Bitcoin

Bloomberg Analyst Predicts Massive but Historically ‘Normal’ Market Crashes for Bitcoin, Oil and Stock Market

Credit : dailyhodl.com

Bloomberg Commodity strategist Mike McGlone says that there’s a probability of an enormous correction in American markets that may pummel the value of Bitcoin (BTC), oil and shares.

In a message on the social media platform X, McGlone says that the US has a “self -correcting mechanism” that may return to President Trump’s tariff warfare, which may create market chaos.

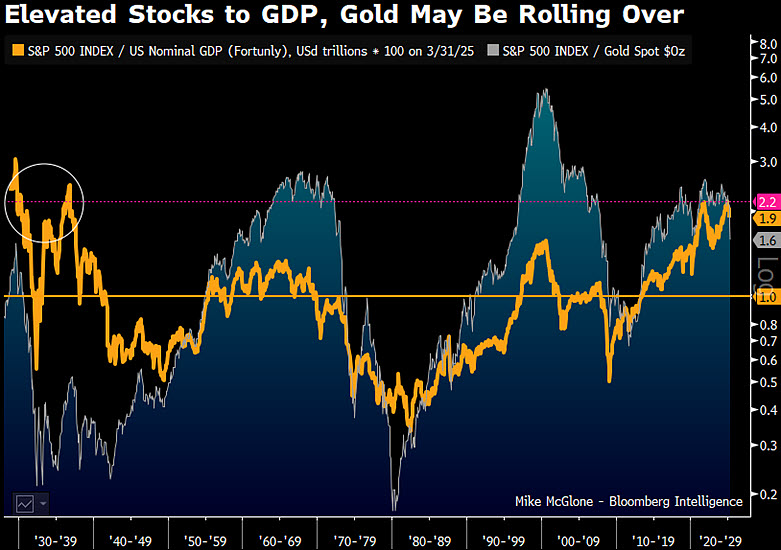

The analyst shares a graph that implies that the S&P 500 versus BBP -Ratio and the S&P 500 versus Goud -Ratio are each at raised ranges -an set -up that traditionally marked inventory market crashes, resembling within the Thirties, late nineties and 2008.

In keeping with McGlone, such an occasion, or “reversal” can result in a big fall within the shares, bitcoin oil, purchaser and bonds.

“The American self -correcting mechanism can’t be stopped. If unprecedented charges and cuts don’t work, pushback will likely be within the subsequent elections. If the foremost try of re -balanced, it may reset world order for the approaching century.

The issue is that the discombobulation comes with the American inventory market capitalization versus GDP and the remainder of the world, the very best in about 100 years.

My regular reversing base case:

– 50% drawing on the US inventory market

– $ 40 per barrel of crude oil

– $ 3 per pound copper

-3% US 10-year yield

– $ 10,000 bitcoin, 90% drawings in most thousands and thousands of cryptocurrencies

– $ 4,000 gold, the out of a bit due to no easy reversal “

Whereas McGlone’s predicted, Drawdowns appear critical, the analyst appears out That the scale of the potential subsequent to the subsequent actions is “regular” primarily based on historic phrases.

On the time of writing, Bitcoin acts for $ 87,529.

Observe us on X” Facebook And Telegram

Do not miss a beat – Subscribe to get e -mail notifications on to your inbox

Examine value promotion

Surf the Day by day Hodl -Combine

Generated picture: midjourney

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024