Policy & Regulation

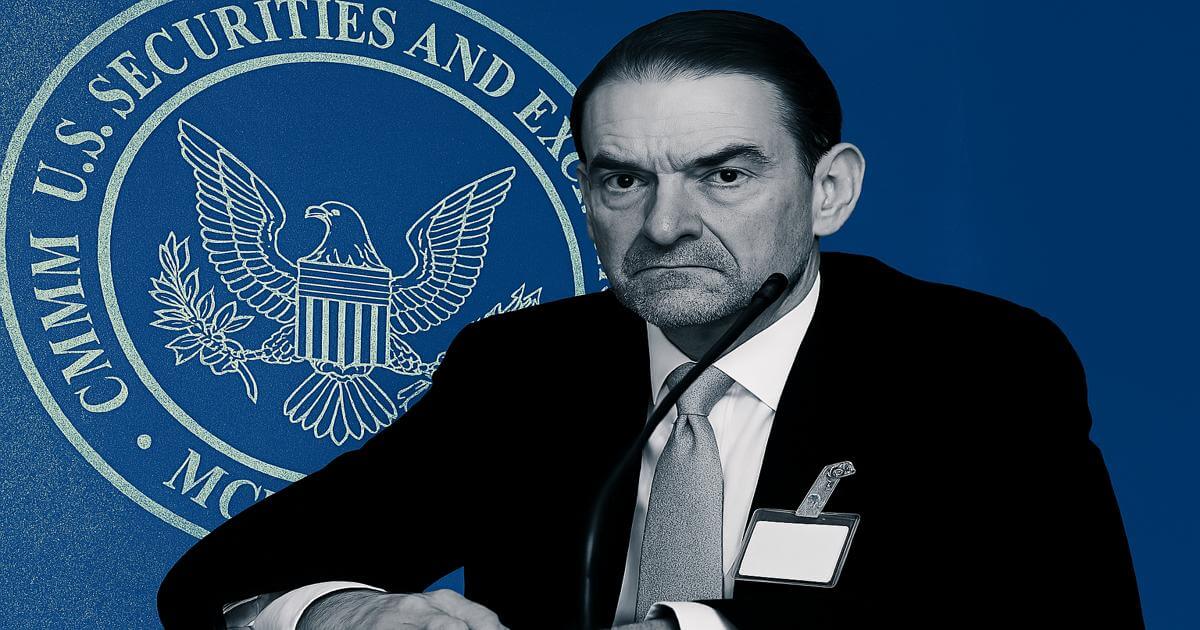

Senate Banking Committee grills Paul Atkins over crypto ties as he vows SEC reforms

Credit : cryptoslate.com

Paul Atkins, former SEC commissioner and the candidate of President Donald Trump to suggest the US Securities and Trade Fee (SEC), appeared on March 27 for the Senate Banking Committee and promised to revive readability and restraint to the regulatory agenda of the company.

An vital focus of his testimony was the necessity for coherent guidelines for digital property, which he described as an pressing problem for each innovation and the safety of buyers.

Atkins criticized points of the time period of workplace of former SEC chairman Gary Genler, and emphasised concern about federal courts that cancel out regulatory initiatives, elevated employees output and controversial enforcement actions in opposition to cryptocurrency corporations.

He argued for a shift to deregulation and emphasised the necessity for clear and efficient guidelines that promote innovation and on the identical time defend market integrity. He promised to deliver the company again to his core mission to guard buyers, promote environment friendly markets and to facilitate capital formation.

Concern about conflicts, crypto previous

Through the affirmation listening to session, Senator Elizabeth Warren Paul Atkins requested sharply about his connections with the cryptocurrency business and monetary corporations.

In a letter submitted previous to the listening to, Warren questioned if Atkins may stay impartially in view of his consultancy with the business, particularly his function that FTX advises earlier than its collapse.

She additionally issued concern about his private monetary disclosures, which present that substantial pursuits associated to the crypto sector in whole round $ 6 million.

Warren urged atkins to decide to reconsidering future issues wherein his former clients have been concerned and to forestall him from returning to the monetary sector at the very least 4 years after serving. She emphasised that such steps have been wanted to revive the belief of the general public within the independence of the SEC.

Paul Atkins responded to the interrogation of Senator Warren by emphasizing his dedication to moral requirements and full transparency. He assured the committee that, if confirmed, he would get rid of all monetary corporations that might current a battle of curiosity, together with crypto-related property and his consultancy, Patomak International Companions.

He additionally acknowledged that he would adjust to all federal moral guidelines and sec protocols with regard to restoration. Whereas he stopped recording a proper prohibition after the providers, Atkins claimed that his choices could be led solely by the general public curiosity and the authorized mandate of the sec not by earlier relationships.

Atkins positioned his expertise within the personal sector as an lively, with the argument that it gave him the perception that was essential to make efficient rules with out suppressing innovation. He rejected the concept that his work from the previous endangered his skill to handle impartially, and stated it had geared up him as an alternative to know the practical influence of the principles of the workplace.

He additionally promised to additional examine the FTX assortment and to make sure that the SEC has completely investigated the case in response to the priority of Senator Chris van Hollen.

Mapping a brand new course

Wanting forward, Atkins stated that one in every of his prime priorities would work with fellow commissioners and legislators to make a regulatory method to digital property that’s in precept, structured and know-how impartial. He stated that the present lack of readability has led to confusion and discouraged innovation.

He argued that the US may strengthen its management in monetary innovation with acceptable guidelines and appeal to international investments. Atkins additionally signaled his opposition in opposition to what he described as “exaggerated politicized” rules and known as on the SEC to focus on his authorized obligations as an alternative of the selling partisan agendas.

With the SEC at a crossroads, the nomination of Atkins is predicted to type the route of the company on points starting from cryptomarkets and ESG -public making to enforcement priorities and reforms of the market construction.

The Senate Committee will proceed his analysis earlier than he votes whether or not he ought to promote his appointment. If the committee votes earlier than the profit, the appointment goes to the whole Senate for a affirmation voice. A easy majority is required there for the ultimate affirmation.

State on this article

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024