Bitcoin

Tariff Fears Spark $161M Sell-Off in Spot BTC & ETH ETFs – What’s Next for Crypto?

Credit : ambcrypto.com

- Bitcoin might fall by 6.5% to attain its subsequent help at $ 77,400 if it stays under 200 EMA.

- Ethereum might fall by 15% if it breaks an vital stage of $ 1,780.

The speed voltage already influences the cryptocurrency market, with property that have an enormous fall in worth, whereas traders take strategic motion previous to as we speak’s announcement.

Charge fears within the cryptomarket

Because the presidential inauguration of Donald Trump in america, the overall cryptocurrency market has fallen significantly and it has been set for additional lower, as a result of his charges don’t lastly show indicators of lastly.

On April 2, a Crypto analyst Share a message on X (previously Twitter) stating that Bitcoin ETFs noticed an outflow of $ 157.8 million, whereas Spot Ethereum ETFS noticed an outflow of $ 3.6 million on 1 April.

This means that traders withdraw their cash from this property. Massive outflows are sometimes seen as a bearish board, as a result of they will create gross sales strain and result in additional worth decreases.

Within the meantime, the mail on X additionally famous that settings cut back the chance of as we speak’s price announcement.

Present worth momentum

Regardless of these uncertainties, BTC and ETH stay optimistic, with a revenue of 1% and 0.35% respectively within the final 24 hours, in distinction to different cryptocurrencies.

In response to Coinmarketcap information, BTC traded practically $ 84,300, whereas ETH traded close to $ 1,860. Nevertheless, the value income of the energetic proved to fade as a result of the every day card flashed indicators of a attainable lower.

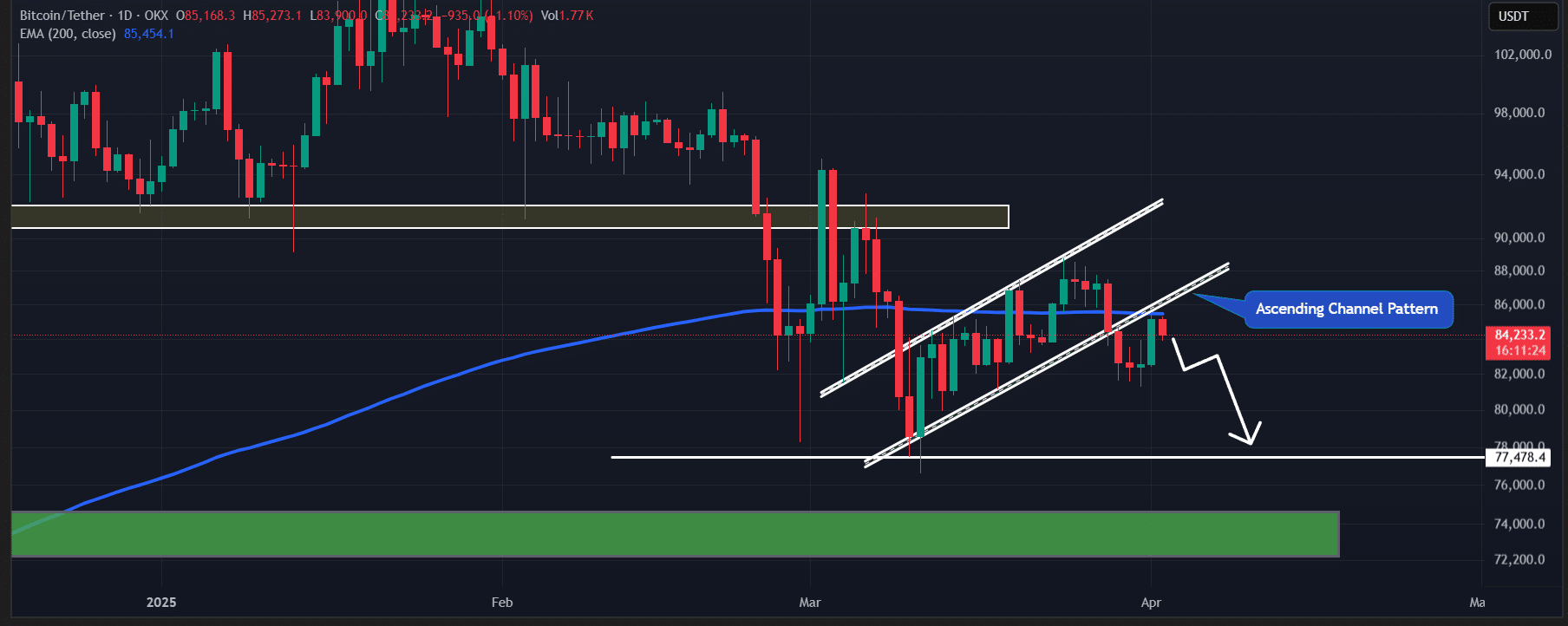

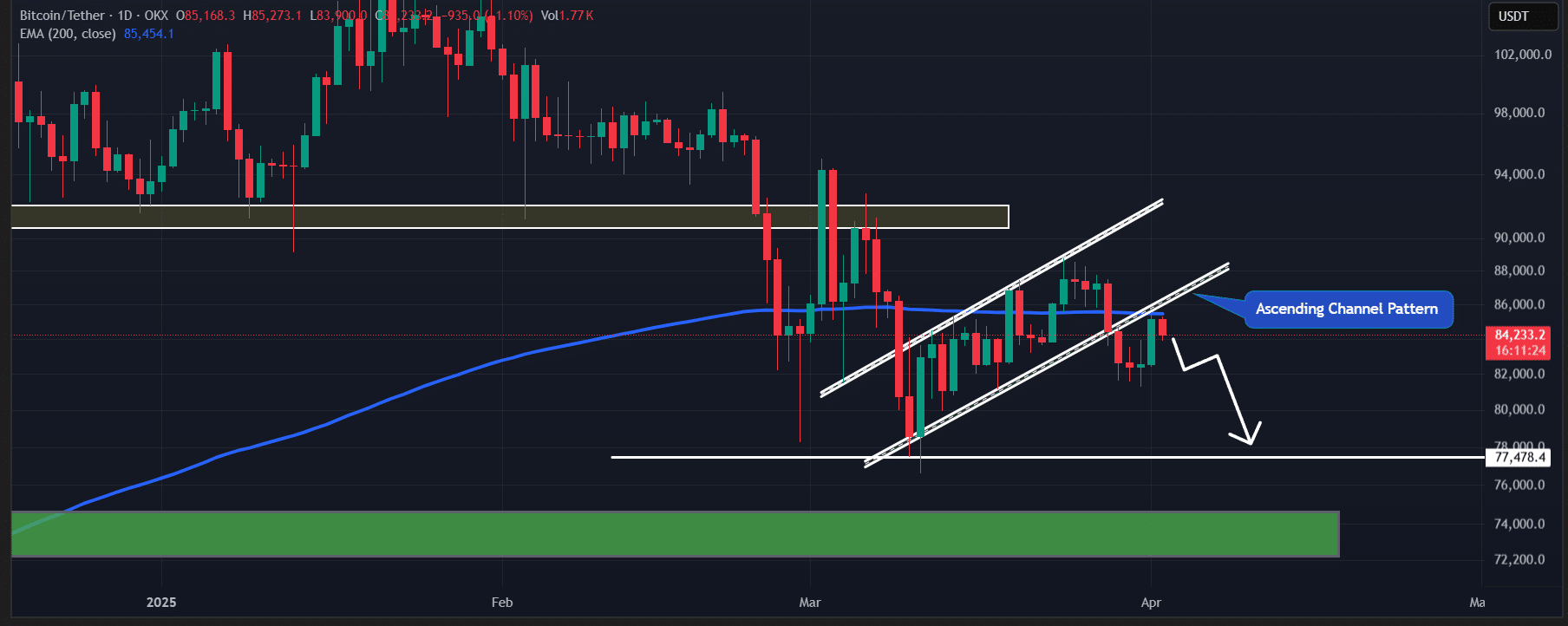

The King Coin has efficiently re-tested the breakdown of the rising channel sample and is now confronted with a worth lower after resistance to the 200-day exponential advancing common (EMA) on the every day interval.

On the idea of current worth motion and the present market sentiment, if BTC stays under the 200-day EMA, there’s a robust chance that it might fall by 6.5% to attain its subsequent help at $ 77,400.

The graph signifies that a very powerful stage of BTC is the 200-day EMA within the every day interval.

Supply: TradingView

Ethereum worth evaluation and key ranges

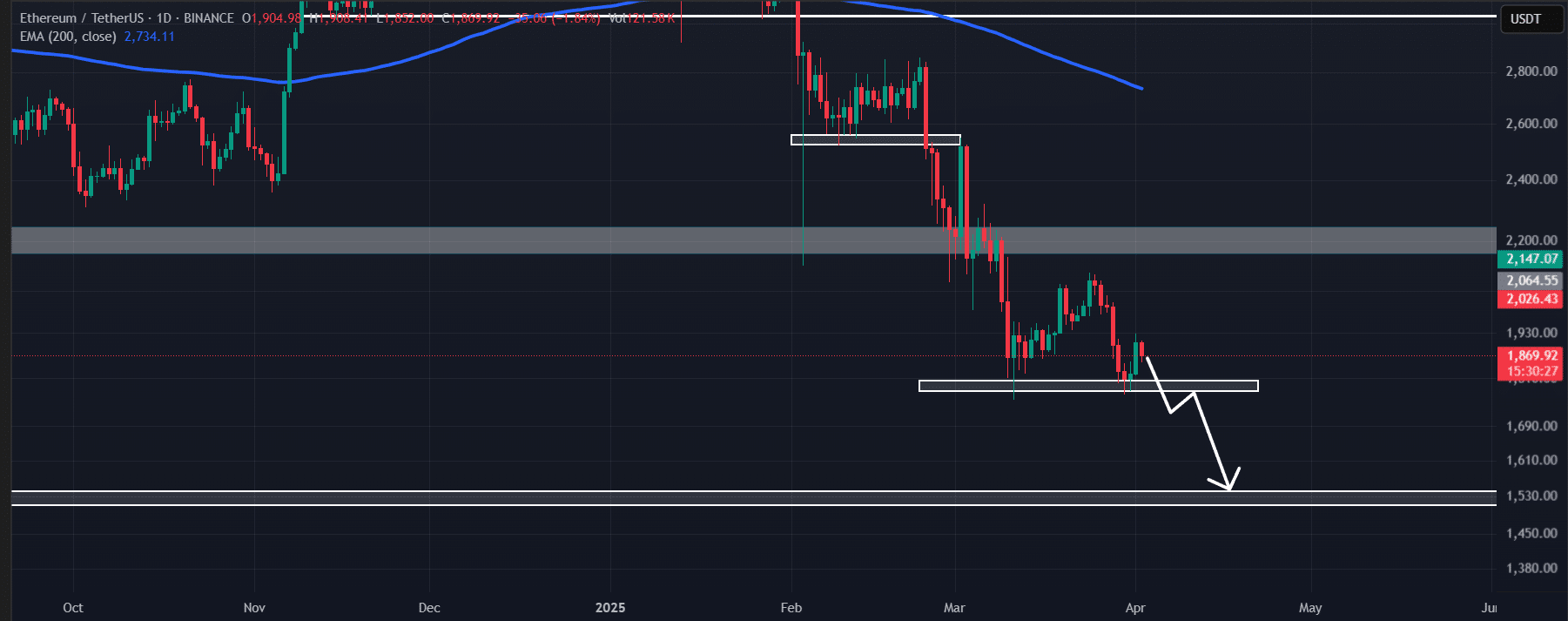

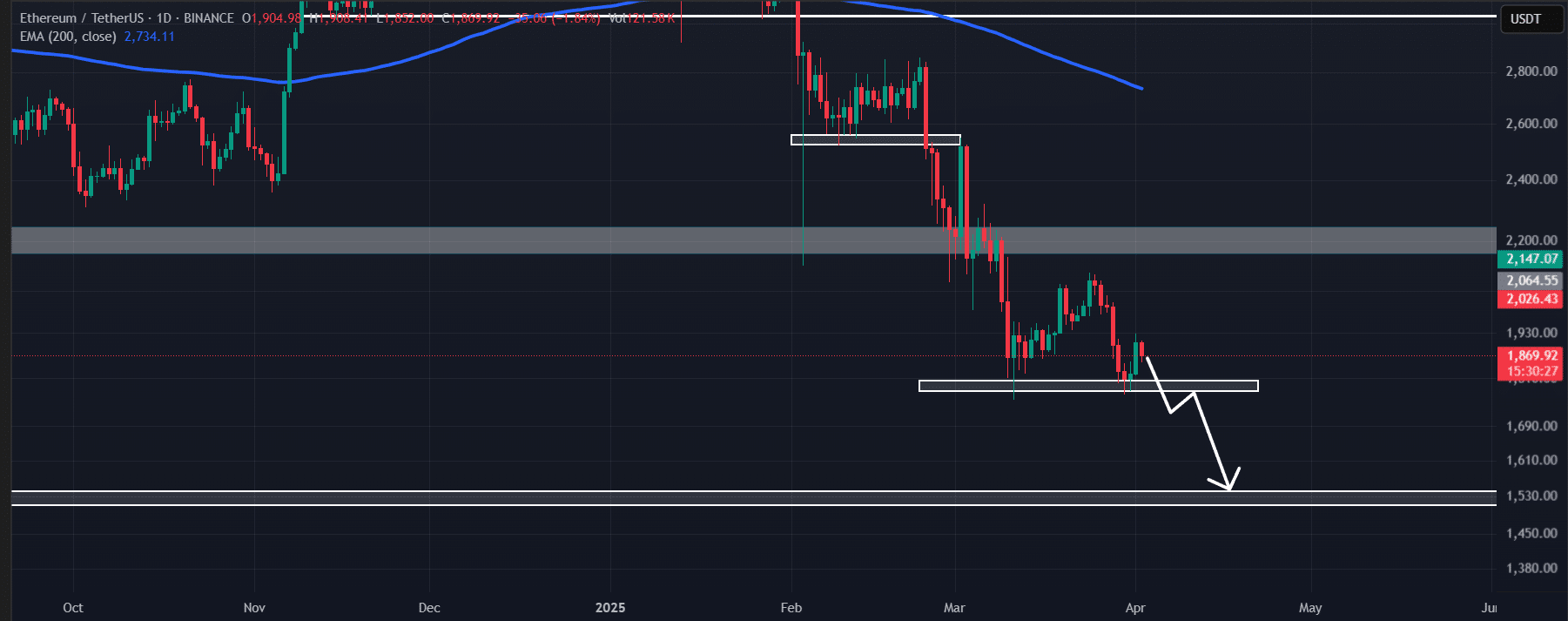

Within the meantime, Ethereum was additionally close to an vital stage at $ 1,780. If ETH continues to fall and breaks this stage, there’s a robust chance of a aggressive lower of 15%, which can trigger the value to fall at $ 1,550.

The Ethereum Every day Chart signifies that $ 1,780 is a vital stage that may decide the subsequent step of ETH.

Supply: TradingView

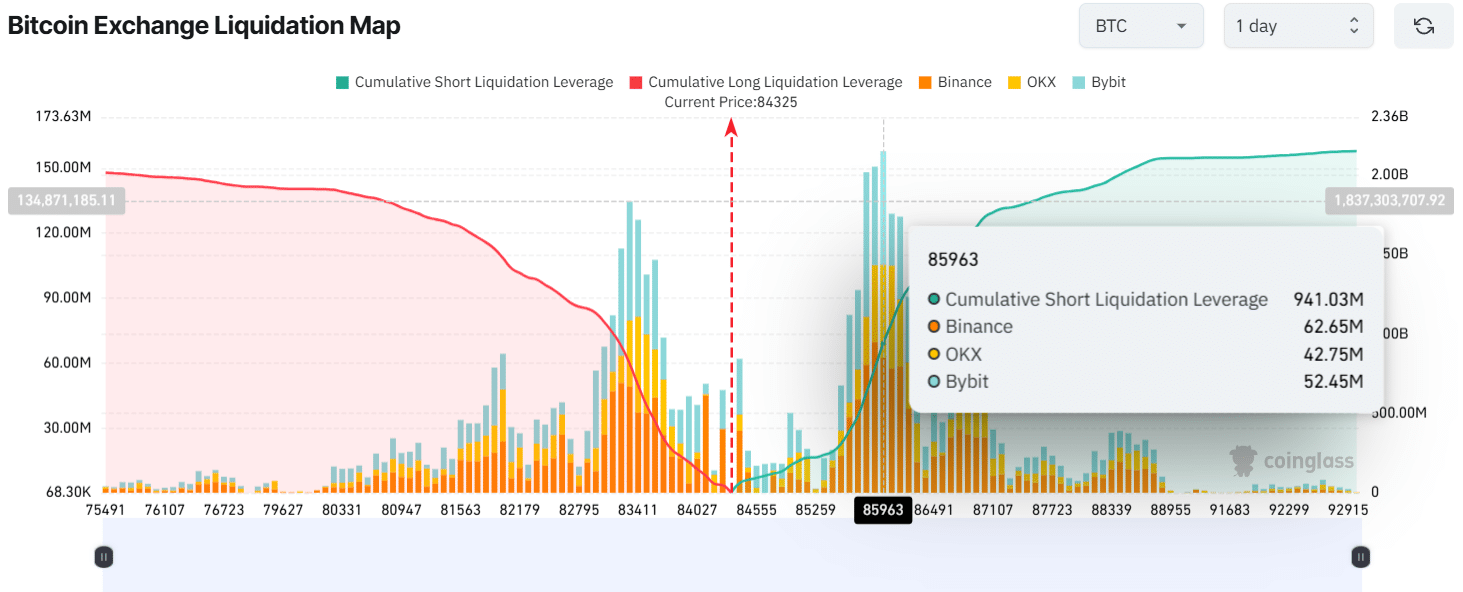

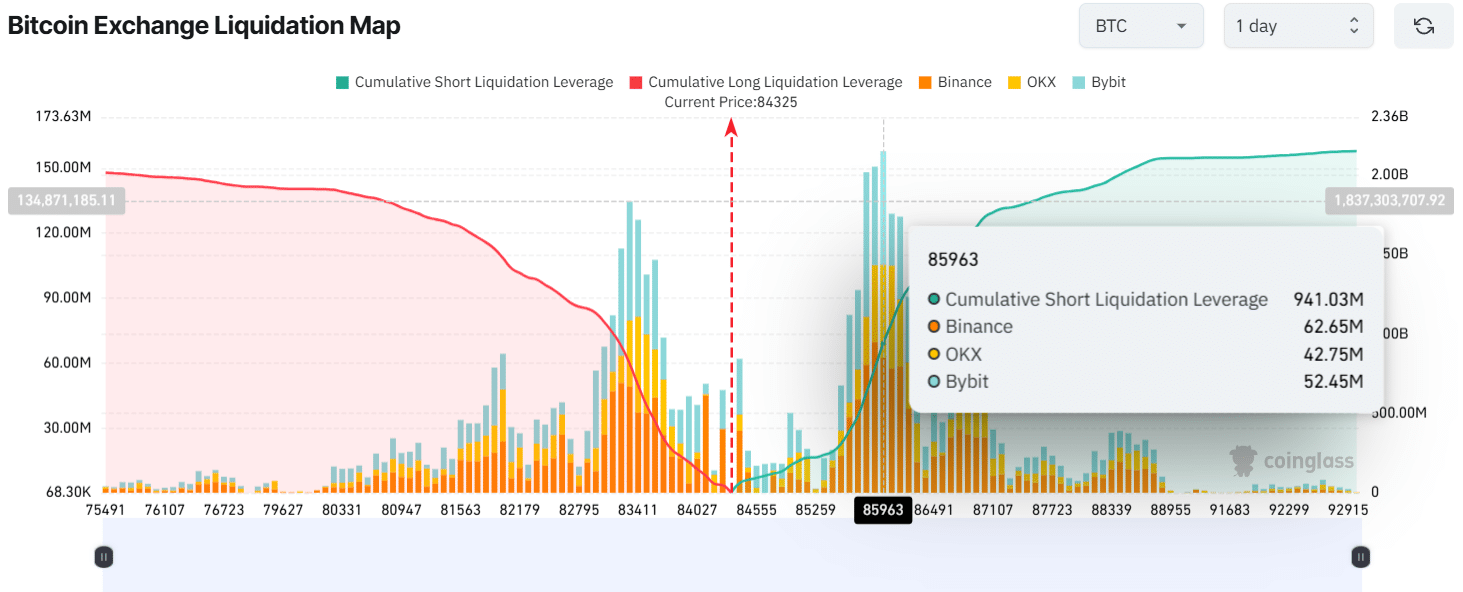

Merchants’ Bearish View on BTC and ETH

Information from the on-chain evaluation firm Coinglass reveals that merchants have been used an excessive amount of on the time of the press, with key ranges at $ 83,320 on the backside and $ 85,960 on the high.

They’ve constructed $ 811 million and $ 941 million in lengthy and quick positions respectively, indicating that bears are at the moment in management.

Furthermore, the upper bets on quick positions have the potential to push the value decrease, which is a crimson flag for BTC.

Supply: Coinglass

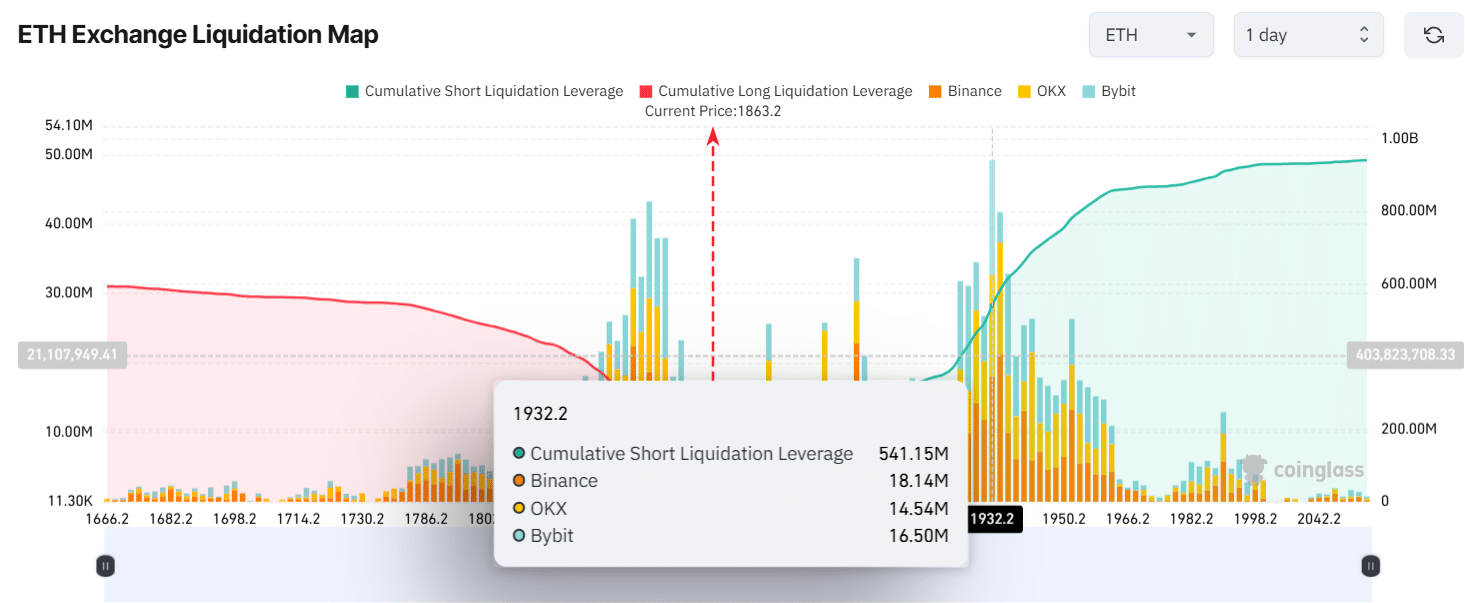

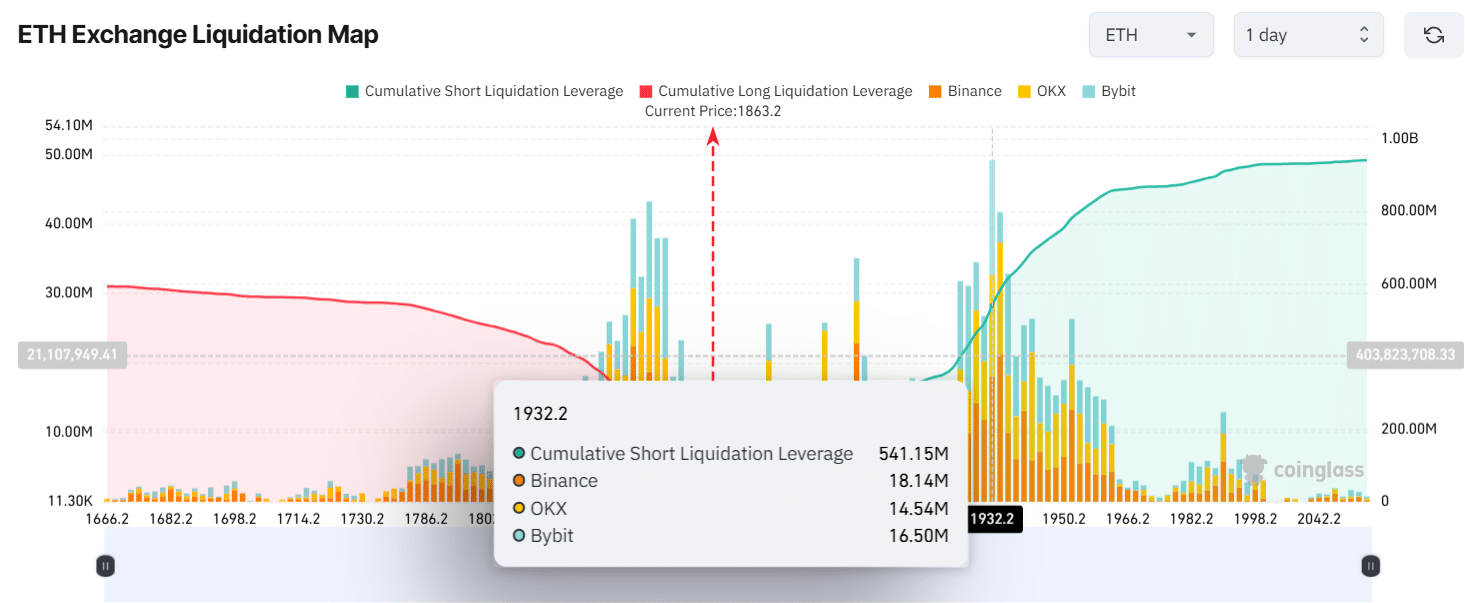

However, merchants regarded robust arary on ETH.

Information reveals that the over-delivery ranges of ETH $ 1,932 and $ 1,840 have been, with merchants constructed $ 541 million in brief positions and $ 185 million in lengthy positions within the final 24 hours.

This means that bears are at the moment in management, presumably because of the upcoming price announcement.

Supply: Coinglass

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now