Analysis

No, Bitcoin trading is not older than fiat or the US stock market, yet

Credit : cryptoslate.com

Bitcoin’s buying and selling instances have surpassed these of the fashionable US fiat inventory market for the reason that Nixon shock, however claims that Bitcoin would outpace your entire historical past of US inventory buying and selling or fiat worldwide could be untimely. Nearer examination reveals a extra nuanced image of the market’s longevity and buying and selling exercise.

The crypto neighborhood was not too long ago abuzz over a statistic that highlighted how Bitcoin had amassed extra buying and selling hours than the fiat inventory market after a analysis by Cory Bates.

Bates identifies how Bitcoin buying and selling has now surpassed the fiat inventory market, however you will need to do not forget that this doesn’t symbolize your entire historical past of the US inventory market. But it could be so derived from that Bitcoin buying and selling predates fiat buying and selling within the US. Nonetheless, it’s not older than fiat worldwide.

The earliest identified use of fiat cash occurred in China in the course of the Track Dynasty (960–1279 CE). The federal government issued paper cash that was not backed by bodily commodities akin to gold or silver. This foreign money was initially backed by authorities credit and was broadly accepted for commerce and tax functions.

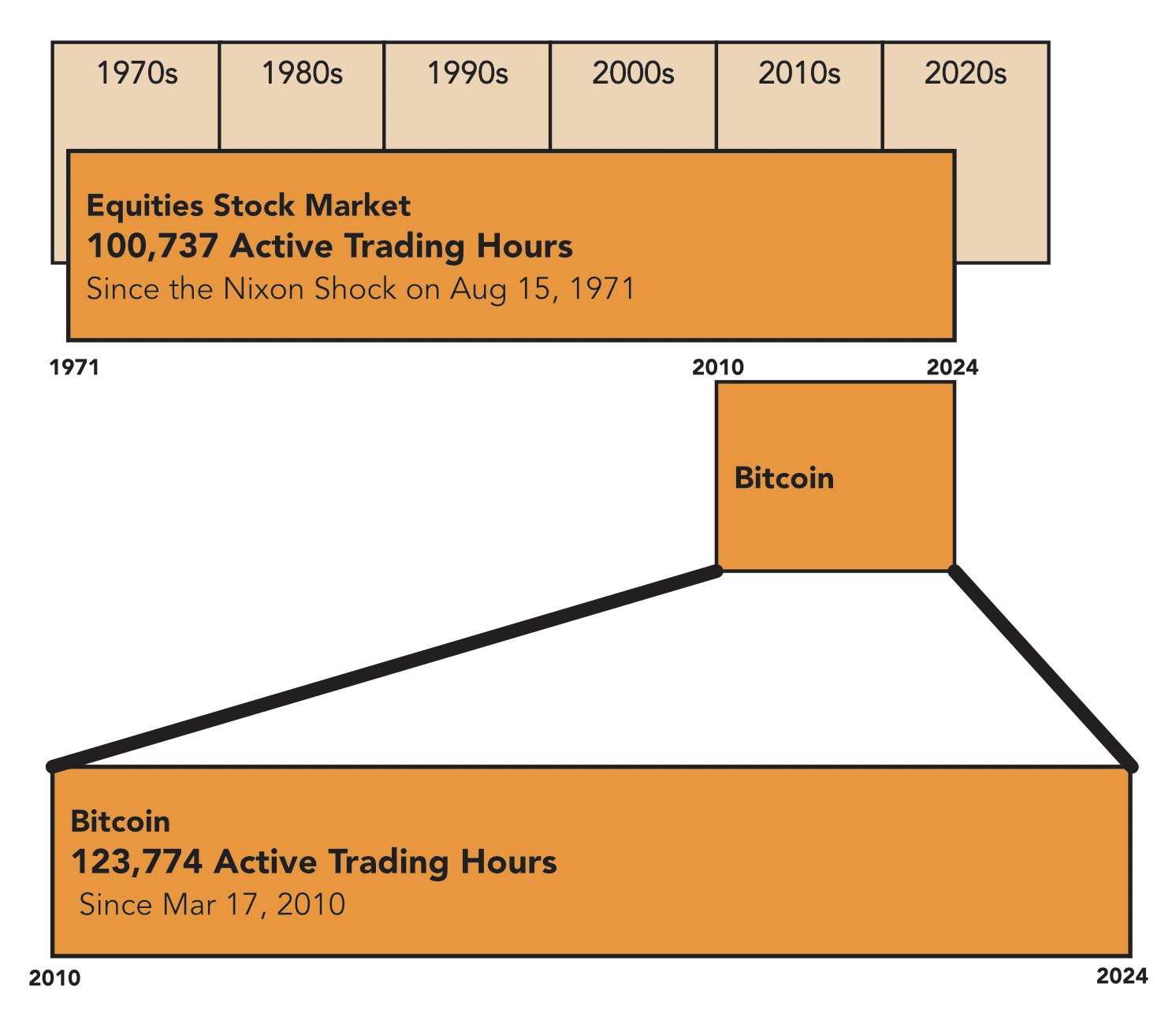

Bitcoin buying and selling hours vs US fiat inventory market

Launched in 2009, Bitcoin has amassed 123,774 energetic buying and selling hours for the reason that first recorded transaction on March 17, 2010. This surpasses the 100,737 hours recorded by the US inventory markets since August 15, 1971 – the date of the Nixon shock, which marked a big shift within the international monetary programs by means of the abolition of the gold normal.

Nonetheless, the historical past of the US inventory market goes far past 1971. Based in 1792, the New York Inventory Trade has a legacy spanning greater than two centuries. If we take into account this entire historical past, the image adjustments dramatically.

Calculations based mostly on the NYSE’s founding date reveal roughly 380,509 energetic buying and selling hours by means of September 6, 2024. This determine dwarfs Bitcoin’s present holdings, regardless of the digital asset’s 24/7 buying and selling schedule.

Bitcoin’s 24-hour availability offers it a big benefit in accumulating buying and selling hours. The normal inventory market operates on a extra restricted schedule, sometimes 6.5 hours a day, 5 days every week, excluding holidays.

Given Bitcoin’s continued buying and selling, projections point out that it’s going to take till roughly April 15, 2053 for the digital asset to truly surpass the full buying and selling hours in your entire historical past of the U.S. inventory market. This assumes that each markets proceed to function on their present schedule with out vital disruptions.

Nonetheless, it’s essential to notice that buying and selling hours alone don’t totally replicate market depth, liquidity, or general financial impression. The US inventory market stays a cornerstone of worldwide finance, with a depth and breadth of listed corporations and buying and selling quantity that Bitcoin has but to match.

Whereas Bitcoin has made exceptional progress in its brief existence, the complete weight of the U.S. inventory market’s centuries-long historical past stays a formidable benchmark.

An entire historical past of fiat cash buying and selling

Bitcoin’s journey, whereas fast, nonetheless has many years to go earlier than it could possibly really declare to have outlasted the cumulative buying and selling hours of the fabled US inventory markets. Additional, in assessing the declare that it has additionally surpassed fiat, so have the foreign exchange markets available Since 1971, 24 hours a day on weekdays.

Estimating complete buying and selling hours for fiat currencies worldwide poses a novel problem because of the staggered historic adoption of fiat programs. Though fiat cash has been utilized in some kind since historic China, fashionable buying and selling instances solely grew to become constant within the twentieth century, particularly after the transition from the gold normal following the Nixon shock in 1971.

Earlier than 1971, international buying and selling hours have been localized, irregular, and diversified from area to area. Whilst fiat programs grew to become extra widespread, there was no unified international buying and selling market and exchanges operated with restricted hours. Nonetheless, after 1971, the rise of the overseas trade market (foreign exchange) grew to become a extra dependable measure for calculating buying and selling hours.

At present, fashionable foreign currency trading operates roughly 120 hours per week (24 hours a day, 5 days every week). Utilizing this as a foundation, it may be estimated that roughly 6,240 hours of fiat buying and selling have taken place per yr since 1971. Over the 53 years from 1971 to 2024, that might quantity to roughly 330,720 buying and selling hours for fiat in fashionable international markets.

In abstract, though Bitcoin has surpassed the post-1971 US fiat inventory market when it comes to buying and selling hours, the cumulative buying and selling hours of worldwide fiat buying and selling have been considerably greater for the reason that inception of organized international foreign exchange markets.

Thus, Bitcoin has not surpassed the full international buying and selling instances of fiat currencies – neither when it comes to fashionable foreign currency trading nor when contemplating the deep historical past of fiat cash worldwide. However except the most important foreign exchange markets are additionally open on weekends, Bitcoin may theoretically finally catch up. Nonetheless, some brokers enable restricted weekend buying and selling on the most well-liked foreign exchange pairs.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September