Altcoin

BTC’s anxiety and greed index gives caution, but do you have to buy for $ 82k?

Credit : ambcrypto.com

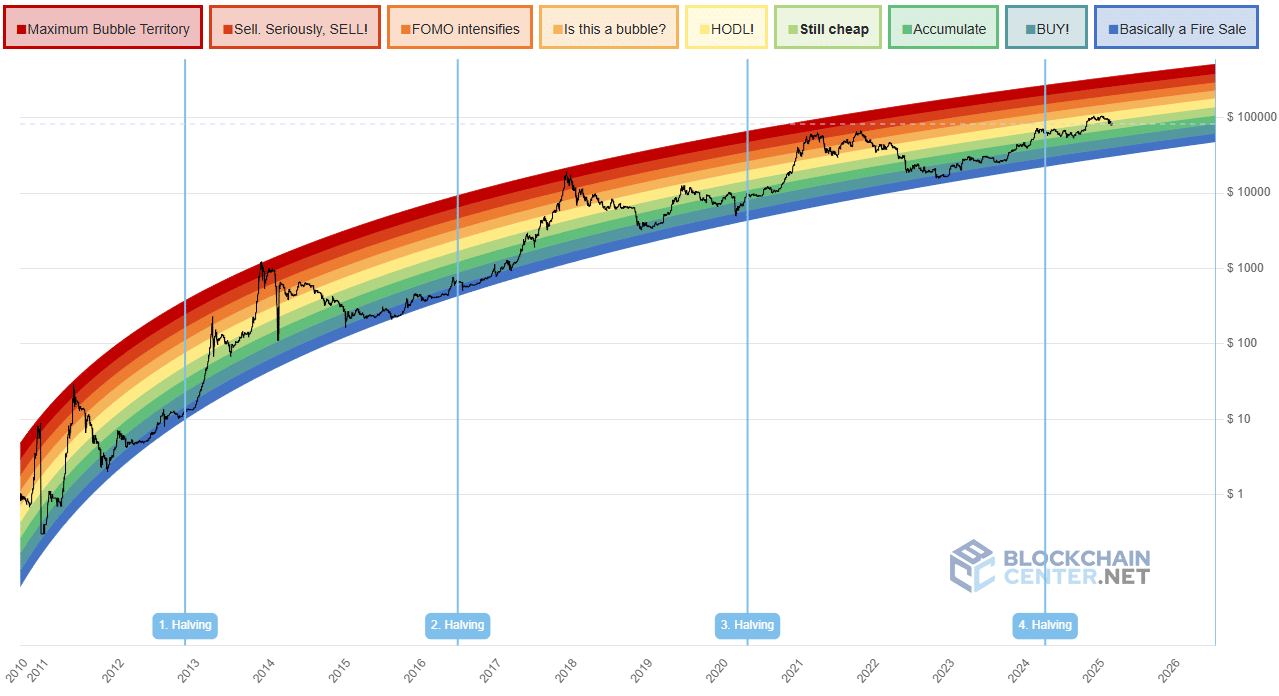

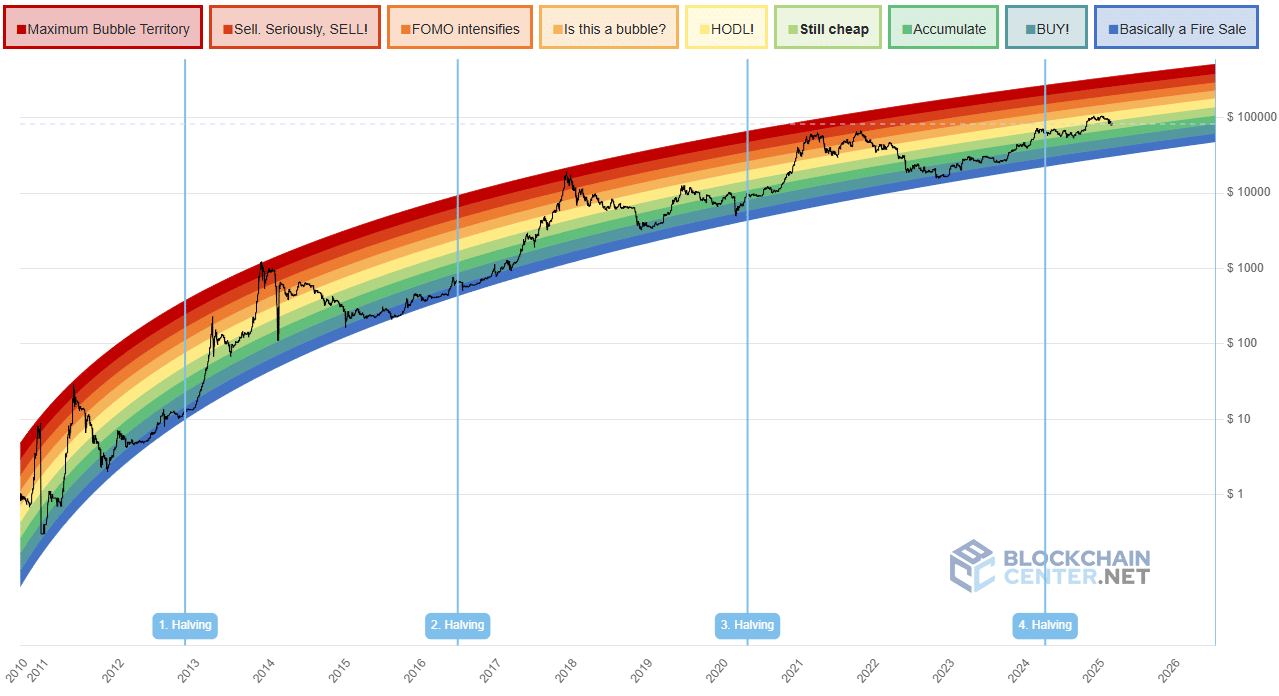

- The Bitcoin Rainbow Chart confirmed that the current dip was a shopping for choice, whilst concern.

- The liquidation heats pointed to $ 86.3k within the coming days.

Bitcoin [BTC] Noticed a worth of 6.89% bouncing from the 1-day commerce sessee worth of 10 March, closing to $ 78.6k. It’s already a outstanding resistance within the $ 84k area.

Evaluation of the value diagram and the liquidation ranges confirmed that consolidation was probably within the quick time period.

Supply: various.me

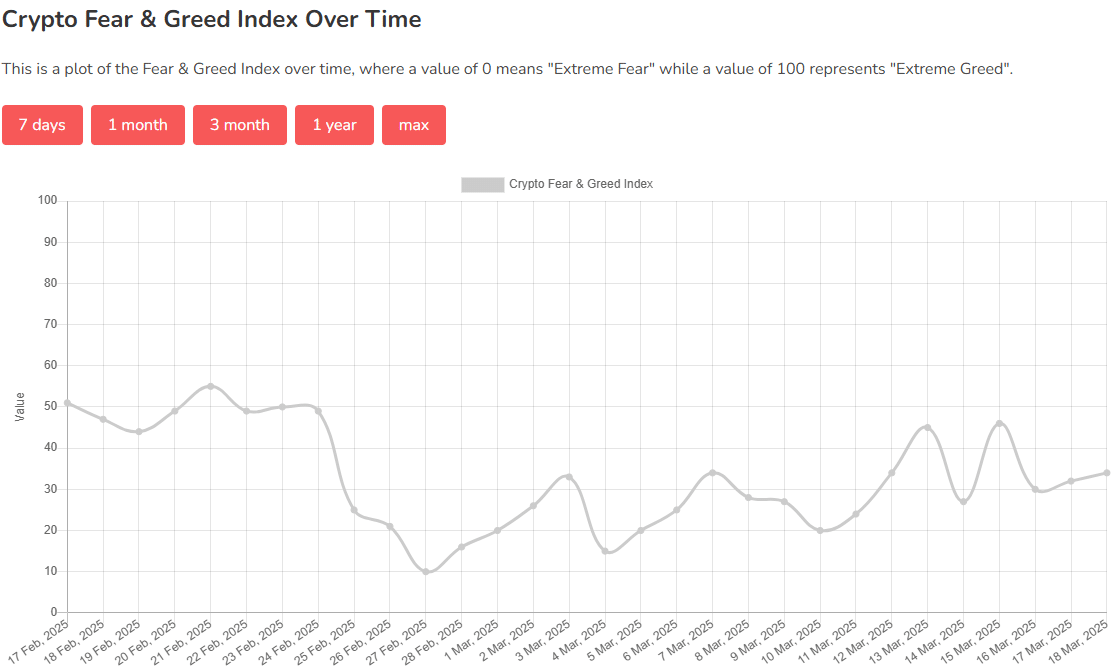

The Bitcoin concern and greed index was on the age of 34 and confirmed concern. Previously week it floated round 30-40, immersing to excessive concern and a worth of 24 to 11 March.

Bitcoin Spot ETFs noticed the $ 900 million outlines previously 5 weeks, which underlines the Bearish market sentiment.

Purchase Bitcoin whereas concern grabs the broader market

Supply: Blockchain Middle

At the very least this was the message of the Bitcoin Rainbow Chart. The lengthy -term valuation software for Bitcoin with enjoyable colours will be helpful for buyers. It’s based mostly on the concept that the value progress of Bitcoin follows a logarithmic sample over time.

The graph has accomplished an excellent job when figuring out cycles and soils, nevertheless it should be famous that this was often accomplished afterwards. In the intervening time the Bitcoin Rainbow Chart reveals that the largest crypto was “nonetheless low cost”.

For $ 82K it was a reasonably large declare, particularly within the background of falling inventory markets world wide. Then again, that may be the attraction to buyers – the danger of rewarding was nonetheless tempting.

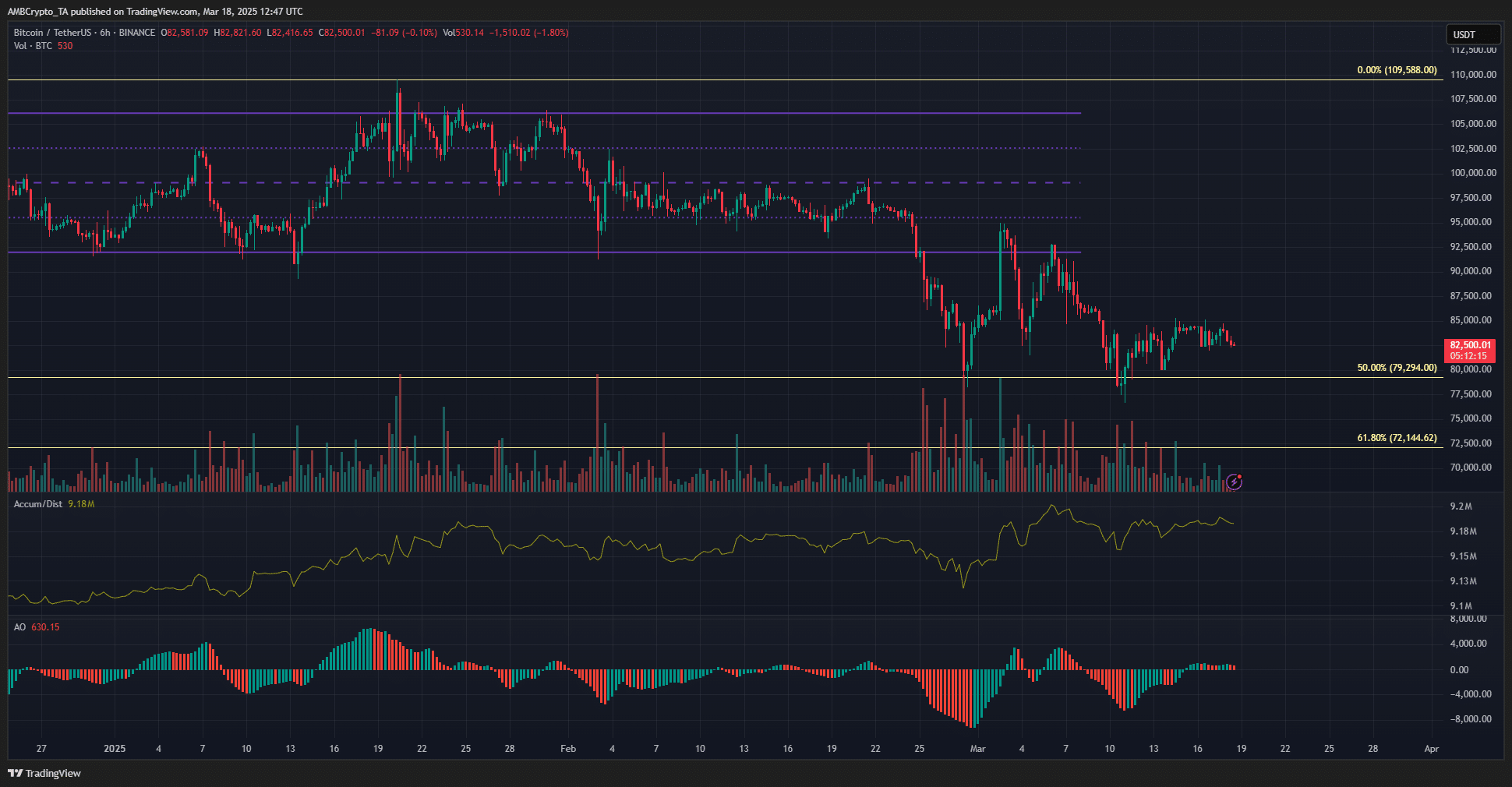

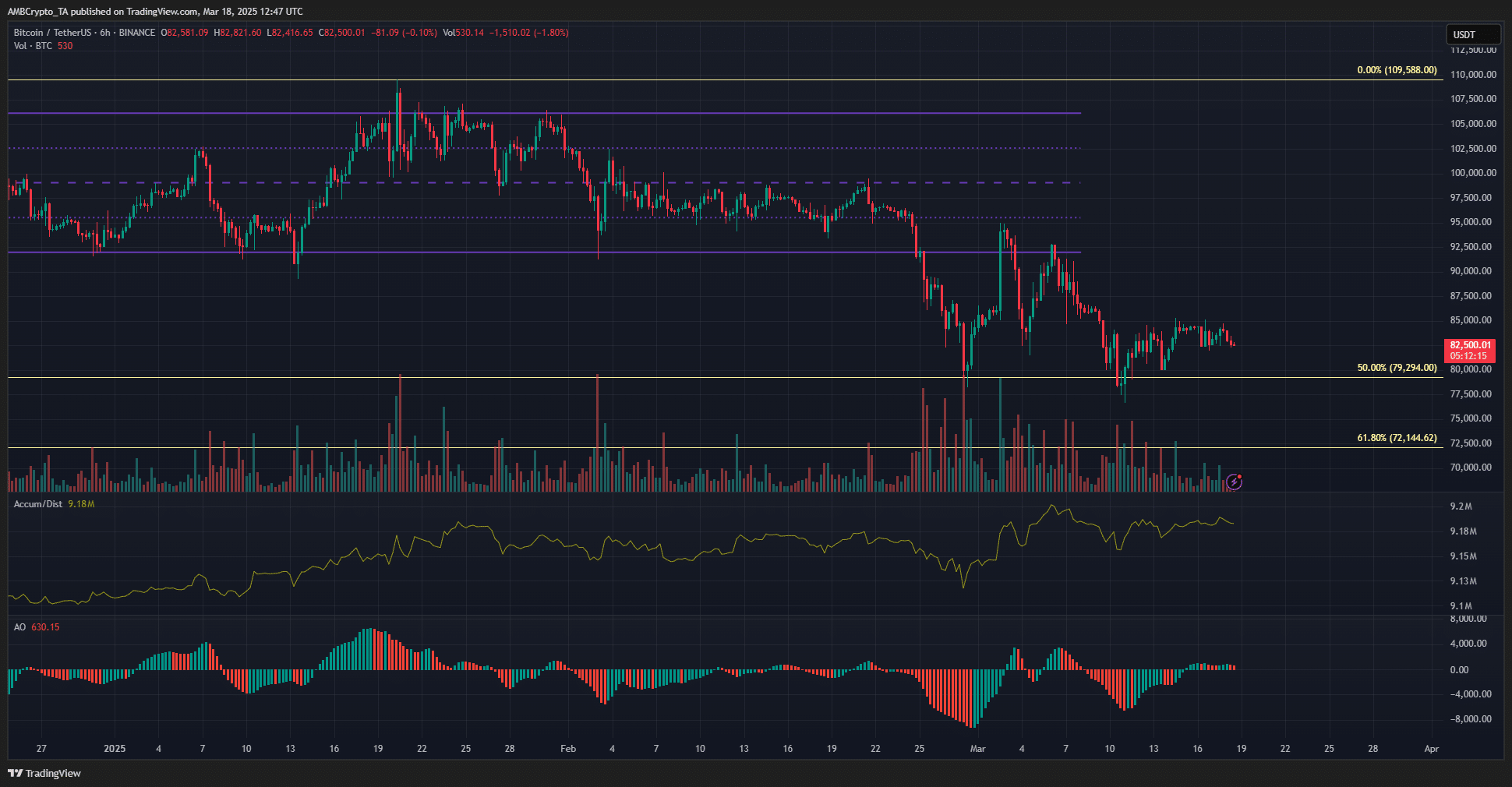

Supply: BTC/USDT on TradingView

Analysis of the 6-hour graph confirmed that the short-term construction was BEARISH. The extent of $ 85k has served as a resistance final week. The A/D indicator confirmed an upward development in March, whereas the value is strung to $ 80k.

This was an encouraging discovering. The elevated raised accumulation and the acquisition exercise will increase, in keeping with the indicator.

The nice oscillator confirmed that momentum was considerably bullish, however not excessive sufficient to stimulate traits.

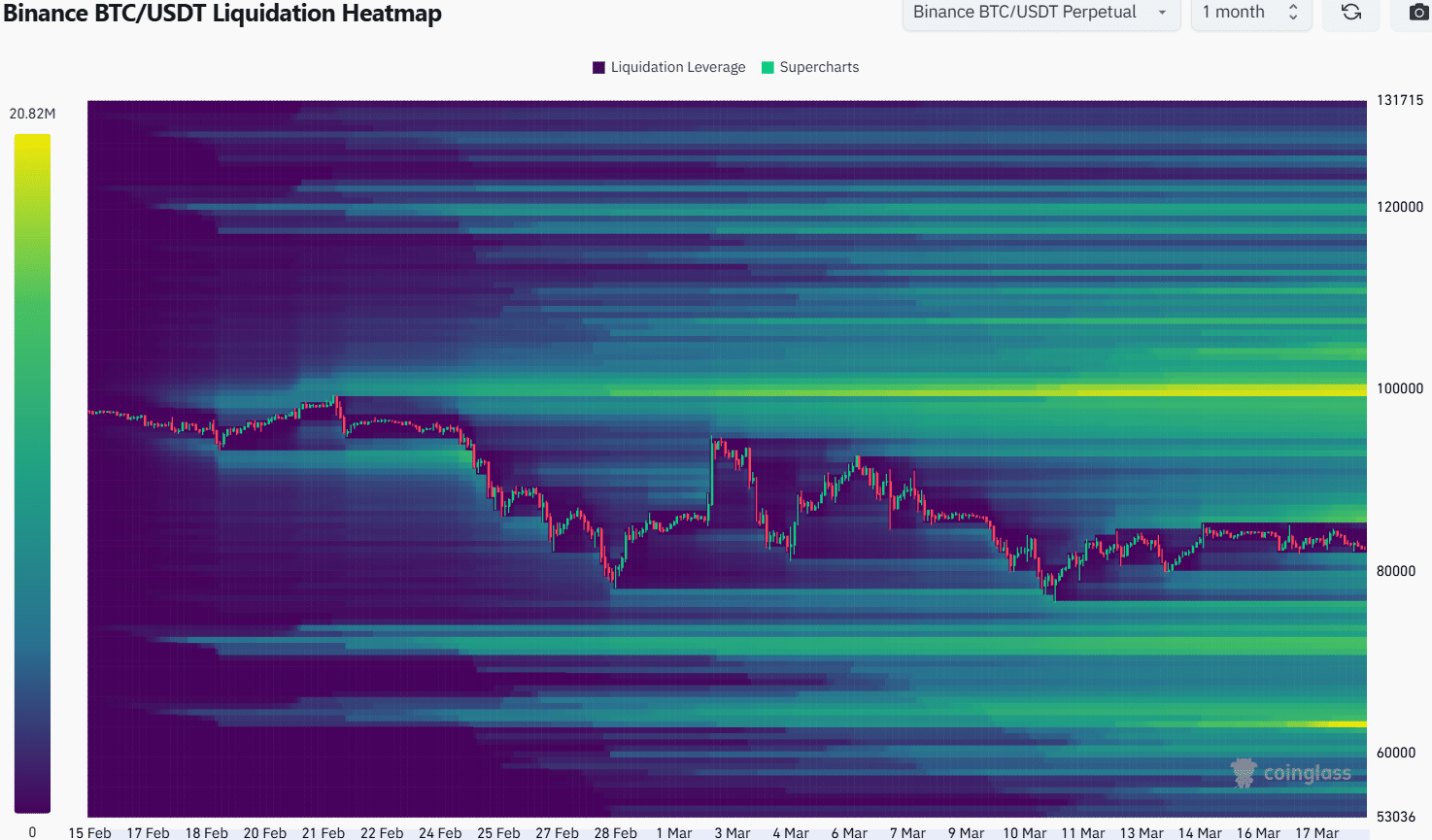

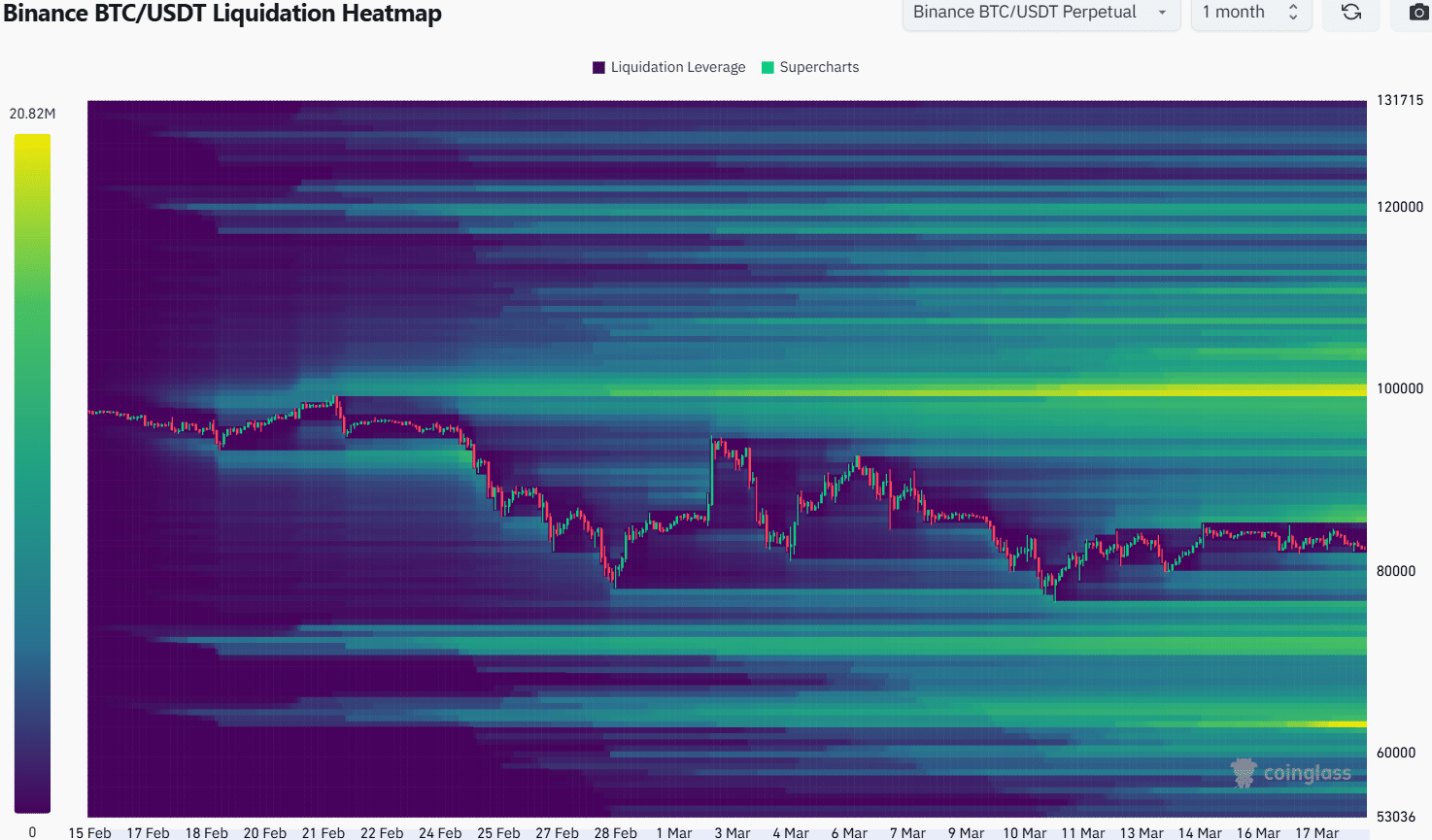

Supply: Coinglass

The 1-month liquidation warmth outlined the $ 100k and $ 71.7k $ 72.3k as appreciable liquidity clusters. Nearer to the value, the $ 86.3k and $ 76.3k had been additionally ranges that might entice the costs for them.

Given the bearish construction of BTC, a motion to the south most likely appeared. Nevertheless, the A/D indicator confirmed {that a} bounce was doable.

Furthermore, such a bumper past the native resistance at $ 85k might turn out to be bullish market individuals, earlier than the Beararish reversal is initiated on the magnetic zone of $ 86.3k.

That’s the reason merchants should preserve a bearish prospect till the native resistance areas have been violated.

Disclaimer: The introduced data doesn’t kind monetary, investments, commerce or different varieties of recommendation and is barely the opinion of the author

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024