Altcoin

Ethereum: What you need to know about the 10-year low exchange stock of ETH

Credit : ambcrypto.com

- Ethereum -Trade facility decreased to 4.9% as accumulation and exercise.

- MVRV Rebounds and open curiosity rise, to help Bullish Breakout -potential.

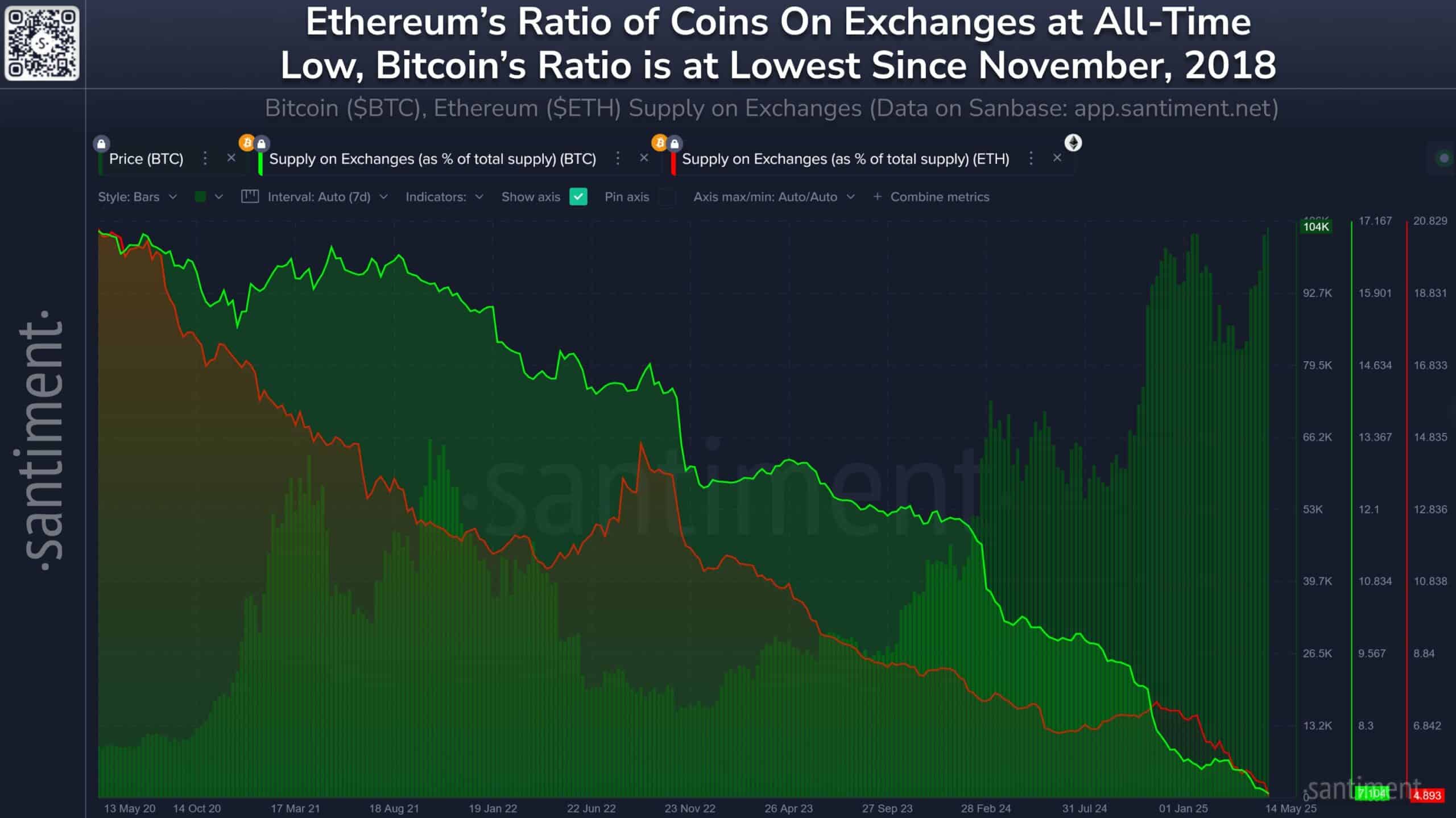

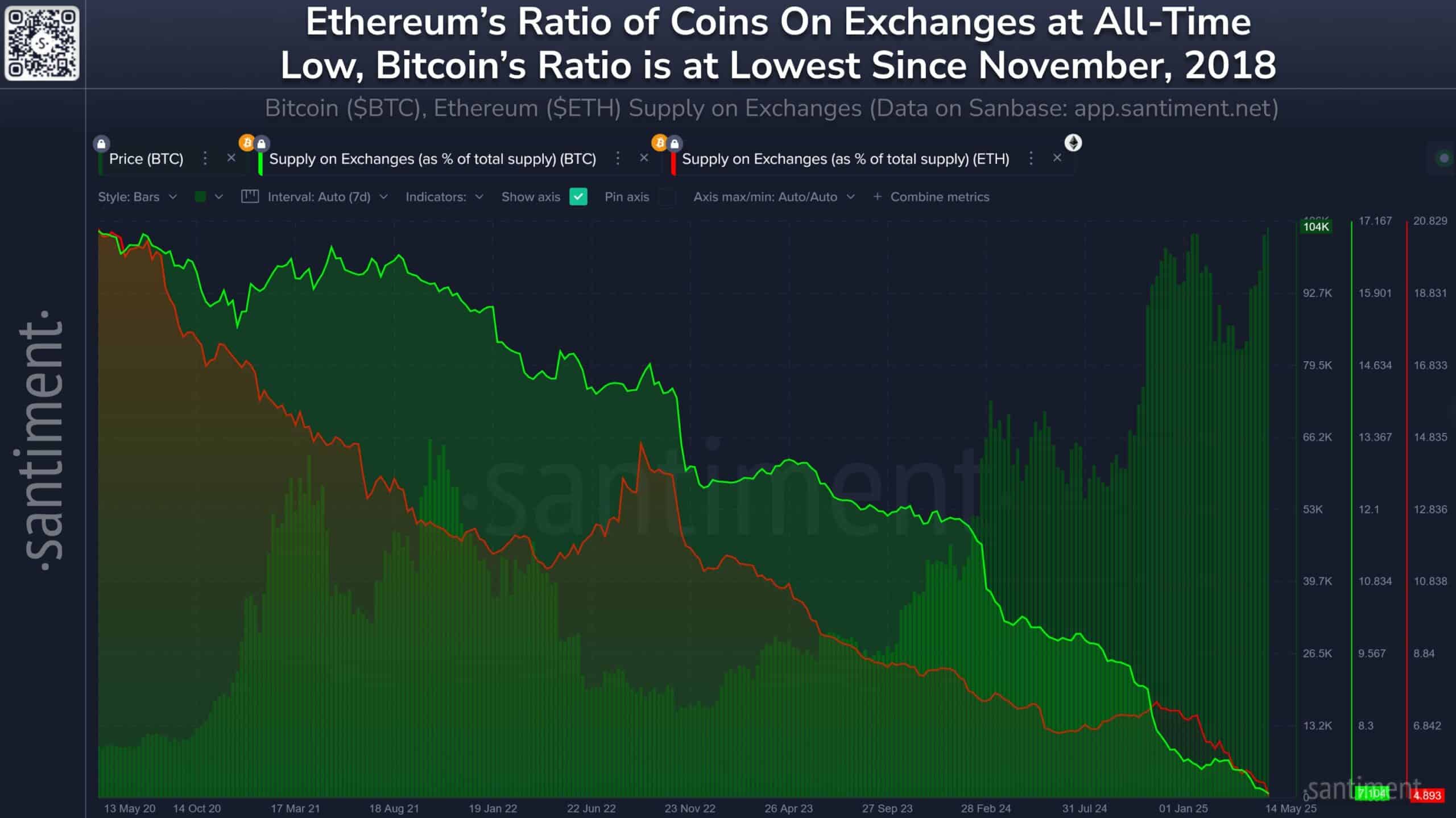

Ethereum’s [ETH] The vary on exchanges has fallen to 4.9%, the bottom degree in additional than ten years, whereas greater than 15.3 million ETH has left centralized platforms since 2020.

This sharp decline displays a powerful lengthy -term accumulation and decreased gross sales stress decreased throughout the board.

As well as, open curiosity (OI) has elevated 11.31% to 16.59 billion, suggesting that an elevated positioning of derivatives merchants.

On the time of writing, Ethereum traded at $ 2,537.15, a rise of 5.37% within the final 24 hours, with rising statistics in each retail and institutional segments that point out renewed market optimism.

Supply: Santiment

ETH’s consumer exercise and whale -distressions ignite new networking momentum

The community exercise of Ethereum particularly picked up, as is obvious from a weekly enhance of 6.09% in energetic addresses.

New addresses have additionally risen by 28.43% in the identical interval, which is able to enter right into a rising variety of contributors within the community. This peak usually displays a rise within the curiosity of retail customers or the onboarding of contemporary capital.

Traditionally, a rise in each energetic and new addresses tends to prior worth extensions, particularly together with decreased alternating abilities.

Supply: Intotheblock

Ethereum’s transaction The amount is significantly intensive over all ranges, with essentially the most putting development that’s seen in bigger transfers. Transactions within the vary of $ 1 million – $ 10 million have risen by 204.68%, whereas these of greater than $ 10 million rose by 240.63%.

This whale exercise normally displays institutional or excessive -grown investor’s pursuits. On the similar time, even decrease brackets similar to $ 1-$ 10 and $ 100- $ 1k of development of 40% and 33% respectively.

Ethereum: These statistics reinforce bullish conviction

Along with growing transaction quantity and energetic customers, the OI of Ethereum has grown by 11.31percentand reached as much as 16.59 billion.

This metric follows the whole worth of open lengthy and quick positions on inventory exchanges, and a constant enhance suggests a rising speculative involvement.

This enhance is especially in keeping with the current worth rebound of Ethereum and powerful Fundamentals on the chain. Nonetheless, rising OI additionally signifies increased volatility forward, particularly if the worth approaches the resistance ranges.

Supply: Cryptuquant

The MVRV ratio of Ethereum has been again to 27.19% after spending a adverse space for just a few weeks.

This metric compares the market worth with the realized worth of hero ETH and helps decide whether or not holders are in revenue. A reasonably constructive MVRV usually suggests a wholesome market with a minimal danger of taking mass win.

Technical evaluation reveals a falling try at channel outbreak

Ethereum lately tried an outbreak of his falling channel sample and bounced the extent of $ 2,314 bounced off.

The worth is now confronted with resistance at $ 2,571 and $ 2,622, akin to the 0.5 and 0.618 FIB retracement ranges. An outbreak above these zones can clear the street for a rally to $ 2,747.52 and presumably the 1,618 extension at $ 2,991.88.

Furthermore, the stochastic RSI floated the second the stochastic RSI floated above 70, indicating bullish momentum but additionally approached overbought situations.

That’s the reason Ethereum is at an important level the place additional bullish affirmation may unlock a substantial benefit.

Supply: TradingView

Ethereum is presently exhibiting sturdy primary ideas which are supported by lengthy -term accumulation, rising consumer exercise, rising whalingan actions and rising OI.

The restoration of the MVRV ratio indicators minimal gross sales stress, whereas the technical setup suggests a potential outbreak. If the momentum continues, Ethereum can erase an important resistors and proceed to the $ 2,750 – $ 3,000 zone.

That’s the reason the present circumstances are in favor of a bullish continuation, supplied that the quantity and sentiment are coordinated.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024