Ethereum

THIS Ethereum metric just hit its 2016 levels; history tell us ETH’s price will…

Credit : ambcrypto.com

- Ethereum alternate reserves lately fell to a vital low

- The primary alerts appeared to level to a attainable short-term rebound on the key degree

Ethereum bears have maintained their dominance over the previous three months, however how for much longer can they keep this? Effectively, current information suggests potential accumulation as ETH flows out of exchanges, highlighting the state of demand at decrease costs.

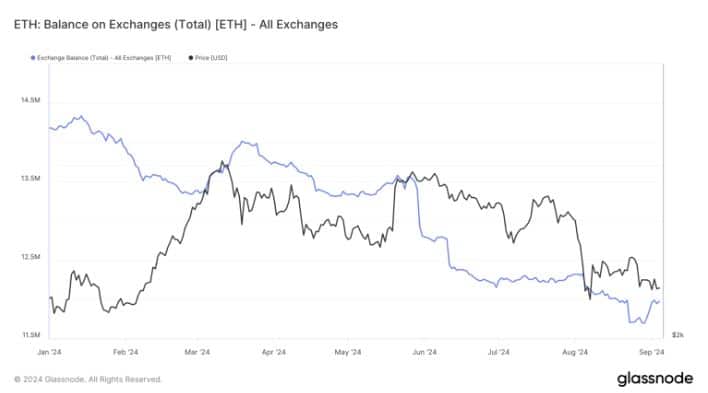

Based on Glassnode, Ethereum is flowing out of the exchanges. Much more notable are the current lows in ETH reserves, which lately retested 2016 ranges. Low international alternate reserves could have contributed to ETH’s strong worth motion within the following yr (2017). Therefore the query: can historical past repeat itself?

Supply: Glassnode

A 2016 historic evaluation of Ethereum discovered that it was experiencing some headwinds. The worth of ETH peaked at $18.36 in June 2016, earlier than falling under $12 in September of the identical yr. In December of the identical yr, the worth even fell to $7.14 earlier than staging an epic rally in 2017.

If Ethereum follows an identical path in 2024, it may level to the potential of 2025 producing a robust rally. The truth that ETH is flowing from the exchanges confirms the presence of robust demand at discounted costs. Furthermore, the tempo of ETH flows has additionally elevated.

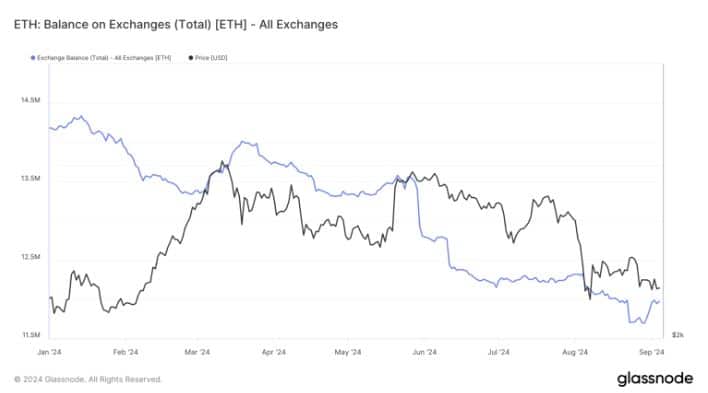

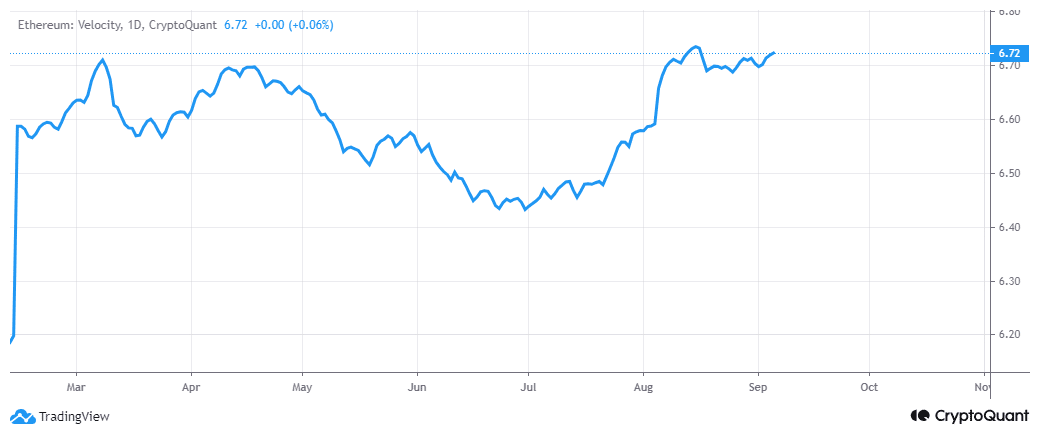

Supply: CryptoQuant

Ethereum’s pace has been on an upward pattern since July. If this pattern continues, coupled with strong demand, a near-term bullish pivot might be within the works.

Nevertheless, actions within the chain have proven that demand has not but reached a turning level the place it should exceed provide.

Might Ethereum’s Demand Result in a Pivot?

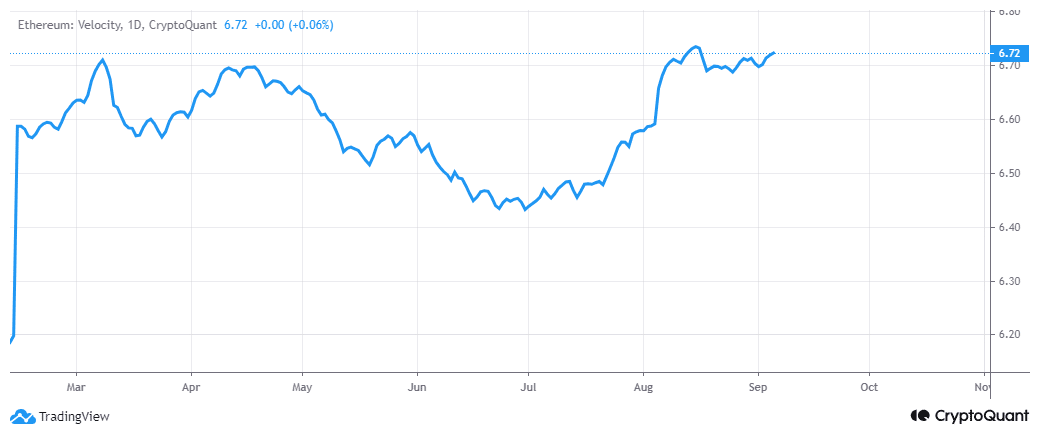

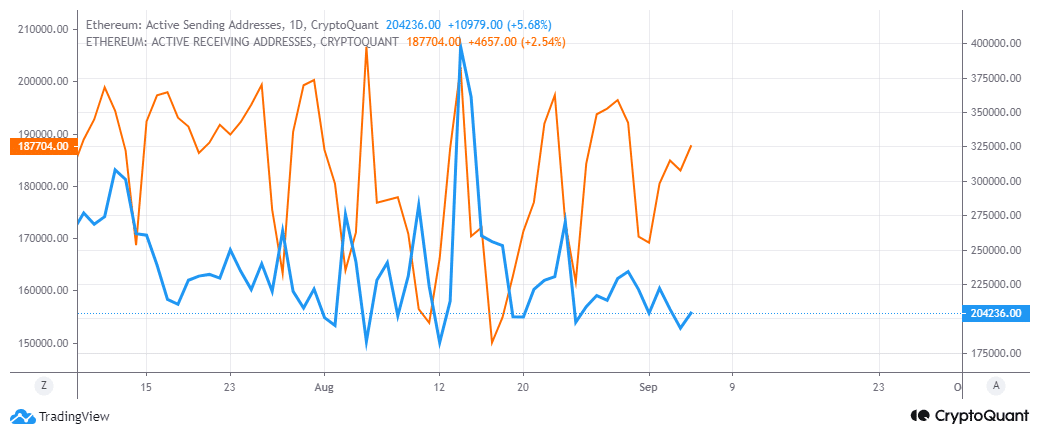

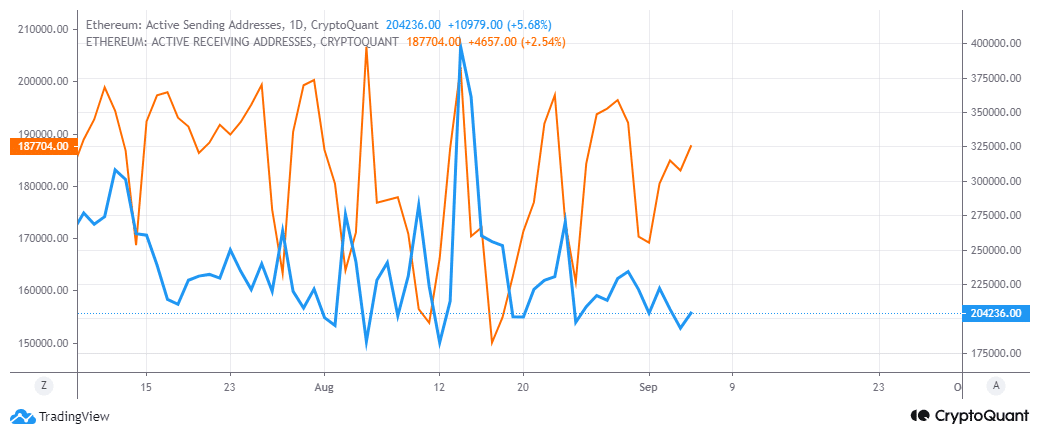

Based on Ethereum deal with information, ETH addresses have seen extra outflows than inflows. On the time of writing, there have been 204,000 lively transport addresses, in comparison with nearly 188,000 receiving addresses.

Supply: CryptoQuant

However, the information on lively addresses additionally revealed one other attention-grabbing commentary.

Over the previous two weeks, lively receiving addresses have elevated, whereas lively transport addresses have decreased. This commentary may point out a shift within the dynamics of provide and demand. Furthermore, this might be as a result of prevailing worth degree of ETH.

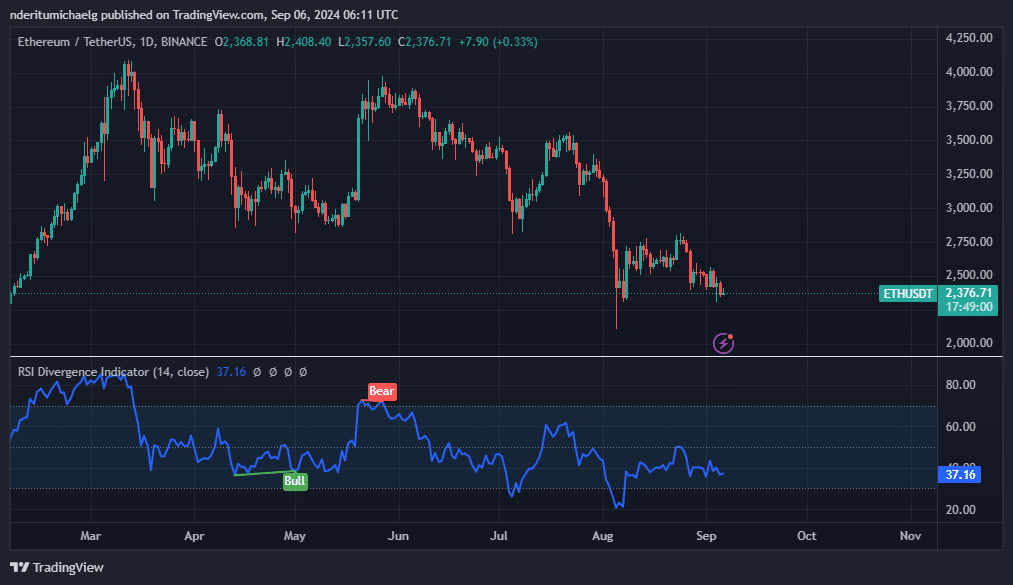

ETH’s newest draw back pushed the worth to a notable help degree close to the $2,333 worth vary. This might be an indication of accelerating expectations of a pivot across the similar worth vary. Particularly now that the Bears are winding down their offense.

Supply: TradingView

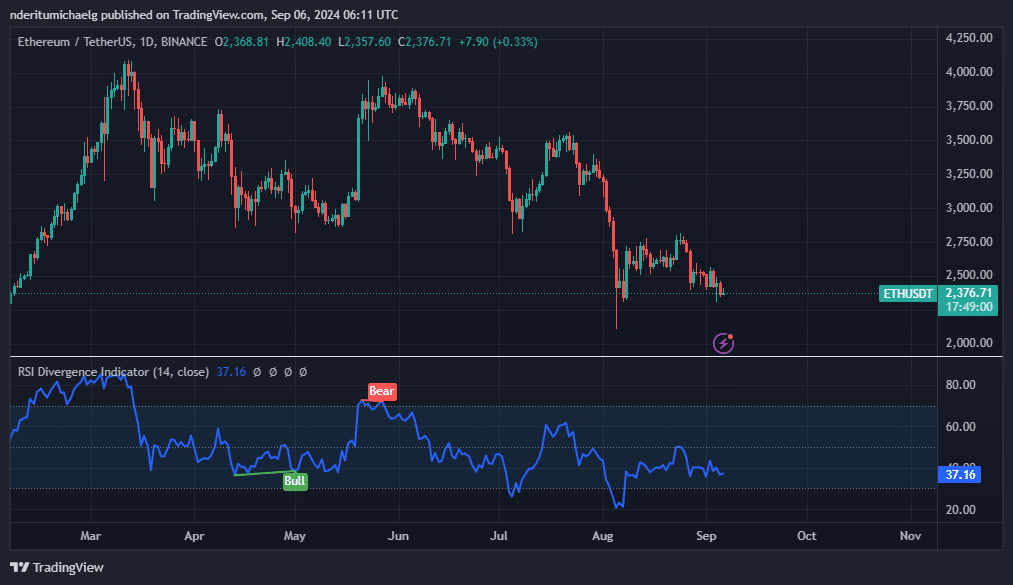

Regardless of these observations, nevertheless, the 1-day chart indicated that the bulls have but to return out swinging.

Furthermore, the RSI indicated that the general pattern will stay in favor of the bears, with room for extra potential downsides. Presumably in direction of the bottom worth degree of August.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024