Bitcoin

Bitcoin traders, watch out! BTC won’t see a real breakout unless…

Credit : ambcrypto.com

- The short-term holders of Bitcoin (STHS) at present maintain a mean non-realized lack of 6%.

- A motion above their price base can shift the sentiment. What are the alternatives?

Bitcoin [BTC] has risen prior to now two weeks after 4 vital resistance ranges and beforehand pushed underwater holders again into revenue.

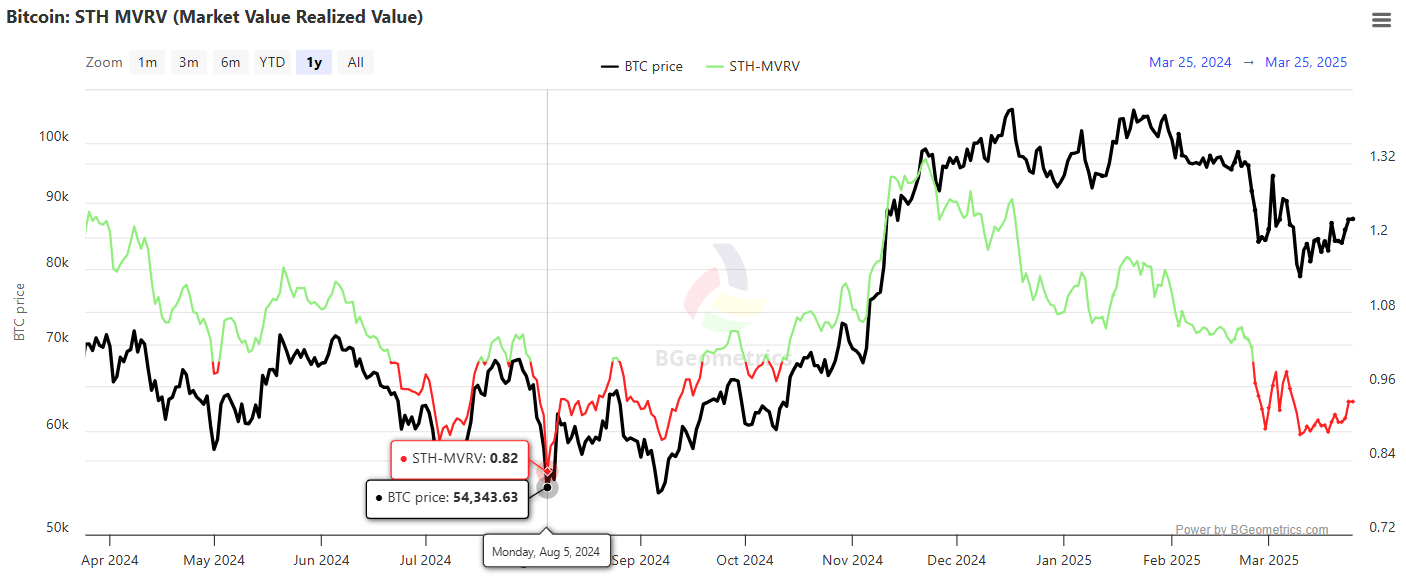

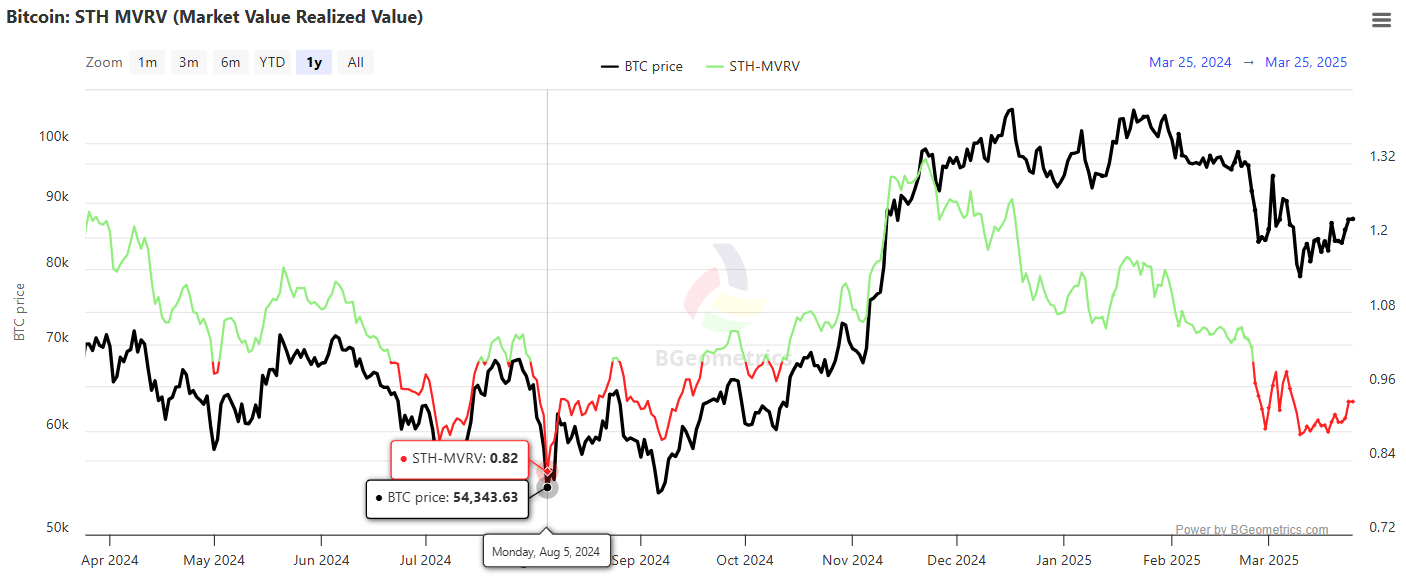

Nevertheless, the market worth within the quick time period and the ratio of the realized worth (STH MVRV) remained in a adverse space, indicating that holders nonetheless have an aggregated non-realized loss within the quick time period.

A persistent motion above their price base is required to stimulate FOMO and to unlock additional upward potential. Unclean facts Van Glassnode mounted $ 93.5k because the vital break life, which marks an vital resistance cluster.

For Bitcoin To keep up its present market worth of $ 88,041 and to increase the rally, bulls should stop pressured liquidations between holders within the quick time period that may trigger distribution -driven gross sales stress.

A failure to do that dangers a repetition of the capitulation occasion firstly of August 2024, with a adverse STH MVRV lecture previous the sharp drawing of BTC from $ 68,525 to $ 54,343 in lower than two weeks.

Supply: Bgeometrics

The direct aim for bulls is due to this fact to place the resistance of $ 93.5K into help, a motion that might drive the STH MVRV ratio in a optimistic space.

Consequently, the short-term holders (> 155 days) would herald non-realized earnings, which relieves the stress on the gross sales facet.

This outbreak is especially essential as Q2 approaches, with macro -economic shifts which are able to introduce liquidity fluctuations. So, to forestall pressured liquidations, Bitcoin should affirm this as a requirement zone.

A vital week forward

Bitcoin’s Retracement to its layer for the $ 78k elections on March 10 activated “Excessive worry”, traditionally a robust accumulation zone.

Since then, BTC has risen 12.82%, so {that a} substantial a part of the stakeholders is restored within the web non -realized revenue.

This shift has pressed the market sentiment within the “religion” part, as indicated by the web non -realized revenue/loss (NUPL) metric.

Supply: Cryptuquant

Merely put, this indicators a desire for hodels above distribution at key resistance ranges.

As well as, Open Curiosity (OI) has returned to his peak of November of $ 57 billion, with $ 12 billion in New lifting tree positions Up to now two weeks, the sturdy speculative demand underlines.

Bitcoin’s restoration of $ 93.5K, an vital Brak Holder (STH) break life stage, stays unsure. A persistent rejection right here may cause gross sales stress, which will increase the danger of liquidations.

A deeper decline in STH MVRV would then connect the capitulation between weak palms, which makes it doable to speed up a wider distribution part.

Of Macro -economic uncertainty Vooruit may introduce Q2 new volatility – an element to take a look at earlier than he offers purely about bullish statistics.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024