Ethereum

Ethereum: Over 760k ETH sold as price declines – Will bulls step in now?

Credit : ambcrypto.com

- Whale outputs and a lower of 63.8% in massive transactions weaken the bullish construction of Ethereum.

- On-chain statistics and rising trade reserves point out growing the gross sales strain and the fading demand.

Ethereum [ETH] Since 25 February, a major lower within the massive transactions of 63.8% has seen, which emphasizes a steep lower in whale participation. Prior to now two weeks, whales have offered greater than 760,000 ETH, which contributes to growing gross sales strain available on the market.

Supplementary, A Long -term Ethereum Holder just lately offered the remaining 2,001 ETH of their portfolio for $ 3.82 million, after initially gathering 5,001 ETH at $ 277 in 2017.

These gross sales point out that giant holders scale back their publicity, probably pending additional worth decreases or as a part of a strategic shift from Ethereum.

This decline of whale-powered accumulation weakens the upward momentum of Ethereum. Once they depart the whales, retail buyers usually wrestle to soak up the gross sales strain, making it actively extra vulnerable to volatility.

Because of this, except the demand returns rapidly, Ethereum could be confronted with a downward strain within the brief time period. Within the coming days can be essential to find out whether or not the market will discover new assist ranges or will expertise an extra decline.

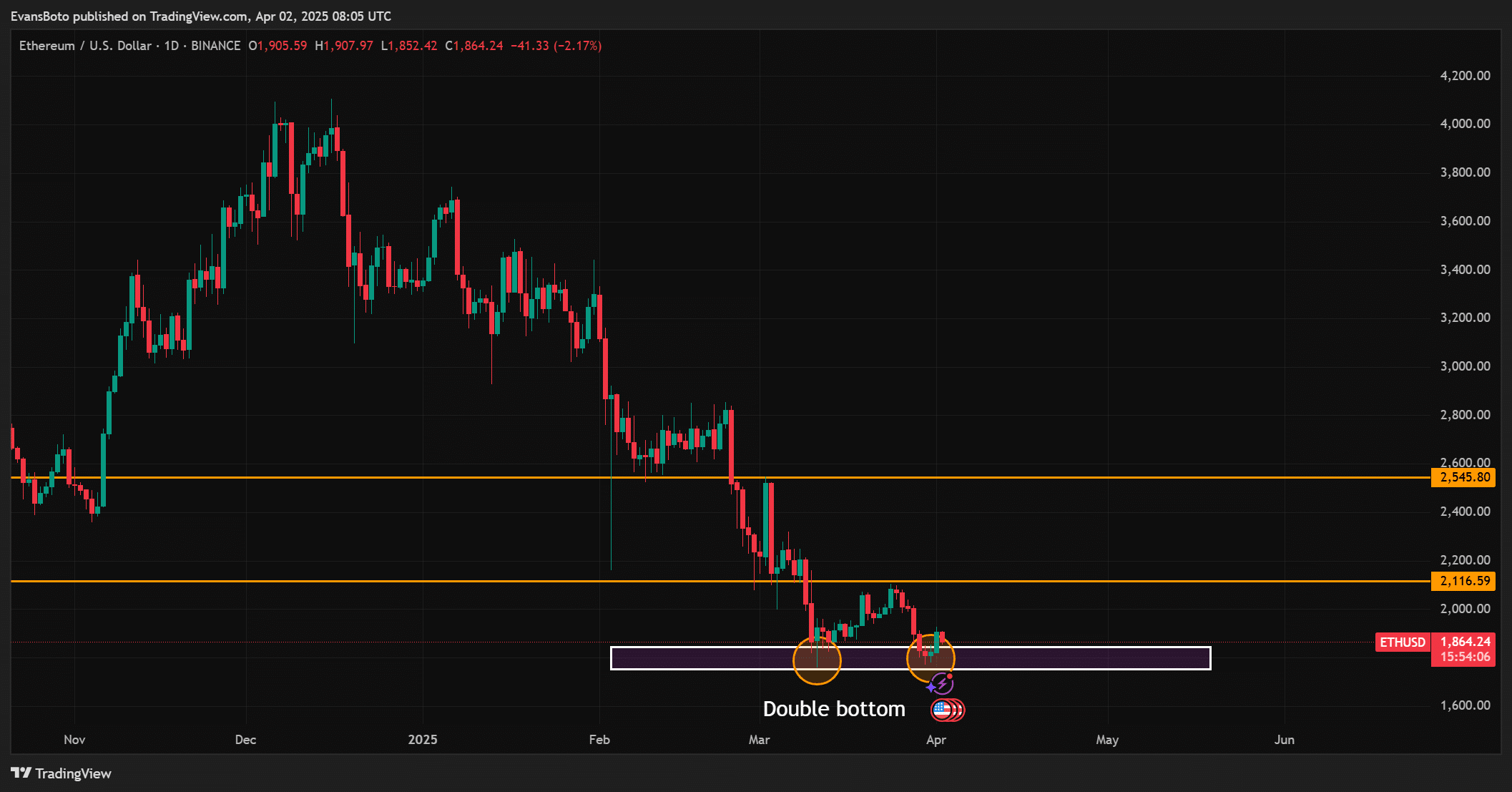

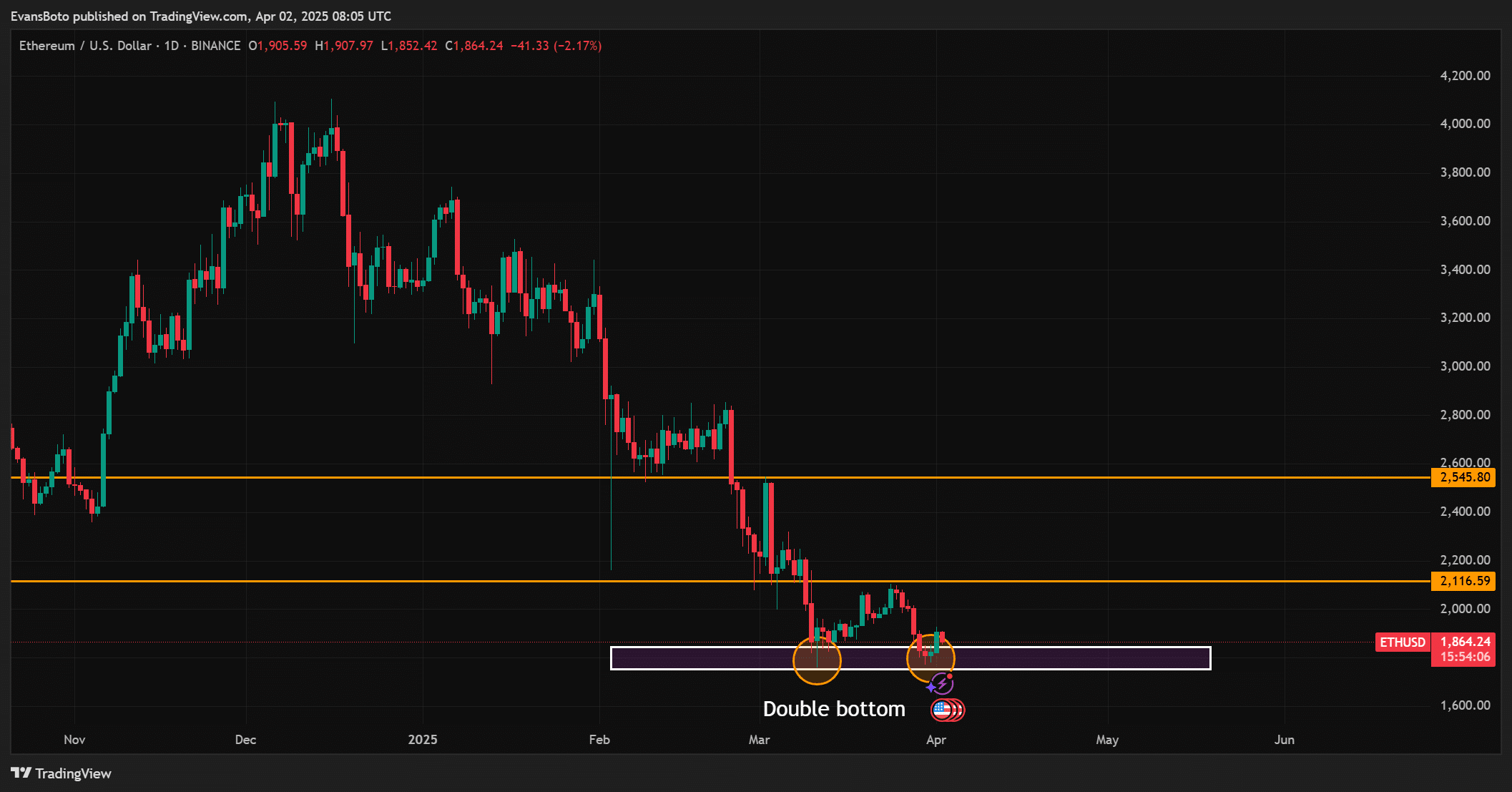

Ethereum is a double backside – Can bulls can take management?

On the time of writing, Ethereum traded at $ 1,863.12, which mirrored a day by day enhance of 0.53%.

The worth motion suggests a possible double backside close to the $ 1,800 assist zone, indicating that bulls could make a restoration try.

The worth of Ethereum, nonetheless, stays below essential resistance ranges at $ 2,116.59 and $ 2,545.80, that are important to get well again to substantiate a bullish reversal. With out breaking above these ranges, the present rebound can show to be brief -lived.

Though the construction of this bounce reveals some optimism, the general development stays cautious.

Latest whale outputs and low market participation dampens the possibility of a persistent outbreak significantly. Because of this, the assist stage of $ 1,800 turns into a crucial threshold; Whether it is violated, this will result in accelerated gross sales.

To stop additional decline, bulls should act decisively and forcefully.

Supply: TradingView

Liquidation information Present resistance to ETH Bulls

The 24-hour liquidation warmth on Binance confirmed a major liquidation exercise between the vary of $ 1,900 and $ 1,950. This means a excessive focus of lever merchants who’re compelled from their positions, creating the short-term resistance.

Ethereum has issue sustaining ranges above this vary, which emphasizes a scarcity of copper confidence. To get the upward momentum again, ETH has to construct stronger bullish assist and break this zone.

If the worth beneath these ranges continues to dam, bears can take management. Sturdy liquidation partitions usually work as boundaries, whereby worth motion inside a lateral buying and selling vary catches.

Supply: Coinglass

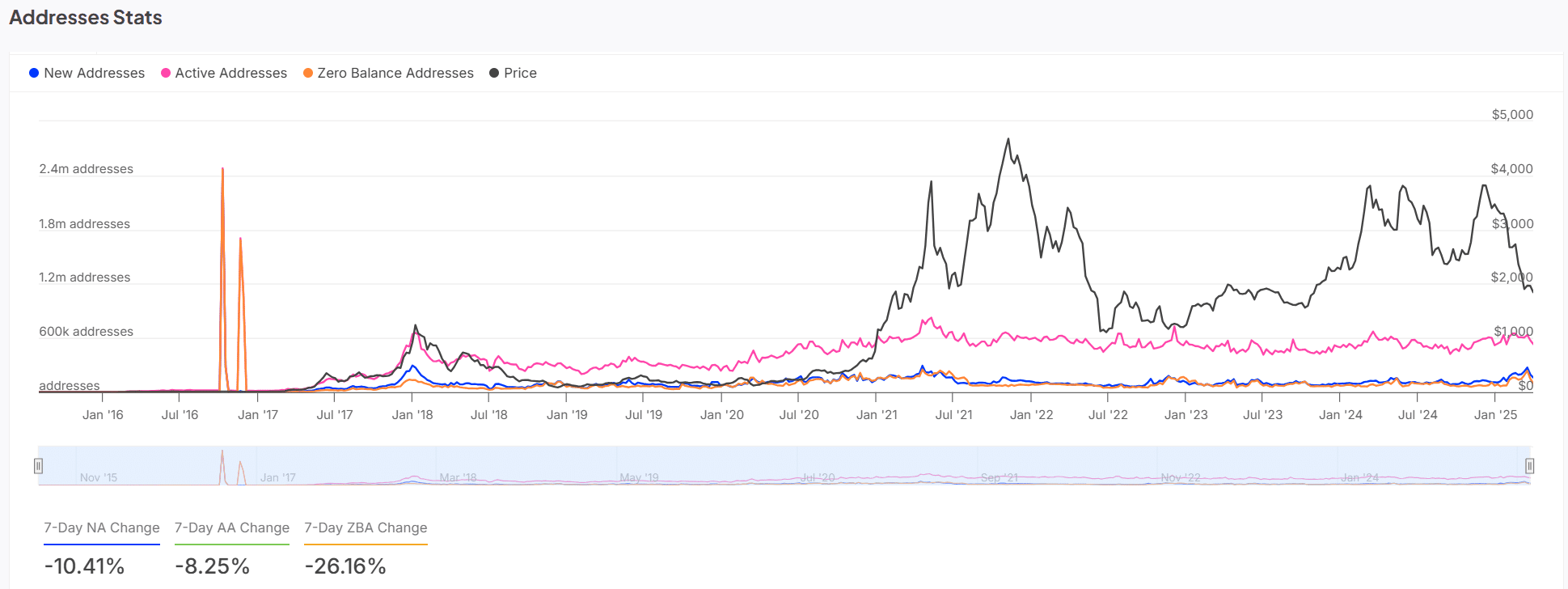

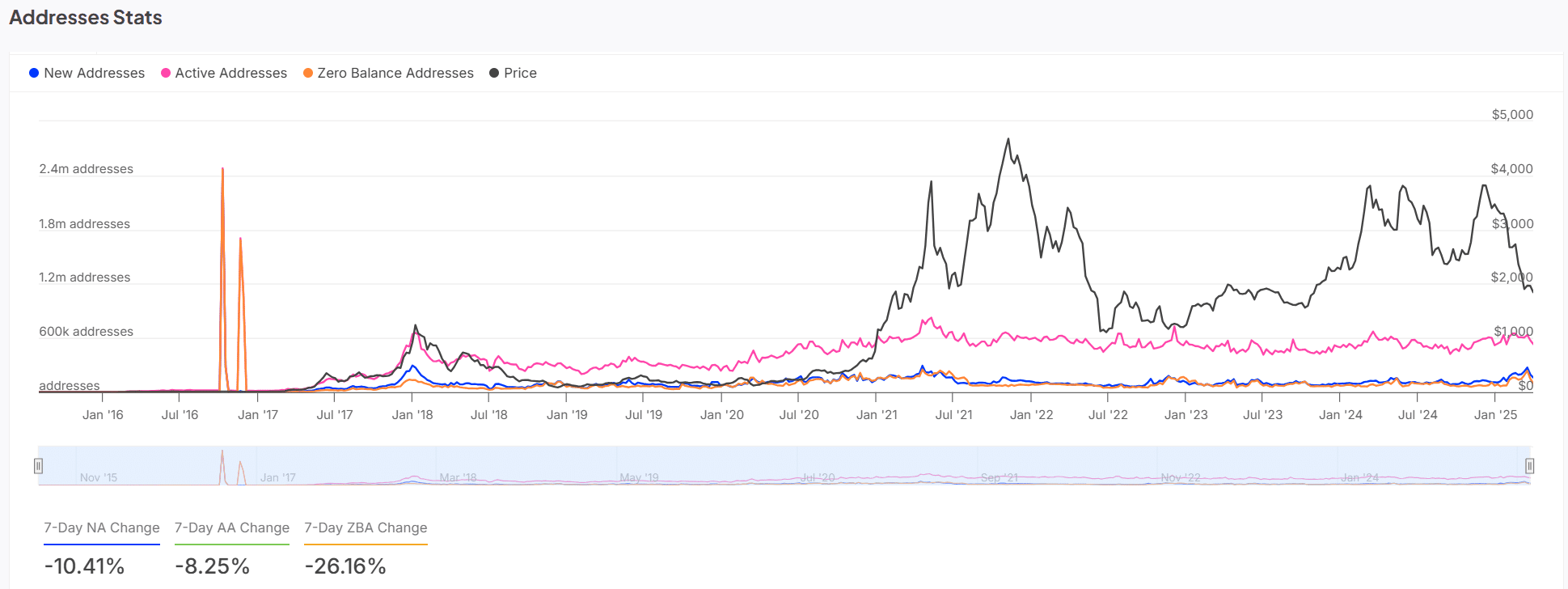

Tackle statistics present the falling community query

The on-chain statistics from Ethereum reveal a lower in person exercise. Prior to now week, new addresses fell by 10.41percentand the lively addresses fell by 8.25%. On the similar time, zero stability addresses have risen by 26.16%, indicating a rise in leaving the pockets.

These traits point out a pullback from each new and current customers, which emphasizes a contraction of community participation. This decline displays the basics of the weakening query.

Whereas fewer usereum deal with or maintain on, market stability additional weakens. Consequently, the low person involvement can reinforce Bearish strain within the coming weeks.

Supply: Intotheblock

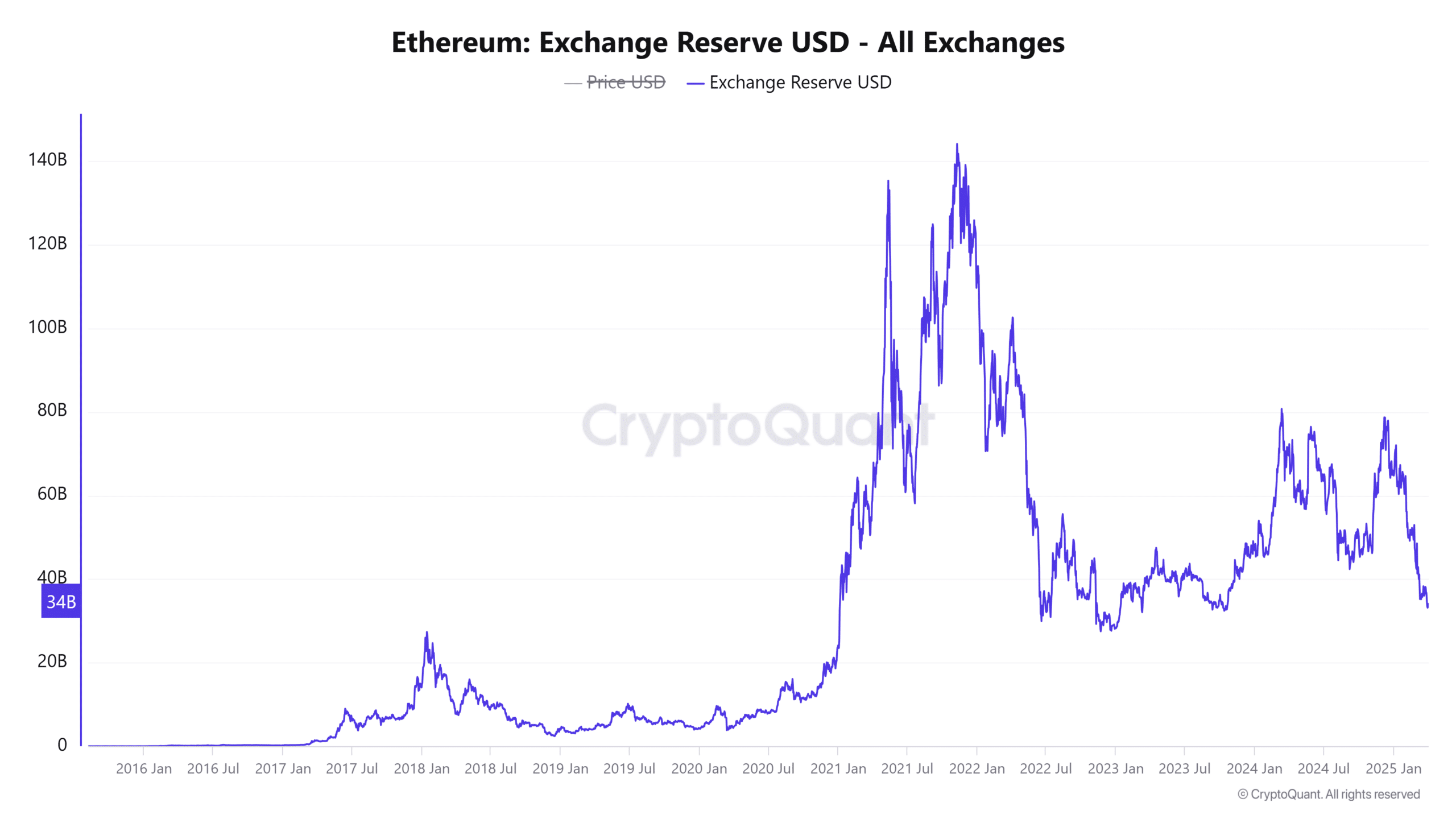

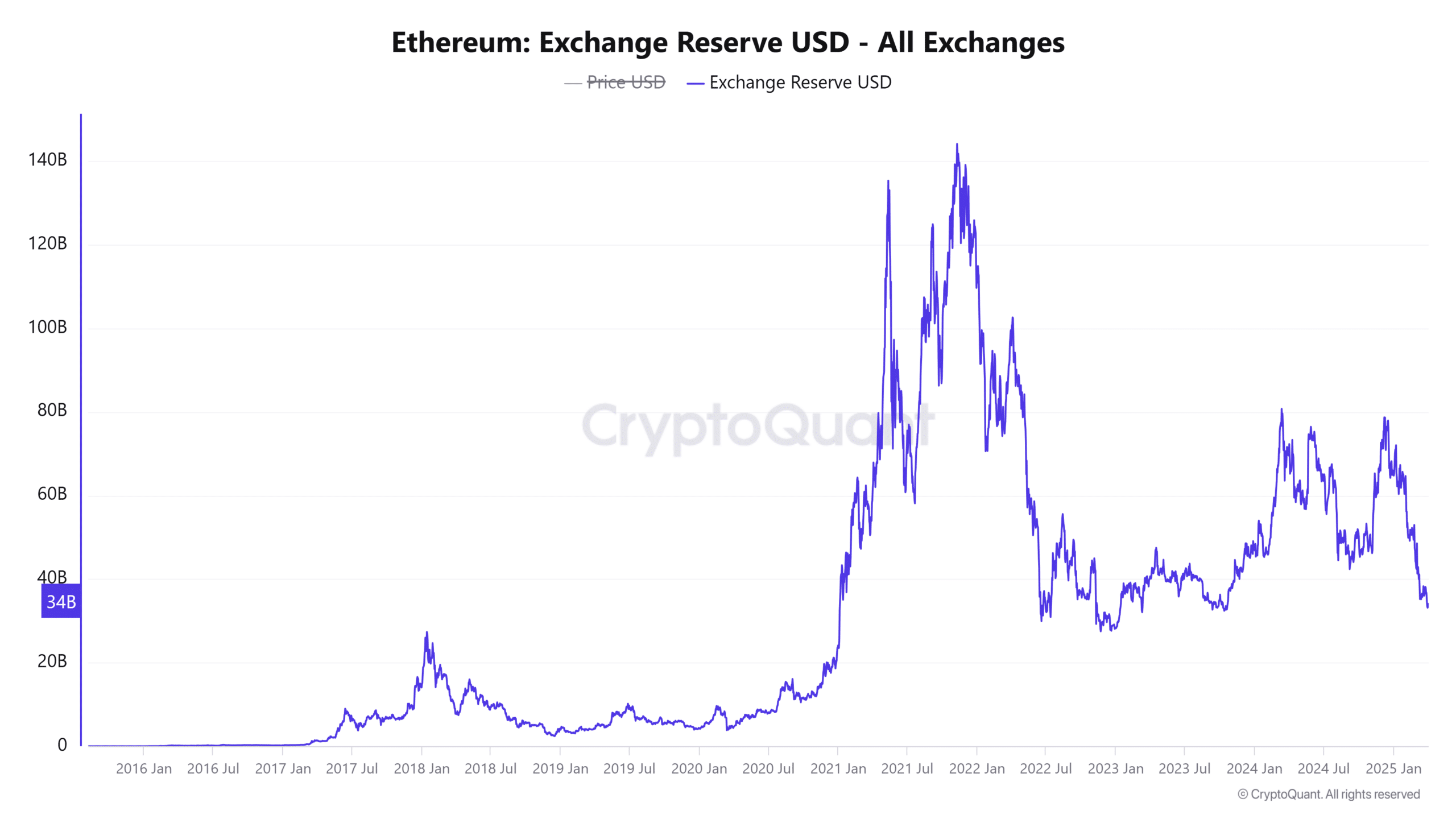

Ethereum Alternate Reserves climbs because the gross sales strain will increase

The full worth of Ethereum that’s held on exchanges has risen to $ 33.98 billion within the final 24 hours, a rise of 0.77%. Rising trade reserves usually point out that extra buyers are making ready to promote as an alternative of retaining.

This habits is in step with the wave of whale outputs and decreased exercise on the chain. That’s the reason elevated reserves counsel that additional downward strain might come up if the query doesn’t assume.

Sellers are presently dominating sentiment, and till this development is shifting, the worth promotion can stay so as to withstand.

Supply: Cryptuquant

What for ETH now

Ethereum appears to be on the best way for a brief correction. A lower of 63.8% in whale chanties, a rise of 0.77% in trade reserves and a rise of 26.16% in zero stability addresses all clarify the weakening demand and elevated gross sales strain.

Whereas the formation of a double backside sample refers to the opportunity of a rebound, the absence of a robust shopping for momentum will increase the possibility of an extra decline.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024