Altcoin

Bitcoin Under $60,000: Checking Out USDT’s Role in BTC’s Next Move

Credit : ambcrypto.com

- Bitcoin noticed a notable enhance on the time of writing in comparison with the day prior to this’s closing worth.

- Are merchants benefiting from the latest pullback or ready for an extra worth drop?

Bitcoin [BTC] has risen considerably over the previous 24 hours, however a full worth correction stays elusive as the worth stays under the crucial $60,000 mark.

Moreover, monitoring stablecoin actions is a vital barometer for measuring total investor sentiment in the direction of BTC.

With this in thoughts, AMBCrypto analyzed a latest one after by CryptoQuant, which indicated a decline in stablecoin inflows.

USDT inflows distinction with BTC’s average rise

It’s no shock that USDT has a 70% dominance of the stablecoin market. Due to this fact, AMBCrypto analyzed latest investor conduct relating to this token.

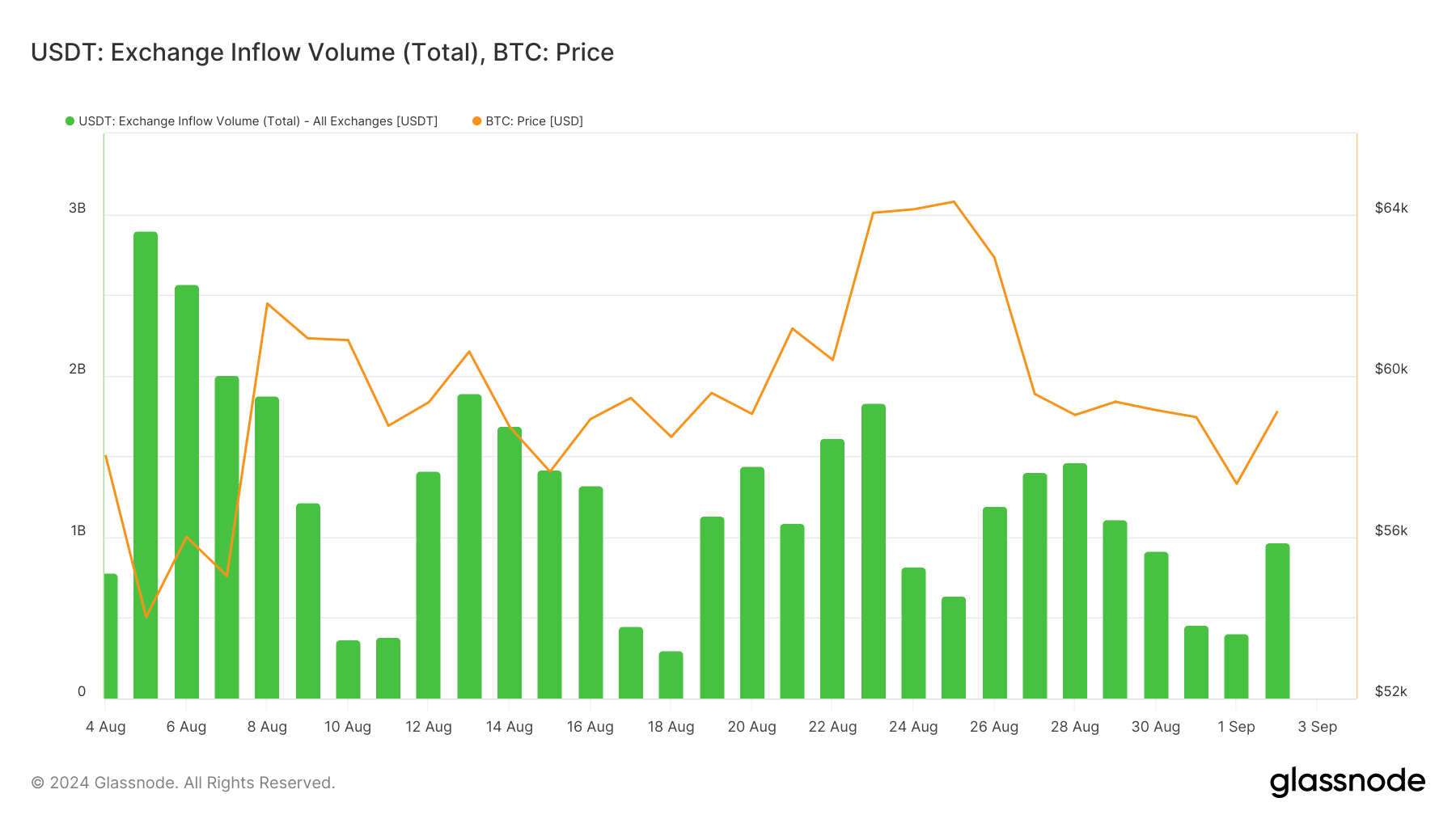

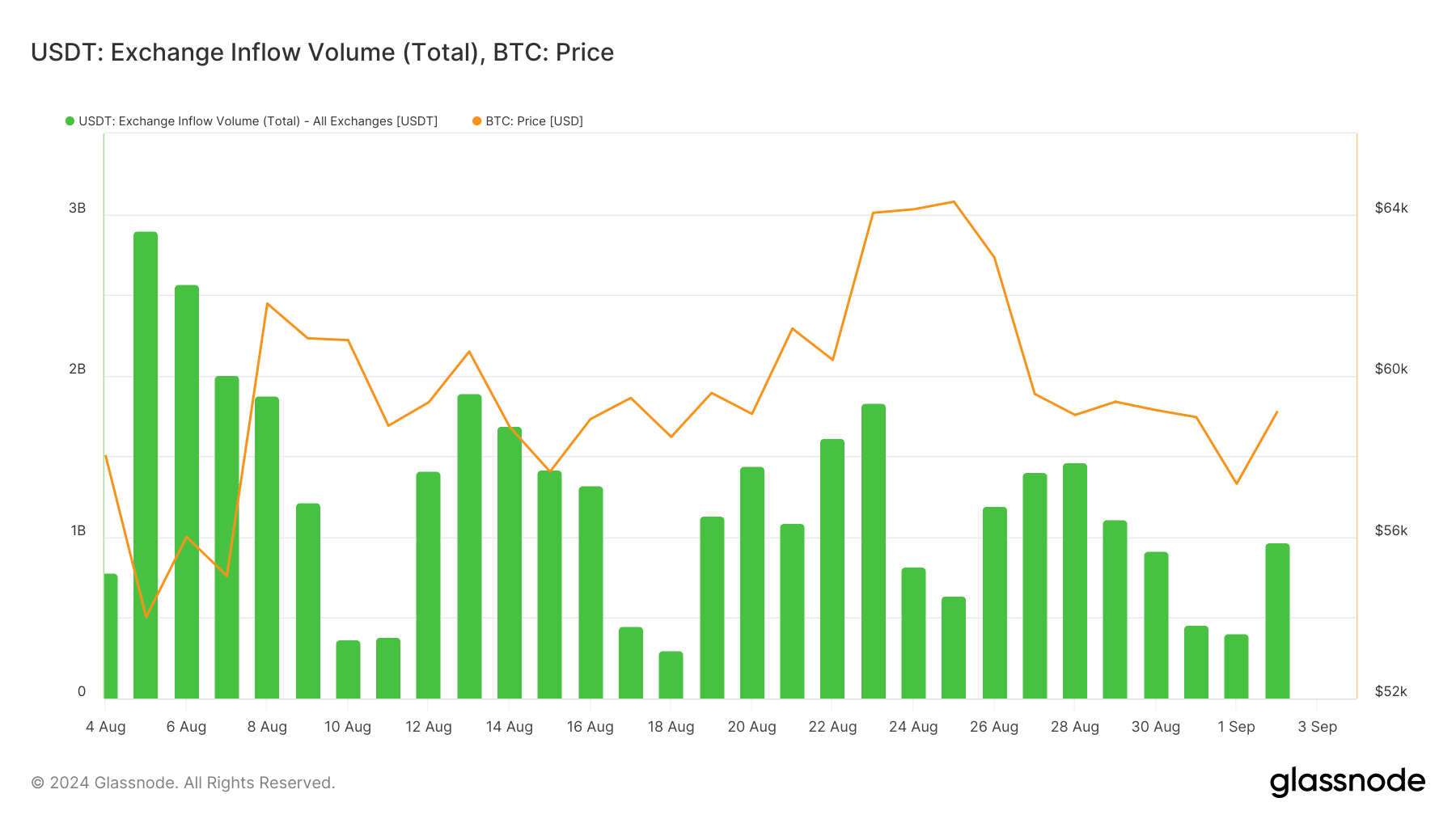

Supply: Glassnode

On the day by day worth chart, Bitcoin began September bearish, falling round 3% to $57,300 from the day earlier than. Nevertheless, a major upward transfer the subsequent day introduced Bitcoin near the $60,000 threshold.

Surprisingly, the upward transfer coincided with a doubling of USDT inflows from $402 million to $970 million.

Based on AMBCrypto’s evaluation, this indicated renewed optimism amongst stakeholders, as evidenced by the rise in USDT deposits on exchanges.

Moreover, these inflows could have precipitated the latest upward transfer, inflicting day merchants to purchase the dip.

This revelation is usually seen as a bullish sign and stands in stark distinction to the aforementioned message.

Due to this fact, AMBCrypto dug deeper and famous that regardless of the rise in USDT, Bitcoin remained simply 0.21% above the earlier shut of $59,129 on the time of writing.

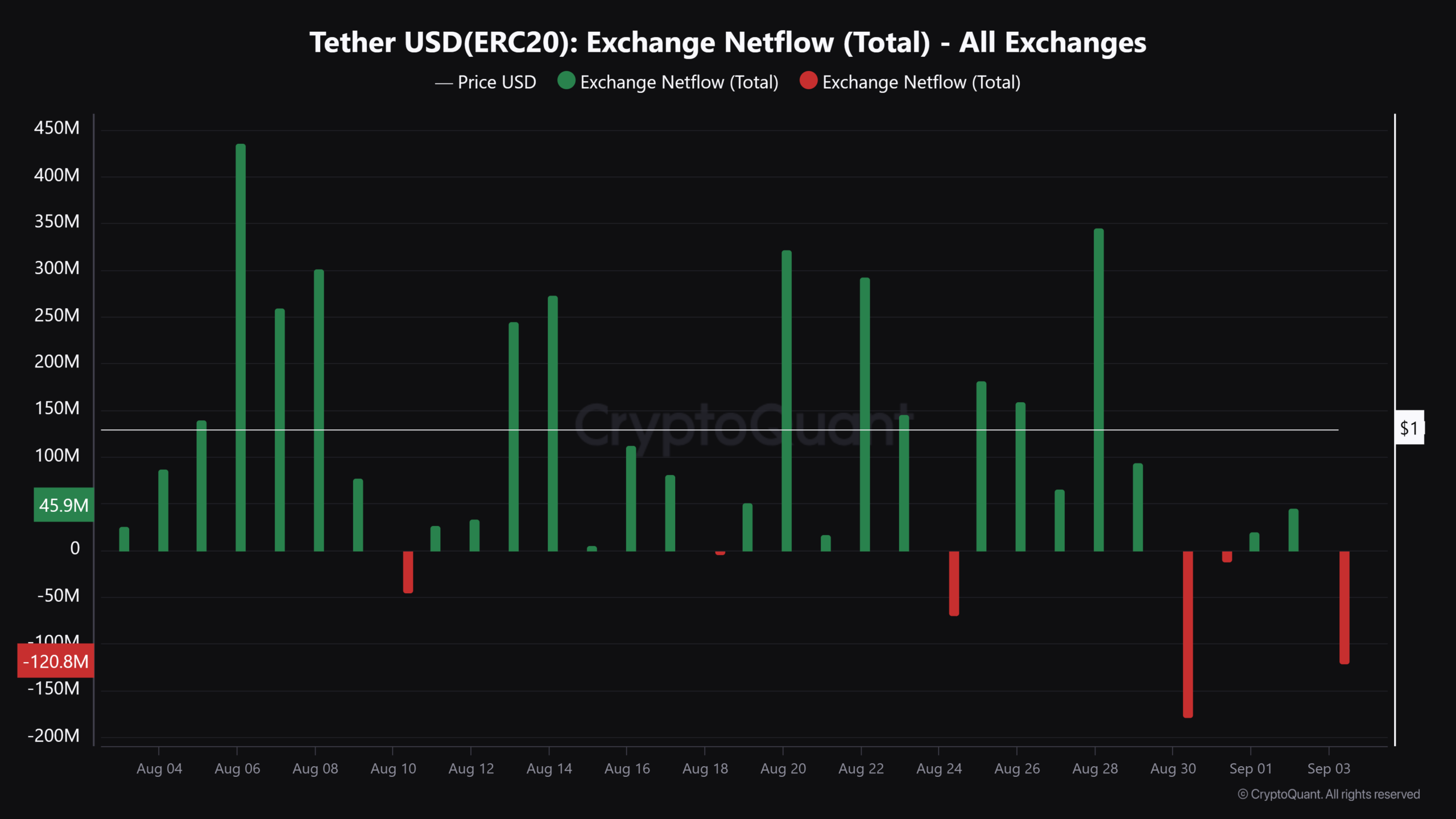

Warning available in the market is obvious from the online flows

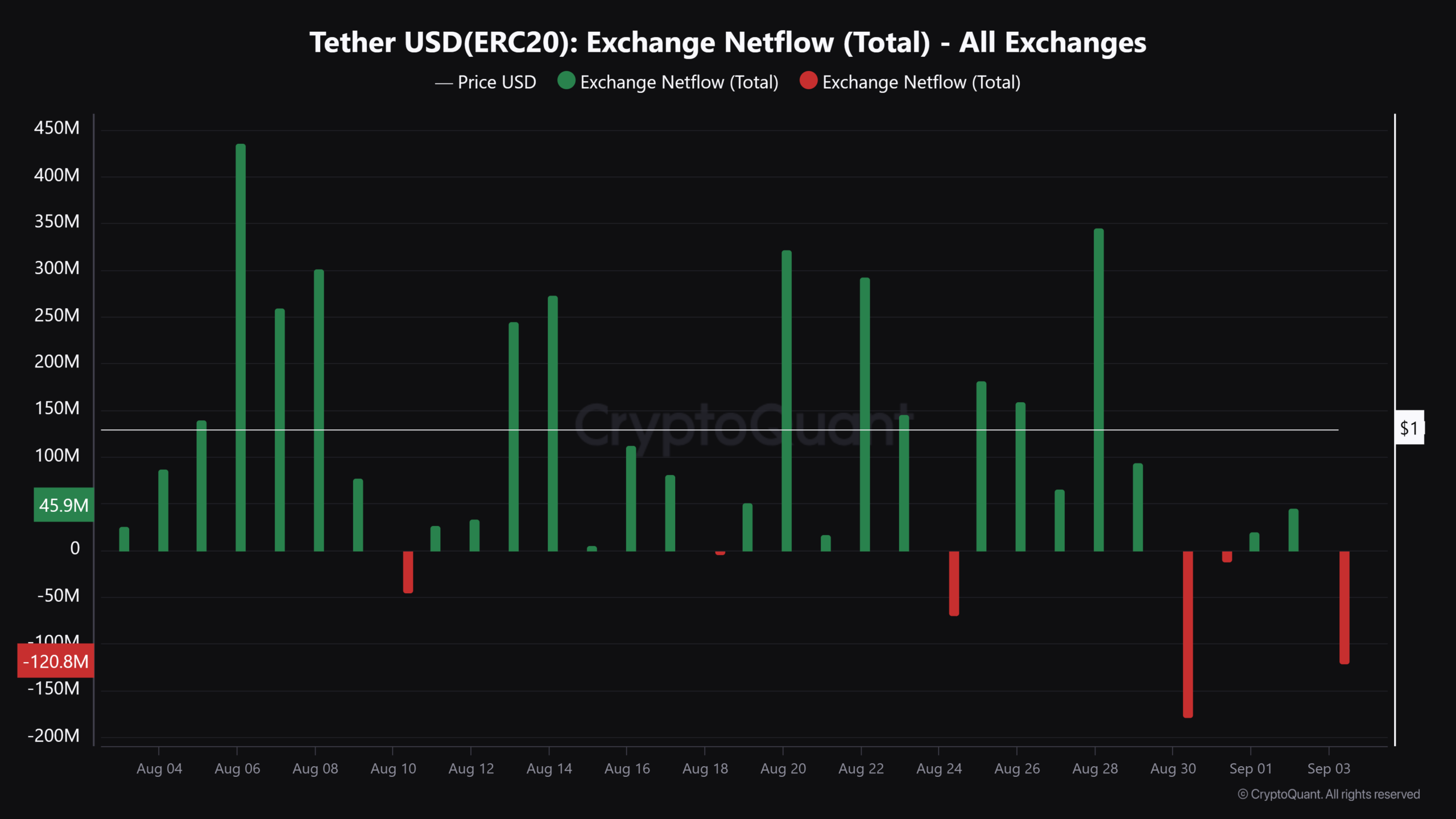

Inspecting the online flows will present higher perception. Presently, USDT’s internet circulate is destructive at $120.8 million because the buying and selling day continues to unfold.

These important internet outflows actually indicated rising warning amongst stakeholders.

Supply: CryptoQuant

Based on AMBCrypto’s evaluation of the chart above, a major Tether outflow of $180 million from the exchanges occurred 4 days in the past.

Following this, Bitcoin skilled a pointy bearish downturn, with the worth closing at $57,700 – the bottom of the day.

These destructive flows do not essentially point out outright promoting stress on Bitcoin, however they do point out warning amongst merchants, who could also be utilizing USDT to lock in beneficial properties or anticipate a dip to purchase. Which one is that?

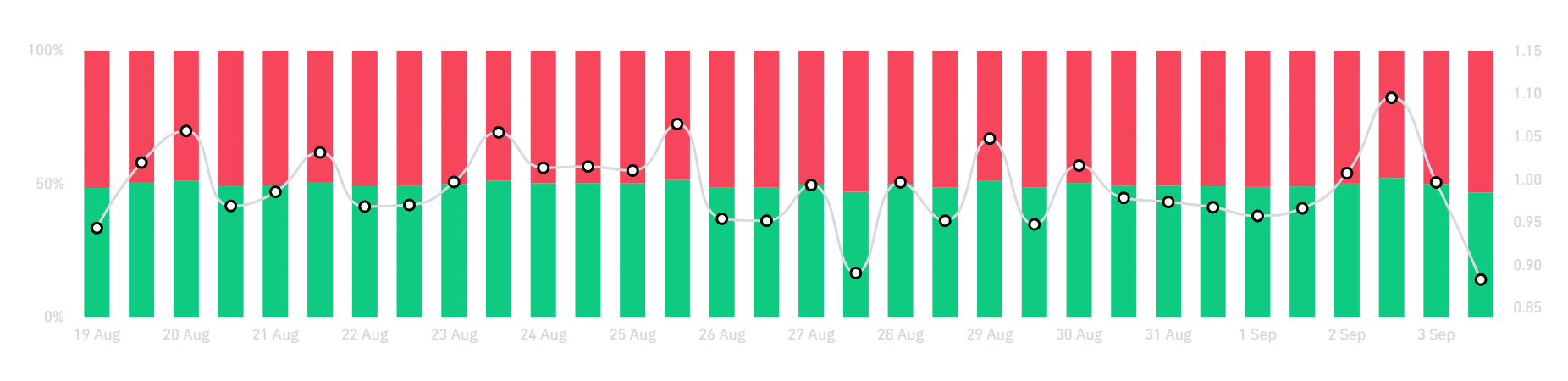

Merchants are bracing for a deeper decline amid rising warning in BTC

AMBCrypto analyzed the chart under to find out whether or not merchants are primarily positioning themselves for a possible decline or searching for extra earnings.

Supply: Coinglass

On the 12-hour chart, a pointy dive reveals 46% lengthy versus 54% brief positions.

Merely put, the dominance of brief positions signifies that merchants are ready for a deeper worth decline earlier than contemplating new lengthy positions.

Learn Bitcoin’s [BTC] Worth forecast 2024-25

Curiously, if the bulls don’t intervene, Bitcoin may return to its earlier assist, someplace round $57,000, earlier than anticipating a worth correction.

Nevertheless, if the market proves to be extra resilient or there’s surprising bullish information, this might result in brief squeezes, with brief sellers being compelled to purchase again their positions, doubtlessly pushing Bitcoin previous the $60,000 ceiling.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024