Ethereum

5 signs that the crypto bull run is coming this September

Credit : ambcrypto.com

- September is seen as a key second for crypto as most belongings witnessed a decline.

- Market sentiment is presently in a state of concern, which might impression this month’s development.

Bitcoin in current weeks [BTC] has skilled vital worth volatility, resulting in a decline beneath the psychological degree of $60,000.

Whereas this drop has had an impression on the general cryptocurrency market, it additionally presents the chance for a crypto bull run, particularly as we enter September – a month traditionally recognized for detrimental developments within the monetary markets.

Nevertheless, a number of indicators counsel that September might break this sample and usher in a bullish section for cryptocurrencies.

The forex reserve is lowering

One of many key indicators supporting the case for a possible crypto bull run is Bitcoin and Ethereum’s dwindling international trade reserves. [ETH].

Traditionally, when the balances of those belongings on the inventory exchanges decline, it urged that traders have been transferring their holdings into chilly storage.

This indicated a long-term holding mentality somewhat than a want to promote. This development typically precedes a bull run as a result of it reduces the accessible provide of those belongings on the exchanges, creating the situations for upward worth strain.

On the time of writing, Bitcoin’s foreign exchange reserves amounted to roughly 2.62 million, persevering with the downward development. The identical goes for Ethereum reserves have additionally fallen to about 18.7 million.

This sample of declining reserves, which intensified towards the tip of the earlier 12 months and continues into the present 12 months, might set the stage for a major enhance in costs.

Market sentiment: concern as a precursor to greed

One other issue pointing to a possible crypto bull run is present market sentiment, as measured by the Crypto Worry and Greed Index.

This index measures total market sentiment, the place excessive concern can point out a shopping for alternative and excessive greed can point out a market prime. Traditionally, a shift from concern to greed typically precedes a bull run.

Based on information from Mint glassthe market is presently in a state of concern.

This sentiment creates an surroundings ripe for a bull run, as concern typically results in capitulation, adopted by a shift to greed as costs start to get better.

The cyclical nature of market sentiment suggests {that a} bullish section might be imminent after a interval of concern.

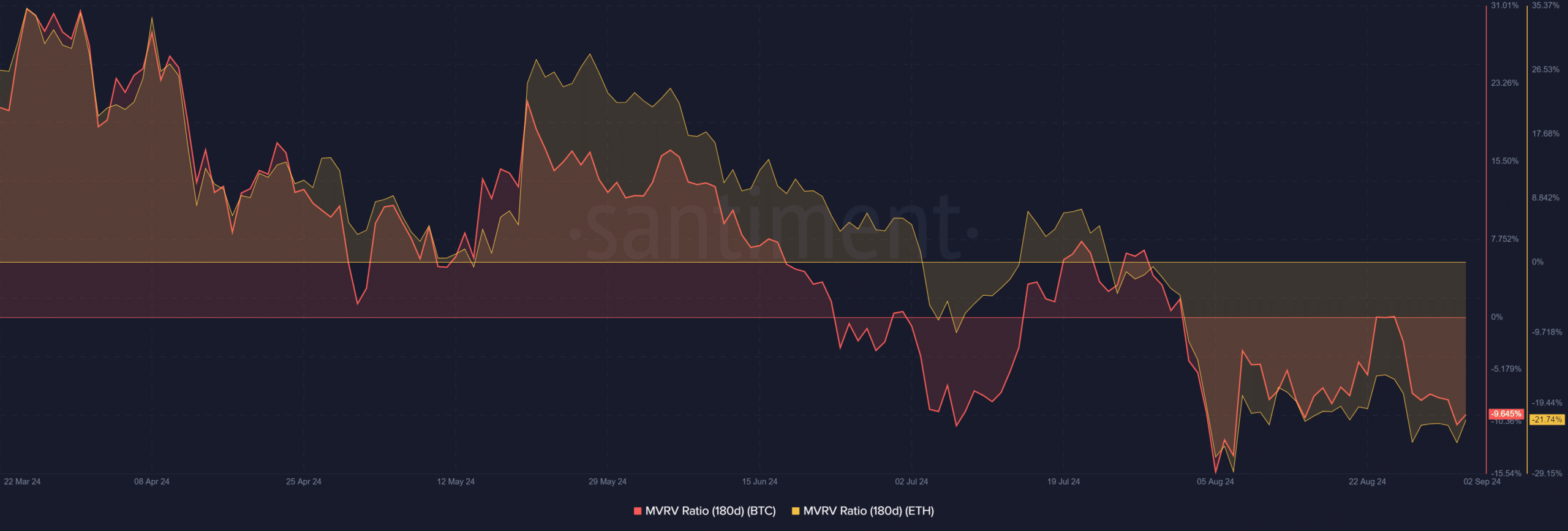

MVRV ratio: A sign for a bull run

The market worth to realized worth ratio (MVRV) is one other essential indicator that factors to a possible bull run. The MVRV ratio measures whether or not the market worth of an asset is above or beneath its realized worth.

When the MVRV is beneath zero, it usually signifies that the holders are making a loss, indicating that the asset is undervalued and could also be due for an adjustment.

Supply: Santiment

On the time of writing, Bitcoin’s 180-day MVRV was round -9.6%, indicating that long-term holders have been sustaining a lack of greater than 9%.

Equally, Ethereum’s MVRV has been beneath zero since July, with the present MVRV sitting round -23%, that means holders are taking a lack of greater than 23%.

These detrimental MVRV ranges point out that each belongings are considerably undervalued, and a correction above zero might set off a bullish run.

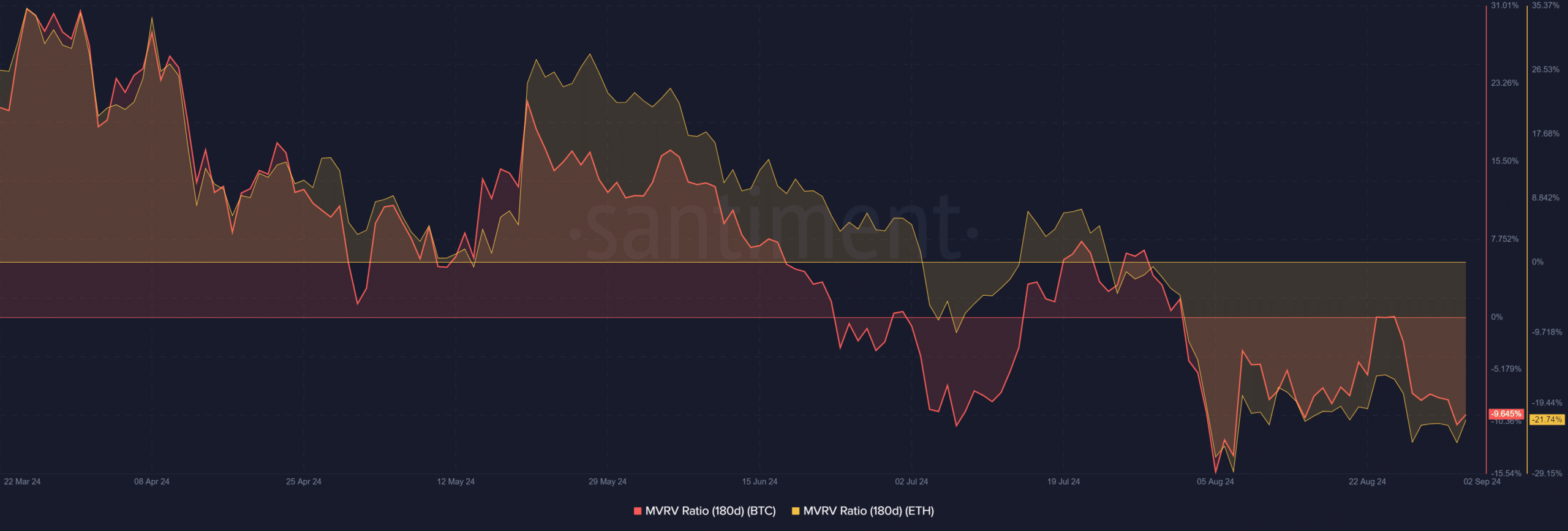

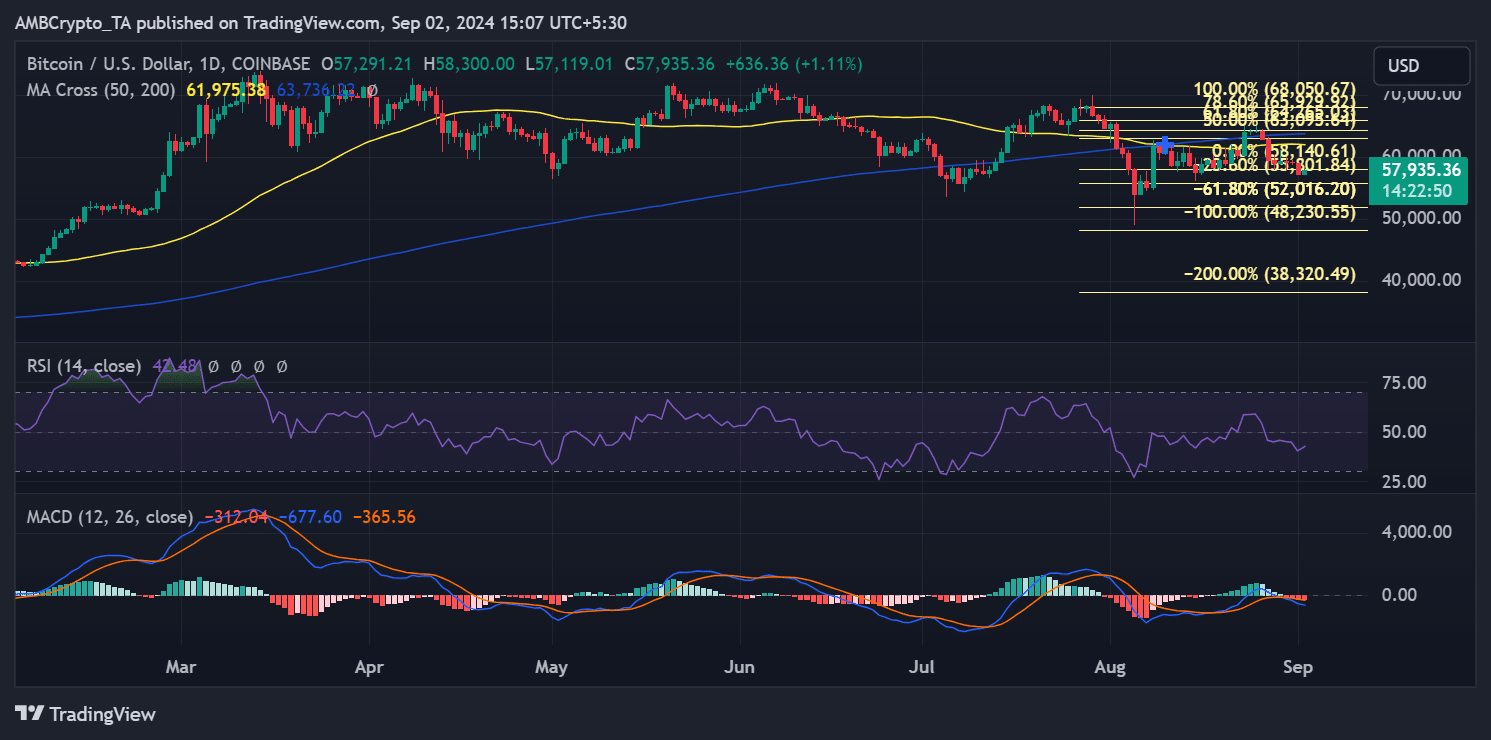

Assist and resistance ranges

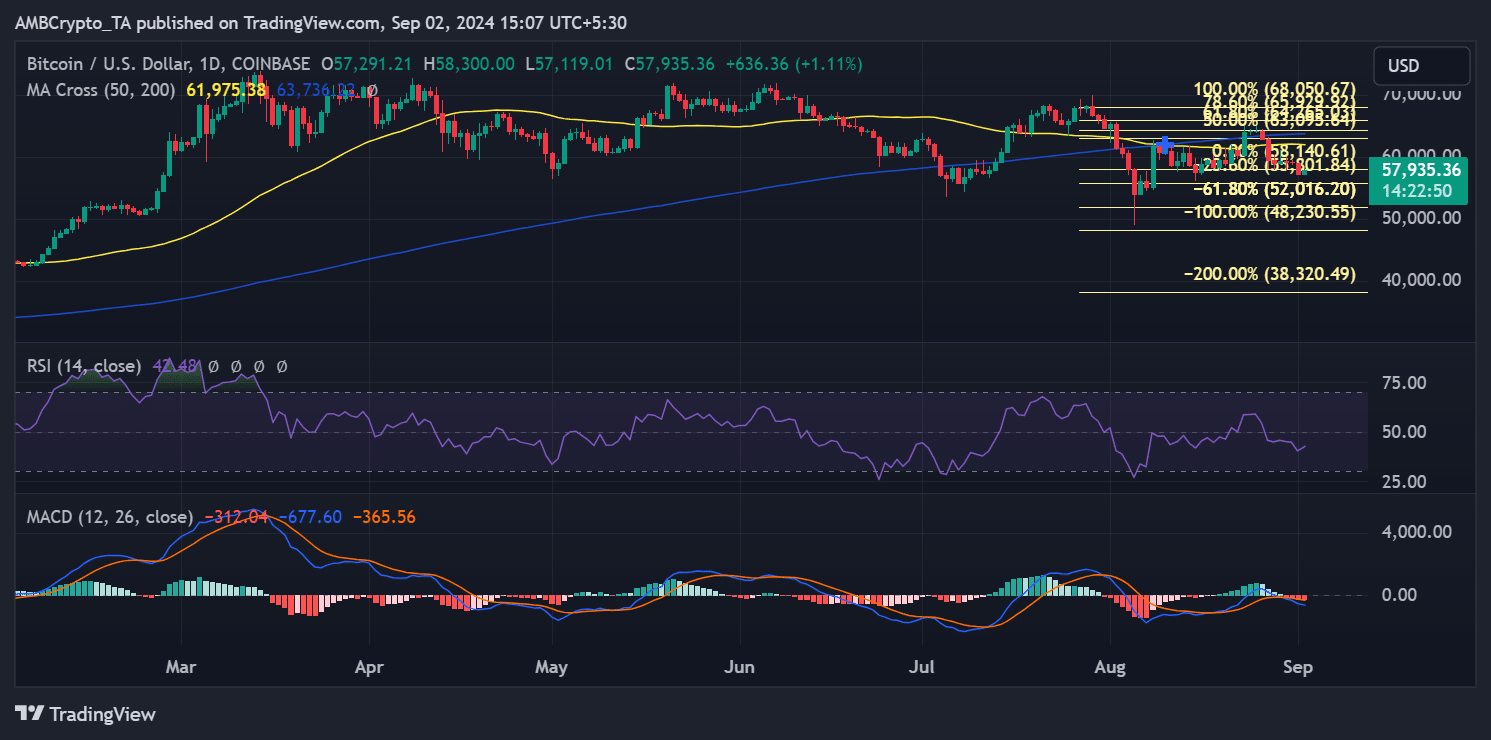

From a technical evaluation perspective, Bitcoin’s worth was beneath the 50 and 200 day transferring averages, indicating that the market is in a bearish or consolidation section.

Nevertheless, a transfer above these transferring averages might sign the beginning of a brand new bullish section.

Supply: TradingView

The 61.8% Fibonacci retracement degree, which presently acts as vital assist round $52,016.20, can be essential.

Bitcoin has examined this degree and is buying and selling above it, indicating that holding above it might lead to a resumption of a bullish development.

Furthermore, the 38.2% retracement degree, which acts as resistance round $58,140.61, is one other vital degree to observe. A break above this degree might result in additional positive aspects, which might sign the beginning of a bull run.

Open curiosity and quantity

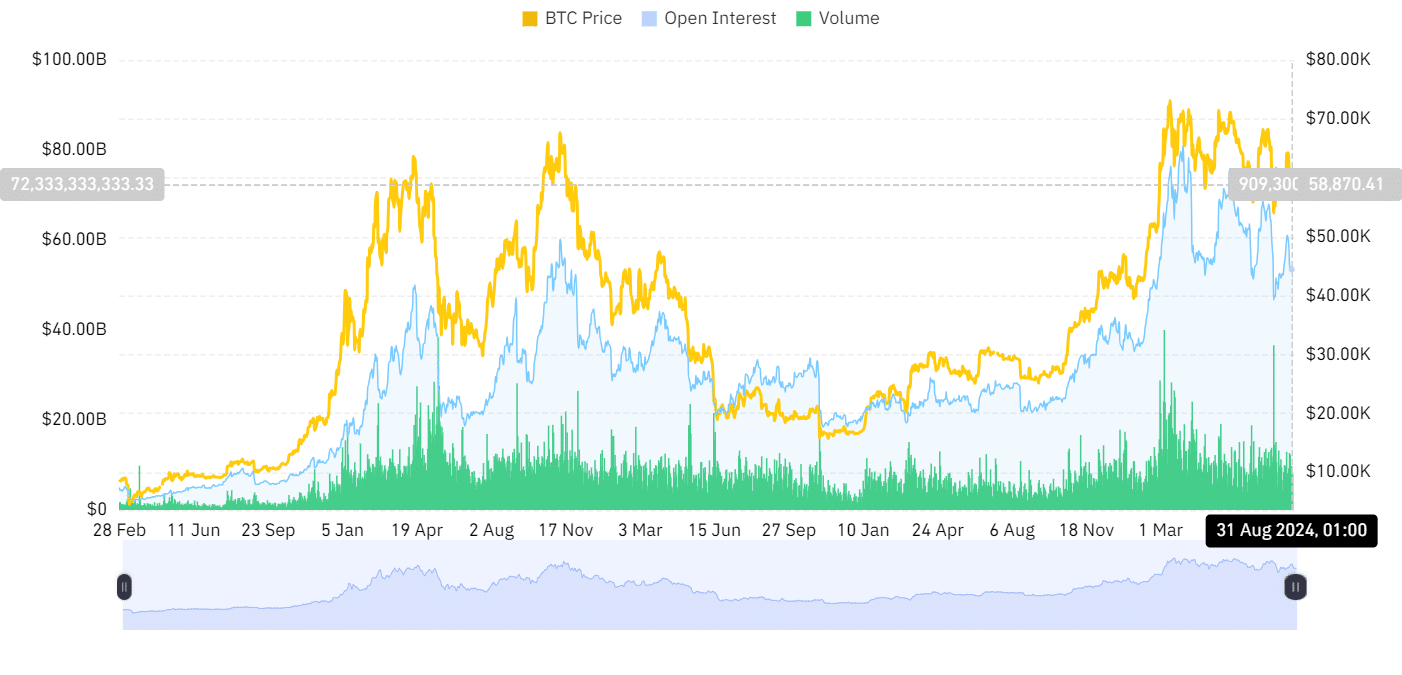

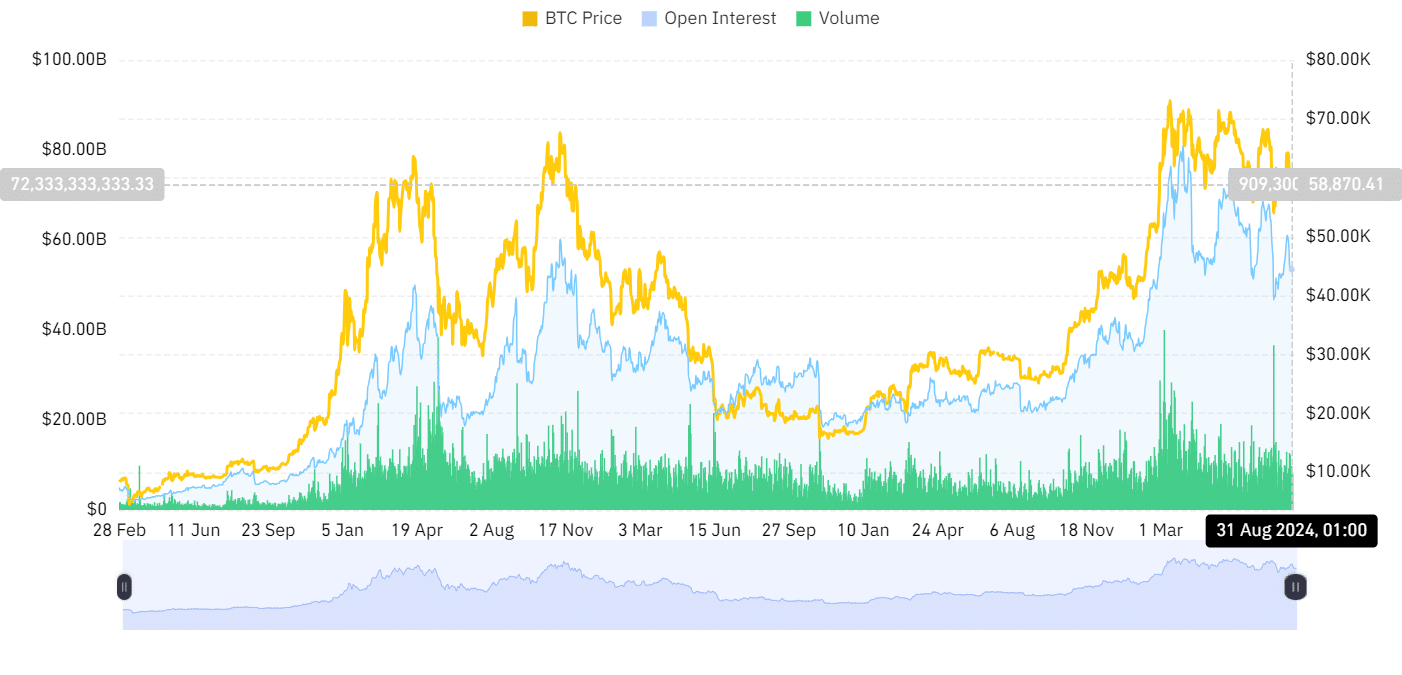

Open curiosity and buying and selling quantity are additionally important metrics to contemplate when assessing the potential for a crypto bull run.

Firstly of the 12 months, a crypto bull run culminated in March, with Bitcoin hitting its all-time excessive round $73,000.

Throughout this era, Open Curiosity and quantity elevated, peaking at over $75 billion and quantity exceeding $199 billion.

Supply: Coinglass

Open Curiosity was additionally all the way down to round $50 billion, and quantity was all the way down to round $100 billion.

Nevertheless, if these numbers begin to rise once more, particularly together with the bullish sentiment, it might sign the beginning of a brand new bull run.

A crypto bull run coming in September?

Whereas September has traditionally been difficult for the crypto market, a number of indicators counsel this 12 months might be totally different.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Falling international trade reserves, a market in concern, deeply detrimental MVRV ratios, and key technical ranges all level to the potential of a near-term crypto bull run.

As Bitcoin and Ethereum proceed to form the broader market development, the approaching weeks might be essential in figuring out whether or not the market will shift from concern to greed, doubtlessly resulting in vital worth positive aspects.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024

-

Policy & Regulation1 year ago

Policy & Regulation1 year agoCoinbase Policy Chief Endorses Kamala Harris’ Crypto Industry Expansion Policy Efforts