Ethereum

Here’s what Ethereum’s 70% orderbook imbalance means for traders

Credit : ambcrypto.com

- On the time of writing, ETH’s order guide imbalance was 70%

- Ethereum might doubtlessly attain new highs on the charts

Ethereums [ETH] Value motion has been a sizzling subject after Bitcoin failed to achieve a brand new all-time excessive (ATH) in 2024. That is regardless of Bitcoin hitting its personal ATH in March.

As anticipated, this has led to considerations that ETH could also be dropping momentum. Nonetheless, latest developments within the ETH/USDT pair supply hope for Ethereum fanatics.

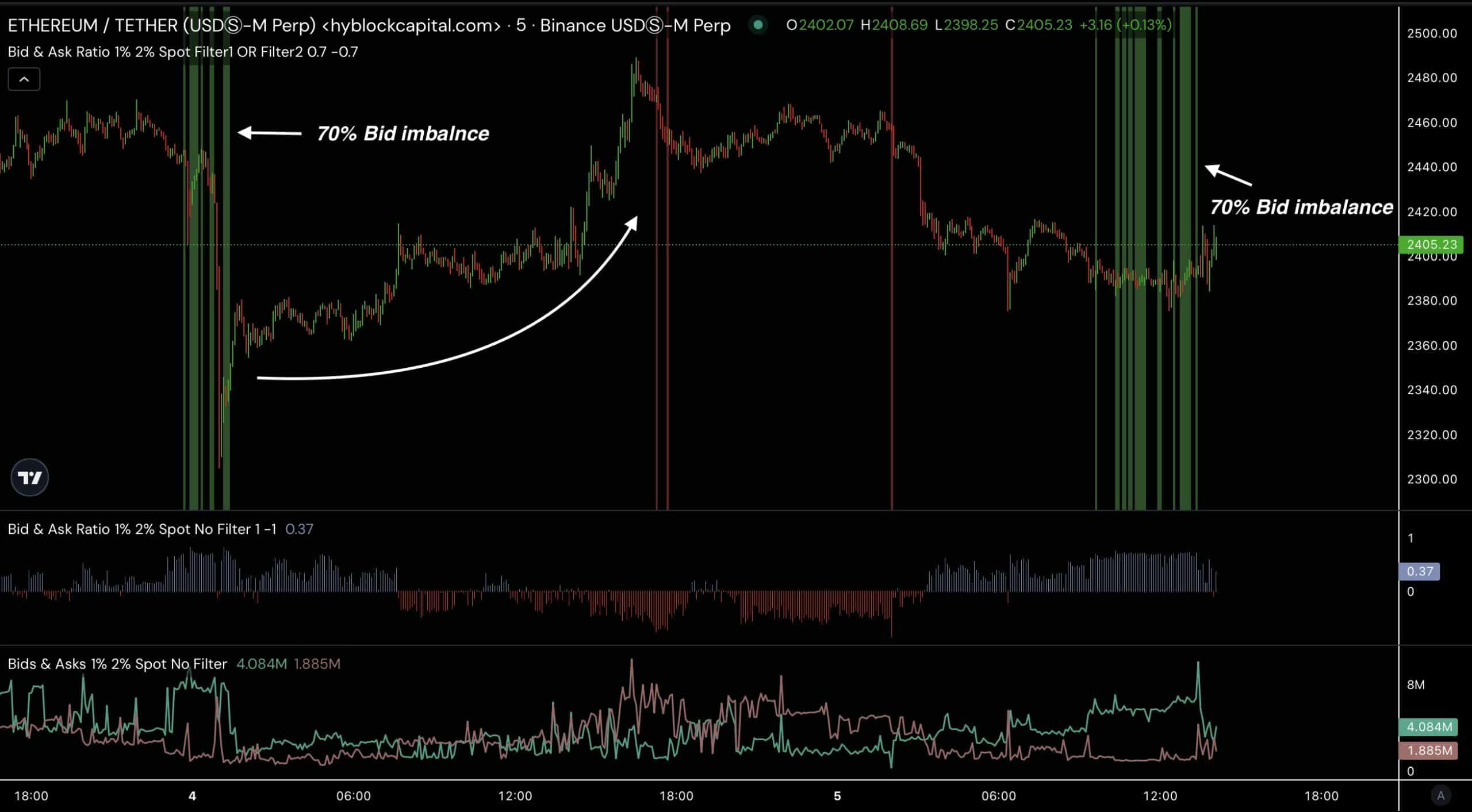

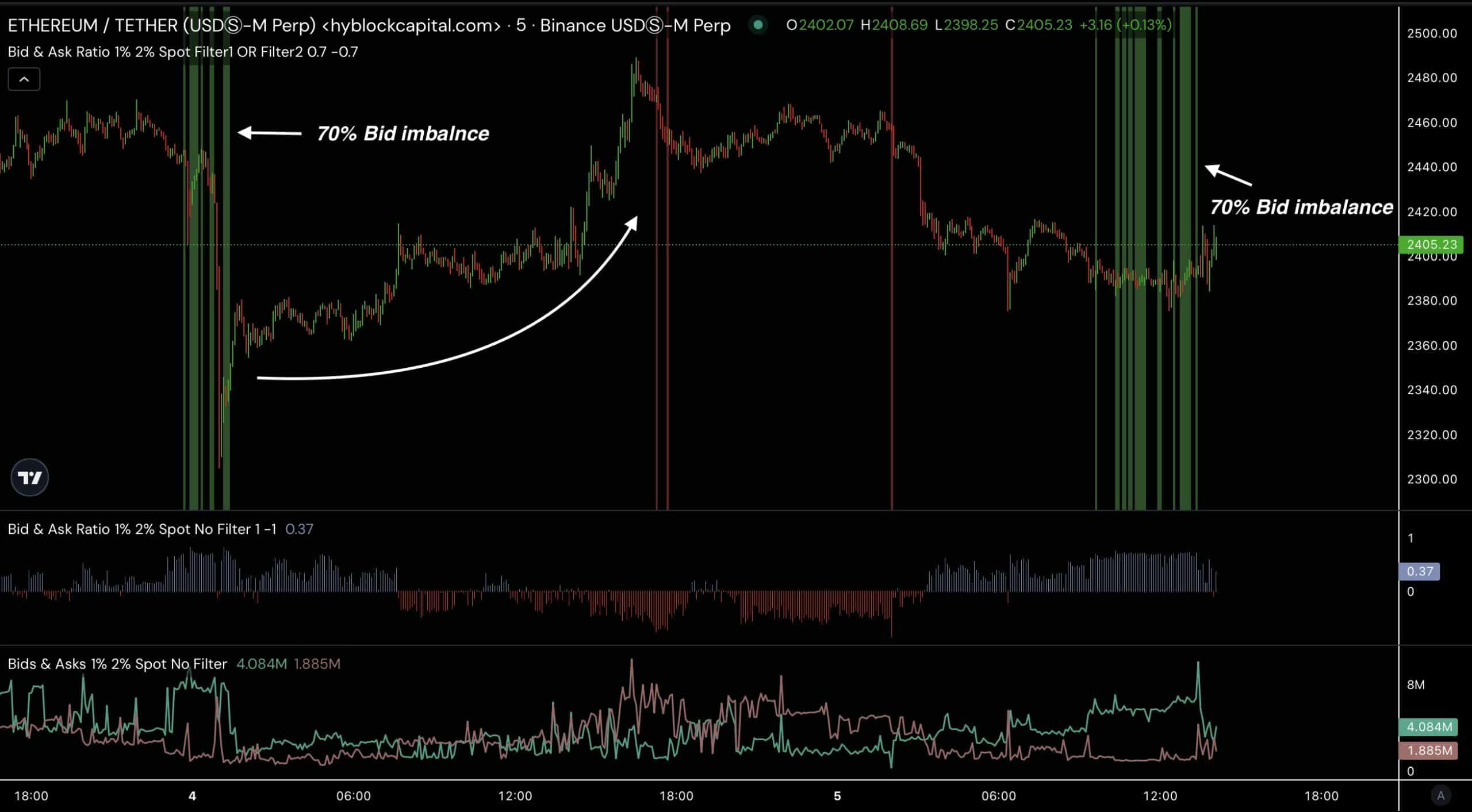

In reality, knowledge from Hyblock Capital revealed a big order guide imbalance of 70% for ETH at a depth of 1-2%. Traditionally, when ETH experiences the same 70% imbalance amongst bids, the worth marks a low and begins to rise.

The present bid imbalance implies that ETH might see a repeat of this upward worth pattern.

Supply: Hyblock Capital

Ethereum in an ascending triangle

Ethereum, on the time of writing, fashioned an ascending triangle on the weekly timeframe, with the worth respecting the 200 shifting common.

This consolidation sample helps a bullish case for ETH, as ascending triangles sometimes result in worth breakouts.

The 70% bid imbalance additional strengthens the potential for an upward transfer within the charts.

Supply: TradingView

Consolidation phases normally precede vital worth actions. On this case, a breakout might take ETH to a a lot increased stage.

Weekly RSI heatmap

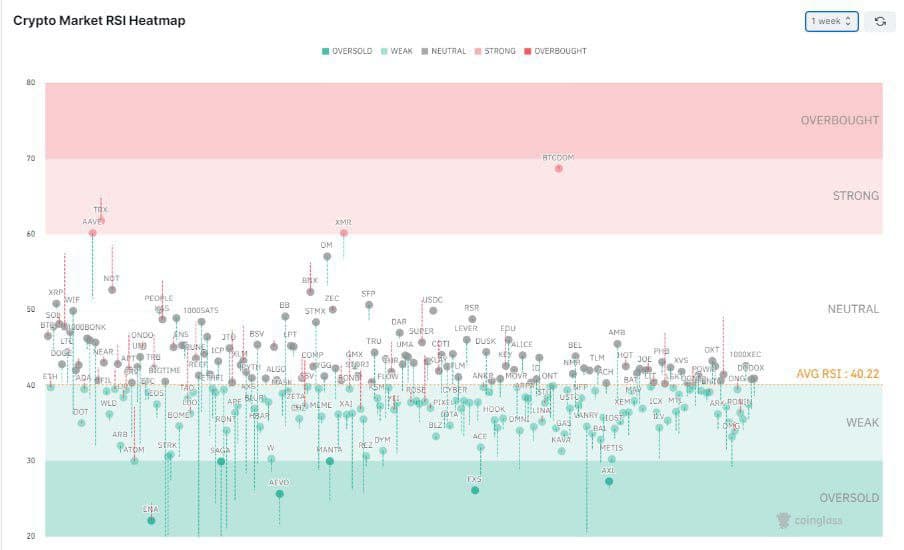

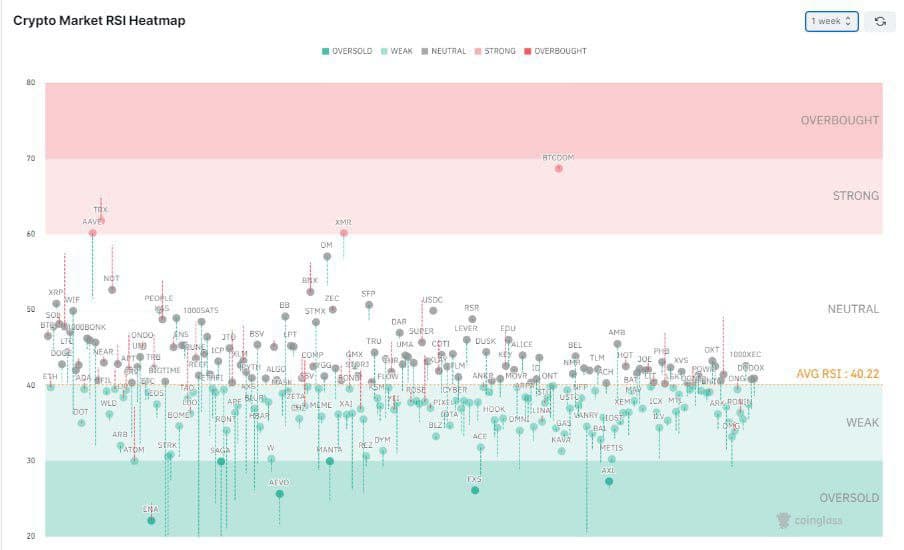

The weekly Relative Power Index (RSI) heatmap indicated that many cryptocurrencies have been within the weak or impartial zone on the time of writing, with a mean RSI of 40.22%.

Because of this the market is at the moment transitioning from an oversold scenario.

Supply: Coinglass

Because the RSI approaches extra impartial ranges, it might point out potential upside for ETH. Particularly for the reason that 70% bid imbalance signifies a doable backside. This might be in step with expectations of a worth improve within the charts.

ETH-based protocols are rising…

Vitalik Buterin, co-founder of Ethereum, just lately introduced his intention to donate his Layer 2 (L2) and venture tokens to help public items throughout the ETH ecosystem and charities.

This transfer additionally strengthens Ethereum’s long-term prospects.

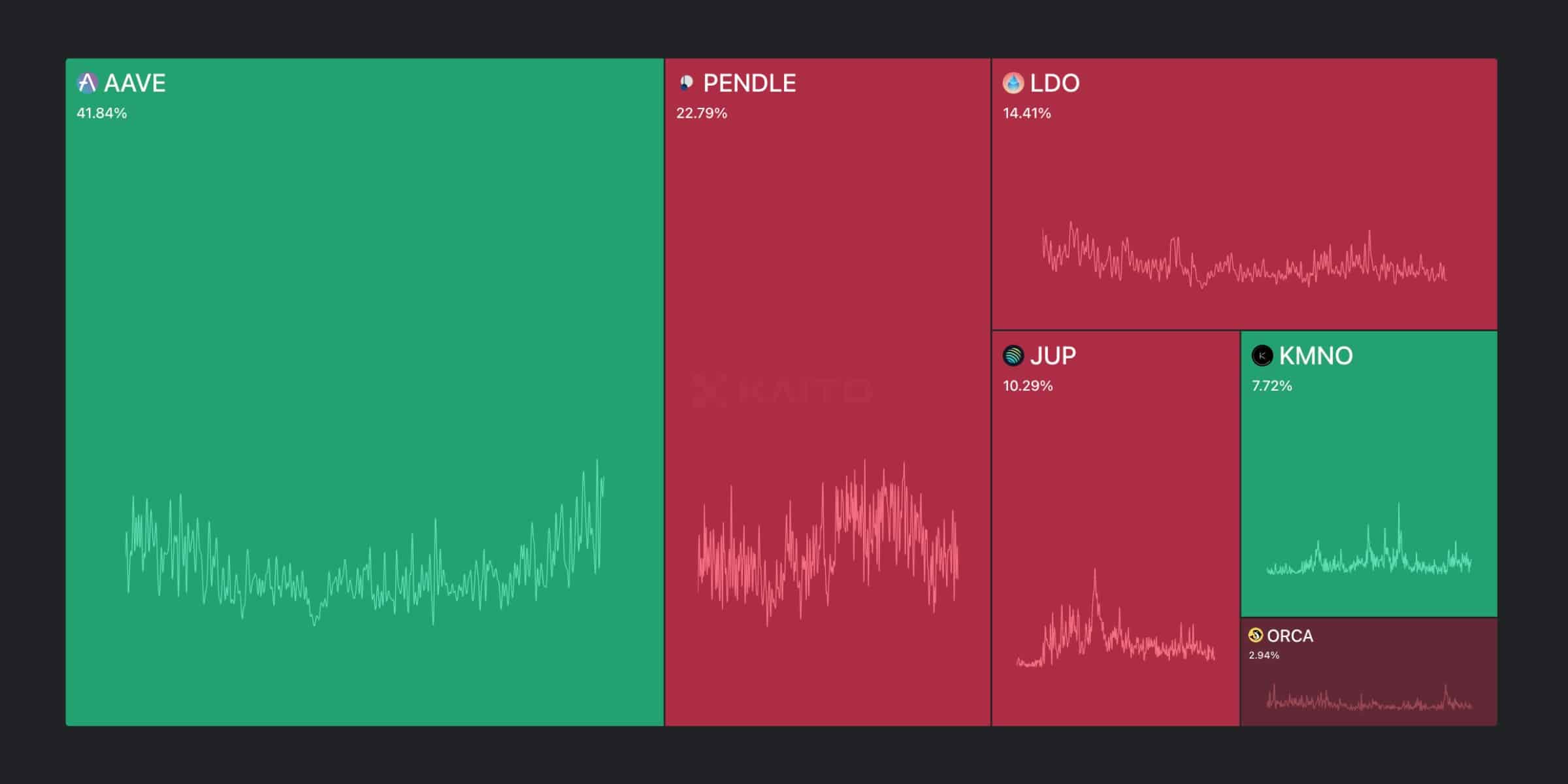

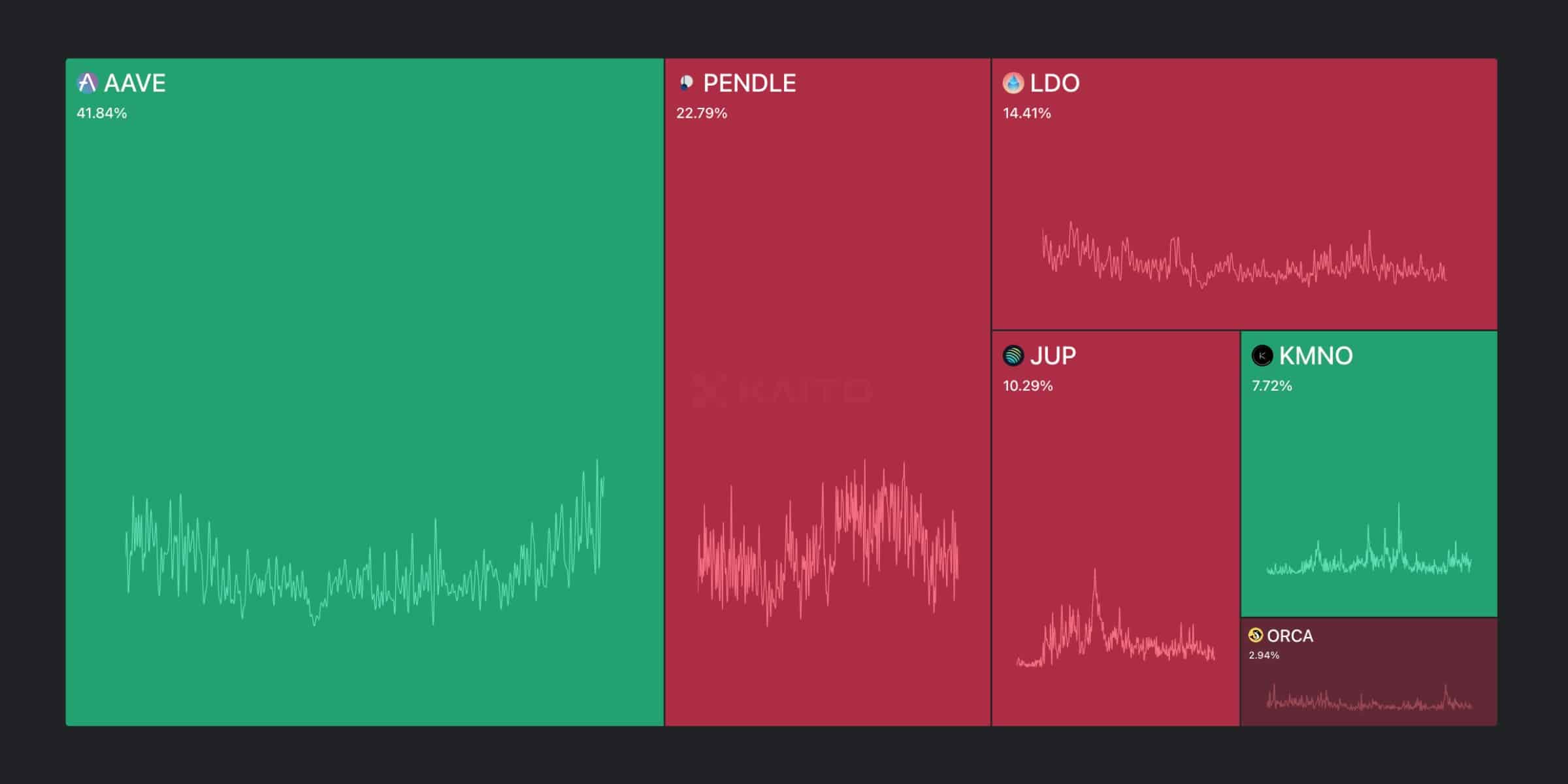

Moreover, whereas some merchants ponder whether Solana might make headway within the decentralized finance (DeFi) sector, Ethereum stays dominant. In reality, analysts at Kaito AI have confirmed that Ethereum nonetheless holds a majority stake in DeFi.

Supply: KaitoAI

Aave, one of many largest DeFi platforms, runs on ETH, together with different main protocols equivalent to Pendle and Lido. These platforms are prone to drive additional adoption of ETH and help its rising worth.

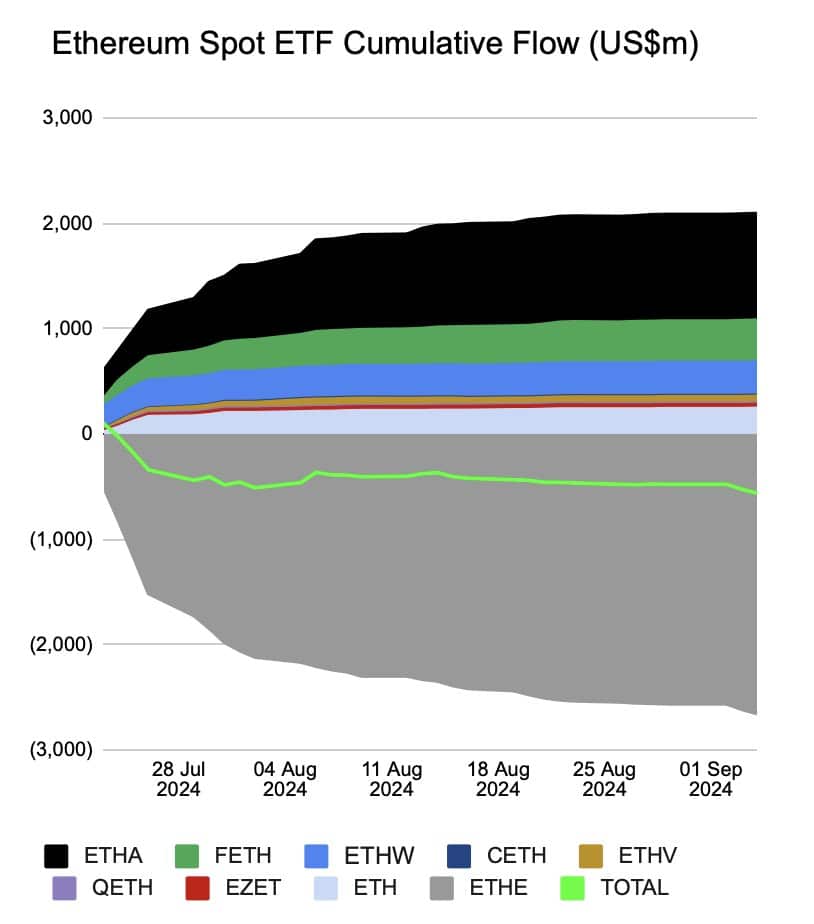

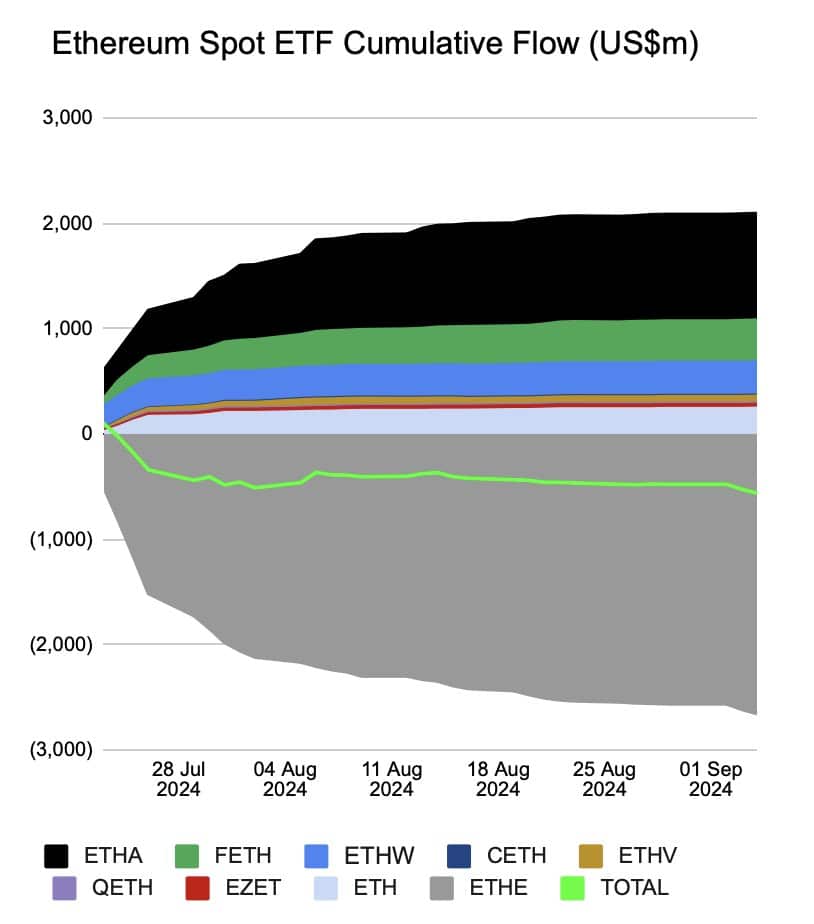

Ethereum ETF cumulative flows

There’s one concern, nevertheless: cumulative flows for Ethereum-based ETFs have reached an all-time low. Web flows in ETH ETFs are at the moment damaging, price $562.3 million.

Whereas the existence of an ETF is a constructive for Ethereum, the shortage of demand poses a threat.

Supply:

If demand doesn’t improve, some ETF issuers could also be compelled to shut their merchandise.

However, as a result of ongoing developments within the Ethereum ecosystem, a worth turnaround might be within the offing.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now