Altcoin

Will BTC price meet buyers’ demand?

Credit : coinpedia.org

The cryptocurrency market begins to get well as a consequence of a common improve in shopping for merchants. This enhance follows a constructive report from the patron prize and the comfort in international tensions. In consequence, Bitcoin’s value is on its solution to hit $ 90k after he reached quite a few vital obstacles. Nevertheless, with a little bit gross sales stress now, buyers surprise if Bitcoin may fall once more quickly.

Bitcoin recovers after constructive information

These days Bitcoin approached the $ 85k marking, fed by bullish developments reminiscent of a constructive client value index (CPI) report and a discount of geopolitical tensions. An vital issue was the Ukraine settlement with a brief cease-fire of 30 days with the American involvement, a motion reported by Bloomberg that cooled the tensions of the world market. This lower in geopolitical uncertainty has improved the arrogance of buyers and introduced stability within the cryptomarket.

As well as, Ontario’s choice to remove a price of 25% within the subject of electrical energy to Michigan, New York and Minnesota, relieve commerce tensions and raised the whole market sentiment.

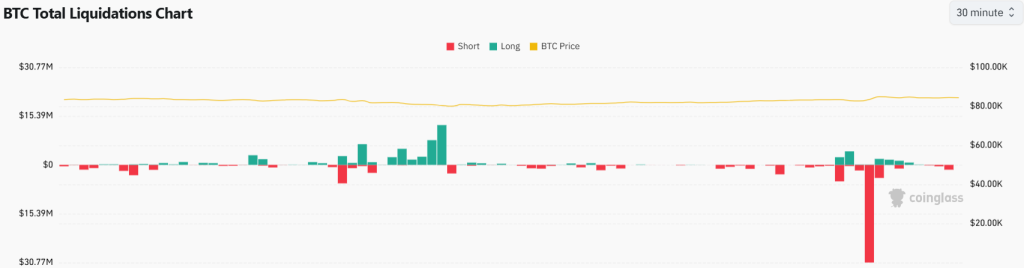

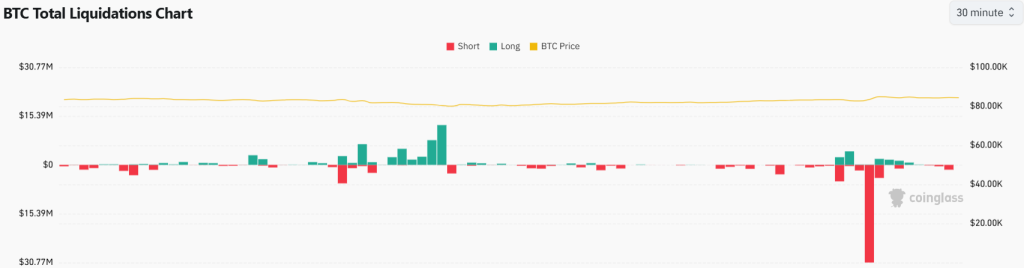

Information from Coinglass reveals that Bitcoin noticed a substantial market exercise with round $ 75.4 million in positions which have been liquidated within the final 24 hours. This included $ 15.4 million by consumers and $ 60 million by sellers, indicating a rise in brief liquidations within the midst of Bitcoin’s value improve.

The Bullish Momentum has additionally influenced Bitcoin market tendencies, with an open curiosity in Bitcoin by virtually 6%, with a excessive level of $ 49.8 billion. Intotheblock knowledge suggests a steady bullish pattern because the trade reserve decreases.

Additionally learn: Trump Crypto Govt Order disturbs new Invoice for US Bitcoin Reserve

The Netflow -Metriek has been persistently unfavourable, with a exceptional outflow of three.1k BTC within the final 48 hours. This pattern signifies that holders transfer their bitcoin from exchanges to self -wide portfolios, which reduces the potential for gross sales stress and factors to steady upward motion within the value of Bitcoin.

What’s the subsequent step for BTC value?

Bitcoin is at present working on a wave of robust bullish exercise and focuses on a steady place above $ 85k. It briefly grew to become a peak of $ 85,309 earlier than the resistance skilled and slipped beneath $ 85k. At present, Bears strongly defend a rise above 23.6% FIB channel. To any extent further the worth of Bitcoin is traded at $ 84,593, which marks a rise of 5.3% within the final 24 hours.

Wanting forward, the BTC/USDT commerce financial savings challenges a resistance space inside $ 84,205 to $ 86,704. It’s anticipated that extra buying efforts will repel any vital withdrawals. If Bitcoin efficiently break by the $ 90k threshold, it might be potential to try for a climb to $ 95,000.

Conversely, an absence to fulfill the customer’s curiosity close to the $ 85k degree can result in a withdrawal, probably fall to a low of $ 79,974.

Nevertheless, the lengthy/quick ratio of Bitcoin has taken a pointy decline, which is at present 0.67. This means an growing dominance by sellers, who in all probability insist on an instantaneous correction within the BTC value chart. At present, round 60% of merchants anticipate a fall within the value.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024