Ethereum

Ethereum’s supply drops to 2015 lows: How did investors’ behavior shift?

Credit : ambcrypto.com

- Ethereum customers determined to lock their ETH after the merger.

- Eth Change Provide has decreased by 16.4% within the final seven weeks.

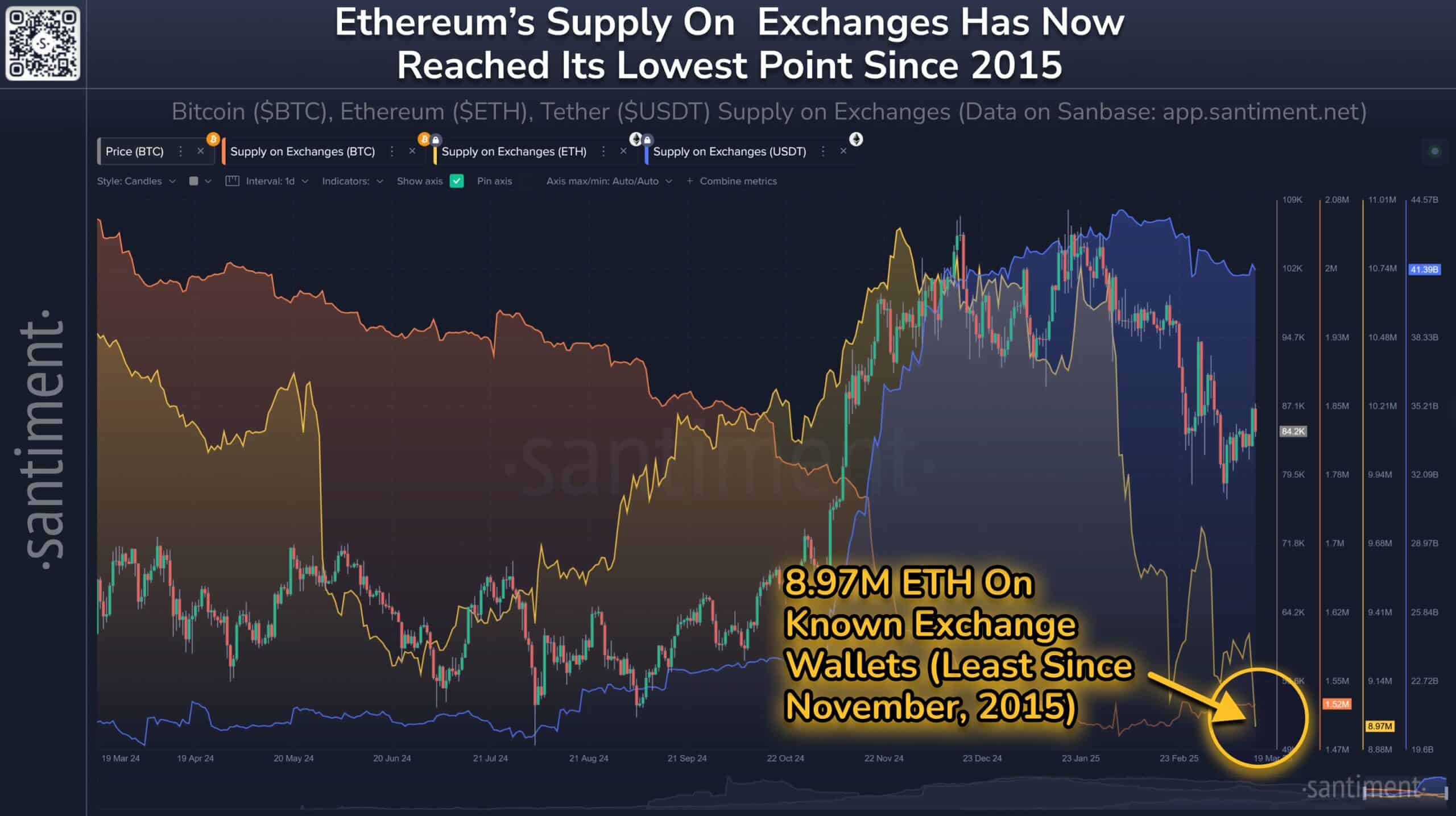

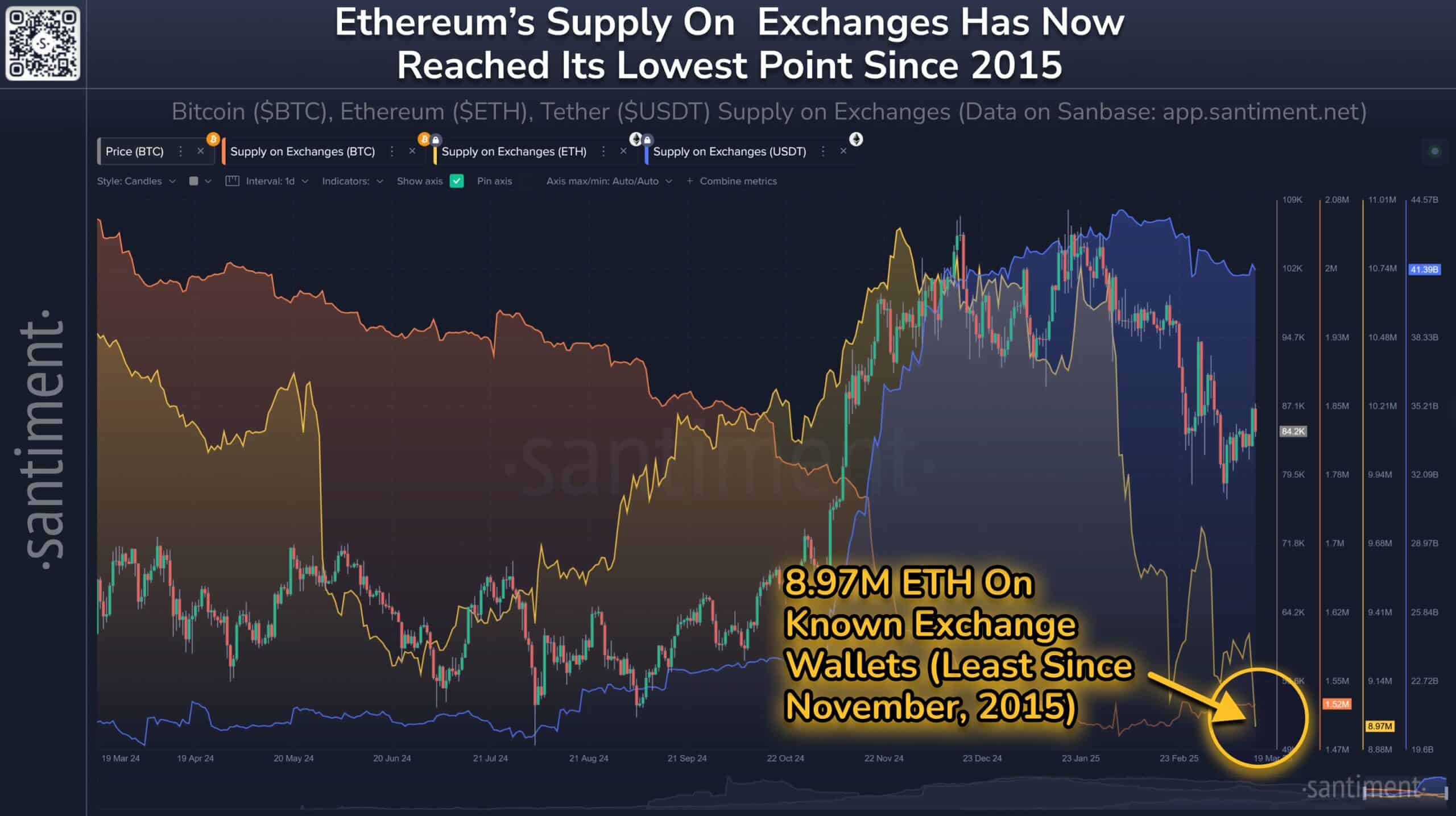

The quantity of Ethereum [ETH] At centralized festivals, it has fallen to eight.97 million ETH, which marks the bottom provide since November 2015.

Furthermore, the conduct of buyers has shifted significantly because the instant commerce provide of ETH reaches this historic low level.

Supply: Santiment

Santiment information reveals a constant decline of the Ethereum provide for centralized exchanges, which is a mirrored image of an elevated belief within the lengthy -term potential of Ethereum.

Consequently, ETH holders are more and more utilizing their tokens for deploying and decentralized monetary actions (Defi), away from prioritizing instant commerce.

Provide Shift: Impression of Defi and strike

The voluntary switch of Ethereum from festivals is principally pushed by the rising curiosity in Defi features and stake rewards. After merging, ETH customers began to lock their tokens if the shift to the proof is essential, providing rewards along with community safety advantages.

As well as, the management of Ethereum has attracted completely different consumer teams within the Defi sector that take part in actions corresponding to loans, liquidity provide and yield of agriculture.

This shift possession displays a choice amongst buyers to actively go inside the ETH community as a substitute of retaining their ETH at centralized inventory exchanges.

The growing interplay with the Ethereum platform helps its sustainability and long-term progress.

Ethereum’s lower within the change provision accelerates

Eth Change Provide has fallen by 16.4% within the final seven weeks, which marks the largest lower for the reason that finish of 2024.

This sharp decline displays the rising belief of buyers, as a result of many shift their possession to the usage of and Defi functions. Ethereum evolves in the direction of a yield -generating energetic as a substitute of only a industrial instrument.

The fixed outflow of inventory exchanges means that holders anticipate a rise within the worth of Ethereum, which helps a protracted -term bullish prospect.

Decreased change provision can considerably affect market dynamics. Restricted ETH availability could be larger costs resulting from shortage of steady demand ranges.

As well as, decreased liquidity on exchanges can result in elevated volatility, which implies that value actions are strengthened. The continual migration of Ethereum of centralized platforms emphasizes robust community confidence and reinforces bullish sentiment.

Whereas Defi and deploying are attracting extra capital, the place of Ethereum strengthens as a priceless long-termactive within the creating crypto-market panorama.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024