Bitcoin

Bitcoin traders alert! – Do key indicators mirror the 2018 crypto crash?

Credit : ambcrypto.com

- Bitcoin’s latest lower of twenty-two% will be made comparisons with earlier cycle corrections previously.

- This evaluation investigates historic traits, market situations and the potential subsequent transfer of BTC.

Lower than three months after Trump’s second time period, market volatility has risen to unprecedented ranges. Bitcoin [BTC] has fallen 22% of the $ 109k of all time excessive, corresponding to corrections which can be seen within the Bull Run 2016-17.

Throughout that cycle, BTC delivered a return at 122.8%, however ended the Q1 with 4% in comparison with the opening value of $ 434.46. Nonetheless, this 12 months’s deeper decline will increase to ask.

Is BTC the Q1 crash from 2018 (- 48%) mirrored to $ 6,929, as a substitute? Ambcrypto has investigated this chance.

Macro parallels from 2018: Commerce battle and Bitcoin’s 72% crash

In 2018, Bitcoin closed the cycle with an annual lower of 72%, with $ 3,740.50.

Specifically, macro circumstances are very comparable on the time to the panorama of at present – Trump’s commerce battle with China and escalating charges. In opposition to the middle of the Q2 2018, inflation Energy to a spotlight of two years of two.9%.

In response, Bitcoin, who had risen to $ 9,826 in April, suffered a quarterly lower of 40%.

Supply: Bitbo

Whereas Q2 unfolds, the crypto market is confronted with renewed macro stress.

With $ 7 trillion on money owed refinancing Traders change capital to protected port activa equivalent to bonds-a pattern confirmed by the 10-year-old Treasury proceeds (curiosity on bonds), which has fallen to a low level of two months.

Merely put, the bond market absorbs the liquidity and travels capital away from threat property whereas the US authorities insures cheaper lend charges.

If this pattern continues, Bitcoin and wider crypto markets will be confronted with an elevated threat, which will increase the prospect of a crash in 2018.

Indicators on the BTC Capitulation Danger chain sign

In line with the newest report from Glassnode, the market construction of Bitcoin has shifted from accumulation to distribution. Within the meantime, the pattern rating of the buildup remained nearly 0.1, which has mirrored a constant gross sales stress since January.

As well as, the Value Primary Distribution (CBD) HeatMap reveals a lower within the “Purchase-the-Dip” exercise underneath $ 92k, which signifies a diminished demand for accumulation.

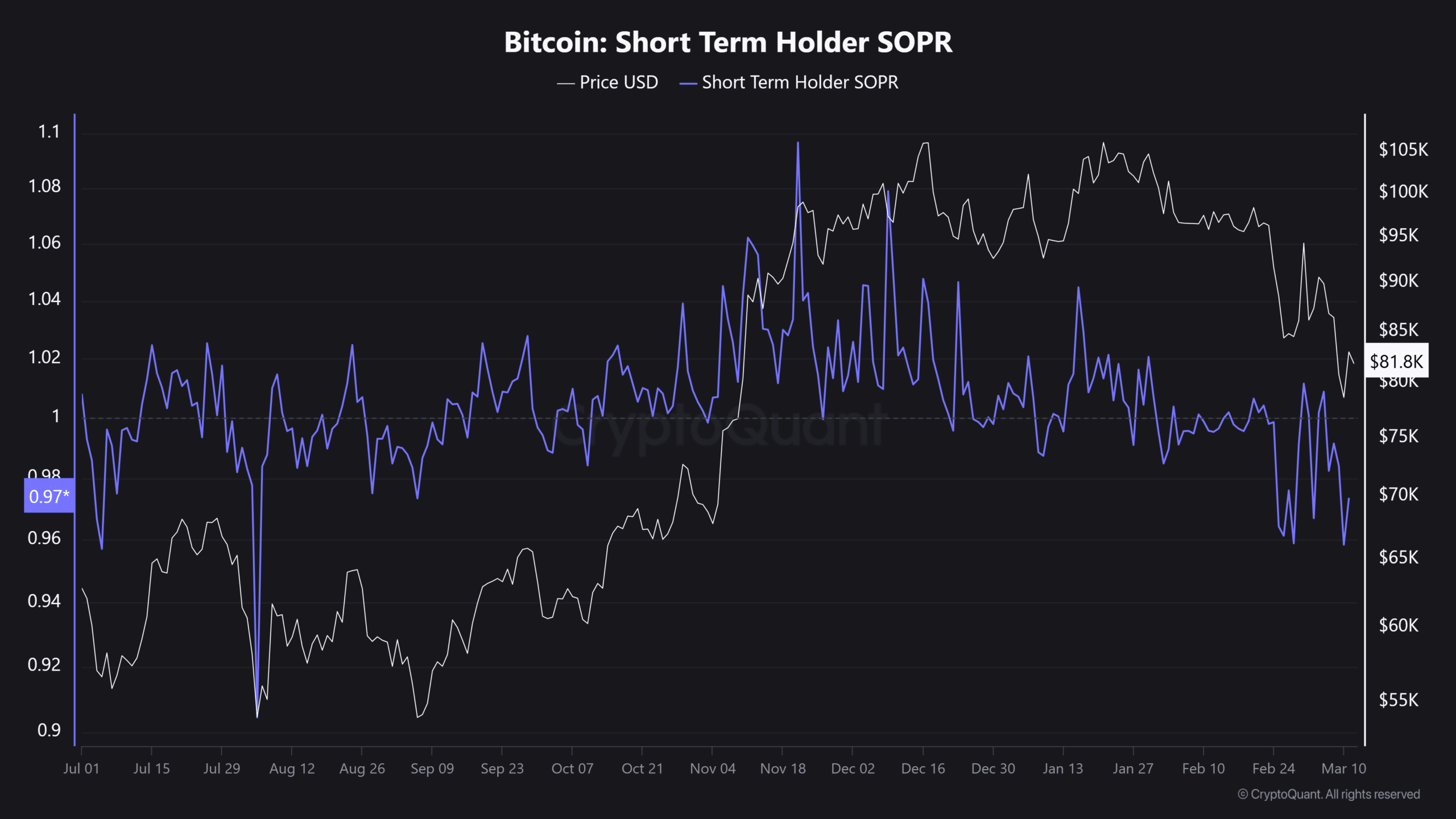

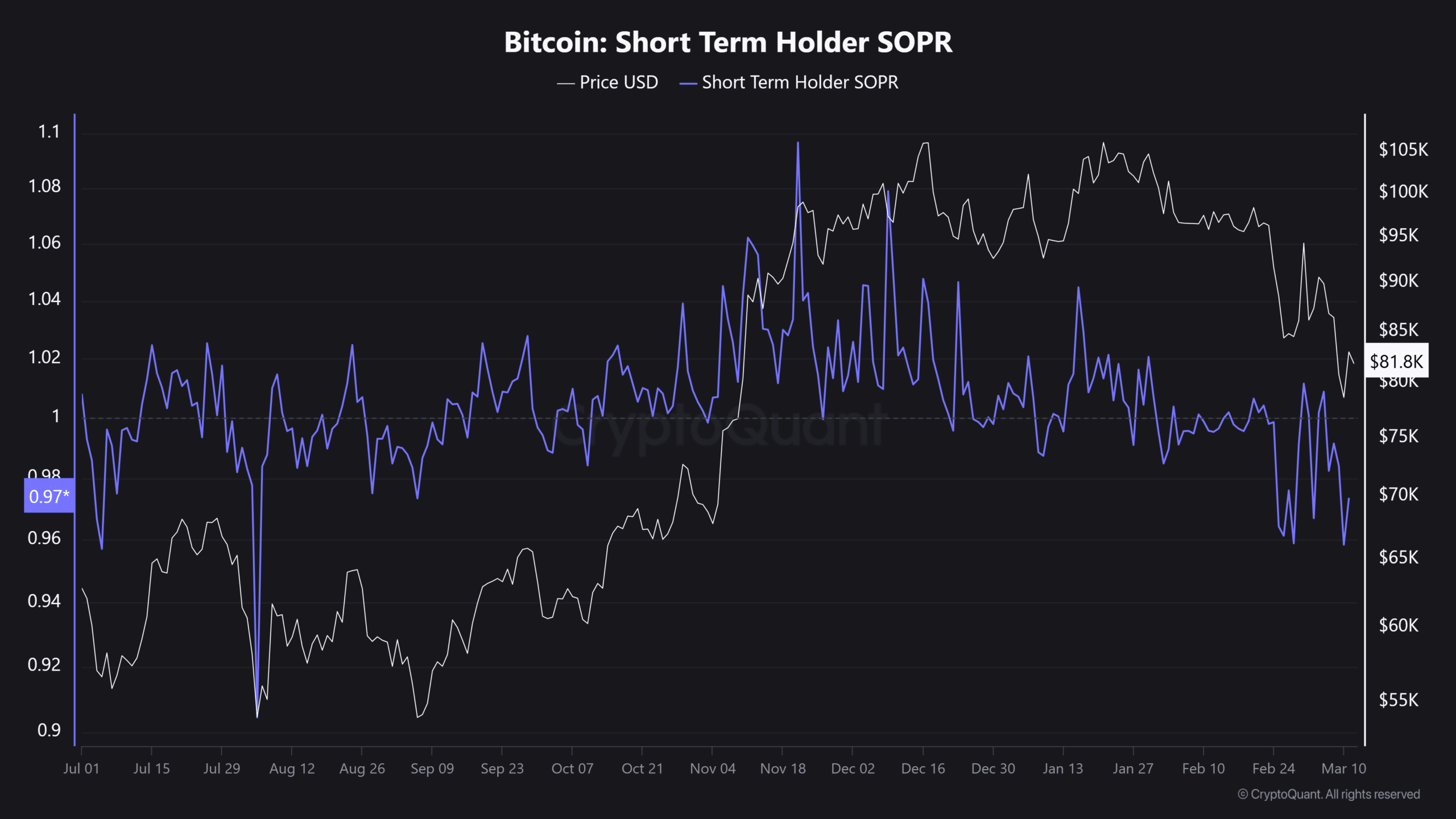

Brief -term holders (STHs) present indicators of capitulation. The STH spent output revenue ratio (STH-Sopr) has remained underneath 1, suggesting that many traders promote with a loss.

It reached 0.97 when Bitcoin dropped to $ 78k, which emphasised a substantial capitulation.

Supply: Cryptuquant

This sample is similar to August 2024, when Bitcoin fell to $ 49k underneath intense gross sales stress.

In the meanwhile the buildup stays weak in essential demand zones, even supposing Bitcoin acts 22% underneath his report excessive of $ 109k. This displays a transparent risk-off sentiment, during which consumers present the reluctance to enter the market.

Together with prevailing macro -economic challenges, the present state of affairs more and more displays the crash of 2018, the place an in depth distribution led to lengthy -term downward actions.

Because of this, Bitcoin is confronted with an elevated threat of additional corrections earlier than a robust degree of help is set.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now