Altcoin

Bitcoin short -term holders realize $ 7 billion in losses – explained

Credit : ambcrypto.com

- STHs have registered $ 7 billion in realized losses, probably the most on this cycle

- The worth of Bitcoin stays below essential superior averages, with the habits of the brief time period that’s essential for the brief -term pattern route

Quick bitcoin [BTC] Holders really feel the warmth as non -realized losses arrange, which marks a crucial bending level on this market cycle. Regardless of all of the construction of stress, historical past means that this is usually a pure cooling section inside a wider bull pattern.

Bitcoin shedding losses, however keep inside historic attain

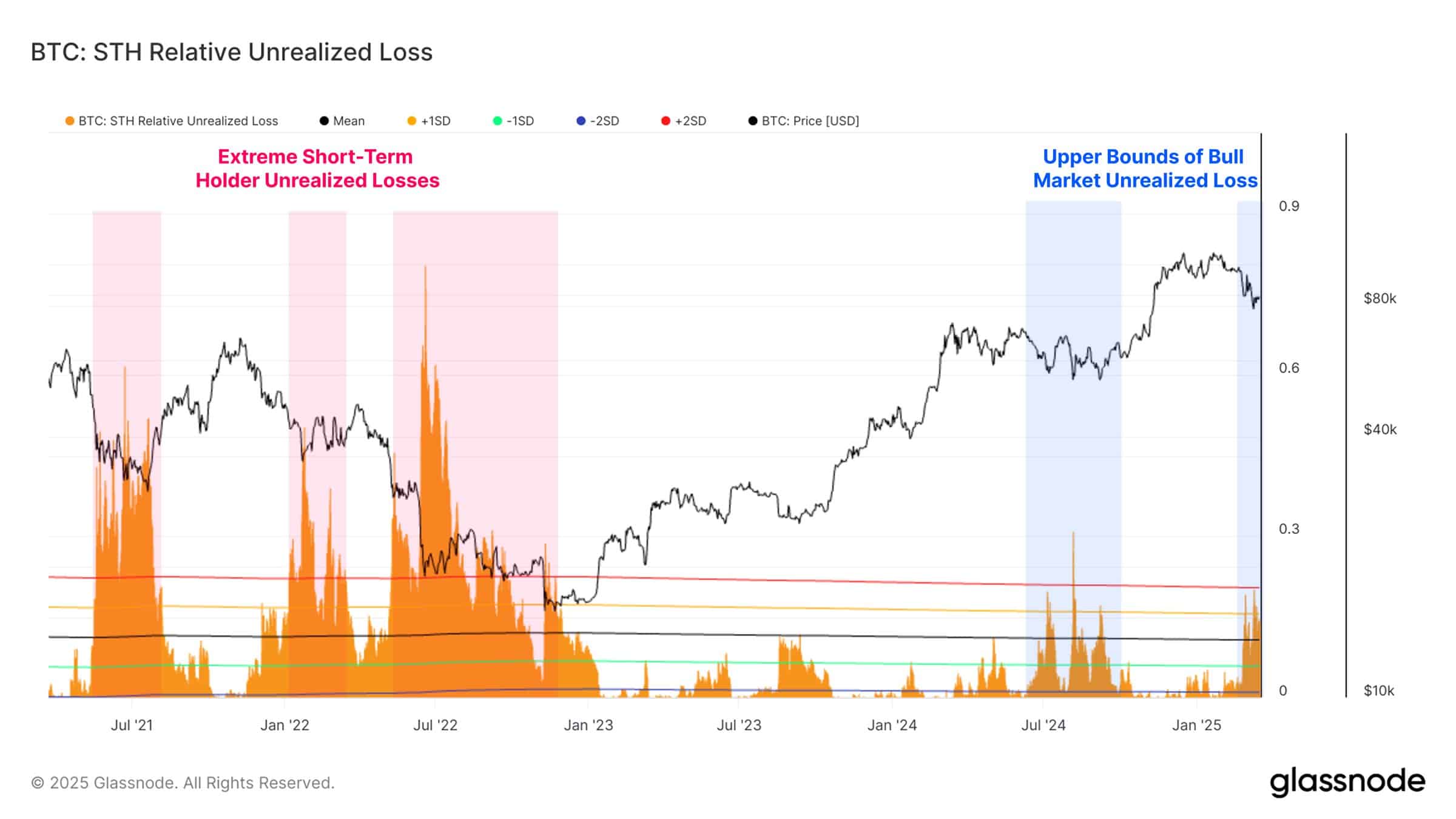

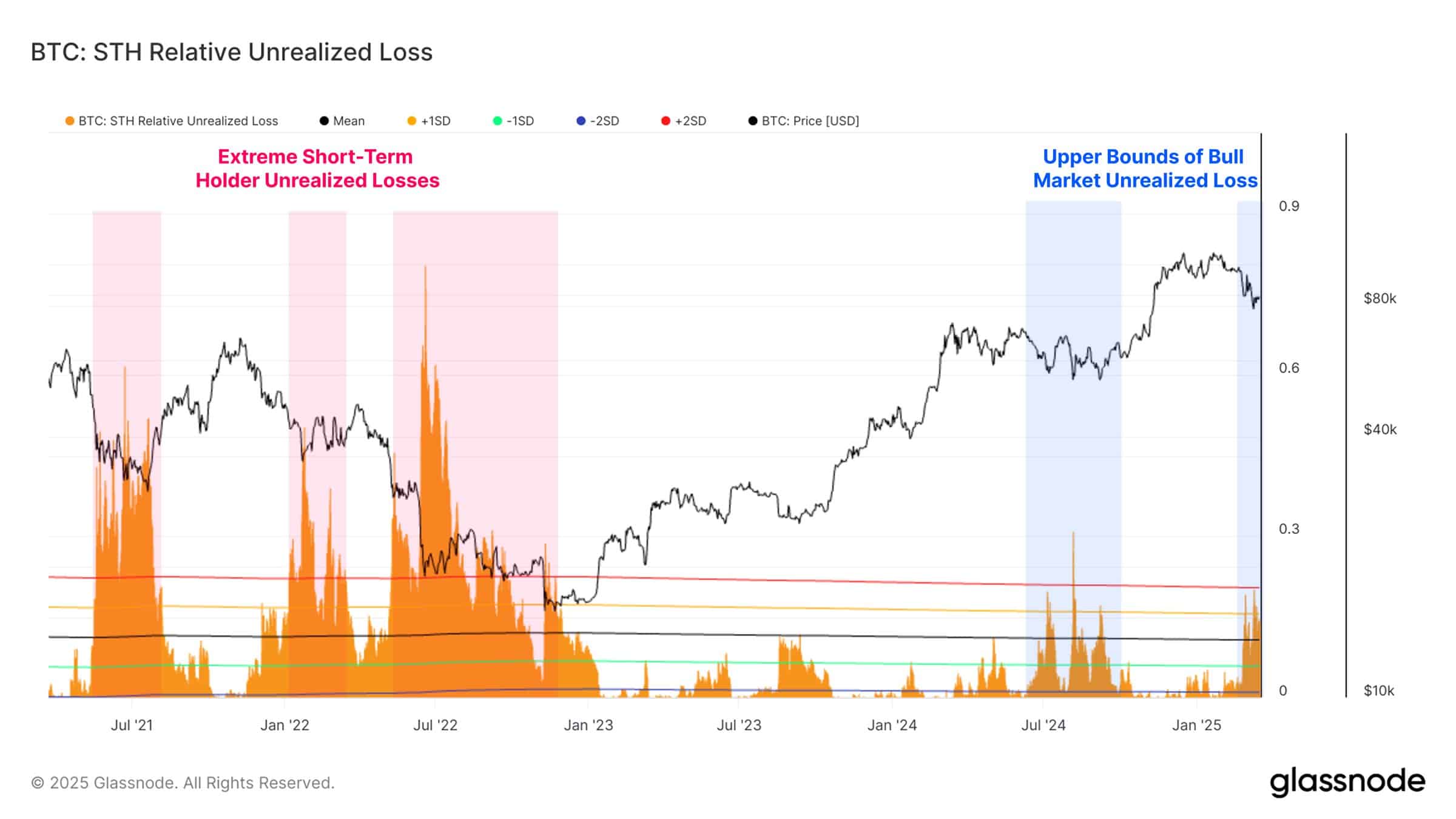

In actual fact knowledge from Glass node revealed that the relative non-realized losses for holders within the brief time period [STHs] Can strategy the +2 normal deviation degree – a threshold that’s traditionally related to peak complaints.

And but they continue to be throughout the higher borders which can be usually seen throughout bull markets, which don’t but violate a capitulation space.

Supply: Glassnode

The time degree of StH ache additionally appeared to be exceptional, with greater than $ 7 billion in realized losses which have been registered within the final 30 days.

Though this determine is the best loss occasion of the present cycle, it’s appreciable below the astonishing $ 19.8 billion and $ 20.7 billion ranges which can be seen throughout a very powerful drawings of Could 2021 and June 2022.

Which means though the losses have elevated, many traders nonetheless depart earlier than excessive capitulation begins. In different phrases, short-term holders can lock modest losses, as an alternative of tolerating deeper drawings-a signal of wider market power.

Bitcoin’s value construction and threat zones

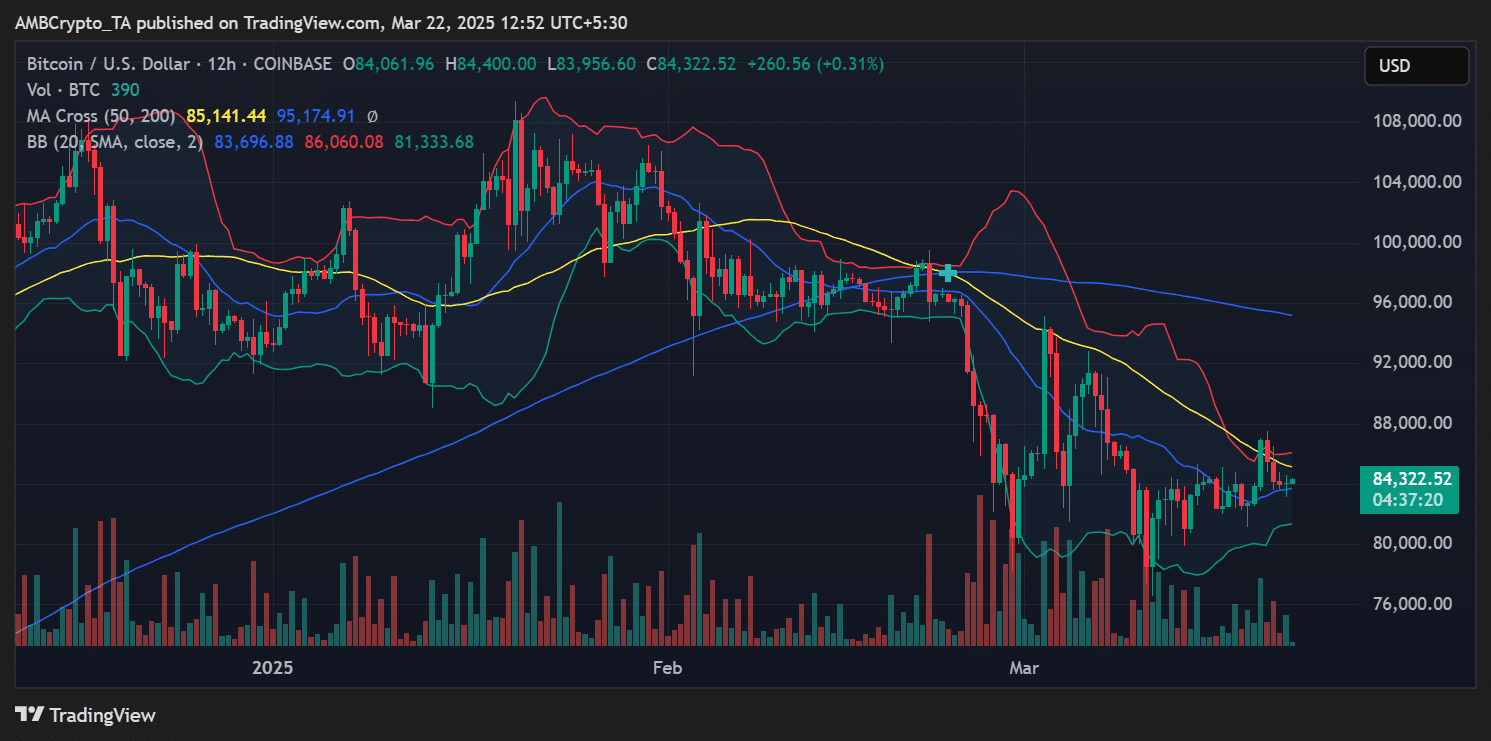

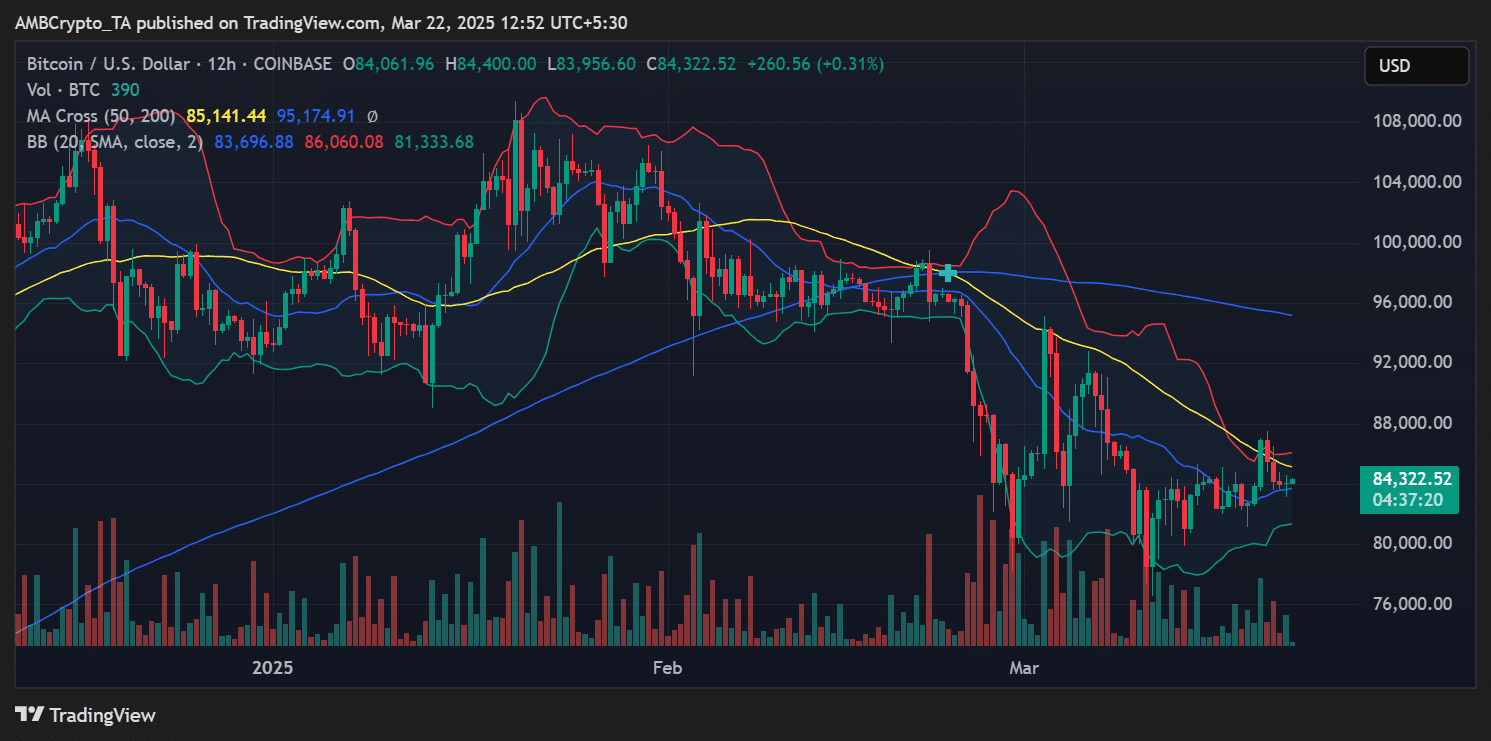

Bitcoin traded at $ 84.322 on the press, with the crypto slightly below the 50-day advancing common of $ 85.141 and nicely under the 200-day advancing common at $ 95.174.

These ranges are essential resistance zones and may proceed to suppress the upward momentum. Particularly if sentiment stays weak within the brief time period holders.

Supply: TradingView

The Bollinger tires additionally emphasised a tightening vary, so {that a} break -out of the bow confirmed.

With brief -term holders below stress, nevertheless, the bias can tilt bearish until the brand new demand enters the market.

What this implies for Bitcoin’s pattern

The mix of rising non -realized and rising realized losses instructed an elevated threat, particularly for individuals who have taken over Bitcoin at latest highlights. Nevertheless, the truth that these losses stay inside historic bullmarkt patterns is an indication {that a} macroom barrier shouldn’t be but confirmed.

If BTC can reclaim the $ 85,000 degree and convert them into help, this could renew the belief below STHS. Conversely, it can not entail $ 83,000 result in extra gross sales whereas testing decrease help almost $ 80,000.

Basically, ache within the brief time period is evident, however not but excessive. So long as Bitcoin applies above a very powerful psychological ranges and macrostrooms stay intact, this correction can serve extra as a reset than as a reversal.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now