Analysis

Will BTC Price Hold or Face Selling Pressure?

Credit : coinpedia.org

The value of Bitcoin retains sturdy above the essential $ 100,000 mark, as a result of holders hold shopping for when the worth drops. The latest return has led to analysts and merchants predicting varied future value targets based mostly on their analysis and opinions. Though Bitcoin dangers a sale of the elevate, some essential on-chain statistics rise, which helps this steady restoration.

Greater than 97% holders turned worthwhile

The rise in Bitcoin past $ 100,000 has shifted the market sentiment in a big method, helped by facilitating tensions within the commerce scenario within the US-China. As the worth broke this key degree, many merchants betting in opposition to Bitcoin took heavy losses. In line with Coinglass, about $ 279 million had been liquidated by Bitcoin positions within the final 24 hours. Of those, $ 243.3 million liquidation got here from sellers and $ 35.7 million from patrons.

Whereas the open rate of interest dropped 3.2% to $ 67.1 billion, the commerce quantity continued to rise, displaying the present market exercise.

Additionally learn: Too late to purchase Bitcoin? Samson Mow offers Bull Run warning as the worth breaks $ 103k

Bitcoin’s $ 100k breakout additionally noticed significantly institutional significance. Spot Bitcoin ETFs noticed $ 142.3 million in web entry, which confirmed a powerful institutional curiosity, in line with Farshep traders. Ark’s ETF led by $ 54 million, adopted by Constancy with $ 39 million and BlackRock with $ 37 million. BlackRock additionally purchased greater than 86 BTC value $ 8.4 million in a single transaction.

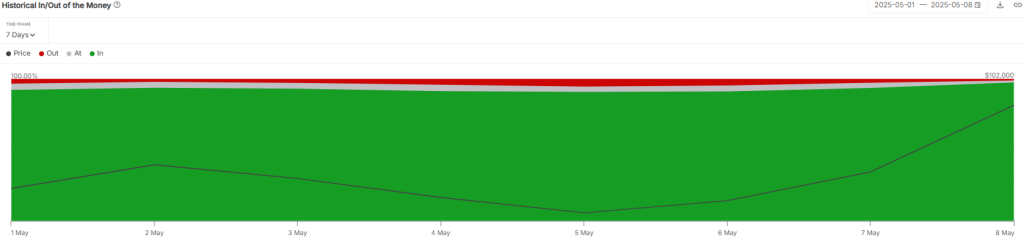

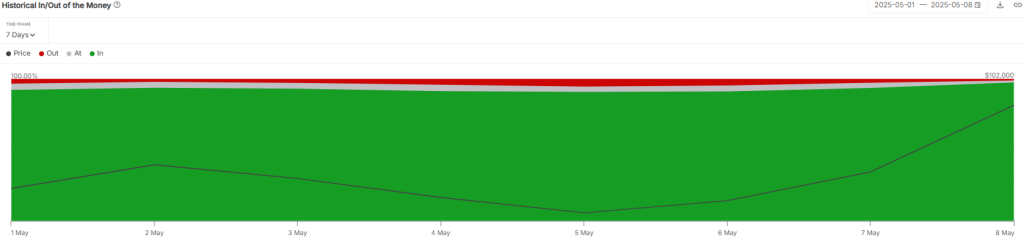

Knowledge from Intotheblock exhibits that greater than 97% of Bitcoin holders are actually in win after BTC has risen past $ 100k. Though this can be a constructive signal for lengthy -term traders, it will probably additionally result in gross sales strain within the brief time period, as a result of extra holders can determine to money in on their revenue.

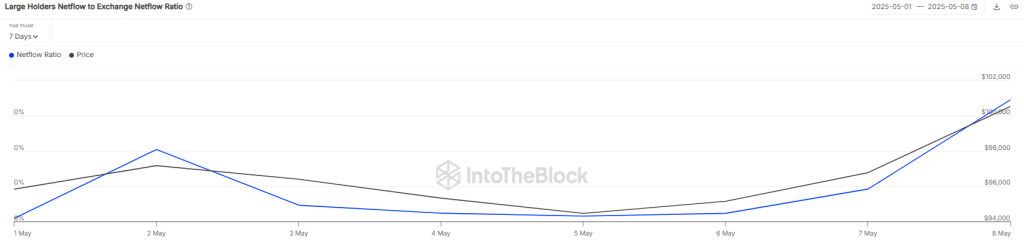

On the similar time, whales contribute to the volatility of the market. The quantity of main transactions has risen sharply and climbs from $ 68.45 billion to $ 72.67 billion, indicating an elevated exercise amongst main gamers.

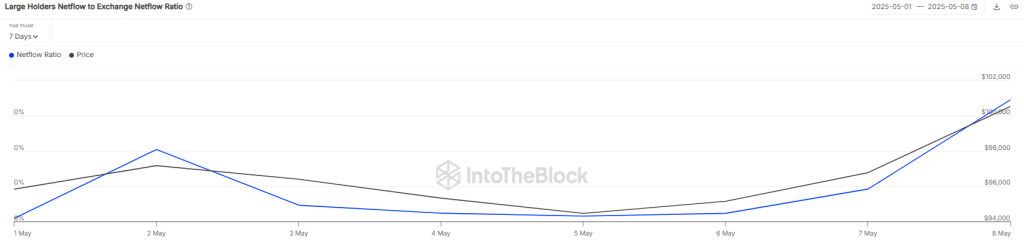

Extra particularly, the massive holder -netflow -ratio ratio has risen to 0.17%, which implies that these massive traders transfer extra Bitcoin to inventory exchanges. One of these habits usually implies that whales put together themselves to promote because the BTC value will increase, which may result in the worth lower within the brief time period or market fluctuations similar to promoting quantity peaks.

What’s the subsequent step for BTC value?

Bitcoin aggressively maintains the acquisition demand over EMA20 Development Line, which exhibits that merchants are nonetheless assured and are prepared to purchase when the worth drops. Nevertheless, sellers have yielded a small resistance at $ 104,360. From writing, BTC value acts at $ 102,483 and will increase greater than 1.13percentwithin the final 24 hours.

There’s a small resistance round $ 104k, but when Bitcoin breaks it by way of, it may be on its strategy to crucial degree of $ 109,500. This can be a main psychological barrier, and sellers will in all probability make an effort to stop the worth from going increased. If Bitcoin succeeds in pushing previous $ 110k, this will make a brand new ATH.

Nevertheless, bears now not have time. To get the examine again, they have to push the worth beneath the progressive common of 20 days and hold it there. If that occurs, Bitcoin can proceed to fall to round $ 93,500, close to the 50-day advancing common.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024