Bitcoin

Hyperliquid whales short Bitcoin as institutional investors keep buying – Explained

Credit : ambcrypto.com

- Hyperliquidwalvissen that management important funds available on the market have opened extra brief positions

- Institutional traders, alternatively, have continued to purchase Bitcoin

Bitcoin [BTC]After he gained by 1.59% final week, a distinct route took within the final 24 hours. In actual fact, the above -mentioned interval noticed the crypto lose nearly 3% of its worth.

That is value watching, particularly for the reason that evaluation of Ambcrypto has proven that this lower may develop as hyperliquic alarms took management of the derivatives market with a adverse internet BTC place. Nonetheless, this raises an vital query – can institutional traders regain the land and reverse the recession?

Hyperliquid whales guess on a big drop

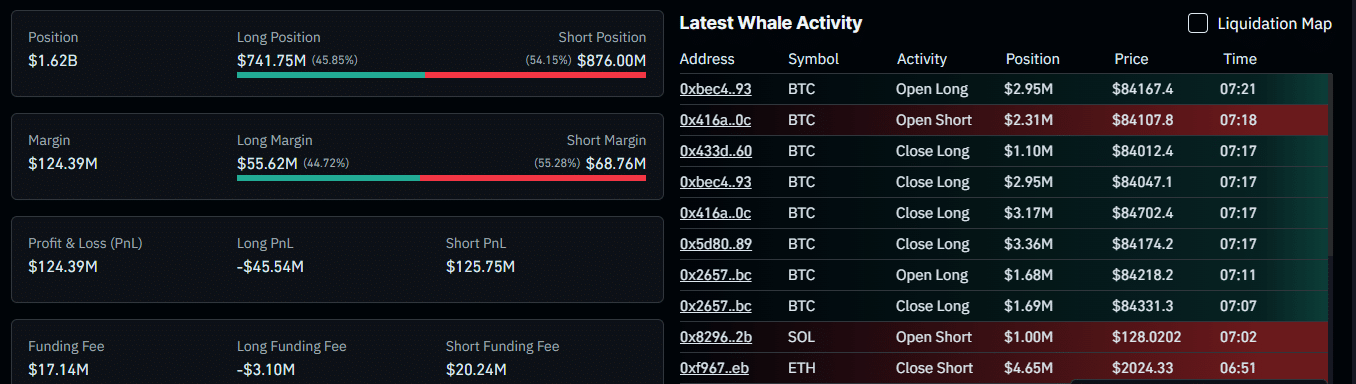

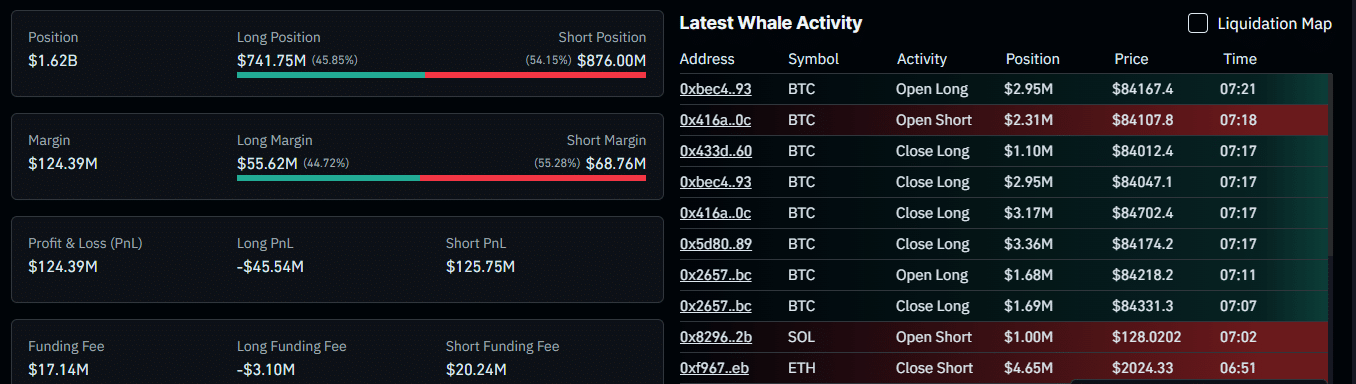

In response to Coinglass, there was a rise in by-product positions on Hyperliquid – a platform that displays the positions of enormous merchants – with figures for a similar climb to $ 1.62 billion.

Apparently, brief positions appeared to be good for 54.15% of those open positions, value $ 876 million. When market knowledge often reveal actions that skew in favor of the bears, this may increasingly point out an absence of curiosity from the perfect market members. This might probably result in a big market drop within the charts.

Supply: Coinglass

Additional knowledge has proven that merchants who’ve positioned opposing bets – lengthy transactions – are actually a loss. On the time of writing, revenue and loss (PNL) fell by $ 45.5 million, whereas brief merchants gained $ 125.75 million inside this era.

Merely put, this advised that promoting has been extra worthwhile – one thing that will have influenced Bitcoin’s deterioration within the final 24 hours. Ambcrypto additionally found that institutional gamers are actively shopping for, in all probability for the long run.

Institutional traders proceed to build up

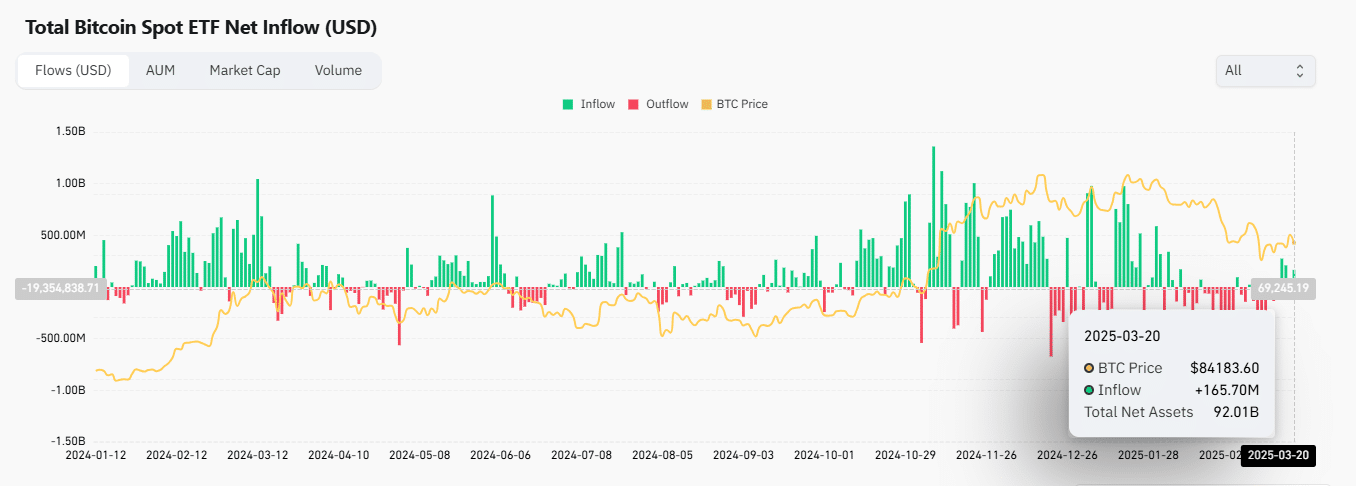

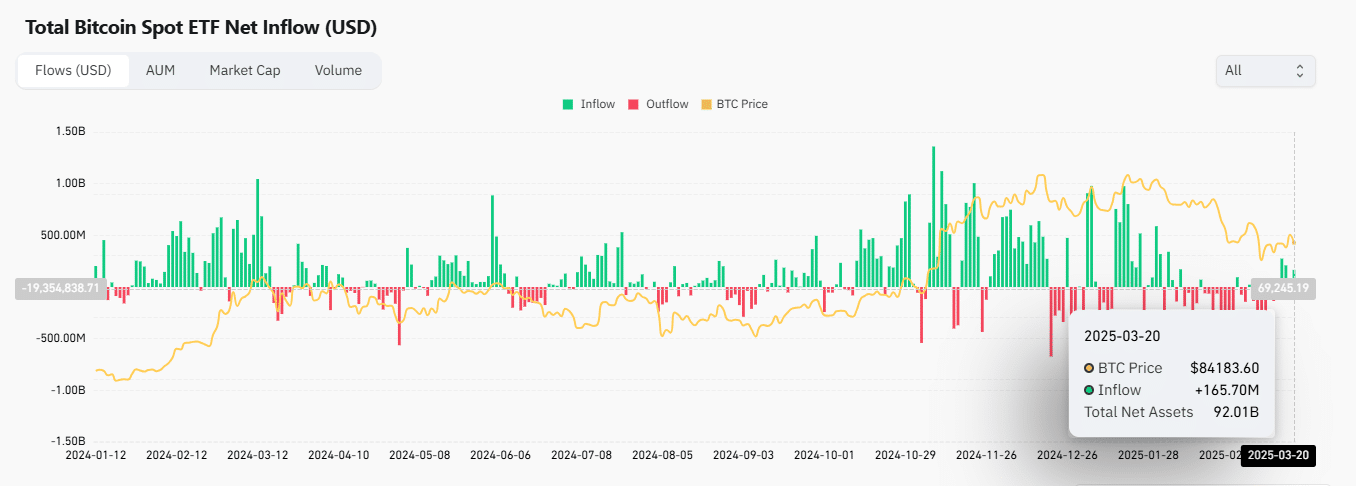

Whereas whales about Hyperliquid predominantly promote, institutional traders have actively purchased Bitcoin. This may be confirmed by the Netflows that follows consumption and outflow.

In response to the identical factor, traders have purchased $ 165.7 million from BTC over the previous 24 hours. Such a big quantity is an indication of a excessive degree of curiosity in Bitcoin.

Supply: Coinglass

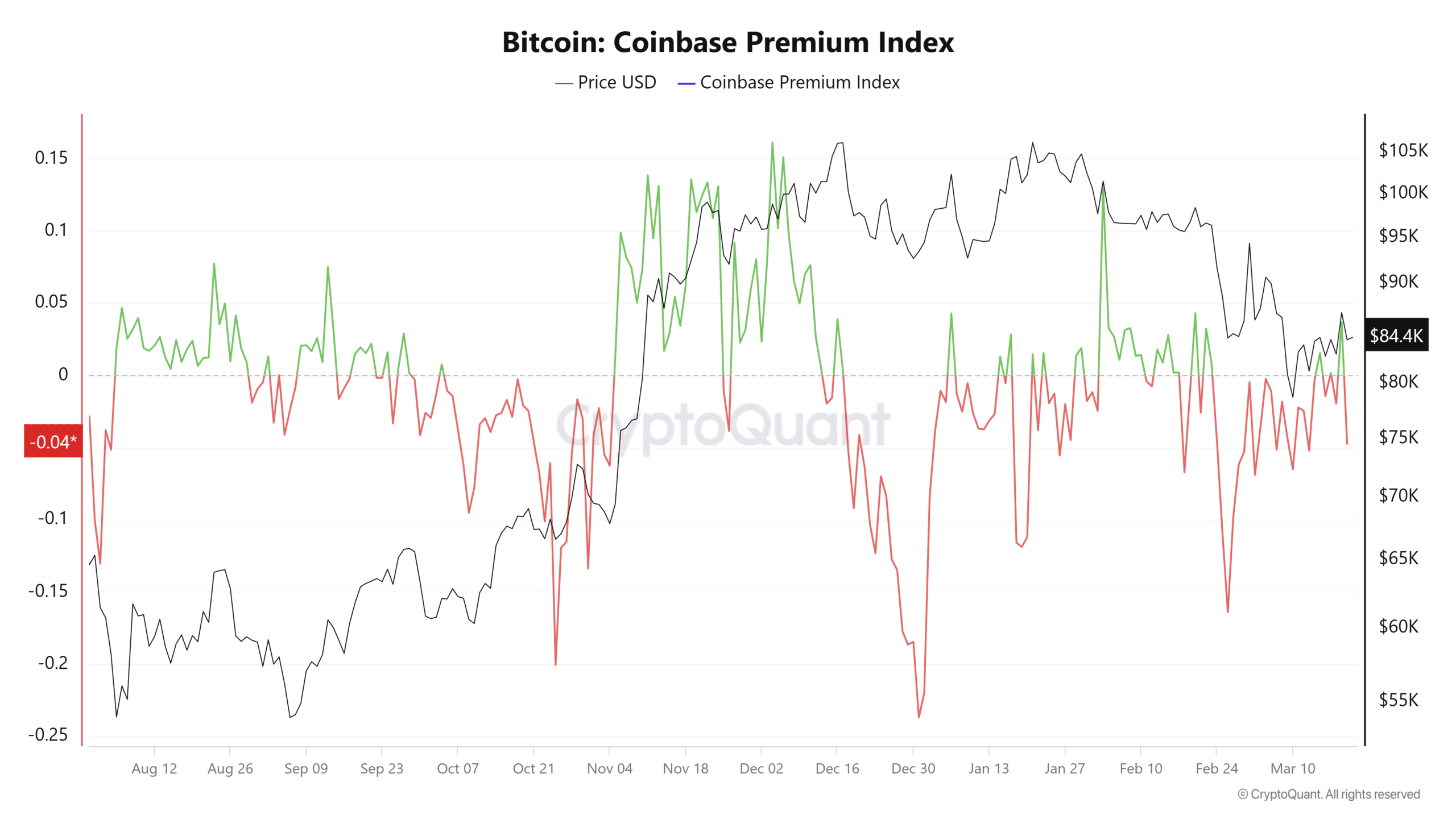

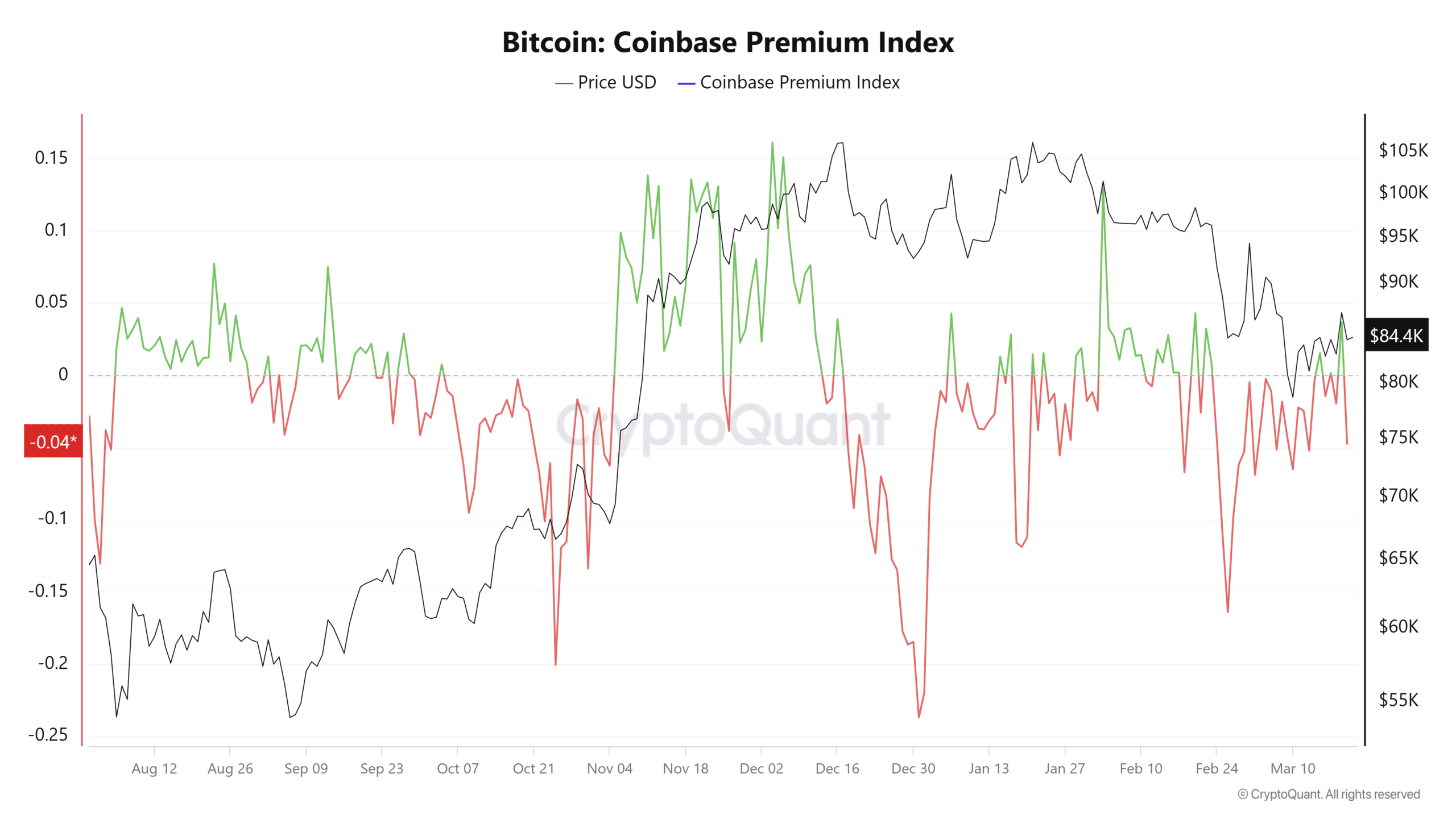

The market premium of the fund, one other vital metric by which Bitcoin costs on institutional funding platforms are in contrast with the broader place market, demonstrated buy actions of those platforms. On the time of writing, the metric was above the impartial degree of 0.

Ambcrypto additionally found that this institutional buying sentiment appeared to be in accordance with the selections of lengthy -term holders to assemble. The motion of their belongings within the final seven days has been declined particularly, with a binary CDD (destroyed coin days) from 0.285.

Right here Binary CDD follows the exercise of the long-term holders primarily based on a scale of 1 to 0. The nearer it’s at 0, as within the present case, the extra shopping for and holding actions are happening. This can be a signal that these traders regain a bullish have a look at the market.

Promote American traders

Lastly, American traders comply with the identical path as hyperliquid whales, that are at the moment promoting, resembling mirrored by the Coinbase Premium that drops to -0.04. When this premium enters adverse territory, this refers to a substantial gross sales strain.

Supply: Cryptuquant

Normally American traders affect Bitcoin’s lengthy -term motion, which implies that if their gross sales strain continues to climb, Bitcoin may fall additional. Nonetheless, if the sale is lowering, Bitcoin may again according to the bullish wave of the institutional traders.

Generally, an vital shift in each instructions – two -fold or bearish – will give us extra readability on Bitcoin within the coming weeks and months.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024