Bitcoin

Why Are We Still Under the SEC’s Gun?

Credit : www.coindesk.com

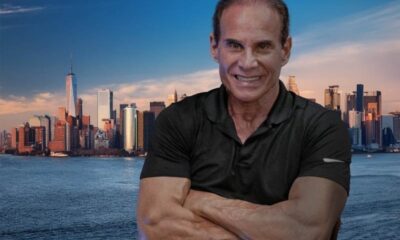

Washington, DC – Unicoin CEO Alex Konanykhin mentioned he requested the American Securities and Alternate Fee to conduct her analysis towards the crypto operation and has not but acquired a response.

Unicoin represented a last shot towards the trade of earlier chairman Gary Genler’s SEC, who informed the company in an official notification On the finish of final yr that the regulator supposed to accuse fraud, deceptive practices and non -registered results. The investigation was introduced within the final days of the federal government of President Joe Biden in December, earlier than the management of the SEC was taken over by these chosen by Crypto Fan President Donald Trump.

The CEO, which has considered a dozen different crypto corporations, left the hook of their enforcement actions by the brand new administration of the company, informed Coindesk that he wrote a letter of 17 March to the brand new Crypto Activity Power of the Bureau, who was requested concerning the research.

“I’m in search of your steerage about the easiest way to sort out this abuse of energy and to place an finish,” wrote Konanykhin within the letter, a duplicate of which was assessed by Coindesk. He requested to terminate the case and that the conduct of the enforcement officer concerned within the case with the company should be revised, due to his “willingness to arm the authority of the SEC for political functions.”

A spokesperson for the sec refused to touch upon the standing of Unicoin on Wednesday. A Unicoin spokesperson informed Coindesk on Tuesday that the corporate “stays within the final phases of the SEC evaluate course of. Any more now we have not acquired any new updates or formal suggestions from the SEC about our registration. We’re absolutely dedicated to compliance and transport parcel, and we’ll proceed to work on acquiring the mandatory approval for our deliberate gives.”

The CEO believes his firm, which suggests Investors can see a maximum of 8,000% returnFinal yr was the goal of company intimidation, he mentioned in an interview with Coindesk in Washington.

“They demanded from us to not be public in america, to not ICO, to not elevate cash,” he mentioned. “So I packed my luggage and moved to Europe to renew enterprise.”

He mentioned that Trump’s election and the President’s guarantees to make the US the worldwide crypto capital, returned him from Switzerland to New York, with the intention of changing into public right here.

“We thought the battle was over and we mentioned towards the Sec:” Hey, we’re resuming our exercise, “mentioned Konanykhin. At the moment, the company introduced that it was planning to focus the corporate with civil prices.

Konanykhin famous that the supervisor had accused them of violating the securities legal guidelines with an airdrop. Konanykhin argued that it’s a widespread advertising and marketing technique that’s seen in lots of crypto belongings, and is “what the president of america does together with his memecoin.”

“It’s embarrassing that the battle towards Crypto continues to be happening,” he mentioned. If the company continues its battle towards crypto by striving for Unicoin: “I believe so many observers might be stunned.”

Unicoin started to create a “extra clear and dependable various” for Bitcoin within the US (which, in line with the Unicoin web site, mentioned, has returned 9 million percent to buyers previously 10 years). He mentioned that some analysts imagine that Bitcoin “created by Chinese language intelligence, however no one actually is aware of who.”

“I’m delighted by the potential for collaborating in making the American crypto capital of the planet, because the president promised that he needs to do, though it is extremely annoying to nonetheless have the previous persecution of the SEC,” mentioned Konanykhin.

Within the meantime, he mentioned, “We’re actively making ready for the general public.”

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024