Altcoin

Rates, whales and volatility ahead

Credit : www.newsbtc.com

Cause to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the trade and thoroughly assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Bitcoin merchants put together for a border and doubtlessly turbulent week. From threatening charges to BTC-bid actions of the scale, listed below are 5 essential components that market individuals want to take care of their radar.

#1 American charges are able to escalate on April 2

The worldwide stage is braced for what US President Donald Trump referred to as ‘Liberation Day’ on 2 April. In keeping with the Kobeissi letter (@kobeissiletter), the plan of the administration for ‘mutual charges’ guarantees to be a river basin second within the present worldwide commerce disputes.

“President Trump has been discussing for weeks this Wednesday 2 April. writes By way of X.

These charges will likely be laid on high of an entire sequence of present American duties that embrace metal, aluminum, Canadian items, Mexican items and a number of Chinese language import. The Kobeissi letter signifies that 25% taxes on automobile import and on international locations that purchase Venezuelan oil may also be in power this week. With retaliation measures from Canada, China, the EU and Mexico within the pipeline, they warn of a ‘huge commerce warfare’, intensifying the uncertainty for the world markets.

Associated lecture

Along with commerce information, the inflation strain was in a position to tackle the inflation strain within the coming days as a consequence of greater client prices for imported items. As regards to a rise within the Economic system Coverage Uncertainty Index, the Kobeissi letter emphasizes: “Coverage uncertainty is at the moment above nearly each disaster in fashionable American historical past. We see ~ 80% greater uncertainty ranges than 2008. Consequently, market adjustments are growing and we count on a particularly risky week.”

Add the newest threats of President Trump with regard to Iran – the place “secondary charges” and potential levies on Russian oil are on the desk – and there are a number of worldwide pace factors that may feed market volatility.

#2 Bitcoin whale exercise

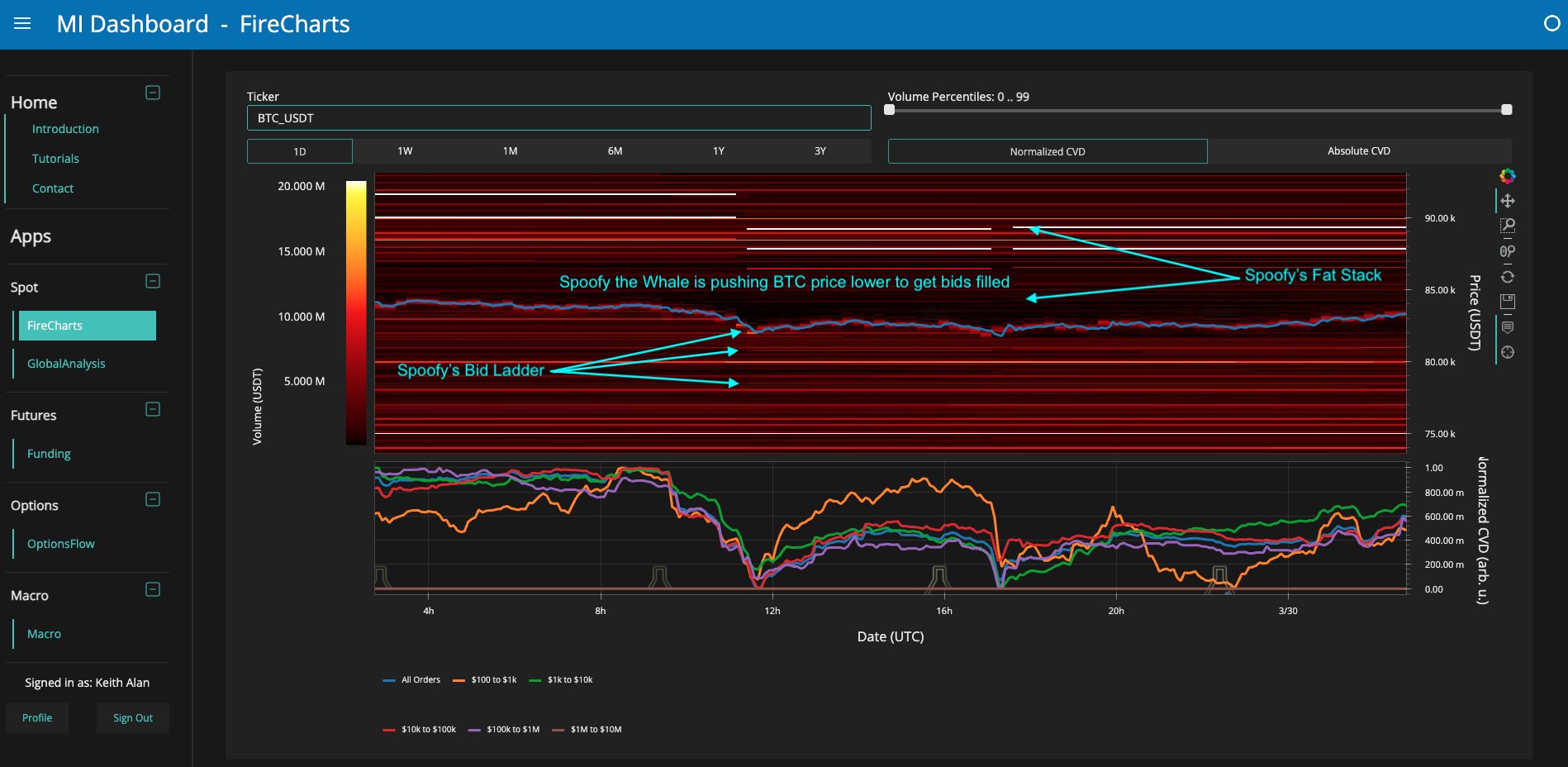

Giant-scale liquidity maneuvers stay a central level within the Bitcoin Area. Keith Alan (@Kapproductions), co-founder of fabric indicators, drawn consideration to a possible whale technique in motion that was assigned to a determine he calls ‘Spoofy the whale’.

“My first indication that one thing was occurring got here up with a sequence of micro actions that appeared to be a bit completely different than his typical value adjustment of his big blocks of query liquidity. With an extra look, I seen {that a} ladder of BTC Bid -Liquidity completely lit and strikes that it’s to don’t have any possible way of lugging liquidity. Been to be the spell that has been purchased, it’s purchased from their very own bid and has bids to $ 78k, ”Alan written On Sunday.

He additionally famous that the convergence of assorted information occasions – the weekly closing of Sunday, the month-to-month closing of Monday and the anticipated price implementation Midweek – that may catalyze additional value fluctuations. Though recognizing BTC may nonetheless be decrease, he understood the obvious dedication of the whale to collect on the present degree: “Within the giant schedule of issues, nothing of this BTC value doesn’t imply decrease, nevertheless it does imply that the whale value has oppressed the BTC value prior to now 3 weeks, a DCA technique to purchase this dip and I’m.”

#3 Bitcoin Beerarish flag breakdown

Technical analyst Kevin (@kev_capital_ta) is warning Merchants to maintain a detailed eye on the essential assist ranges after a bearish flag breaking: “We adopted this bearish flag sample all through the week and as we will see, we had a breakdown of that weak point. If BTC right here loses the golden bag at $ 81k and follows $ 70k -then the measured displacement is the measured displacement. “Measured motion.”

But Kevin states that, given the widespread unfavourable sentiment round 2 April (“Armageddon Day” in some corners of the media), there’s a chance to be a conflicting flip: “Will the speed implementation on 2 April a uncommon” promoting the rumor shopping for the information occasion “?”

Associated lecture

He added: “A bit of lengthy liquidity on the degree of $ 78k $ 80k, however a number of juice within the vary of $ 87k- $ 89k (darkish yellow) for market makers to deal with off simply earlier than the CNBC has proclaimed” Armageddon Day “on 2 April. Makes me asking.”

#4 Accumulate seasoned gamers

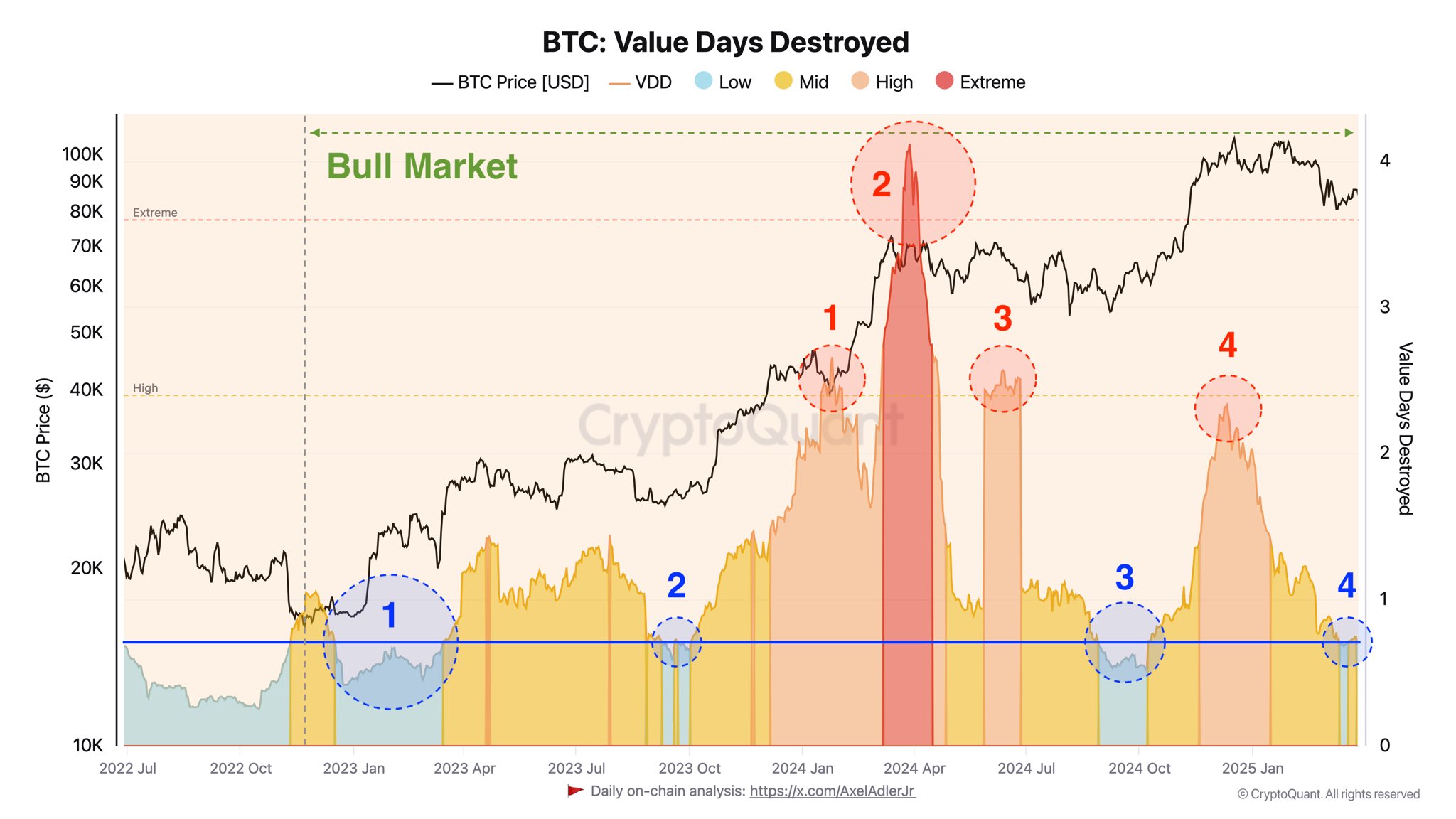

From the attitude on the chain, Axel Adler JR, an analyst at cryptquant, perceive These skilled market individuals transfer to a brand new battery part. Coming from the Worth Days Destreed (VDD), Indicator, Adler identifies a sequence of 4 completely different accumulation durations because the starting of 2023, making the present cycle ripe for potential upward upward upward:

“The absence of appreciable sale within the present part exhibits the arrogance of those skilled gamers that the present BTC value degree is just not favorable for taking a revenue.” Adler emphasizes that historic information demonstrates that low VDD durations typically precede value will increase, which suggests macro components, together with international financial coverage shifts, the market sentiment not derailed within the medium time period.

#5 cme hole

Lastly, merchants should view the CME (Chicago Mercantile Change) GAP formation, which has been a exceptional perform within the Bitcoin value motion. Stretch capital (@Rektcapital) marked The latest filling of a spot between $ 82,000 and $ 85,000: “BTC has crammed the overall CME GAP space from $ 82k -$ 85k. Furthermore, Bitcoin will most likely develop a model new CME gorge this weekend … that BTC may set BTC for a transfer to a minimum of $ 84k subsequent week.”

CME -Hiates typically act as magnets for value motion, and the evaluation of stretching Capital suggests a attainable retracement to fill newly fashioned gaps or a continuation motion that takes BTC greater, relying on how broader market forces unfold this week.

On the time of the press, BTC traded at $ 82,010.

Featured picture made with dall.e, graph of tradingview.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September