Ethereum

Ethereum stakers are back in profit! – Will this fuel ETH’s rally?

Credit : ambcrypto.com

- Studest ETH turned worthwhile for the primary time since March and stimulated the belief of validator and sentiment.

- The Bullish Momentum of Ethereum reinforces $ 2,550 breakout, however indicators of overboughteconditions are rising.

Ethereum’s [ETH] Again within the inexperienced – and so is Validator sentiment. For the primary time since March, STUSTED ETH has un realized earnings, a comeback in confidence within the chain.

However this isn’t only a blip on the charts; It may be the early begin of a wider shift within the worth of the worth of Ethereum.

As a result of the L2 -scaling stimuli and software migration dangers community displays community, the financial foundation of the community might be about to be about one thing enormous.

ETH return on revenue

A current Cryptoquant report has revealed that Ethereum strikers are again within the inexperienced after greater than two months of non -realized losses.

Since March, Stusted ETH was beneath water, with the realized value that was above the market ranges. Nevertheless, on Might 9, ETH crossed the $ 2297 and surpassed the realized value of – strikers turning again in revenue space.

This restoration reinforces Ethereum’s community stability by reassuring validators and utilizing members. Because the revenue returns to strikers, it may be an indication of a bigger bullish shift over the Ethereum ecosystem.

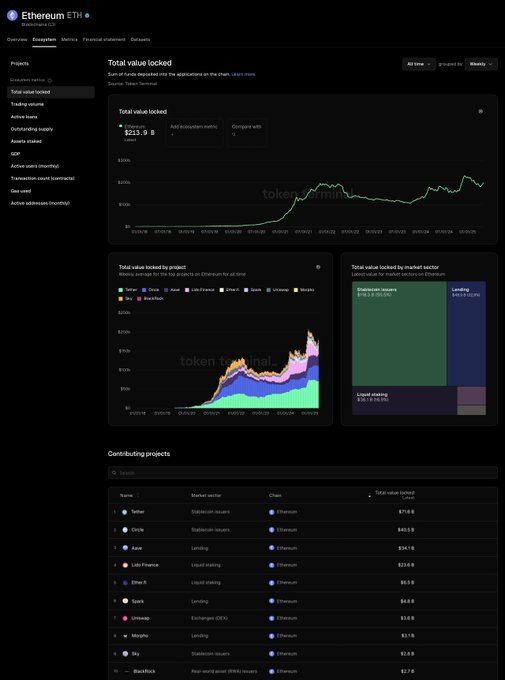

Ethereum as the biggest financial system within the chain

Ethereum stays dominate As the biggest financial system within the chain, with greater than $ 213.9 billion in TVL on loans, dedication and different sectors.

This expansive exercise reveals the unparalleled developer base and Defi infrastructure of Ethereum and attracts the best quantity of app implementation and use.

Supply: X

Nevertheless, the dominance is just not with out threat.

Stimulas linked to scalability and app success create an actual risk of app migration -especially for competing chains.

The brand new management of Ethereum has acknowledged this diploma dangers and reportedly work on methods that guarantee worth retention as apps evolve and increase.

Worth momentum builds

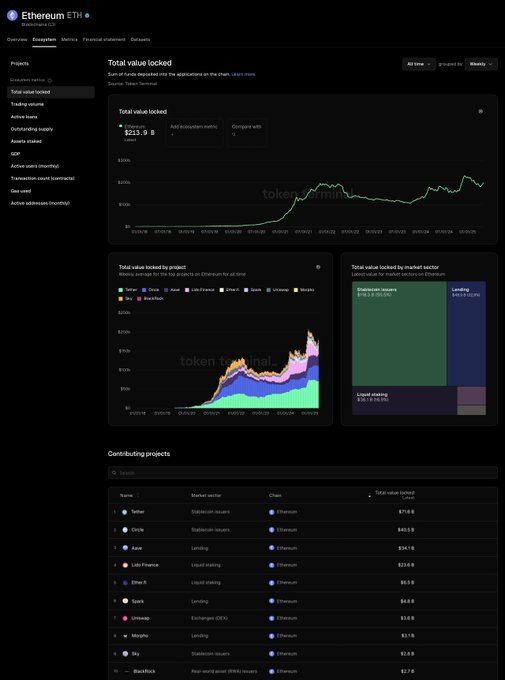

The current ETH breakout pushed it above $ 2,550 on the time of the press, which marked a robust bullish continuation.

Technicals supported the rally – the RSI was 80.58, which signifies a robust momentum, however maybe the energetic overbought territory enters.

Within the meantime, the MACD confirmed a rising hole between the MacD and sign traces, a bullish sign that displays an elevated buying stress.

Supply: TradingView

With volume-retaining steady and sentiment that optimistic revenue restoration after the inventory, the worth of Ethereum can check increased resistances. Nevertheless, overtargence can result in brief consolidation earlier than the subsequent leg up.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now