Altcoin

Ethereum vs Bitcoin – Explanation of the 44% Underperformance

Credit : ambcrypto.com

- ETH and BTC gave the impression to be at oversold ranges on the charts

- Bitcoin has made extra features than ETH over the previous two years

Bitcoin (BTC) and Ethereum (ETH) stay the most important cryptocurrency belongings by market capitalization. Nevertheless, ETH has underperformed BTC over the previous two years, regardless of each belongings experiencing important worth fluctuations.

Though each BTC and ETH just lately noticed the adoption of Spot Alternate Traded Funds (ETFs), this improvement was not sufficient to reverse the altcoin’s relative underperformance.

Ethereum is sliding towards Bitcoin

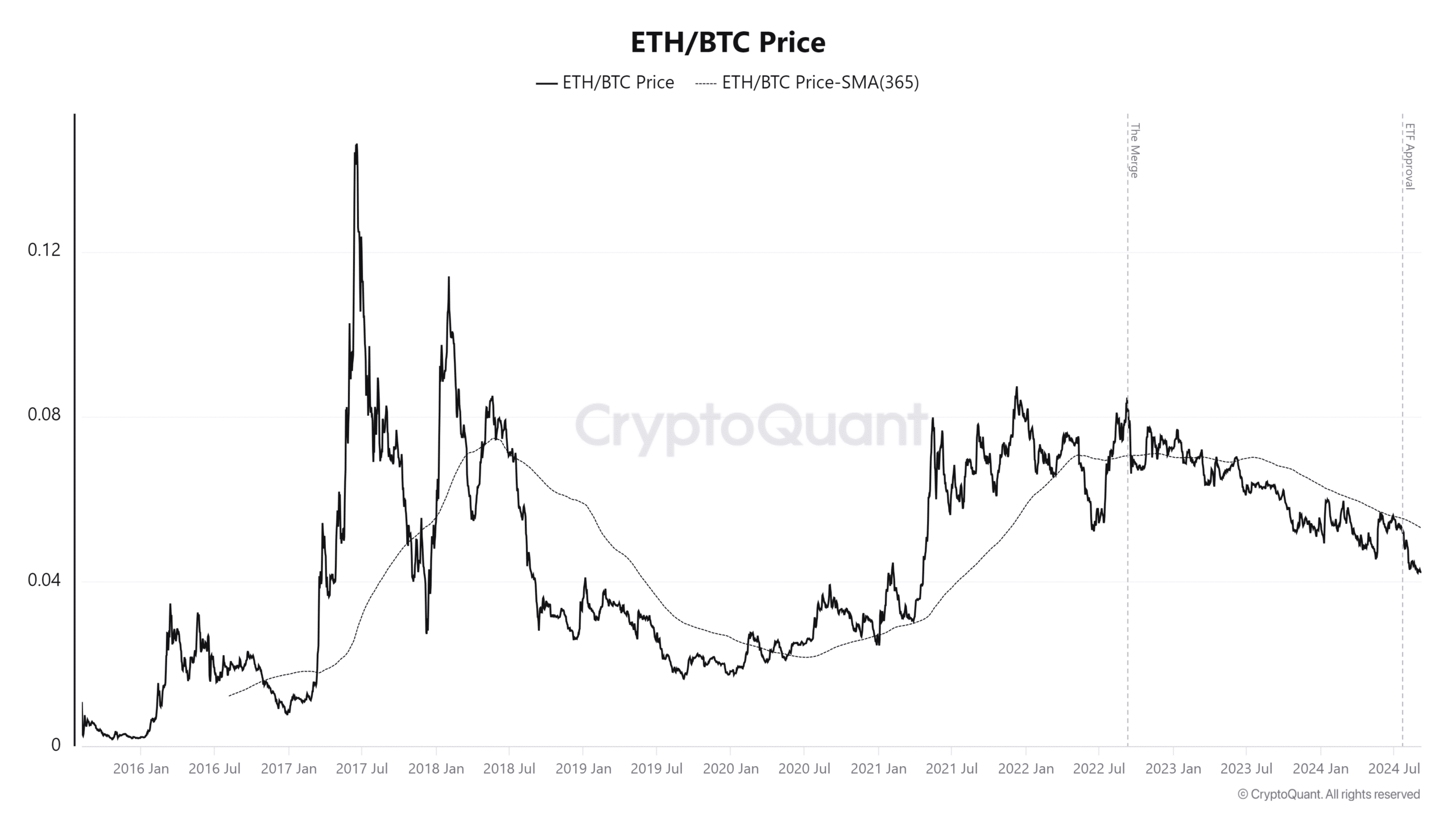

In accordance with knowledge from CryptoQuantEthereum has underperformed Bitcoin by 44% over the previous two years. The evaluation indicated that ETH’s decline towards BTC started after The Merge, which modified Ethereum from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism.

Since then, Ethereum has struggled to maintain up with Bitcoin.

Supply: CryptoQuant

The ETH/BTC worth stood at 0.0425 on the time of writing, marking the bottom degree since April 2021.

Regardless of the constructive information concerning the approval of Spot ETFs for each belongings in 2024 – Ethereum’s ETF is because of be accredited in July – the approval has carried out little to reverse ETH’s lack of efficiency towards BTC.

Some causes for the disparity between Ethereum and Bitcoin

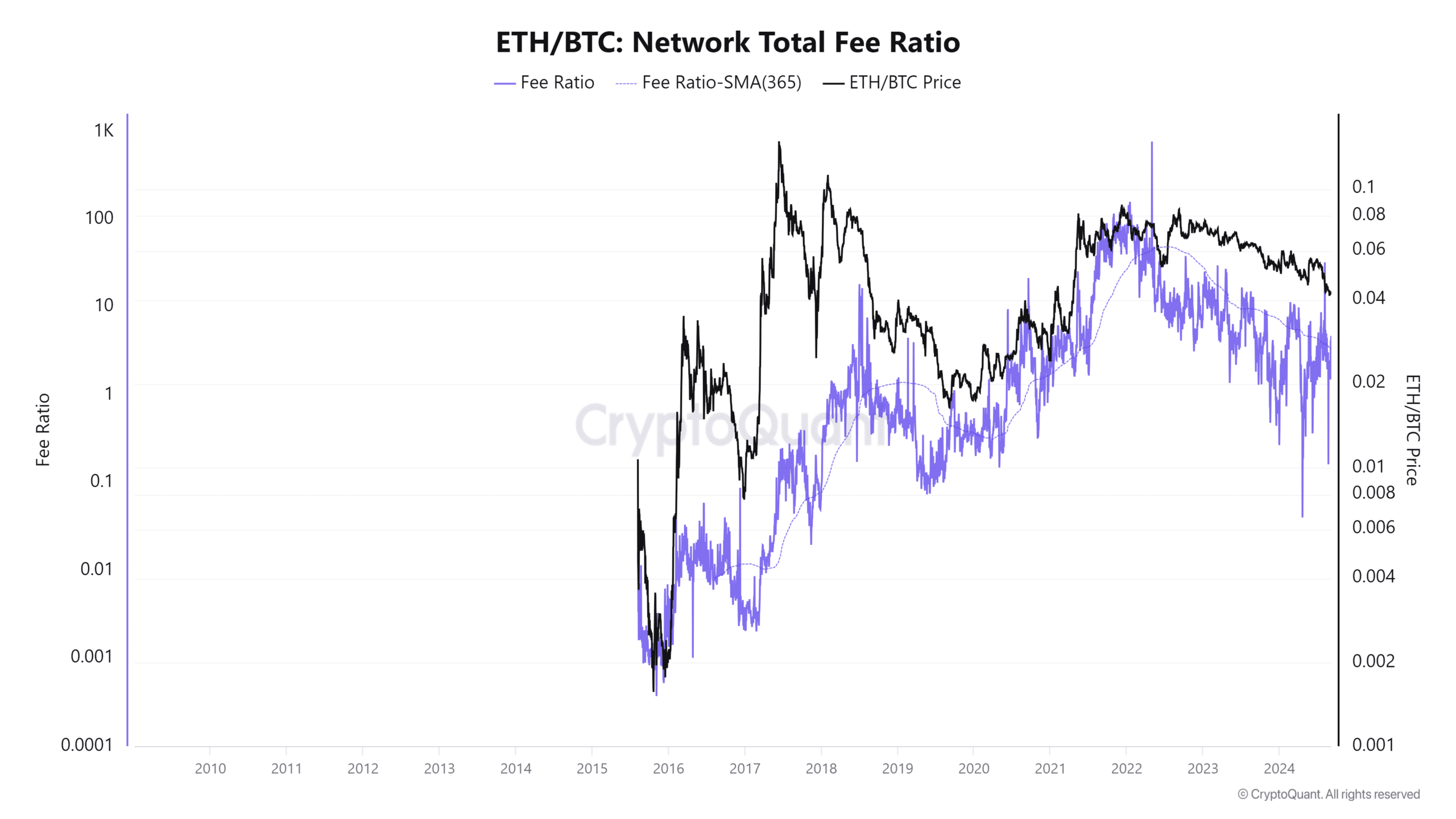

Ethereum and Bitcoin have seen contrasting developments in community charges and transaction exercise in current months.

In actual fact, knowledge exhibits that Ethereum prices dropped after the Dencun improve, which contributed to the decreased community exercise. Moreover, the relative variety of transactions in Ethereum has fallen considerably, from a peak of 27 transactions per second in June 2021 to simply 11 – one of many lowest ranges since July 2020.

Supply: CryptoQuant

Quite the opposite, Bitcoin has seen a spike in each charges and transactions in current months. That is primarily because of the introduction of inscriptions (associated to Bitcoin Ordinals) and Runes. These developments have elevated the demand for block area, which has contributed to the rise in transaction charges on the Bitcoin community.

The drop in Ethereum charges has additionally affected the burn price, linked to the EIP-1559 mechanism. With decrease charges, much less ETH is burned, decreasing deflationary strain on the community and making Ethereum extra inflationary.

This shift contrasts with earlier intervals the place excessive community charges led to the next burn price, inflicting total ETH provide to say no.

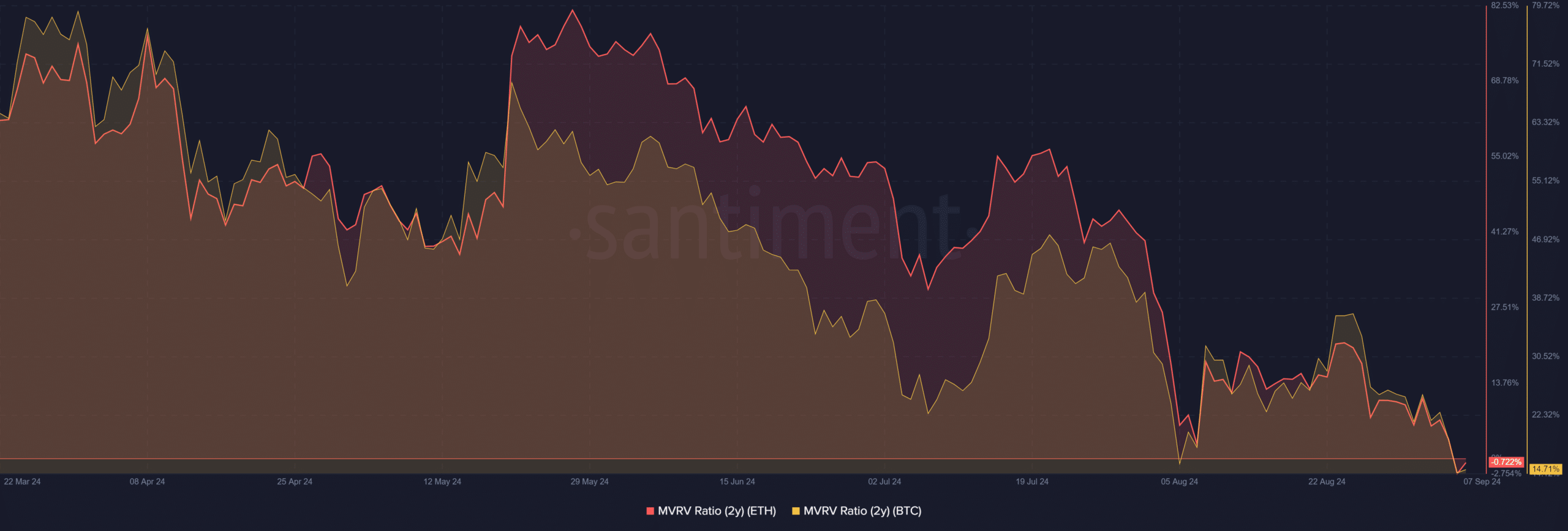

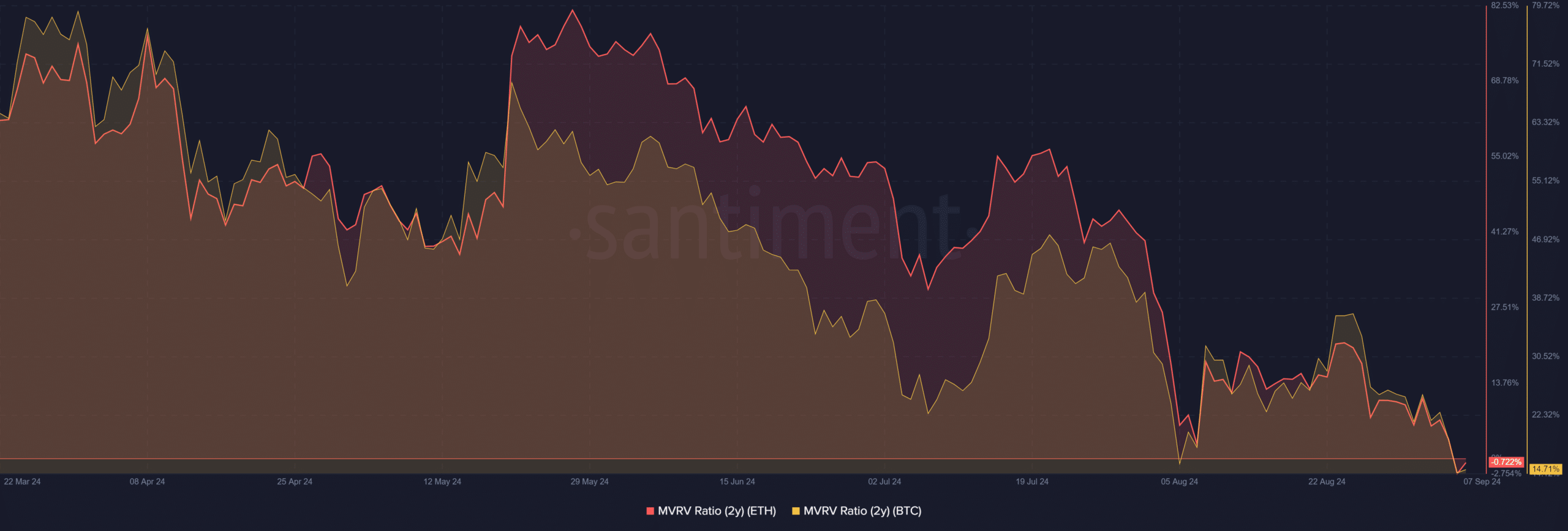

Evaluation of the two-year ETH/BTC MVRV

Lastly, an evaluation of the two-year market worth to realized worth (MVRV) ratio for Ethereum and Bitcoin has highlighted the rising disparity between the 2 belongings.

On the time of writing, Ethereum’s MVRV was barely beneath zero at -1.16%, whereas Bitcoin’s MVRV was considerably larger at over 14%.

Supply: Santiment

– Reasonable or not, right here is the ETH market cap by way of BTC

This disparity in MVRV ratios illustrates how a lot ETH has underperformed in comparison with BTC.

Right here, the MVRV ratio measures holders’ achieve or loss based mostly on the distinction between the present market worth and the realized worth of an asset. On this case, BTC holders are sitting on a achieve of over 14%, whereas ETH holders are seeing a lack of over 1%.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024