Altcoin

Stellar price determination – will $ 0.2 be the last line of defense?

Credit : ambcrypto.com

- Stellar has re -tested $ 0.3 as resistance, however has been confronted with rejection for the previous ten days

- Retest of the demand zone of $ 0.2 can have a small bullish response, however buyers should stay cautious

Stellar [XLM] Has needed to cope with 14.5% losses within the final 24 hours. This, after Bitcoin [BTC] Did to $ 74.5ka a number of hours earlier than the time when the inventory markets worldwide fell within the aftermath of the tariff waves. Nevertheless, Altcoin merchants should be cautious. Particularly for the reason that bearish pattern of the previous three months grew to become a lot stronger on account of current occasions.

Consumers could be affected person as a substitute of attempting to purchase the underside immediately, as a result of there aren’t any indications that has even shaped a backside. BTC tendencies may also be checked for directions on the broader market.

Stellar is falling under $ 0.2, as a result of the gross sales strain is intensifying once more

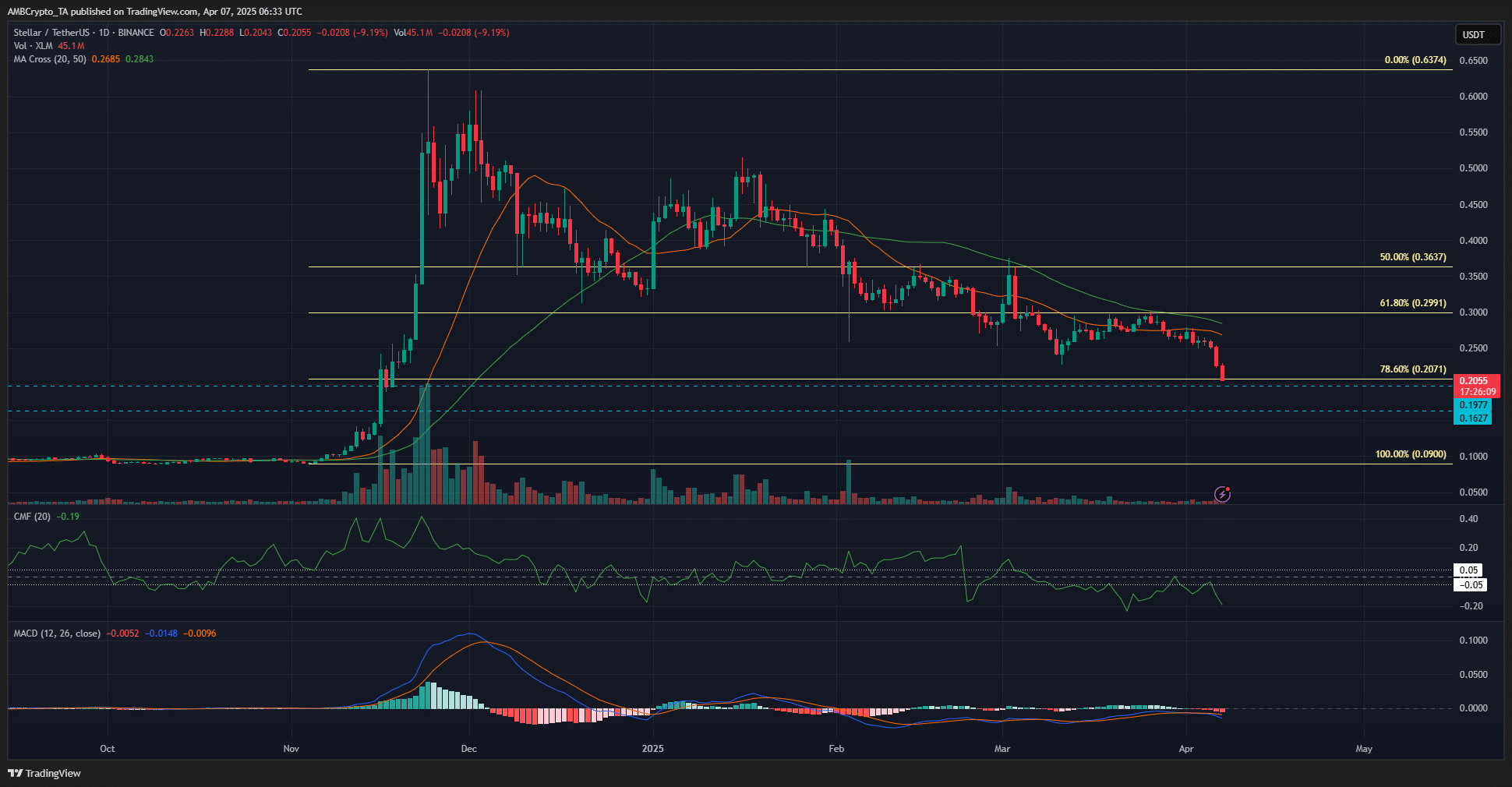

Supply: XLM/USDT on TradingView

The 1-day pattern remained significantly bearish. The advancing averages of 20 and 50 intervals had been above the value and confirmed that Beerarish Momentum was dominant. The MACD went decrease once more after a motion above the zero line.

This was the results of the consolidation part round $ 0.25- $ 0.3 in March, which was adopted by sharp losses in April. The CMF has been under zero since March and has once more been nicely under -0.05 to point heavy capital flows from the Stellar market.

Collectively the momentum and the gross sales strain meant that additional losses may in all probability be for Stellair. The Fibonacci retracement ranges primarily based on the November Rally confirmed that the extent of 78.6% at $ 0.207 was.

On the time of the press, the value was just under this check assist stage. The degrees of $ 0.197 and $ 0.162 had been additionally lengthy -term assist ranges to concentrate.

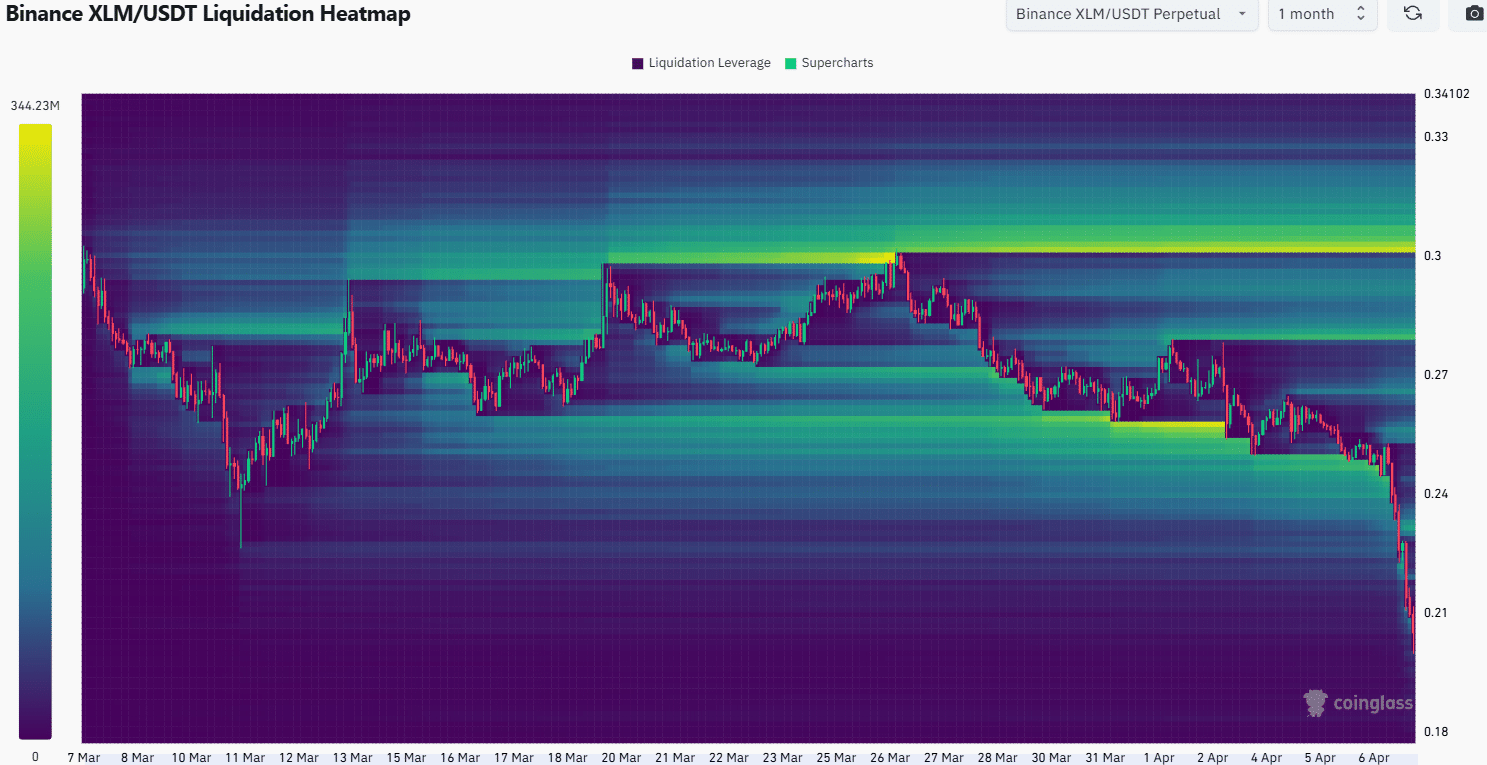

Supply: Coinglass

The 1-month liquidation warmth revealed that the $ 0.246- $ 0.26 zone was stuffed with lengthy liquidations.

In addition they coincided with the native assist ranges from the primary half of March. The final worth dunge took the value of XLM far beneath the liquidity cluster of $ 0.24.

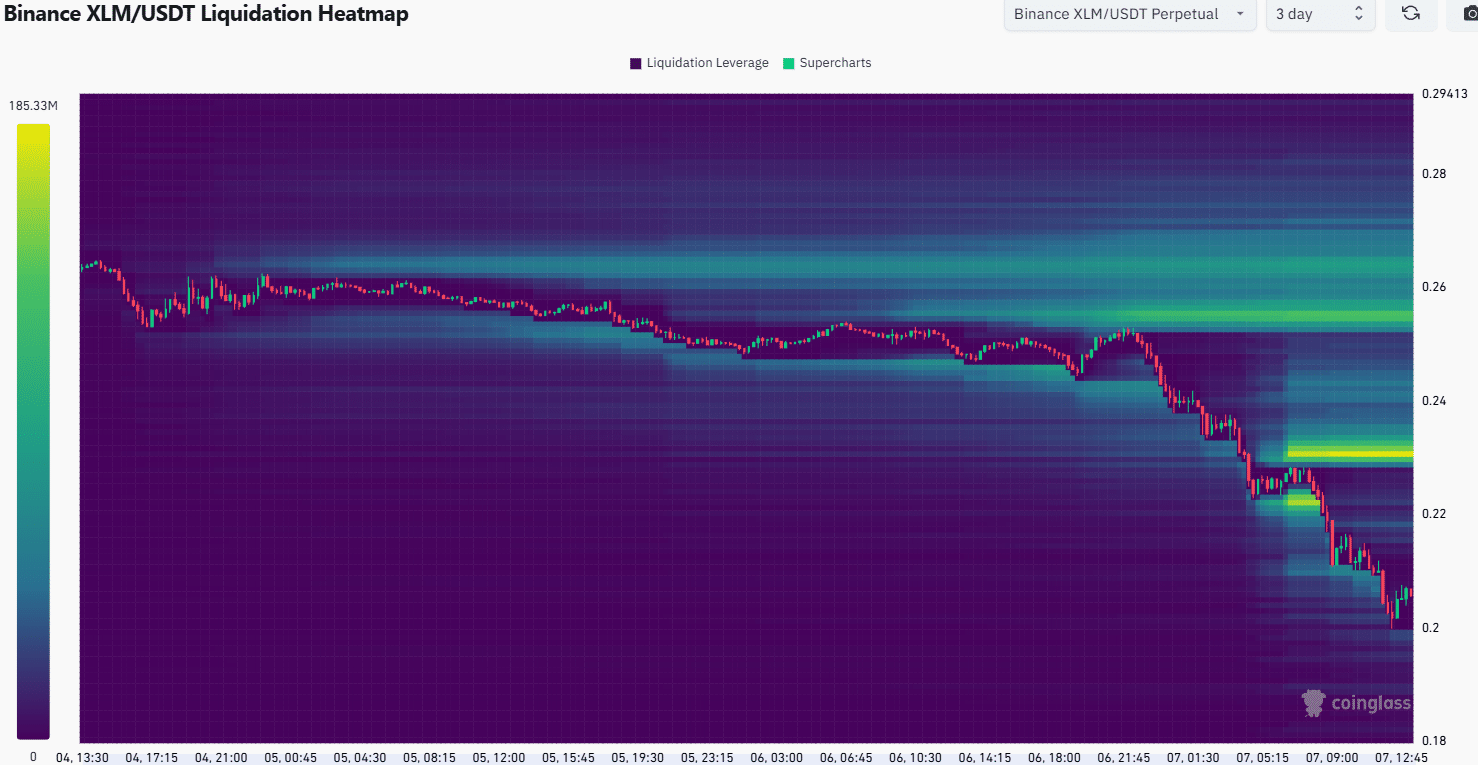

Supply: Coinglass

An additional consideration of the native liquidation ranges gave some indications concerning the subsequent step of XLM. The construction of liquidity round $ 0.23 introduced a sexy goal and the potential of a bearish reversal within the case of a worth bounce.

Moreover, the $ 0.255- $ 0.265 zone is the following magnetic zone to concentrate. Stellar merchants should be cautious and never instantly attempt to purchase the underside.

Disclaimer: The introduced info doesn’t type monetary, investments, commerce or different kinds of recommendation and is just the opinion of the author

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024