Bitcoin

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

Credit : bitcoinmagazine.com

Bitcoin has been scuffling with decrease lows in current weeks, in order that many buyers wonder if it’s lively in a big bear cycle. Nonetheless, a uncommon knowledge level linked to the US Greenback Energy Index (DXY) suggests {that a} appreciable shift in market dynamics could be positioned. This Bitcoin purchase sign, which has solely appeared 3 times within the historical past of BTC, might point out a bullish reversal regardless of the present Bearish sentiment.

View a current YouTube video right here for a extra in-depth view of this topic:

Bitcoin: This had only happened 3 times before

BTC vs Dxy Reverse relationship

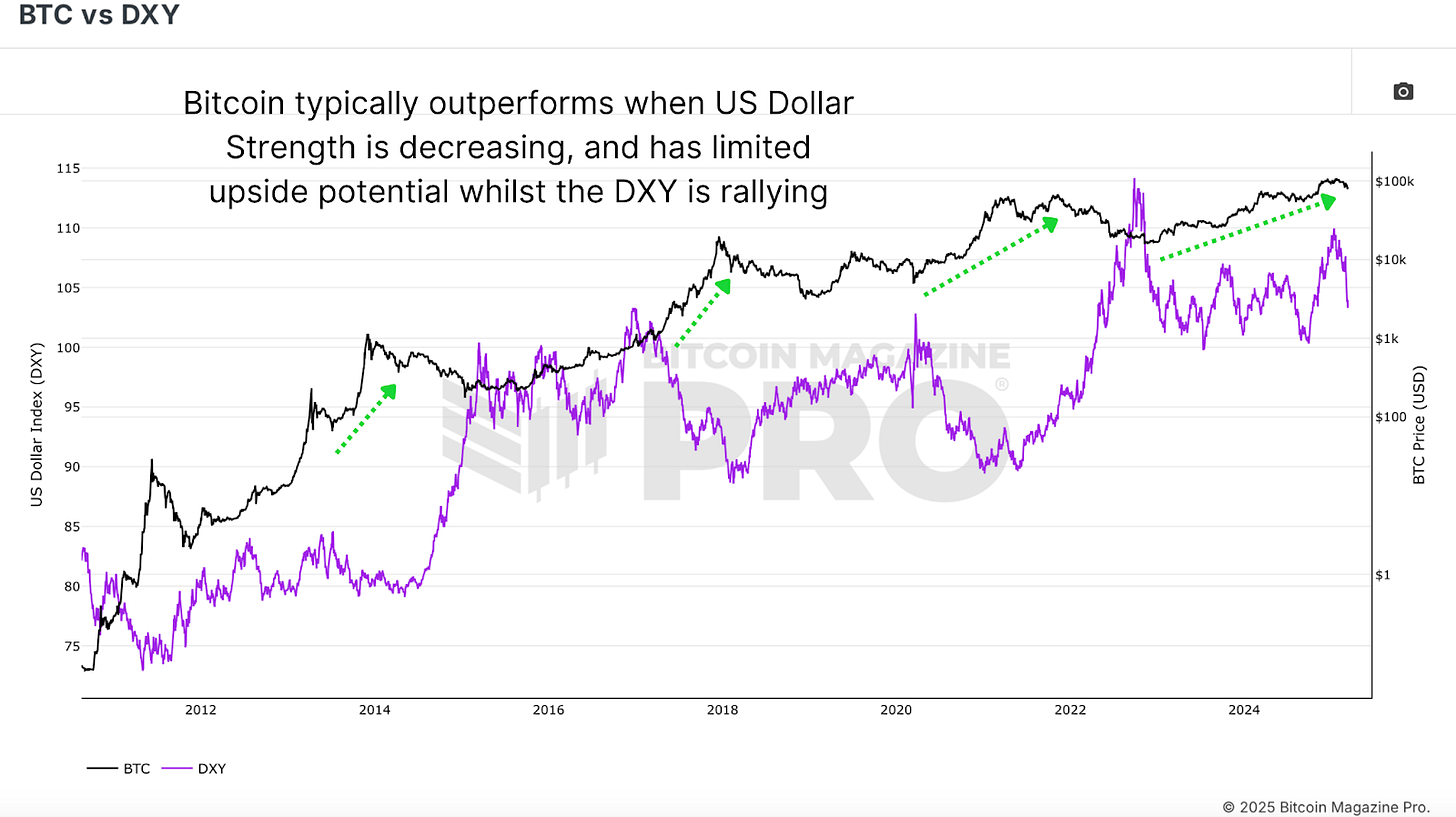

Bitcoin’s worth promotion has lengthy since reversed with the US Dollar Strength Index (DXY). Traditionally, when the DXY strengthens, BTC tends to battle, whereas a reducing DXY usually creates favorable macro -economic circumstances for Bitcoin worth valuation.

Regardless of this historic bullish affect, the value of Bitcoin continued to withdraw, and lately dropped from greater than $ 100,000 to lower than $ 80,000. Nonetheless, the previous of this uncommon DXY racement suggests {that a} delayed however significant BTC Rebound might nonetheless be within the recreation.

Bitcoin Purchase Sign Historic Occasions

At the moment, the DXY is in a pointy fall, a lower of greater than 3.4% inside just a few week, a change of change that has solely been noticed 3 times in your complete commerce historical past of Bitcoin.

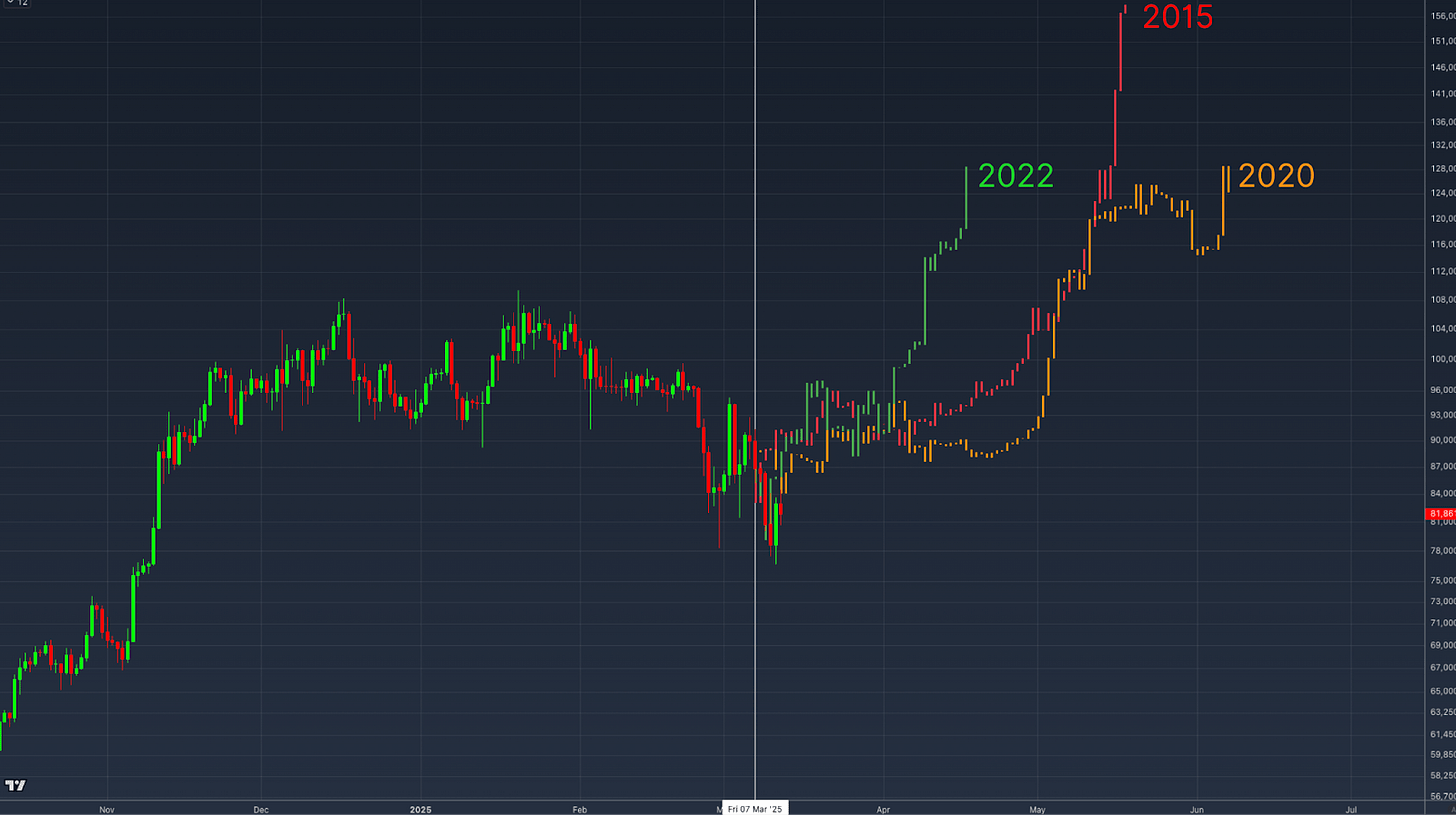

To grasp the potential impression of this DXY sign, we let the three earlier authorities look at when this sharp fall within the US greenback power index befell:

- 2015 Soil after the Bear Market

The primary occasion was prolonged after the BTC prize was prolonged in 2015. After a interval of lateral consolidation, BTC’s worth skilled a major upward improve of greater than 200% inside just a few months.

The second copy befell within the early 2020, after the sharp market that was activated by the COVID-19 Pandemie. Identical to the 2015 case, BTC initially skilled a jerky worth motion earlier than a speedy upward pattern was created, culminating in a rally of a number of months.

- 2022 Beermarkt restore

The newest copy occurred on the finish of the Berenmarkt of 2022. After an preliminary interval of worth stabilization, BTC adopted with an extended -term restoration, climb to significantly increased costs and the present bull cycle begins the next months.

In any case, the sharp fall within the DXY was adopted by a consolidation section earlier than BTC began a substantial bullish run. We overload the value motion of those three authorities at our present worth promotion, we get an thought of how issues can come out within the close to future.

Inventory markets Correlation

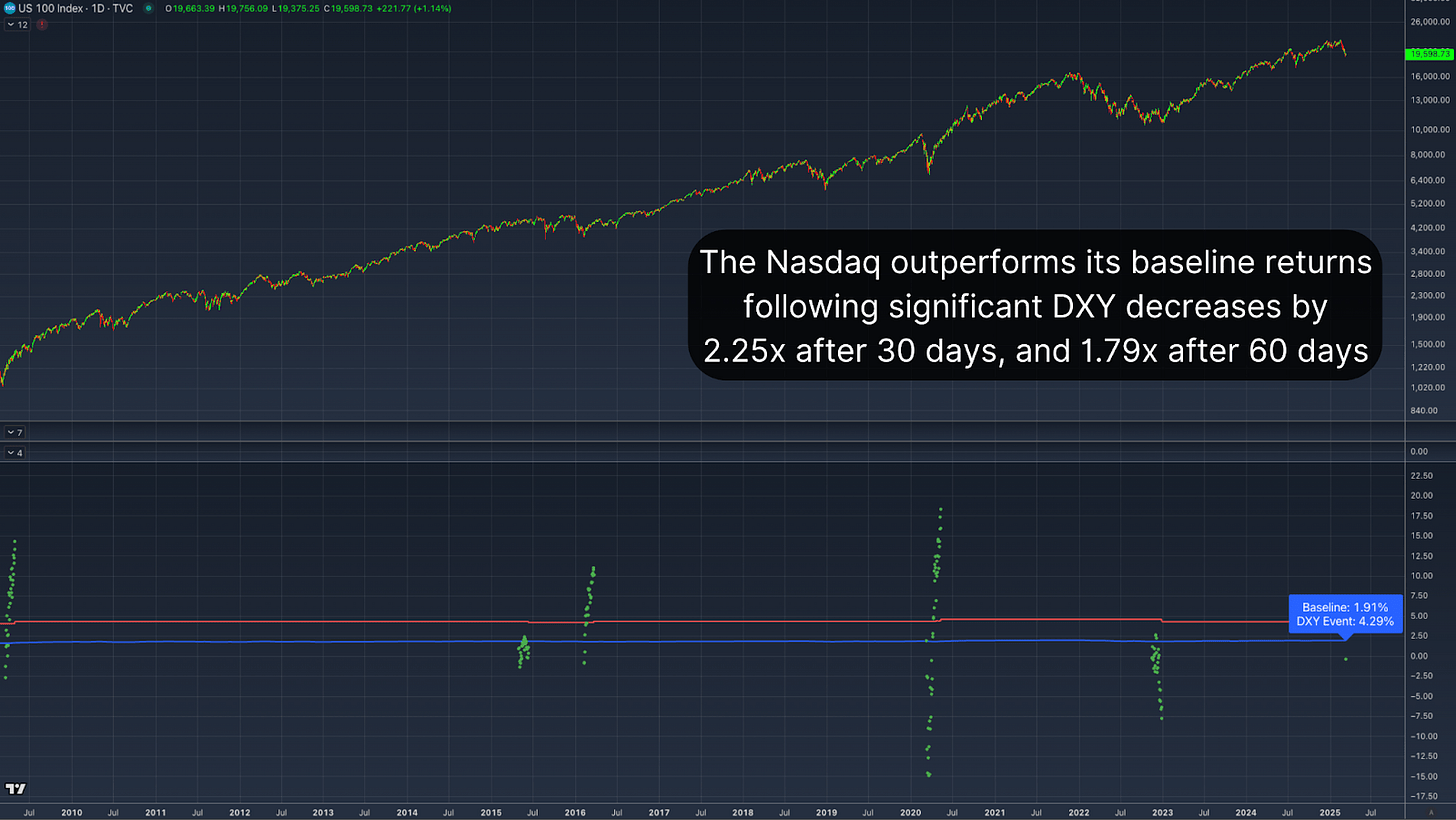

Curiously, this sample will not be restricted to Bitcoin. An analogous relationship could be noticed in conventional markets, specifically within the Nasdaq and the S&P 500. When the DXY absorbs strongly, inventory markets have carried out traditionally higher than their primary returns.

The common common return of 30 days earlier than the Nasdaq after a comparable DXY lower is 4.29%, properly above the usual return of 30 days of 1.91%. By extending the window to 60 days, the common return of the Nasdaq will increase to virtually 7%, in order that the standard efficiency of three.88percentalmost doubles. This correlation means that the efficiency of Bitcoin, after a pointy DXY racement, corresponds to historic wider market traits, which strengthens the argument for a delayed however inevitable constructive response.

Conclusion

The present lower within the American greenback power -index represents a uncommon and historic bullish Bitcoin -buy sign. Though the speedy worth motion of BTC stays weak, historic precedents counsel {that a} interval of consolidation is prone to be adopted by an essential assembly. Particularly when they’re strengthened by observing the identical response in indexes such because the Nasdaq and S&P 500, the broader macro -economic setting is favorably arrange for BTC.

Discover dwell knowledge, graphs, indicators and in -depth analysis to remain forward of Bitcoin’s worth motion Bitcoin Magazine Pro.

Disclaimer: This text is just for informative functions and shouldn’t be thought-about as monetary recommendation. All the time do your individual analysis earlier than you make funding choices.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024