Altcoin

Solana crashes 36% to $ 120, but is the worst still coming?

Credit : ambcrypto.com

- The restoration of Solana is beneath stress from giant -scale sale and weak sentiment.

- Along with Technically, Solana was engaged in controversy.

Solana [SOL] Has deposited 36% this month and ranks because the worst performing topactive. A rise of two% within the commerce quantity, together with an Oversold RSI and a Bullish MacD -Crossover, signifies potential dip that buys round $ 120.

With threat -still low, can Sol Bulls solely use technical means to introduce a restoration?

Past the charts: key elements within the sport

Pumpfun not too long ago continues to feed the gross sales stress on Solana transfer 196,370 Sol value $ 25.3 million for Kraken.

A complete of two,629,656 SOL value $ 511 million for $ 194 and hit the 264,373 Sol for $ 41.64 million USDC at $ 158, which contributes to the present decline.

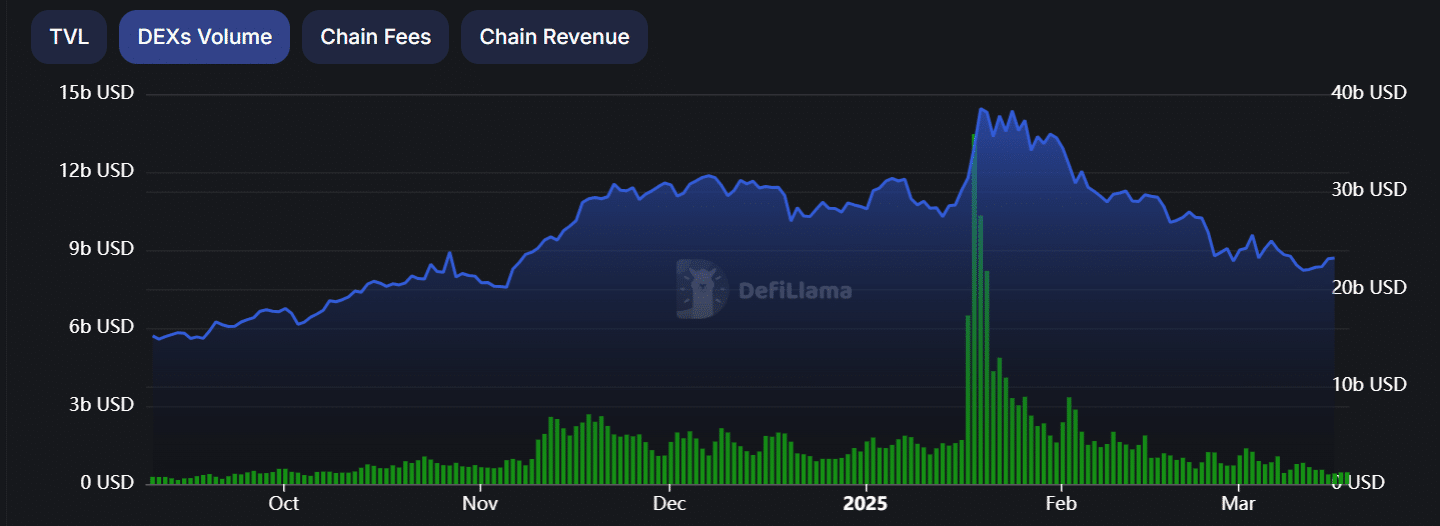

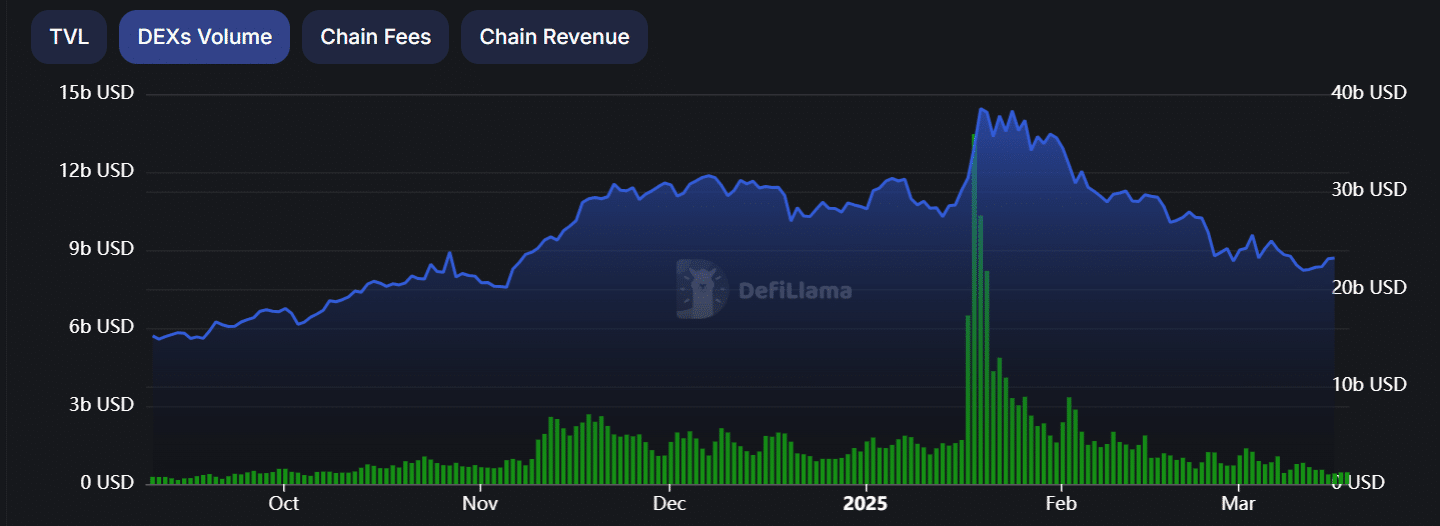

With growing liquidity on the gross sales aspect in a risk-off market, a rebound appears to be like unsure. Within the meantime, the Dex quantity of Solana and TVL have been lowered to earlier than the elections, which signifies weakening community exercise.

Traditionally, the restoration phases of Solana are characterised by double figures development in TVL and DEX quantity, which regularly signifies a market base.

On March 15, nevertheless, the Dex quantity fell beneath $ 1 billion, in order that concern was expressed a couple of potential development removing.

Supply: Defillama

Except merchants intervene with a robust buy-side momentum, additional drawback stays. Along with the uncertainty, Solana is now confronted with a recoil on a controversial advertisement on X (previously Twitter).

The commercial, which gained 1.2 million views, obtained an awesome negativity, forcing Solana to take away it. Nonetheless, the injury was precipitated and, nevertheless, influenced the market sentiment.

Composite bearish indicators, weighed sentiment has reversed Detrimental, the strengthening of the shortage of bullish affirmation and means that traders stay cautious a couple of potential rebound.

Assessment of the subsequent step from Solana

The Solana value motion emphasizes a persistent imbalance of the supply. Whereas Bitcoin consolidates, Solana nonetheless has to see sturdy burglaries of strategic traders.

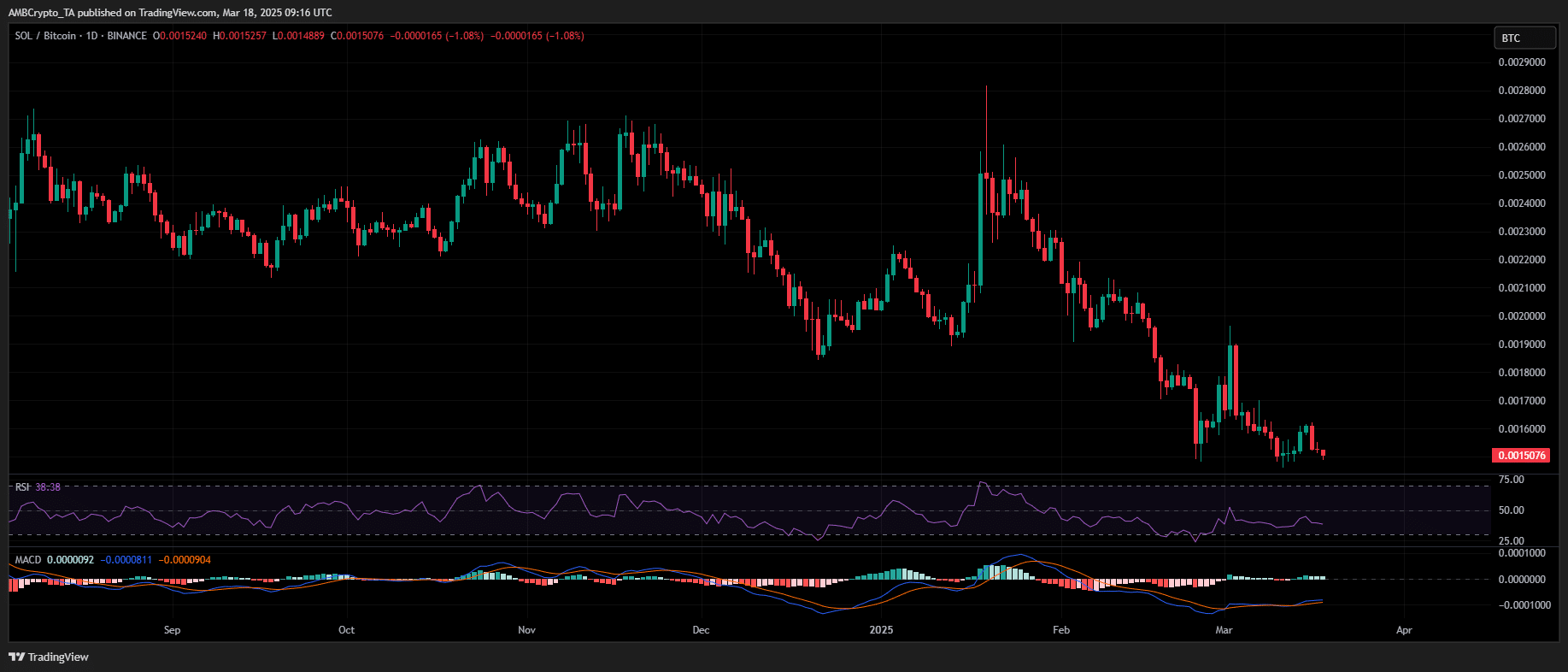

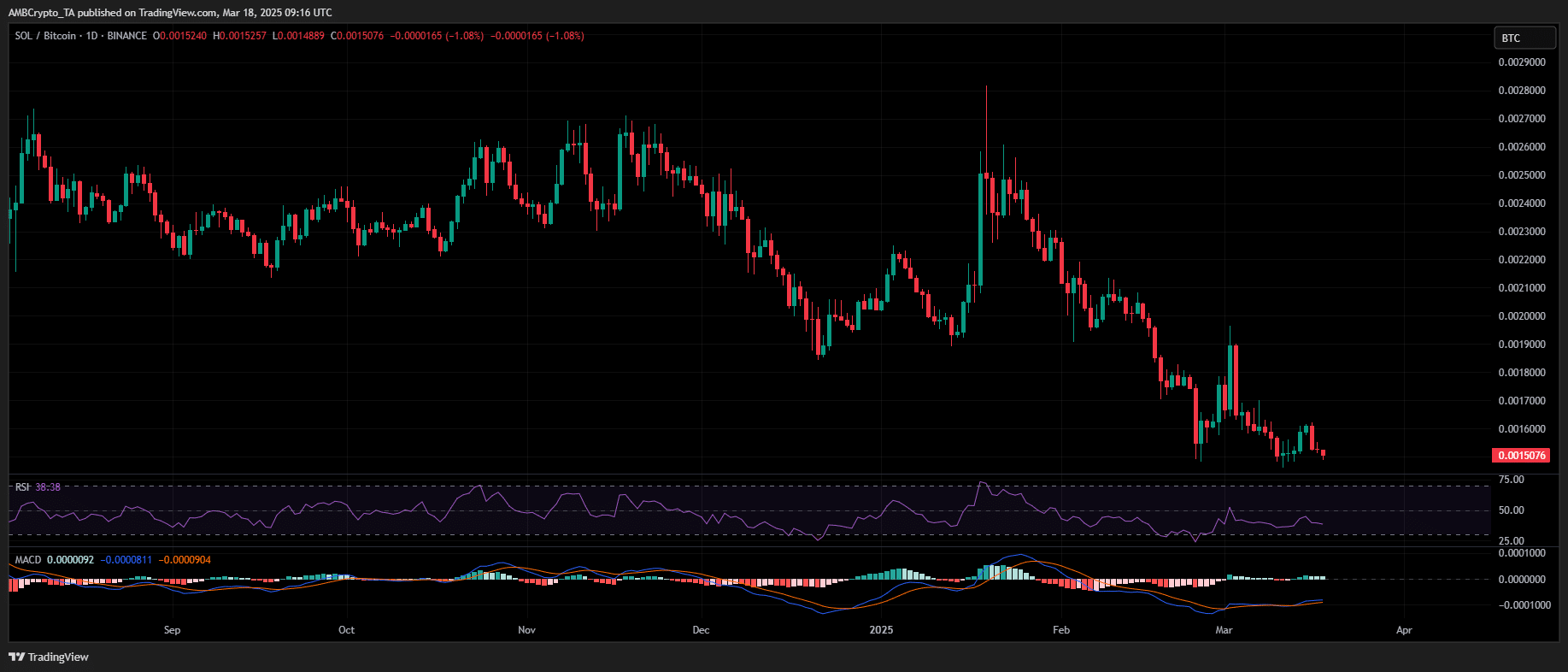

Regardless of a month-to-month fall of 30%, the lowered costs didn’t trigger sturdy accumulation. The SOL/BTC purple continues to print decrease lows, which not too long ago prints to a two-year layer, signaling of weakening relative power.

Supply: TradingView (SOL/BTC)

With giant -scale sale and bearish sentiment that dominate, the absence of conviction of threat -managed merchants weakens the probabilities of SOL to reclaim a very powerful resistance ranges.

Given the present market dynamics, an extra withdrawal to $ 120 or decrease appears to be increasingly possible.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024