Altcoin

What is the next step for ETH price?

Credit : coinpedia.org

After feedback from the Federal Reserve chairman Jerome Powell, the value of Ethereum is struggling as a result of it doesn’t validate a transparent upward development. On April 16, throughout a speech in Chicago, Powell said that the Federal Reserve just isn’t in a rush to decrease the rates of interest, with a cautious “wait -and -see” method depending on additional financial information. This announcement led to a rise within the change price of Ethereum, which signifies the alternatives for a possible bearish correction.

Ethereum is confronted with rising bearish threats

The worth of Ethereum is trending down, hit by the cautious view of the Federal Reserve on the economic system, which has stuffed within the sentiment of buyers. In keeping with information from Coinglass, Ethereum noticed round $ 40.6 million in liquidations for the previous 24 hours. Lengthy positions of this accounted for round $ 26 million, whereas brief positions had been round $ 14.6 million.

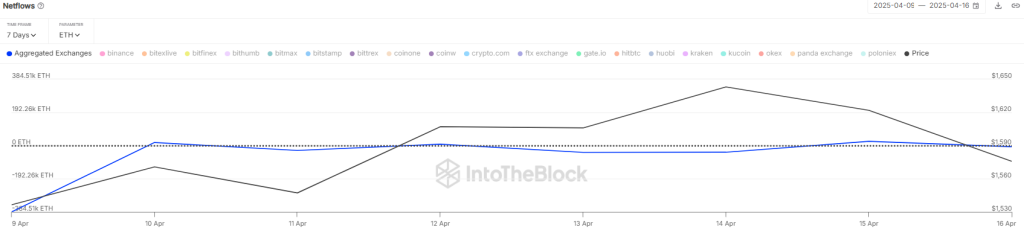

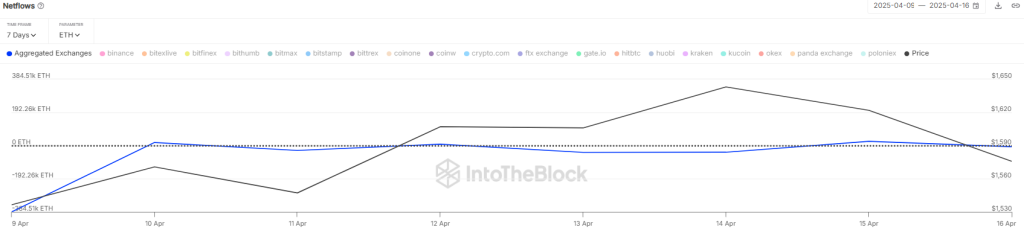

The latest worth lower coincided with a powerful enhance in change reserves. On the day past alone, greater than 77,000 ETHs had been transferred to derived exchanges, which marked the biggest web inflow by in the future in just a few months. This sudden enhance within the supply will increase the potential for gross sales strain.

Additionally learn: Giant influx into Ethereum: will the ETH worth fall once more?

Nevertheless, information from Intotheblock exhibits that the Netflow -metthrical stays unfavorable, at round -6,800 ETH. This means that the general outflow have exceeded the influx, which means that many buyers collected Ethereum within the midst of the value lower.

Coinglass additionally reveals that open curiosity in Ethereum has risen regardless of the downward strain. The OI metthriek rose by greater than 3.87percentand hit greater than $ 18 billion. Nevertheless, the financing proportion is trending across the unfavorable area with 0.0015%. Consequently, Bears nonetheless have management to consolidate ETH with fast FIB assist ranges.

Nevertheless, the present decline can quickly be a powerful rebound. In keeping with a cryptoquant analyst, Ethereum trades near the realized worth, a stage that has typically indicated massive rebounds up to now. The realized worth, now round $ 1,585, is seen as a powerful level for purchasing worth.

What’s the subsequent step for ETH worth?

Ether’s try at a worth restore loses the momentum round EMA development strains, as a result of bears strongly defend the EMA20 stage. Consequently, the value is floating across the falling resistance line. ETH worth at present acts at $ 1,588 and has fallen greater than 1.5percentwithin the final 24 hours.

If sellers achieve stimulating the value under $ 1,400, this may trigger a deeper lower from the top of the Bearish channel for $ 1,130. This stage is anticipated to draw the buying rate of interest, but when Bearish Momentum stays robust, an extra lower to $ 1K is feasible.

On the prime, a decisive break and near $ 1,700 can be the primary indication that consumers win again management. Such a motion might open the trail for a rally to $ 2K. Though the 50-day SMA can decelerate the restoration, it’s going to in all probability be surpassed if Bullish Momentum builds. A powerful push above $ 2K would counsel that the downtrend might flip over.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024