Altcoin

Crypto -fear and greed index drops to 21: what it means for the market

Credit : ambcrypto.com

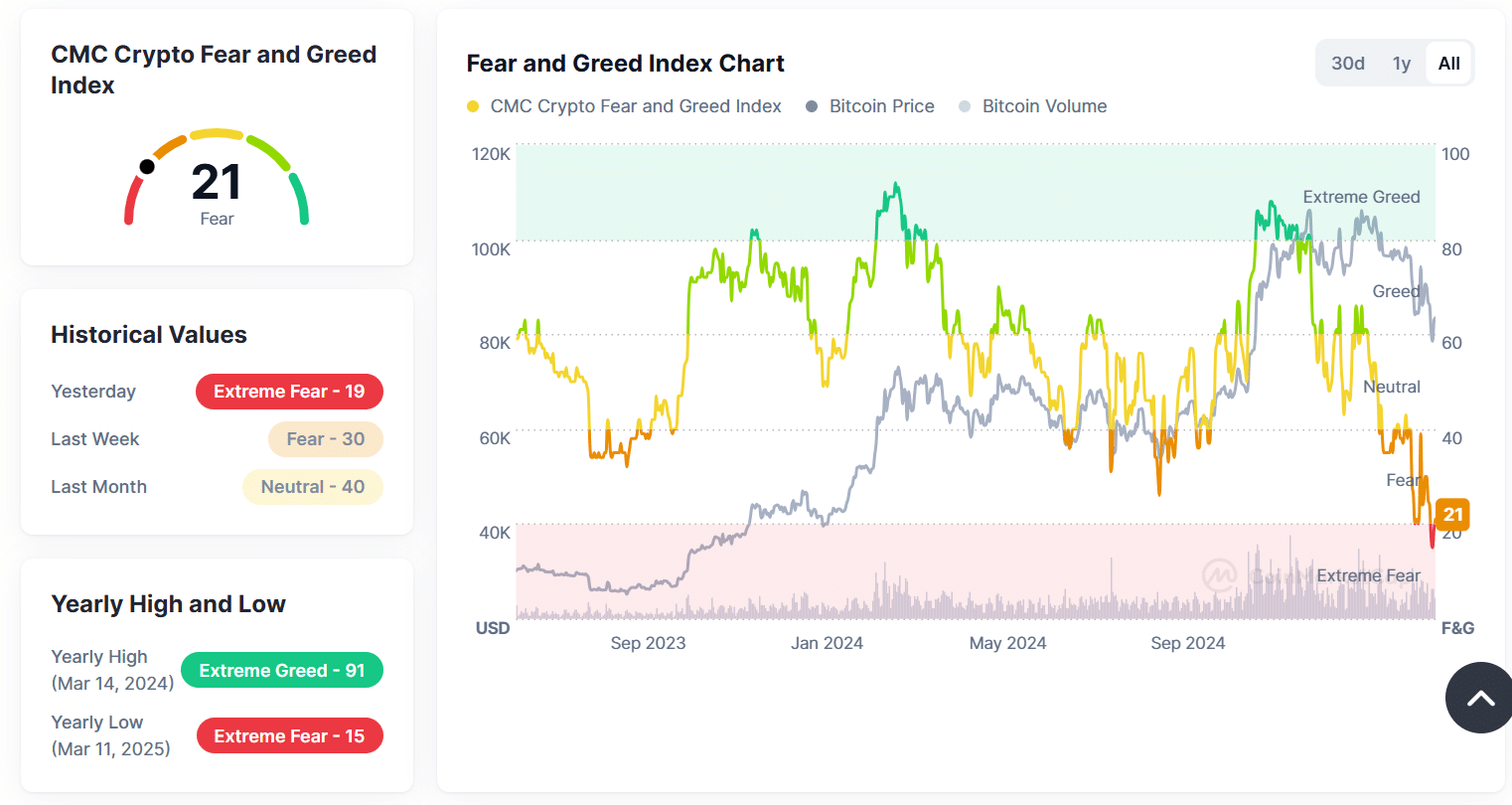

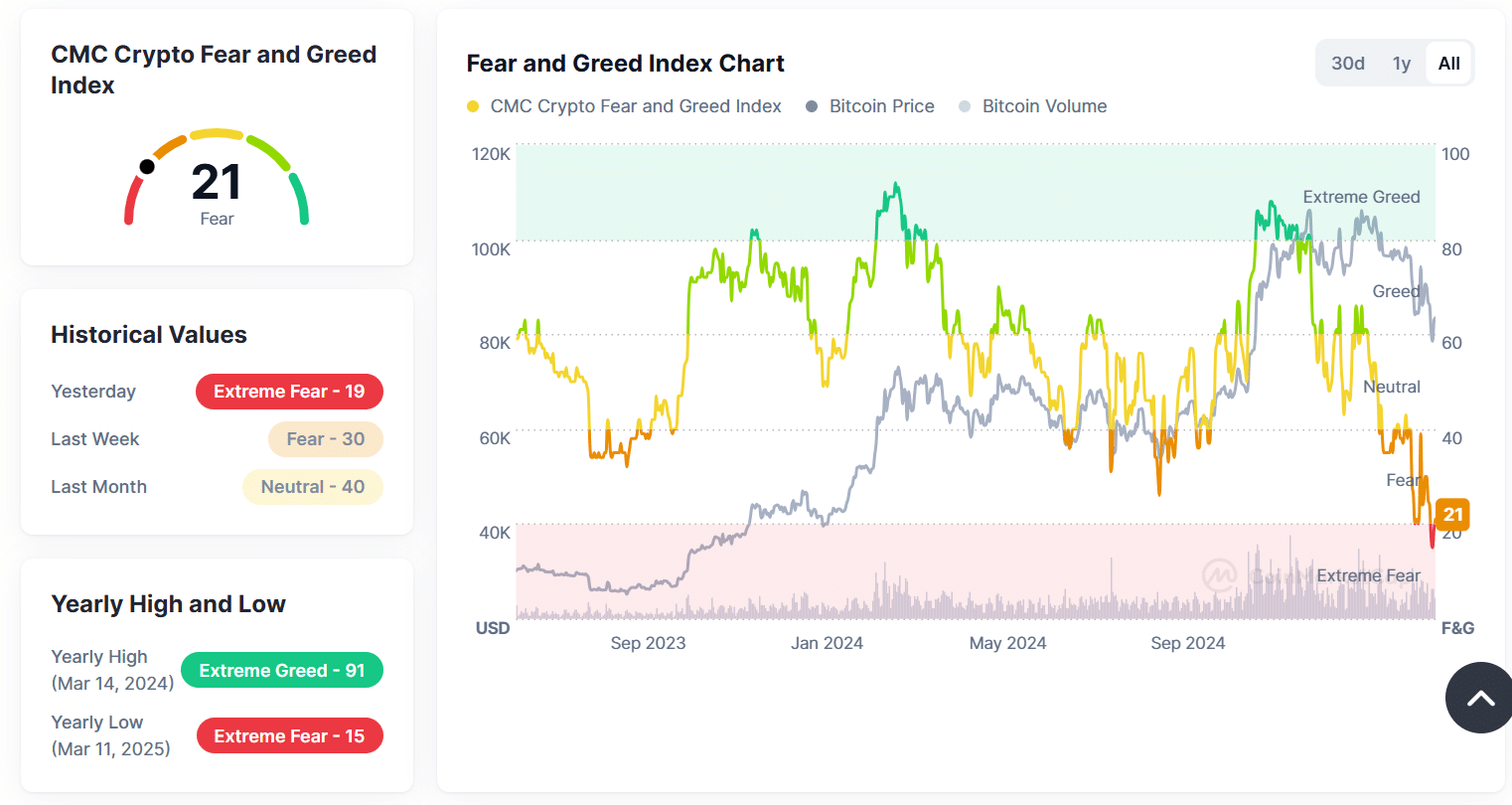

- The concern and greed index has plummeted to 21, in order that elevated concern is marked out there.

- ETF -network flows present a combined pattern, the place BTC sees small influx whereas ETH is scuffling with steady outflow.

The cryptocurrency market experiences elevated concern, with the crypto concern and the index of greed.

This sharp decline displays the rising uncertainty, pushed by vital outflows of ETFs, falling market capitalization and wider macro -economic care.

Crypto -fear and greed index falls

The crypto Market sentiment taken an vital hit when the concern and greed index dropped to 21, which signifies excessive concern of traders.

Final month the index stood on a impartial 40, with a pointy fall in confidence as market circumstances deteriorated.

Supply: Coinmarketcap

This drop is according to a broader market correction, mirrored within the crypto market capitalization and ETF -Netto movement developments within the final 30 days.

Market hood is affected by giant decreases

The full crypto market capitalization is now round $ 3 trillion, with Bitcoin [BTC] and Ethereum [ETH] take vital hits.

The market capitalization of Bitcoin was $ 1.65 trillion on the time of the press, which marked a lower of 15.11%, whereas Ethereum has seen a extra drastic lower and 30.53% dropped to $ 227.41 billion.

Within the meantime, Stablecoins remained comparatively steady at $ 216.23 billion, which displays a shift to threat -aging belongings in a time of elevated uncertainty.

Supply: Coinmarketcap

Different altcoins have additionally needed to take care of main sale, with their collective market capitalization with 19.76%.

ETF Netflows mirror combined sentiment

ETF -Netflows supply additional perception into investor conduct.

Whereas Bitcoin noticed a modest $ 13 million in optimistic influx, Ethereum registered $ 10 million, which emphasised the diverging investor sentiment between the 2 main cryptocurrencies.

Supply: Coinmarketcap

Prior to now month, a number of days of destructive flows have contributed to the bearish sentiment, which displays the intense concern within the index.

The persistent outflows recommend that traders are nonetheless hesitating to make use of capital and additional weigh on market restoration.

Implications for crypto markets

A concern and greed index on these ranges often signifies a offered -up market, nevertheless it additionally signifies a scarcity of service provider confidence amongst traders.

Traditionally, such excessive concern ranges preceded the restoration phases, as a result of opportunistic merchants need to profit from decrease costs.

Nevertheless, with steady decreases in market capitalization and chronic ETF outflows, the highway to restoration can nonetheless expertise resistance.

If Bitcoin doesn’t hold its market dominance and the outflow of Ethereum continues, the Bearish pattern may live on, forcing extra liquidations and the market correction deepens.

However, any shift to optimistic ETF consumption and stabilization of market capitalization can mark the beginning of a sentimenta save.

Conclusion

The present market sentiment suggests a cautious strategy for merchants and traders. Though excessive nervousness can supply buying choices, macro -economic components and capital outflows stay vital dangers.

Monitoring of ETF developments, stablecoin -dominance and the market power of Bitcoin can be essential in figuring out the following huge step.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024