Altcoin

Solana’s Stablecoin Supply sticks with $ 106 million: can this be a rally driving?

Credit : ambcrypto.com

- Sol has set a outstanding share of the Stablecoin supply within the final 24 hours because the rate of interest grows.

- The buildup on the spot market has elevated over the previous 5 days, which signifies the growing market curiosity within the energetic.

Regardless of his latest Bearish Development previously week and months, Solana [SOL] has remained comparatively secure for the previous 24 hours if the sentiment shifts and light-weight drops by 1.05%.

The expansion of the availability of Stablecoin and the buildup of Sol traders are clear indications of a ruling bullish sentiment in the marketplace.

Solana’s Stablecoin vary and accumulation develop

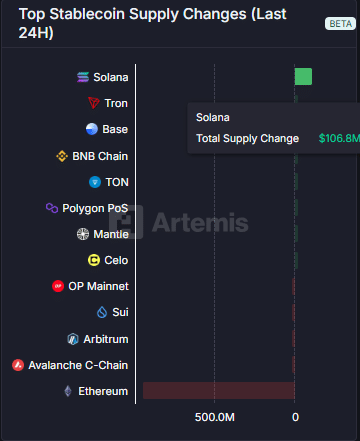

There was a outstanding enhance within the complete provide of Stablecoins on Solana within the final 24 hours. On the time of writing, $ 106.8 million to Stablecoins has been added to the community, indicating that the rising demand for SOL.

This could possibly be for various functions, together with establishing in protocols or improvement actions.

Supply: Artemis

Sentiments equivalent to these are inclined to positively replicate on the worth, whereby it actively regularly climbs greater. Nonetheless, it might require extra elementary catalysts for a big momentum rally.

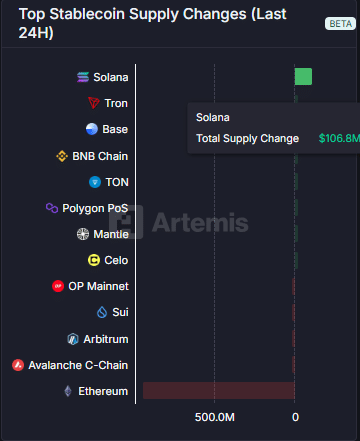

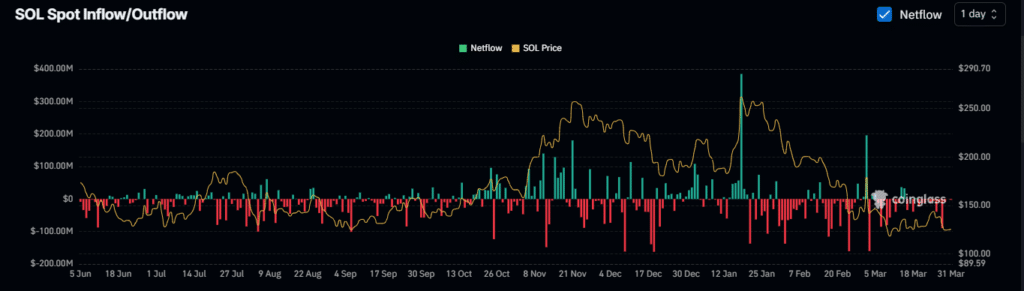

Spotmarkthandelers have steadily collected the SOL for the previous 5 days. Any further these merchants have purchased greater than $ 100 million in SOL, with the biggest buy on March 28, when $ 89 million was bought.

Supply: Coinglass

Spot merchants have transferred their amassed Sol to personal portfolios, which signifies potential lengthy -term preserves and the market facility is lowered.

The transaction exercise has additionally elevated, which signifies elevated community involvement. Between March 24 and now the entire transaction officers rose from 87.6 million to 92.7 million, which displays a robust presence of dealer.

Supply: Artemis

Given the numerous accumulation by spot merchants and the comparatively secure value vary of SOL, buying and selling exercise appears to have a optimistic affect on value actions.

Lengthy bets rise in futures and possibility markets

Within the derivatives market, rates of interest develop as indicators present that merchants place lengthy bets awaiting a rally.

The variety of stressed by-product contracts, referred to as Open Curiosity (OI), has elevated on each futures and possibility markets.

On the time of writing, the OI within the Futuresmarkt has risen by 1.69percentand reached as much as $ 4.70 billion. Equally, the OI within the possibility market has risen by 16.19percentand climbs to $ 3.3 million.

This enhance, mixed with a rise of 21.15% of the entire market commerce quantity to $ 11.25 billion, displays the rising exercise.

The info means that lengthy merchants management the momentum, anticipating a rise within the value of SOL.

Supply: Coinglass

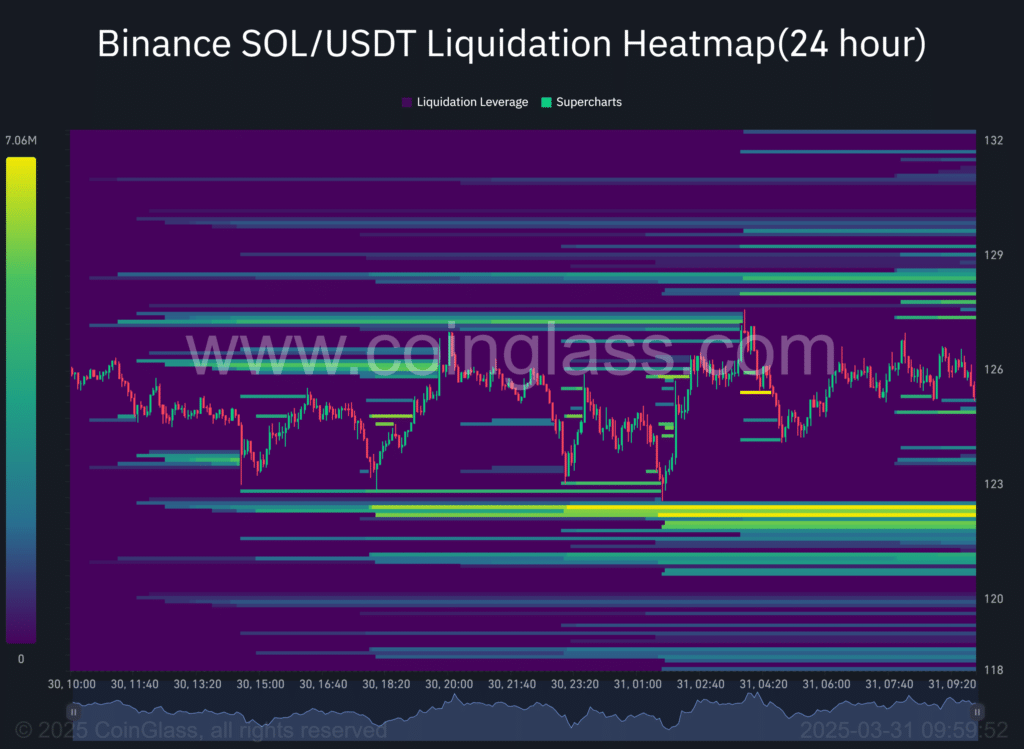

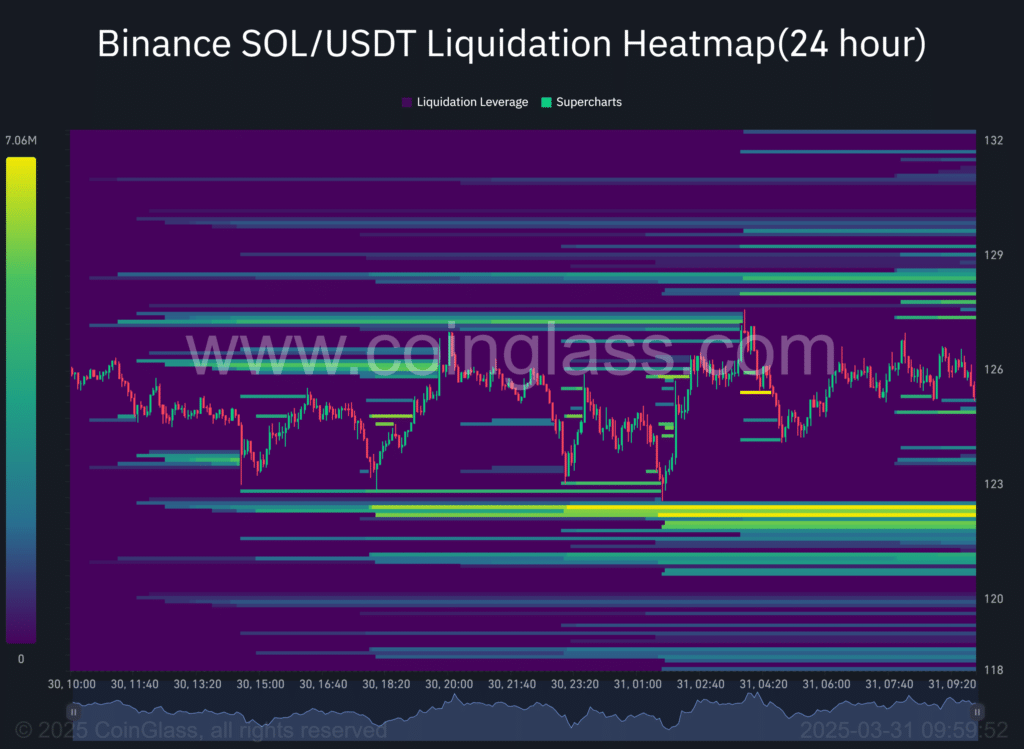

The liquidation warmth map, which identifies areas of non -filled orders, signifies {that a} potential value motion may happen in each instructions.

The marked sections of the graph in inexperienced and yellow counsel liquidity at these ranges, which have a tendency to draw value actions.

With the bullish market sentiment – specifically the expansion of the stablecoin and the buildup of the spot merchants – Sol is prone to go up, with the potential to reclaim the $ 130 area.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024