Ethereum

Ethereum’s big gamble – Whales bet on the dip, but will it pay off?

Credit : ambcrypto.com

- Ethereumwalvissen appear to carry out a technique for ‘buy-the-fear’ technique whereas ETH breaks by means of help ranges

- Is a rebound on palms within the charts?

When huge cash flows in the marketplace throughout a dip, that is referred to as a “buy-the ambiance” technique. On this case, Ethereum [ETH] Whales appear to do precisely that and use the panic to create a reduction within the discipline of a reduction pending a market restoration.

The thriller group “7 brothers and sisters” made one gutInvesting $ 42.66 million to amass 25,100 ETH at round $ 1,700, in a comparable step, one other whale borrowed 8.25 million DAI to purchase 5,227.3 ETH at round $ 1,578.

Therefore SSMust you observe the instance and purchase the worry?

Ethereum On Whale Alert

On the time of the press, Ethereum appeared to interrupt by means of multi-year lows, with the Altcoin commerce 16.8% decrease at $ 1,490 ranges that weren’t seen in two years. The prospects appeared cloudy and anticipated an instantaneous rebound can be untimely.

Why? The “7 brothers and sisters” group is at present confronted with a lack of $ 5.27 million, which corresponds to a lack of $ 120 per ETH. Equally, the opposite whale has been a lack of $ 460K.

This emphasised that regardless of the aggressive accumulation, these whales are nonetheless beneath Significant pressure. Particularly for the reason that market stays in a fragile state. Until these massive palms enter revenue positions, the market can be prone to extra sale if these whales resolve to even break.

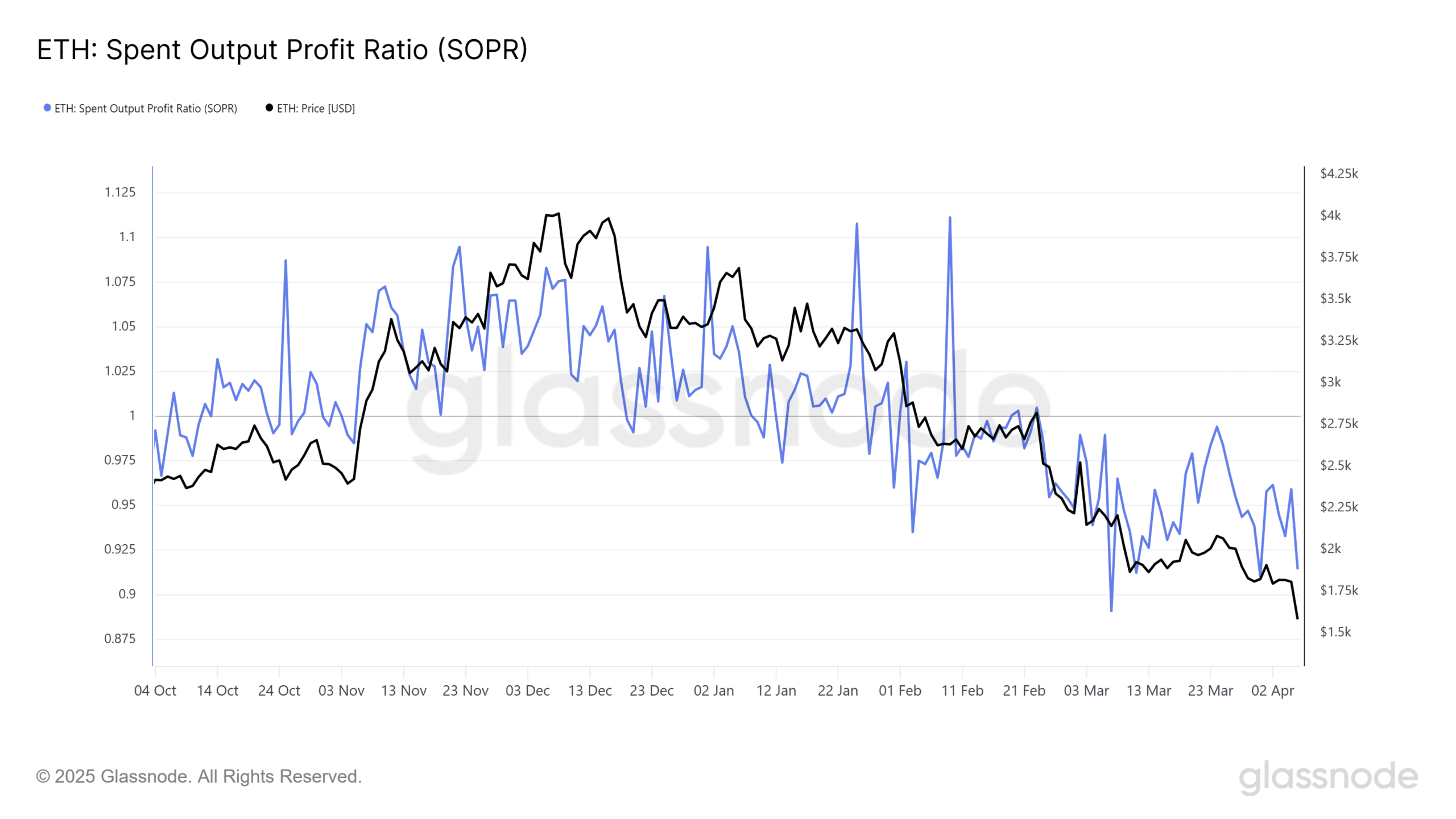

Wanting on the Sopral graph (greatest output revenue ratio) underlined the prospect of sustaining sale. Particularly for the reason that identical fell to a low level of six months.

The Sopr -metthrical confirmed {that a} majority of market individuals need to cope with losses, which will increase the danger of additional liquidations.

Supply: Glassnode

To soak up the pressure-side strain, extra has to withdraw extra some huge cash.

Small palms are panic or look forward to Bitcoin to recuperate. Till bigger gamers take management, the market can be weak for additional drawback.

What’s the following – a brief squeeze or a speculative loop?

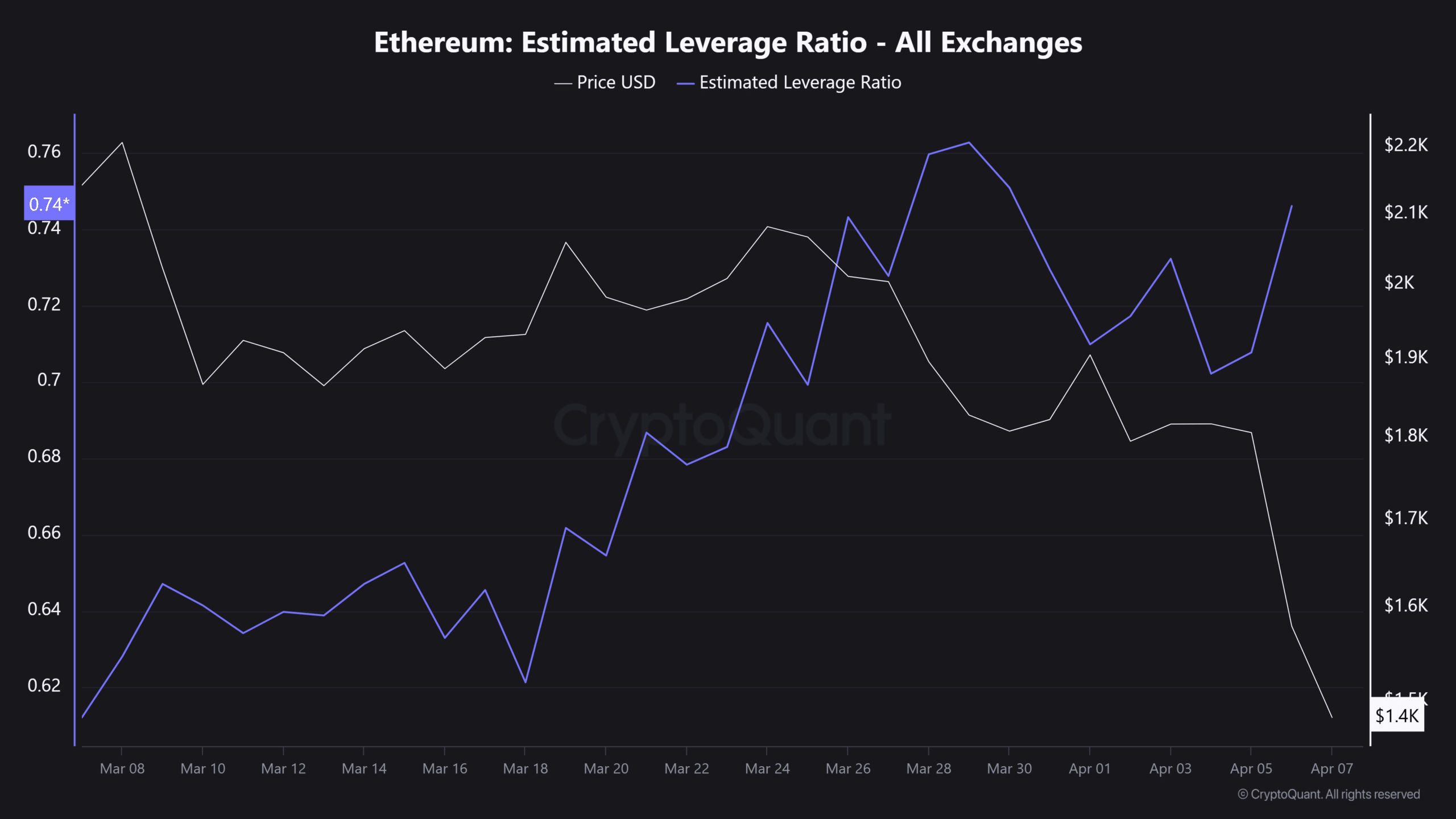

The sudden crash has overwhelmed Futures merchants, which initiated a wave of dangers of $ 349.59 million Long liquidations. Nonetheless, nevertheless, the estimated lever ratio of Ethereum (Elr)-a signal that merchants nonetheless soar in bets with a excessive danger.

Supply: Cryptuquant

This speculative enhance, together with a big inflow of cash, can arrange a brief squeeze when the market reverses.

Nevertheless, within the context of a Bearish development, this will rapidly flip round. Why? As a result of the sale of the gross sales aspect of Ethereum remains to be necessary, with ETH -Reserves Climbing from 18.21 million on April 1 to 18.50 million, which signifies elevated liquidity in the marketplace.

Until sturdy demand arises, Ethereum is caught in a speculative loop, the place whales “purchase the worry and promote the greed.” This retains the ELR excessive, whereas the danger of extra liquidations is elevated.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024