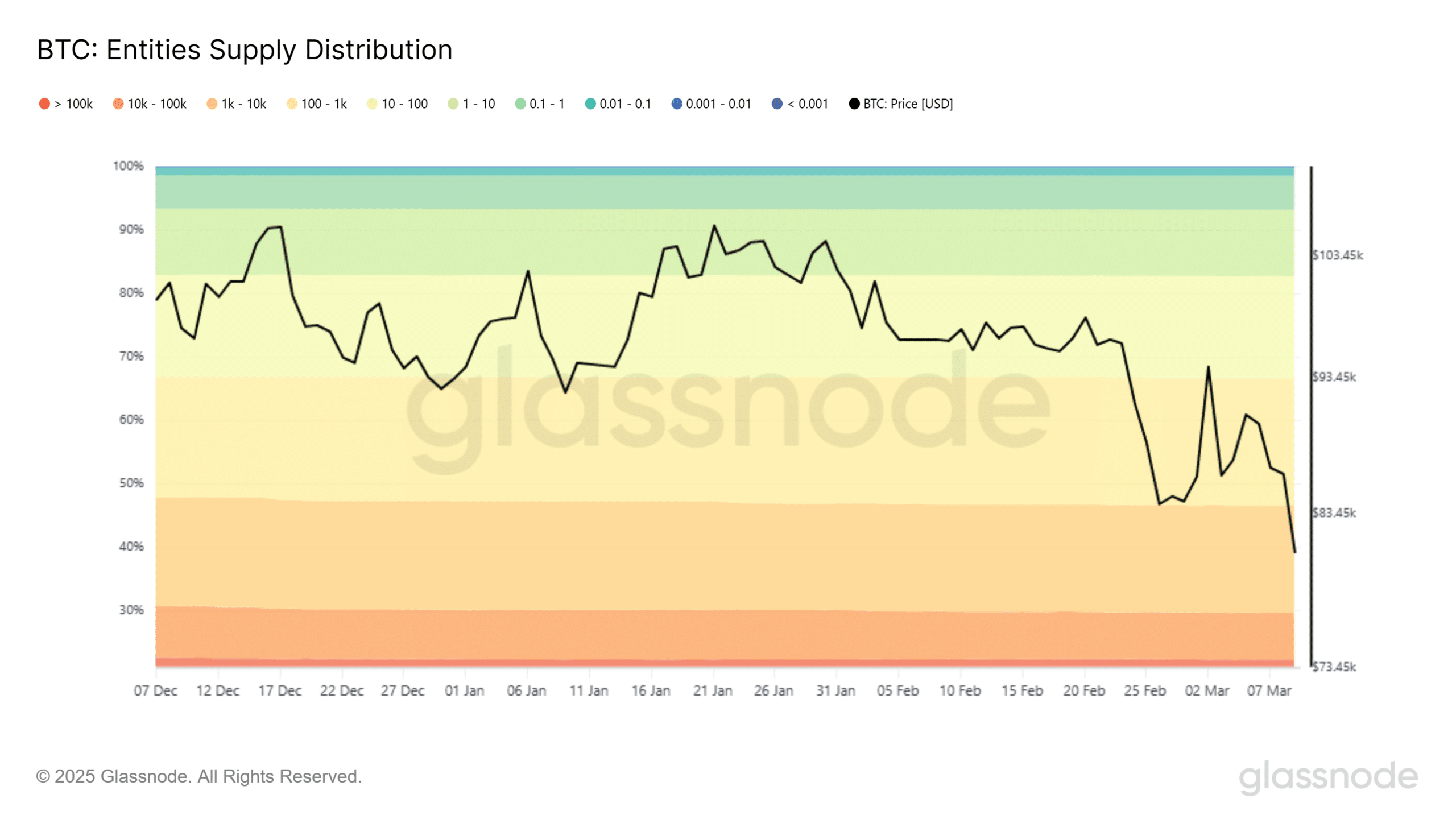

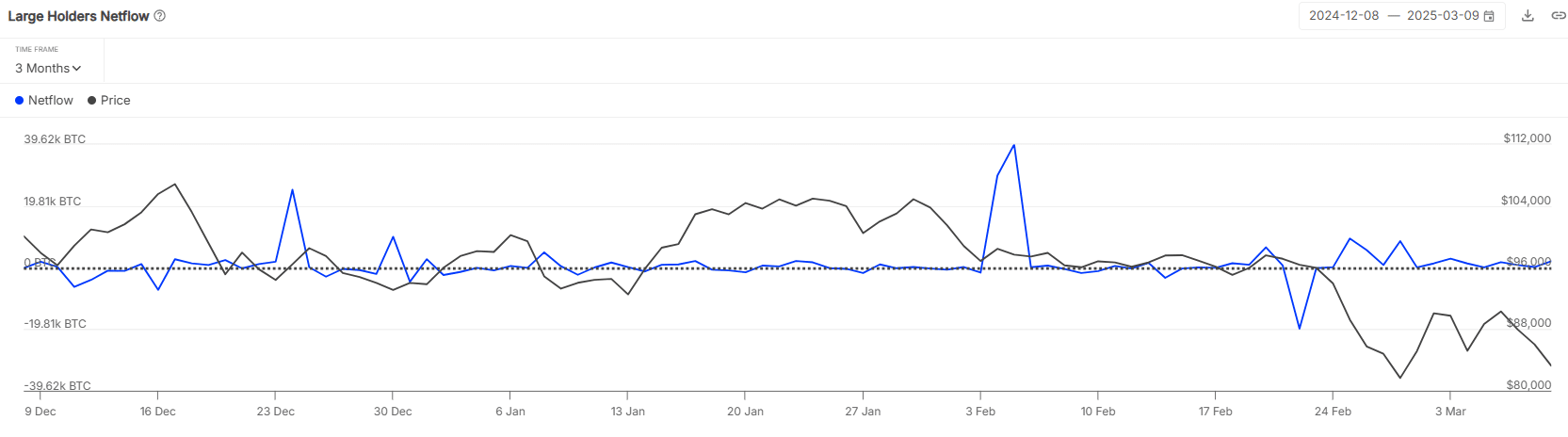

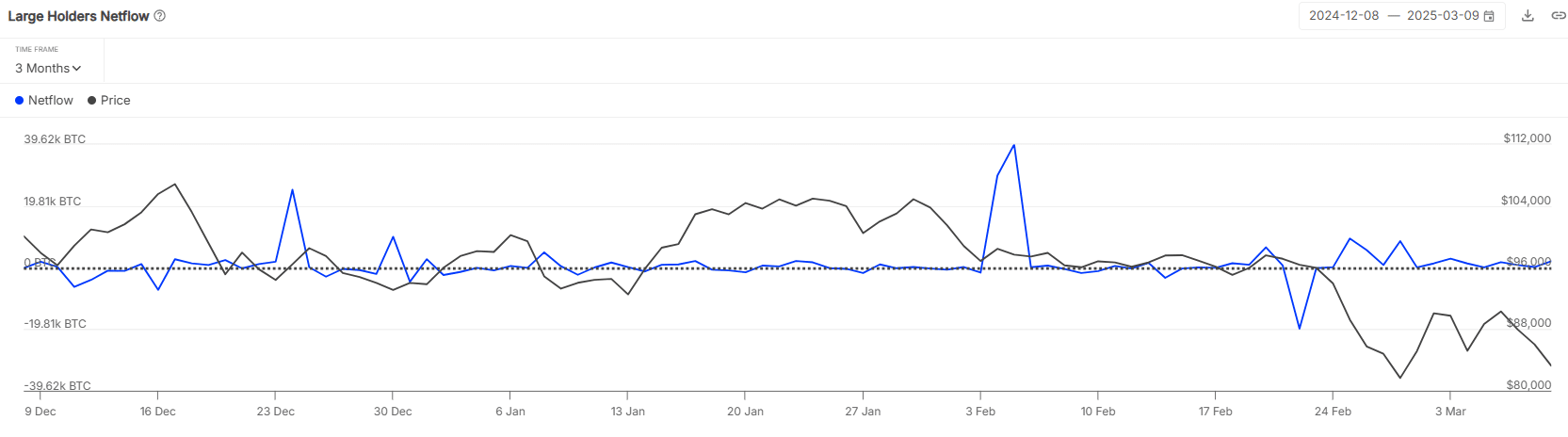

Netflow knowledge from IntotheLlock gave additional affirmation of whale conduct.

The biggest internet entry befell on 5 February, with +39.62k BTC that got here within the portfolios of huge holders at $ 97,692. This meant that whales accrued at excessive costs, anticipating additional earnings.

Supply: Intotheblock

A lower within the Netflows adopted, nevertheless, with solely +2.08k BTC on March 9 – an indication of lowered demand from massive holders.

The worth lower of Bitcoin from $ 97k initially of February to $ 80k in March according to the sharp lower in its Netflows.

The 7 -day Netflow change fell by -27.69%, whereas the 30 -day Netflow fell by -546.90% -on doable exhaustion at institutional accumulation.

And but, trying on the greater image, the 1-year-old Netflow on the press had risen by +714.19%. This indicated that though quick -term whale curiosity can fade, lengthy -term convictions haven’t utterly disappeared.

A ticking time bomb or a bullish setup?

Whale exercise has been the driving pressure behind the current value promotion of Bitcoin. Giant holders gathered aggressively earlier than the January peak of $ 106,000, however began distributing in February. The discount within the Netflows and the lower in holders of 1,000-10,000 BTC urged that some whales already money in.

The decline of Bitcoin to $ 80,000 and decrease tailor-made to this distribution development. If whales maintain loading, Bitcoin might be confronted with additional corrections. Nonetheless, the persevering with development of retail commerce and lengthy -term community flows signifies that not all traders lose confidence.

Whether or not the subsequent transfer by Bitcoin is one other rally or a deeper withdrawal will rely on one essential query – are the remaining whales nonetheless ready to purchase?

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024