Bitcoin

Bitcoin short-term holders control 40% of market wealth – What this means for BTC

Credit : ambcrypto.com

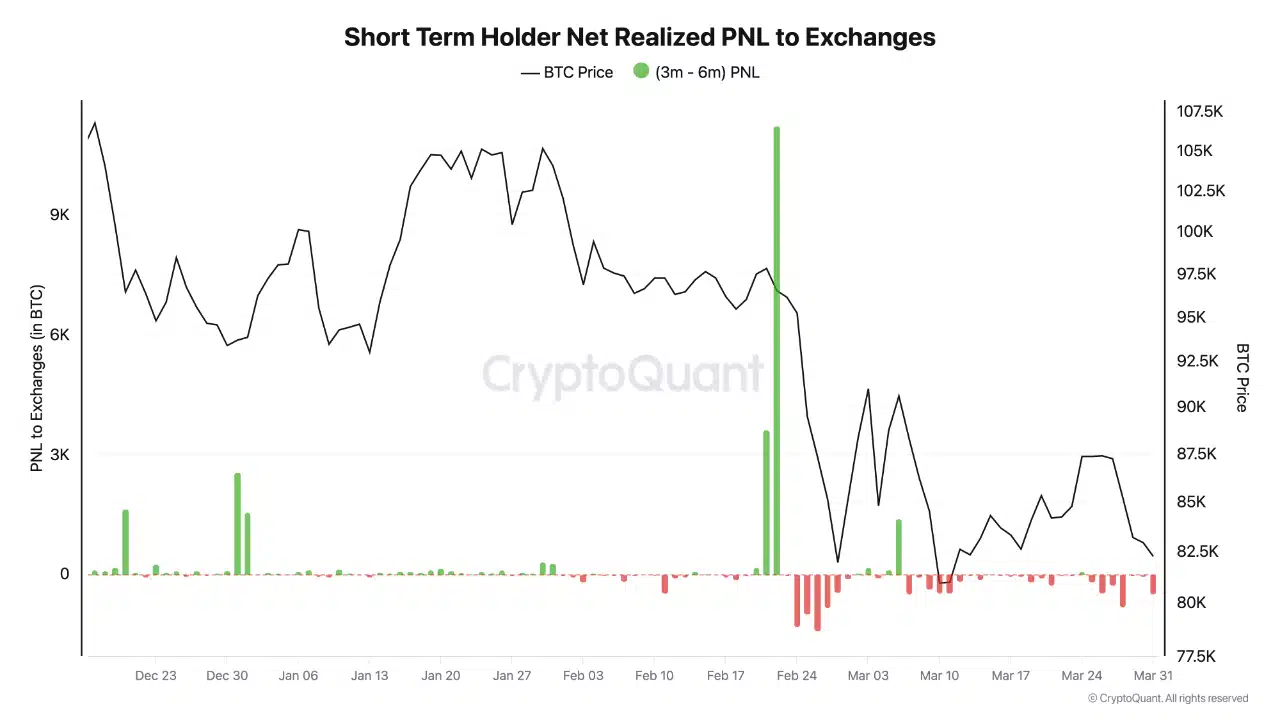

- The quick -term holders of Bitcoin present reluctance, lowering the gross sales strain and the signaling potential for secure progress.

- With much less speculative capital, the Bitcoin market turns into extra resilient, which signifies diminished downward volatility.

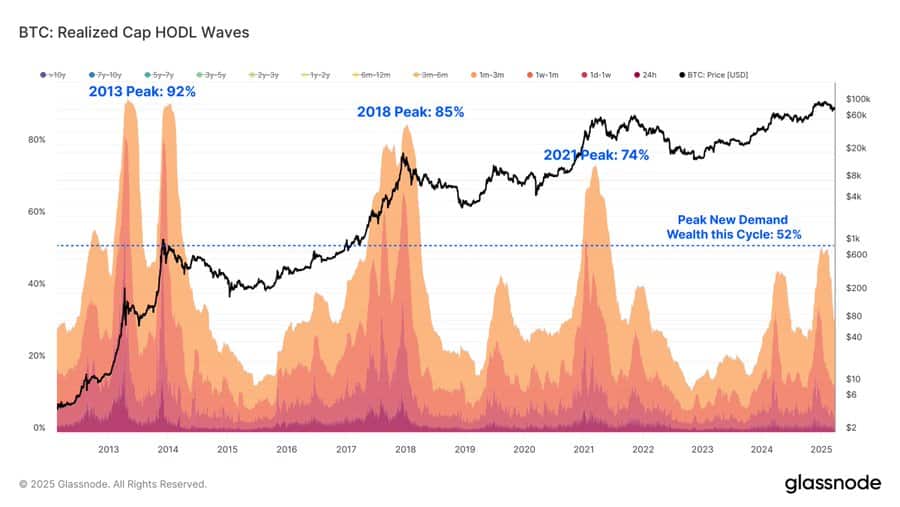

Bitcoin [BTC] Navigates risky circumstances, with a exceptional shift briefly -term holders (STHS), who now examine 40% of the wealth of the community.

Regardless of latest losses, these usually reactive sellers present restraint, which reduces gross sales strain.

Though that is far under the previous, the place the wealth of recent traders reached 70-90%, it signifies a extra balanced, tempered bull market.

This shift suggests a possible turning level for Bitcoin, with much less shut volatility, which clears the best way for stability and progress.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024