Ethereum

Over 1.9M Ethereum Positioned Between $1,457 And $1,598 – Can Bulls Hold Support?

Credit : www.newsbtc.com

Motive to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the trade and punctiliously assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum acts above $ 1500 after per week of elevated volatility and fixed international uncertainty. Macro -economic tensions – powered by charges, shifting coverage and weakened investor sentiment – proceed to weigh closely on cryptomarkets. Regardless of the latest bouncing, the worth motion of Ethereum nonetheless refers to a wider downward pattern, through which Bulls is struggling to reclaim vital resistance ranges that may trigger a significant restoration.

Associated lecture

Nonetheless, there are indicators of potential energy forward. If bulls achieve pushing ETH over instant resistance zones, a bullish momentum shift may come up. Market watchers preserve an in depth eye on the price -based ranges to find out the place a powerful demand can pop up.

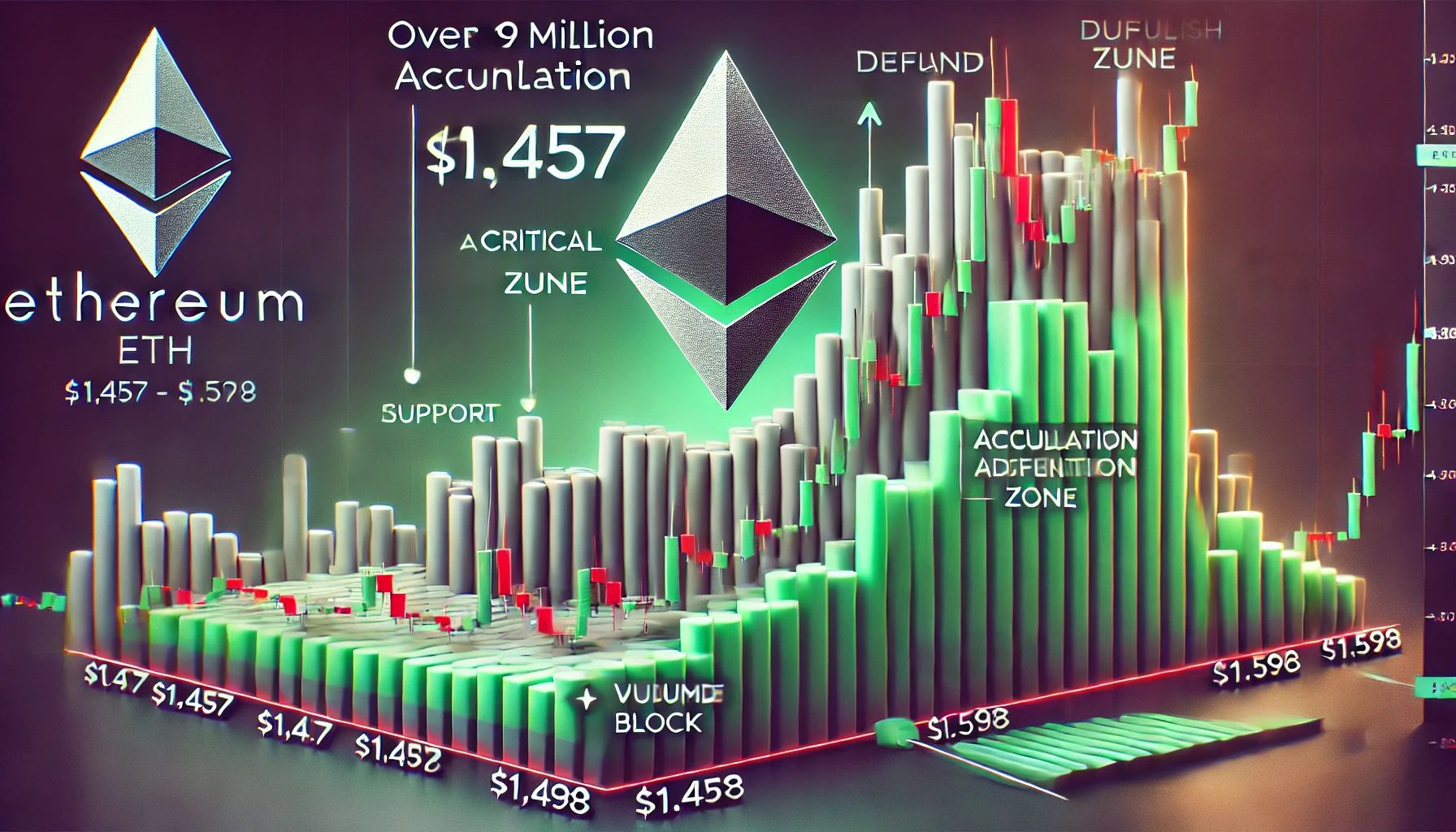

Based on information from Glassnode, the price -basis distribution of Ethereum reveals three high prize clusters that can most likely type motion within the quick time period. Amongst them, the extent of $ 1,546 stands out as an important, with 822,440 ETH that was beforehand collected on this attain. A profitable perspective or outbreak above this zone can present a stable basis for a higher restoration.

In the meanwhile, Ethereum’s prospects will stay cautious, whereby bulls should get well these greater ranges to shift the sentiment and problem the broader pattern.

Ethereum most vital price -based ranges can outline worth promotion

Ethereum has misplaced greater than 50% of its worth because the starting of February, making it a scene for a difficult however presumably essential restoration part. After months of heavy gross sales stress, ETH is now traded simply above $ 1500, a zone that might function a springboard if Bullish Momentum builds. Though the broader market has proven indicators of restoration, the overwhelming worth motion of Ethereum traders continues to check persistence. But analysts consider {that a} restoration rally is feasible, particularly if it improves macro -economic sentiment.

Persistent international commerce tensions, present tariff fights and shifts in overseas coverage proceed to inject volatility into monetary markets. These components have suppressed the demand for danger property as Ethereum, however some consider that the worst could be left behind.

Glassnode’s on-chain data Presents a extra detailed view of the quick -term provision of Ethereum. Based on their price -basis distribution evaluation, three worth clusters will most likely give the worth of the ETH form to the worth within the quick time period. About $ 1,457 had been beforehand collected round 408,000 ETH. For $ 1,546, greater than 822,000 ETH sit, making it one of the important ranges. Lastly, round 725,000 ETH had been bought round $ 1,598.

These clusters replicate areas with a excessive exercise on the chain and are anticipated to behave as help or resistance zones throughout the present worth consolidation part. An outbreak above the $ 1,600 degree may trigger a bigger motion to $ 1,800 and past. In the meanwhile, the worth of Ethereum will stay accessible, however market contributors preserve an in depth eye on these ranges for indicators of a decisive shift.

Associated lecture

ETH is confronted with essential resistance whereas bulls combat to regain the momentum

Ethereum is at the moment buying and selling at $ 1,580 after not breaking the resistance degree of $ 1,700, indicating that Bullish Momentum stays weak. Regardless of a quick restoration of latest lows, ETH has issue reclaiming greater land and vital resistance ranges proceed to weigh on worth motion.

For bulls to connect the beginning of an actual restoration part, Ethereum has to push above 4 hours 200 mA and EMA, each round $ 1,820. A decisive motion above these indicators would point out renewed market confidence and open the door for a push within the course of important demand ranges round $ 2,000.

Nonetheless, the chance of additional drawback stays. If Ethereum loses the help degree of $ 1,500, the gross sales stress can speed up, which can stimulate the worth under $ 1,400. At first of 2023, this zone served as an vital degree and could possibly be examined once more if Beerarish Momentum Bouwt.

Associated lecture

With macro -economic uncertainty and commerce tensions that also dominate the story, traders stay cautious. The following few commerce periods can be essential for ETH, as a result of it floats between potential restoration and the specter of renewed decline. Merchants should take note of quantity peaks and response round $ 1,700 and $ 1500 zones to evaluate the following step.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024