Bitcoin

Bitcoin Skew Normalizes as $85K-$100K Option Plays Regain Popularity

Credit : www.coindesk.com

Bullish Bitcoin (BTC) choices methods grow to be in style once more, stabilizing an important sentiment pointer that triggered a panic initially of final week.

BTC has been bounced as much as greater than $ 84,000 since final week lows of lower than $ 75,000. The restoration is as a result of the bond market chaos supposedly President Donald Trump has pressured to capitulate charges only some days after saying radical import duties in several international locations, together with China.

On the finish of Friday, the Trump administration issued new pointers, which saves vital technical merchandise comparable to smartphones from its 125% China charge and fundamental line 10% international levy. Hours later Trump refuted the information and didn’t counsel a aid at charges.

However, the value restoration inspired these merchants inspired in BTC by way of the decision choices of the Deribit-Genotered name. A name offers the customer the proper, however not the duty to purchase the underlying asset at a predetermined value on or earlier than a selected date. A purchaser purchaser is implicit Bullish available on the market and needs to profit from an anticipated value enhance. A nicely purchaser is alleged to be bearish, searching for protecting or successful a revenue.

“Trump’s bond market-crisis has fed the rate-walkback the vocal story reversed from aggression to capitulation, and the markets from capitulation to aggressive bounce. Protecting/bear play BTC $ 75k- $ 78k [strike] Wells had been dumped and $ 85k $ 100k [strike] Calls had been lifted when BTC rose from $ 75k $ 85k, “Deribit mentioned in a market replace.

The Pivot to upward calls has normalized the choices, which mirrored the robust bias or approaching fears of final week, based on information that’s adopted by Amberdata. The SKEW measures the implicit volatility (demand) for calls in comparison with Putten and has been a dependable indicator for market sentiment for years.

The 30, 60 and 90-day skewers have returned to only above zero, every week in the past of deep damaging ranges, which signifies a lower in market panic and a revival of upward curiosity. Though the seven -day meter stays damaging, it displays a remarkably weaker bias than every week in the past when it dropped to -14%.

$ 100k is the most well-liked wager

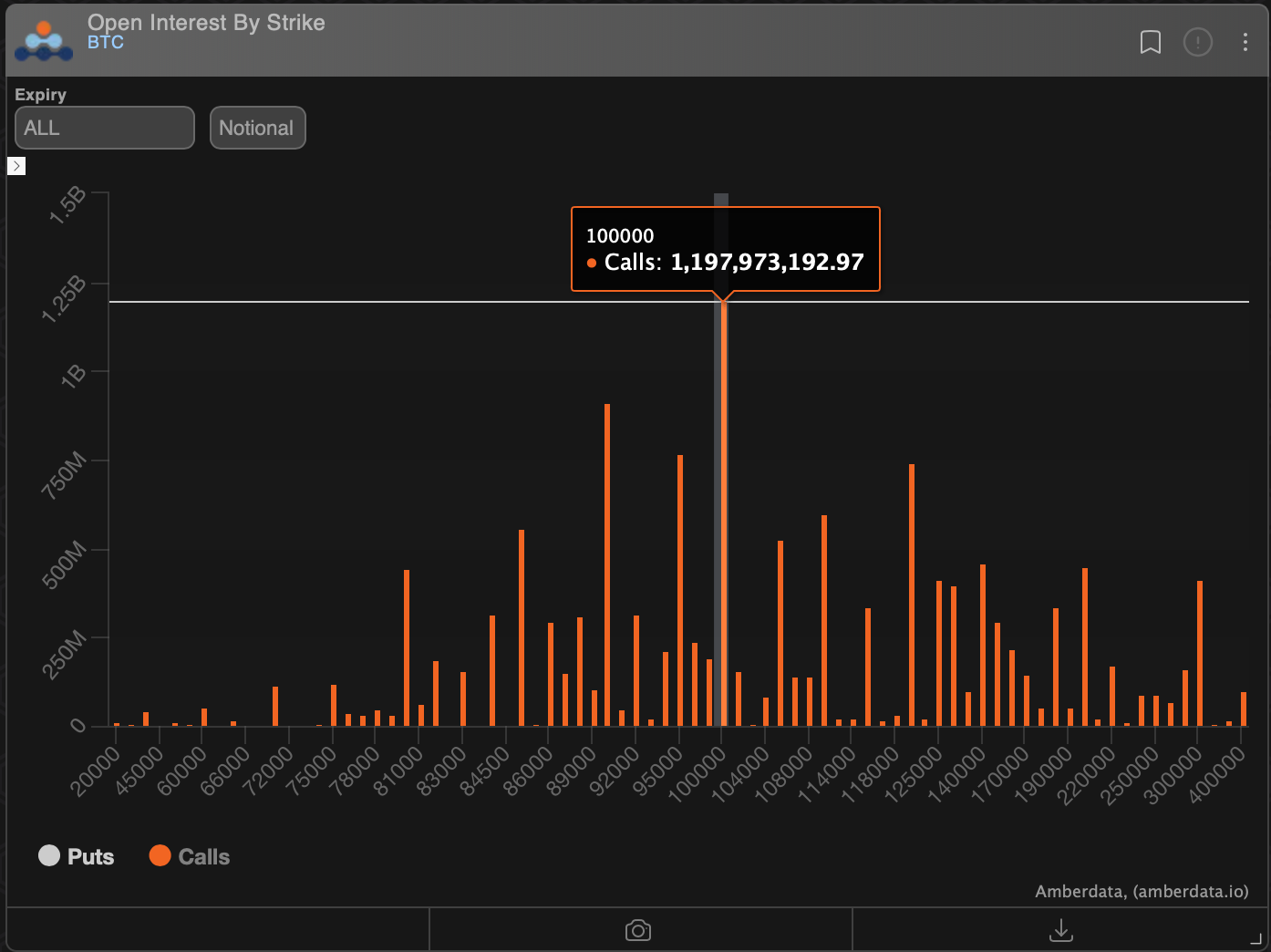

One other information level that in all probability confirms the lately battered market members is the distribution of open curiosity, which emphasizes the revival of the $ 100k name as probably the most favourite choices wager on Deribit, which accounts for greater than 75% of the worldwide choices exercise.

From writing, the $ 100k name had a cumulative notional open curiosity of just about $ 1.2 billion. The fictional determine represents the US greenback worth of the variety of lively possibility contracts at a sure time. Calls on $ 100k and $ 120K had been in style early this 12 months earlier than the market -searched merchants wager cash within the $ 80k within the $ 80k that was positioned final month.

The graph exhibits the focus of open curiosity in calls in strikes starting from $ 95,000 to $ 120,000. Within the meantime, the $ 70k is placing it on the second hottest sport with an open curiosity of $ 982 million.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September