Ethereum

Why did the crypto market crash today? – Tariff-driven panic and more…

Credit : ambcrypto.com

- Trump’s charge announcement has worn out $ 490 million from Crypto when the costs of Bitcoin and Ethereum fell sharply.

- Sentiment caught up with concern, whereas correlated inventory sale deepens the downward momentum of Crypto.

The Cryptocurrency market noticed intense volatility over the previous 24 hours, fueled by the novel new charges of US President Donald Trump.

These embrace a minimal 10percentduty for all enter, with larger charges for necessary companions reminiscent of China (34%), Japan (24%) and the European Union (20%).

Because the information broke out, each conventional and digital markets responded rapidly. Bitcoin [BTC] fell from $ 88,500 to $ 83,500, whereas Ethereum [ETH] Fell from $ 1,934 to lower than $ 1,800 on the time of writing.

Furthermore, the whole crypto market capitalization fell by 2percentand settled nearly $ 2.68 trillion. This lower occurred in the course of the Mid-Jap buying and selling session on 3 April.

Such a pointy response underlines how delicate crypto stays into world macro -economic shocks. That’s the reason these charges not solely disrupted world commerce – they induced a direct hit for digital belongings.

Liquidations destroy greater than 160,000 merchants

After the latest worth lower, greater than $ 490 million had been liquidated by lifting tree positions, with greater than 160,000 merchants. The most important single liquidation occurred on Binance, the place an ETH/USDT place price $ 12 million was closed. Most losses had been sustained by lengthy merchants who had gambled on rising costs.

Bitcoin Futures was good for $ 170 million in liquidations, whereas Ethereum contracts misplaced $ 120 million. Smaller Altcoins contributed an additional $ 50 million to the whole.

Apparently, the volatility influenced each markers – $ 257 million got here from lengthy positions from liquidated, whereas $ 232 million got here out of shorts. This recession in the end punished each Bullish and Bearish merchants.

Market sentiment shifts sharply in concern

Within the first occasion, the market skilled a brief wave of optimism. Nonetheless, since merchants absolutely assessed the affect of the charges, that belief disappeared rapidly.

Market analyst Rachael Lucas reported a rise of 46% in commerce quantity, pushed by main gamers who alter their positions. Retail merchants, then again, remained particularly cautious.

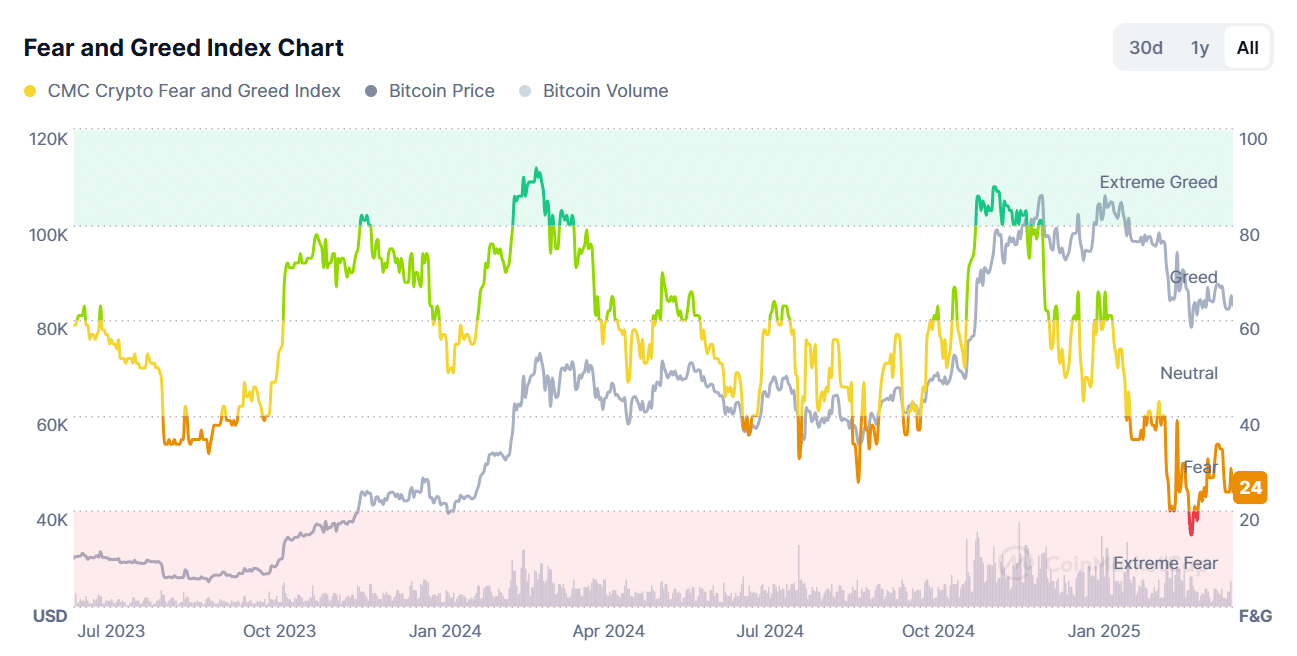

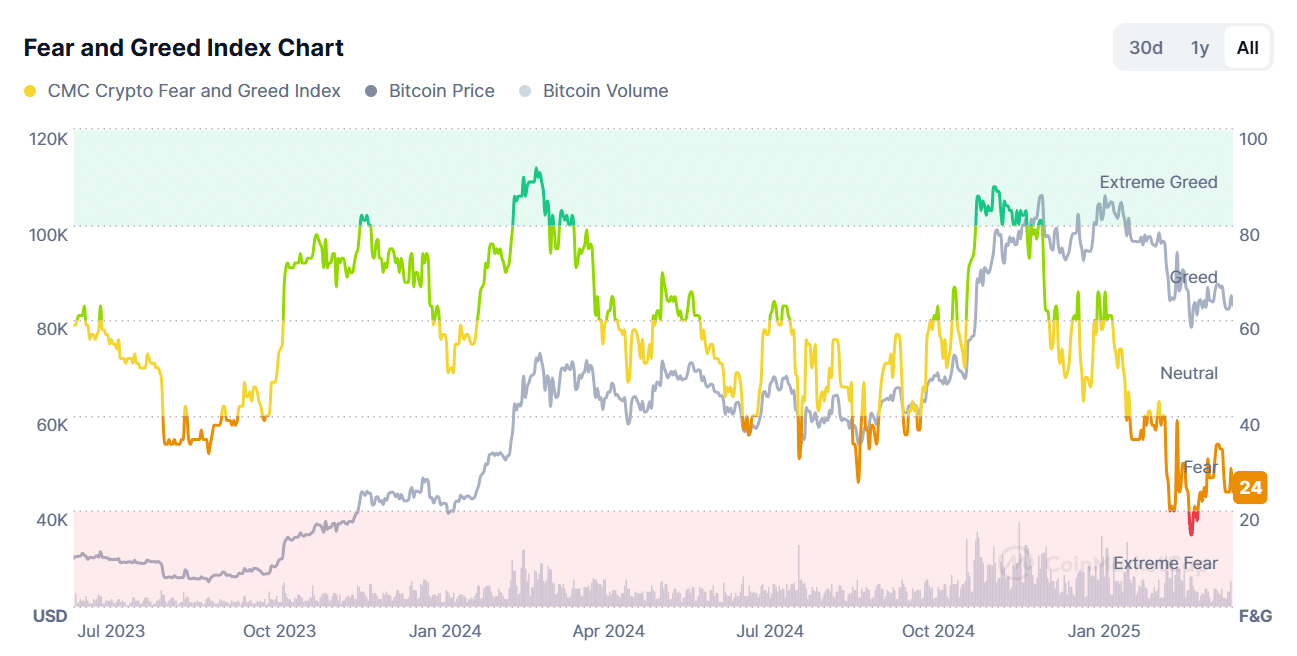

The Crypto Worry & Greed Index dropped to 24, which signifies elevated concern in the marketplace. Only a week in the past, sentiment was nearer to impartial. This sharp shift in buyers forecast emphasizes how delicate the market is to necessary coverage modifications.

Supply: Coinmarketcap

The sale of the heavy inventory market is burning crypto losses

The S&P 500 Futures will throw $ 2 trillion to market capitalization inside simply quarter-hour after the announcement. Massive technical shares, together with Apple (-5.59%), Amazon (-4.50%) and Nvidia (-3.43%), skilled vital losses.

This broad sale additionally got here throughout to cryptocurrency markets.

As cryptom markets have been correlated with shares, each sectors fell on the similar time. Consequently, the panic in conventional funds will increase the crypto -crash. The shock was each instantly and carefully linked to widespread financial fears.

In conclusion, the crypto market crash was immediately induced right now by US commerce charge bulletins.

These induced anxiousness, induced mass liquidations and had been tailor-made to a world sale of shares. That’s the reason a transparent geopolitical coverage – no rumors – was the primary explanation for the crash.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024