Ethereum

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

Credit : www.newsbtc.com

Cause to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the trade and thoroughly assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum acts across the $ 1,600 stage after a couple of days of failed makes an attempt to win larger prizes. Bulls present indicators of life, however their momentum stays weak whereas bearish stress continues to dominate the market. Regardless of a quick restoration bumper final week, the broader construction of Ethereum nonetheless displays a transparent downward pattern.

Associated lecture

The cryptomarkt stays within the shadow of macro -economic uncertainty, as a result of fixed tensions between the US and China weigh closely on a worldwide monetary sentiment. No decision or settlement between the 2 financial giants has been introduced, making traders cautious and threat -avoiding.

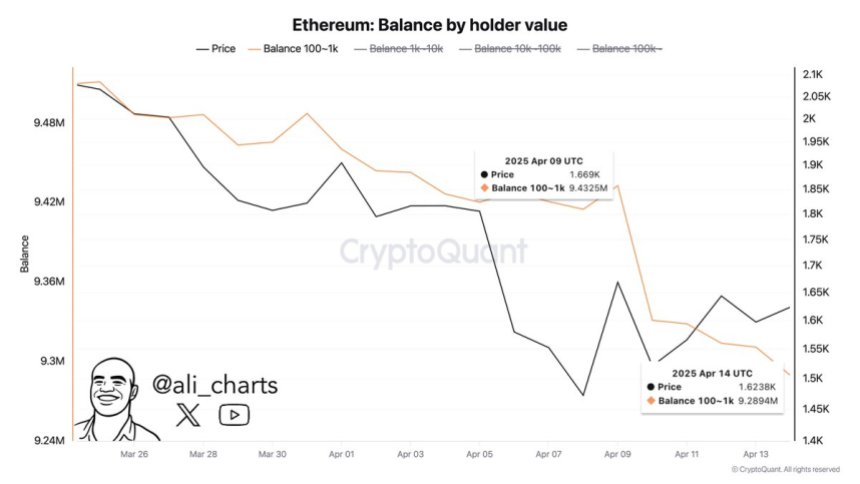

Add to the unfavourable sentiment, cryptoquant knowledge present that Ethereum -Walvissen have loaded round 143,000 ETH previously week. This massive -scale distribution reinforces the fears for additional down, with lengthy -term holders and huge portfolios that select to cut back publicity as a substitute of gathering.

Though some analysts nonetheless see potential for a change if the important thing ranges are recovered, the present market atmosphere stays fragile. Except Ethereum can regain and be capable to hold above the brief resistance ranges, the specter of one other leg may be very actual. Merchants at the moment are trying intently within the value actions for indicators of a shift – however for now, warning continues to take the lead.

Ethereum is confronted with gross sales stress as a whale output

Ethereum is confronted with a essential check as a result of value promotion stays lack of readability and the help ranges stay susceptible. Regardless of brief makes an attempt to rebound, ETH has not succeeded in establishing a transparent soil and the downtrend construction stays intact. The market is struggling to outline a robust demand zone, making it troublesome for bulls to protect upward momentum. Because the gross sales stress builds up, analysts warn that Ethereum can proceed to slip to a decrease ranges of demand within the absence of robust buy curiosity.

Wider macro -economic situations proceed to weigh closely on threat belongings resembling Ethereum. Worldwide commerce tensions, particularly the unsolved tariff place between the US and China, have created uncertainty within the monetary markets. Mixed with the worry of a delaying world financial system and lack of coordinated tax help, cryptom markets stay underneath stress.

Add to the Bearish sentiment, high analyst Ali Martinez shared data on the chains Revealing that whales have loaded round 143,000 ETH previously week. This massive -scale distribution by influential holders has significantly weakened the prospects of Ethereum, which strengthens concern that sensible cash is getting ready for a deeper drawback.

Because the finish of December, ETH has remained in a protracted -term Bearish pattern, the place each try at restoration was reached by renewed sale. Except bulls recuperate a very powerful technical stage and shift the market sentiment, Ethereum can slide additional.

Associated lecture

ETH value caught in risky vary

Ethereum is at the moment buying and selling at $ 1,600 after sustainable days of large volatility and macro-economically pushed uncertainty. Regardless of brief aid bouncing, ETH stays locked in a bearish construction, unable to generate a protracted -term momentum. For bulls to regain management, it’s essential for recovering the resistance stage of $ 1,850. This stage is consistent with the 4-hour 200 mA and EMA round $ 1,800, making it an vital zone to concentrate to a affirmation of a short-term status.

Holding above these advancing averages would sign a renewed energy and probably mark the beginning of a restoration rally. Value motion, nevertheless, continues to battle amongst them and never pushing over these indicators would verify persistent weak point. In that case, Ethereum can re -test the extent of $ 1500 and even dive underneath it if the gross sales stress will increase.

Associated lecture

The present atmosphere is fashioned by world tensions and macro uncertainty, with out clear catalysts to stimulate an outbreak in each instructions. So long as ETH stays underneath a very powerful superior averages, the chance of one other leg stays raised down. Bulls should act rapidly to reverse the sentiment and forestall a deeper correction for the lengthy -term demand ranges.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024