Bitcoin

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Credit : bitcoinmagazine.com

Bitcoin’s value course of once more data the headlines, and this time the catalyst appears to be international liquidity traits that reform the sentiment of buyers. In a latest in depth demolition, Matt Crosby, chief analyst at Bitcoin Magazine Propresents mandatory The renewed bullish momentum of the digital belongings bind to the rising international M2 sum of money. His insights not solely spotlight the way forward for Bitcoin value, but additionally anchor his macro -economic relevance in a broader monetary context.

Bitcoin prize and international liquidity: a high-impact correlation

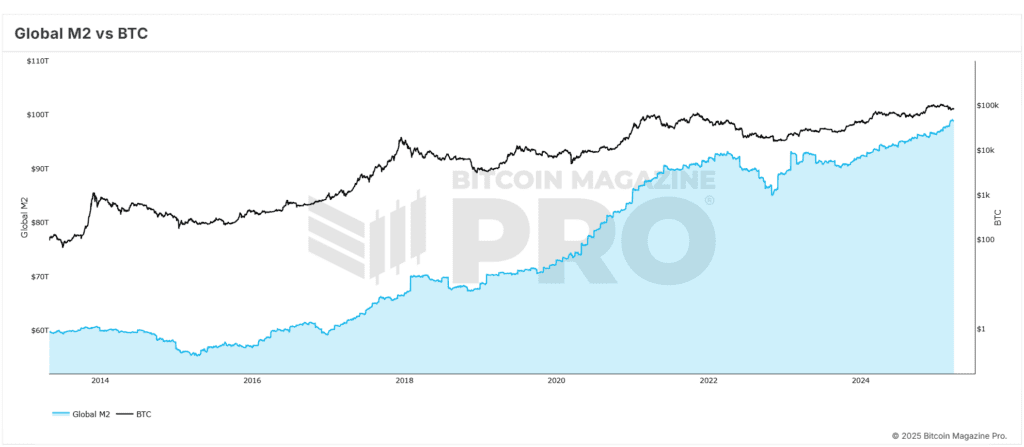

Crosby emphasizes a outstanding and constant correlation – usually greater than 84% – between Bitcoin – value and international M2 -Liquidity ranges. Because the liquidity will increase through the international economic system, Bitcoin value often responds to upward motion, though with a noticeable delay. Historic information assist the remark of a delay of 56-60 days between financial enlargement and Bitcoin value will increase.

This perception has not too long ago proved correct, as a result of Bitcoin Worth has recovered from lows from $ 75,000 to greater than $ 85,000. This pattern is intently adjusted to the anticipated restoration that Crosby and his group had defined on the idea of macro indicators, which threatens the energy and reliability of the correlation to the Bitcoin value upwards.

Why influences the 2-month Bitcoin value

The delay of two months out there response is a essential remark for understanding Bitcoin value actions. Crosby emphasizes that financial coverage and liquidity injections don’t instantly affect speculative belongings reminiscent of BTC. As an alternative, there’s an incubation interval, often roughly two months, throughout which liquidity filters begins to affect by monetary methods and the Bitcoin value.

Crosby has optimized this correlation by numerous again assessments, adjusting timetables and offsets. Their findings point out {that a} delay of 60 days yields probably the most predictive accuracy in each short-term (1 yr) and in depth (4-year) historic Bitcoin value promotion. This delay affords a strategic benefit for buyers who comply with macro traits to anticipate Bitcoin value will increase.

S&P 500 and its affect on Bitcoin -Perrends

Crosby provides additional credibility to the dissertation and extends its evaluation to conventional inventory markets. The S&P 500 exhibits an excellent stronger correlation of about 92% with international liquidity. This correlation reinforces the argument that financial enlargement is a crucial motivation, not just for Bitcoin value, but additionally for wider risk-ony courses.

By evaluating liquidity traits with a number of indices, Crosby exhibits that Bitcoin value shouldn’t be a deviation, however a part of a broader systemic sample. When liquidity rises, each shares and digital belongings are inclined to take benefit, making M2 an important indicator for timing Bitcoin value actions.

Bitcoin -Worth predicting as much as $ 108,000 by June 2025

To construct a future-oriented perspective, Crosby makes use of historic fractals from earlier bull markets to mission future Bitcoin prize actions. When these patterns are coated with present Macro Day, the mannequin factors to a state of affairs by which Bitcoin value may re-test and presumably surpass his heights, aimed toward $ 108,000 by June 2025.

This optimistic projection for Bitcoin value is determined by the belief that international liquidity continues its upward course of. The latest statements by the Federal Reserve counsel that additional financial stimulus might be used as market stability Hapert – one other tail wind for Bitcoin -price progress.

The enlargement price influences the Bitcoin value

Though the rising liquidity ranges are appreciable, Crosby emphasizes the significance of monitoring the pace of liquidity enlargement to foretell Bitcoin -Prijstrends. The expansion price on an annual foundation affords a extra nuanced picture of Macroeconomic Momentum. Though liquidity normally has elevated, the tempo of enlargement was briefly delayed earlier than he resumed an upward pattern in latest months.

This pattern is remarkably just like the situations that have been noticed in the beginning of 2017, simply earlier than Bitcoin Worth entered an exponential progress section. The parallels reinforce Crosby’s Bullish Have a look at Bitcoin value and emphasize the significance of dynamic, relatively than static, macro evaluation.

Final ideas: Making ready for the subsequent Bitcoin -prize section

Though potential dangers reminiscent of a worldwide recession or a big correction of the inventory market, the present macro indicators level to a good setting for Bitcoin value. Crosby’s information -driven strategy affords buyers a strategic lens to interpret and navigate the market.

For individuals who wish to make knowledgeable choices in a unstable setting, these insights supply helpful data primarily based on financial Fundamentals to reap the benefits of Bitcoin value alternatives.

Go to a go to to a bigger examine, technical indicators, actual -time market warnings and entry to a rising neighborhood of analysts Bitcoinmagazinepro.com.

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. All the time do your personal analysis earlier than you make funding choices.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024