Policy & Regulation

SEC Claimed NFTs Are Not Securities. Which Case Will Resolve Next?

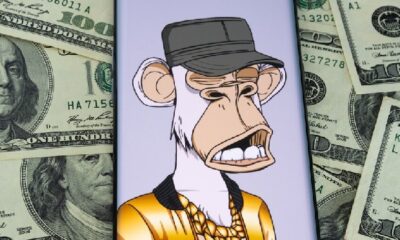

Credit : cryptonews.net

The US Securities and Alternate Fee (SEC) has formally closed its analysis into Yuga Labs, the corporate behind the Bored Ape Yacht Membership and Cryptopunks NFT collections. The corporate introduced this improvement in a press release and marked a big shift within the SEC method to digital belongings. Yuga Labs confirmed that the probe had been terminated with none enforcement motion, on account of which the place that NFTs are usually not results strengthened. This determination follows a collection of instances which have fallen by the SEC in opposition to giant crypto corporations, which displays a broader authorized shift below the brand new administration.

Yuga Labs Investigation concludes

Yuga Labs unveiled the choice of the SEC on X and emphasised the implications for the broader NFT market. The closure of the case corresponds to latest developments wherein the SEC has moved a number of investigations into cryptocurrency corporations, together with vital platforms equivalent to Coinbase, Kraken and Uniswap Labs.

https://x.com/yugalabs/status/189668737915187538

The SEC initially launched his probe in Yuga Labs in October 2022 and investigated or sure NFT gross sales didn’t kind -registered securities affords. Authorized specialists famous that the investigation was aimed on the classification of NFTs in response to American securities laws.

Throughout your entire course of, Yuga Labs had maintained that his digital assortment objects didn’t meet the definition of securities. Now that the case is now being closed, NFT marketplaces and makers can get extra confidence in steady actions with out regulatory uncertainty.

A shift in sec crypto enforcement: evaluation of lawsuits Droped Causs.

The SEC not too long ago in contrast the investigation at numerous high-profile crypto corporations. In latest weeks, the company has withdrawn from issues with regard to Robinhood Crypto, OpenSea, Uniswap Labs and Consensys, amongst different issues. Furthermore, the SEC reached settlements with Coinbase and Kraken whereas the discussions proceed with regard to Tron’s Justin Solar.

The case in opposition to Coinbase Began in 2023 when the SEC accused the commerce in no less than 13 tokens, which claimed that it ought to have been registered as securities. Coinbase resisted that cryptocurrencies don’t adjust to the authorized definition of an funding contract. The lawsuit was additionally aimed toward Coinbase’s deployment companies, which, in response to the SEC, acted as a non -registered provide of securities.

Kraken had been confronted in the identical means with accusations of exploiting a non -registered inventory change. The SEC accused the platform of processing buyer and enterprise funds, however Kraken disputed these claims. The lawsuit progressed to courtroom earlier than the sec determined to drop the case with prejudice, which implies that it couldn’t be crammed once more. In a weblog put up, crack stated That the supervisor has misunderstood his enterprise mannequin and referred to as the lawsuit politically motivated.

Uniswap Labs additionally noticed the SEC shut his analysis into his decentralized change platform. The corporate had obtained a Wells notification in April 2024, however introduced on 25 February that the probe ended with out plans for enforcement motion. Consensys, the developer of the Metamask pockets, skilled the same end result, wherein the SEC reverses its lawsuit in opposition to the corporate.

Ripple -Rechtszaak stays unsolved

Regardless of the withdrawal of a number of issues, the lengthy -term lawsuit of the SEC in opposition to Ripple Labs stays lively. The case began in December 2020 and claims that Ripple carried out a non -registered provide provide by promoting XRP. The lawsuit has seen appreciable authorized fights on the classification of XRP and / or its sale of funding contracts below the Howey check.

Latest developments recommend that the lawsuit will be resolved quickly. President Donald Trump not too long ago recorded XRP in his proposed Crypto strategic reserve alongside Bitcoin, Ethereum, Cardano and Solana. Market analysts consider that this step might affect the course of the case, which might presumably result in a regulation or favorable assertion for Ripple. Authorized specialists anticipate that the evolving angle of the SEC with regard to crypto regulation might speed up the decision of the matter.

The authorized shift follows on management adjustments on the SEC, whereby appearing chairman Mark Uyeda results in cut back enforcement actions. Commissioner Hester Peirce, recognized for her assist for decentralized funds, has performed a key position in reforming the rules priorities. The newly established cyber and rising expertise unit now focuses on tackling fraud moderately than implementing broad securities classifications for digital belongings.

What’s the subsequent step for the SEC?

With the withdrawal of a number of lawsuits, questions in regards to the future method of the SEC for Cryptocurrency Regulation come up. The company appears to be on a framework that distinguishes between fraudulent actions and legit blockchain tasks. Whereas enforcement actions from the previous below former chairman Gary Genler targeted on an aggressive efficiency, the brand new management appears inclined to work with the trade.

The congress can also be liable for establishing clear pointers for the crypto sector. The proposed laws is meant to outline regulatory guidelines for stablecoins and broader market buildings. If these efforts succeed, the trade of authorized preventing can shift to compliance with rules.

So far as Ripple is anxious, the case stays an vital focus for the crypto neighborhood.

The evolving place of the SEC and Trump’s pro-Crypto coverage can speed up authorized proceedings. If XRP is formally built-in right into a digital asset reserve supported by the federal government, this could reinforce arguments in opposition to its classification as a safety. Nonetheless, the end result stays unsure and stakeholders within the trade proceed to observe the matter intently.

The latest actions of the SEC point out a brand new part in crypto regulation. Rejected with a number of instances, the main target shifts from broad enforcement to focused supervision. Whether or not this development will happen will depend upon steady legislative efforts and additional management adjustments on the company.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024