Altcoin

Will Bitcoin (BTC) crash again? Beerarish pattern spot

Credit : coinpedia.org

Within the midst of the present tariff struggle, Bitcoin (BTC), the world’s largest cryptocurrency per market capitalization is prepared for a large worth crash due to the Bearish worth motion. In latest days, BTC appears to consolidate inside a decent attain. On additional investigation, nonetheless, it appears to have fashioned a bearish predominant and shoulder sample on the four-hour interval.

Present worth momentum

Evidently the market doesn’t reply to constructive information. Earlier, after the daring assertion from Treasury Secretary Scott Bessent, BTC began recovering along with nice property, however the upward momentum pale later and all of the wins have been misplaced. BTC is at the moment being traded close to the extent of $ 82,500 and BTC has registered a worth fall of greater than 1.10% within the final 24 hours. In the identical interval, commerce quantity fell by 50%, indicating a decrease participation of merchants and traders on account of outstanding market volatility.

Bitcoin (BTC) Technical evaluation and upcoming ranges

In accordance with the technical evaluation of consultants, BTC with the latest fall in worth is on its technique to the neckline of the Beararish predominant and shoulder sample.

Based mostly on latest worth motion and historic patterns, if the momentum continues and BTC breaks the neckline on the degree of $ 81,500, there’s a robust chance that it may fall by 4% to succeed in $ 78,200 degree within the close to future.

Any more, it’s actively buying and selling below the 200 exponential advancing common (EMA) on each day by day and 4 hours of time frames, which signifies a robust downward development and weak momentum.

Merchants often look forward to a worth bounce within the energetic, which explains the latest worth peak and the next lower inside lower than 24 hours.

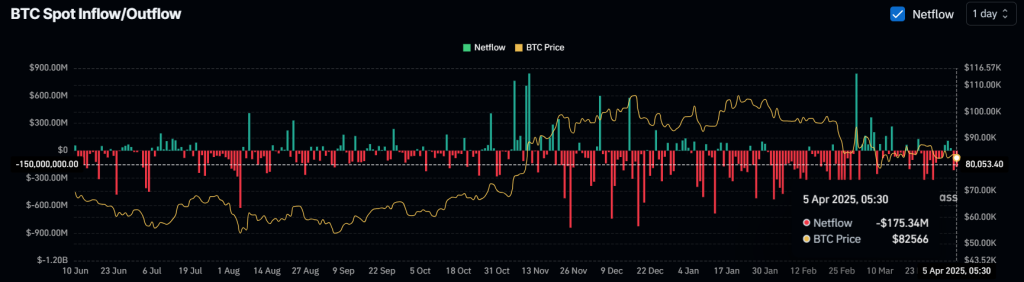

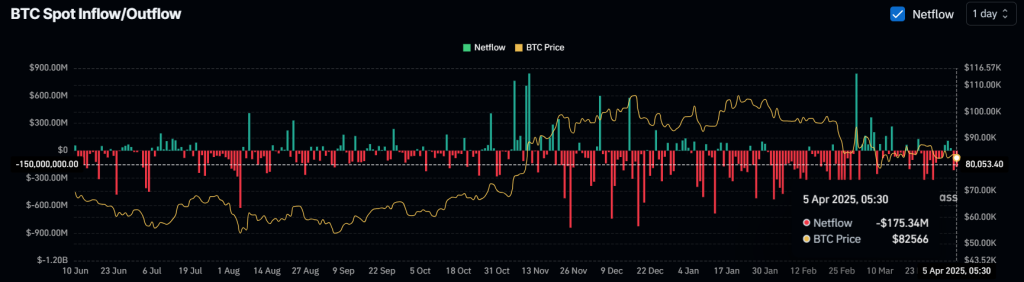

$ 175 million in BTC outflow

Regardless of the Bearish entrance views, traders and long-term holders appear to gather it actively, as reported by the on-chain evaluation firm Coinglass.

Knowledge from Spot -entry/outflow exhibits that exchanges have witnessed within the final 24 hours of an outflow of round $ 175 million in BTC. Such outflow throughout a Bearish market sentiment suggests potential accumulation.

Though this could trigger the buying stress and activate an upward rally, it often happens throughout a bull run.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September