Bitcoin

Are Bitcoin Long-Term Holders Starting To Sell?

Credit : bitcoinmagazine.com

After a unstable begin as much as 2025, Bitcoin has now recovered the $ 100,000 marking, which units a brand new highest excessive level and renewed belief is injected into the market. However when costs rise, a essential query arises: have a number of the most skilled and profitable holders of Bitcoin, the lengthy -term buyers, begin promoting? On this doc we are going to analyze some knowledge on the chains in regards to the habits of lengthy -term holders and whether or not taking latest revenue -making needs to be a motive for concern, or just a wholesome a part of the Bitcoin market cycle.

Indicators of a revenue seem

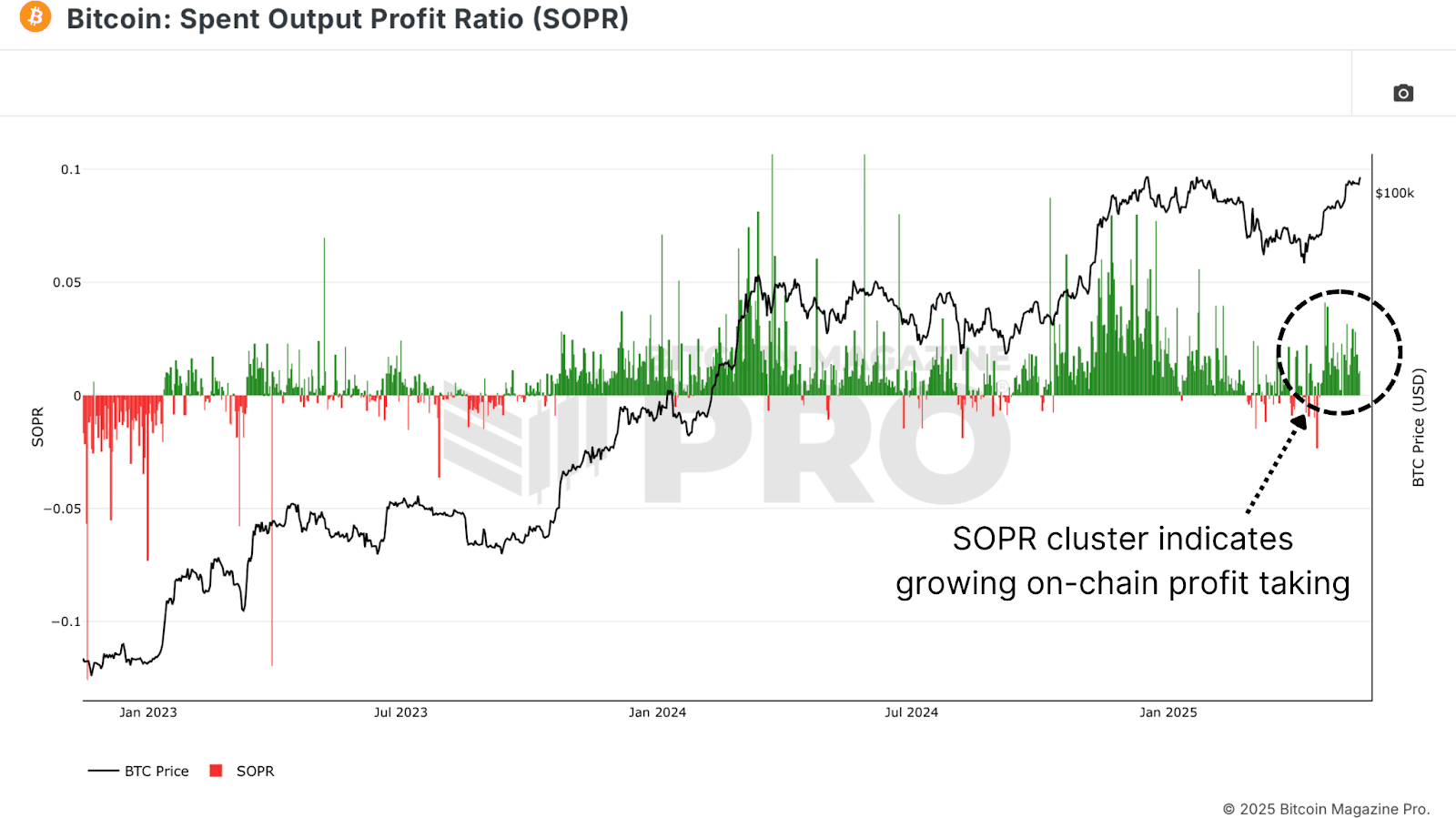

The Best output profit ratio (sopr) Presents an instantaneous perception into realized revenue within the community. Zooming in in latest weeks, we are able to observe a transparent rising revenue realization. Clusters of inexperienced beams point out {that a} noticeable variety of buyers certainly promote BTC for revenue, particularly after the value rally of the $ 74,000 – $ 75,000 attain to new highlights above $ 100,000.

Nevertheless, though this may be involved about potential overhead resistance within the quick time period, it’s essential to border this within the broader context on the chain. This isn’t uncommon habits in bull markets and doesn’t point out a cyclespiek in itself.

Lengthy -term holder’s providing remains to be rising

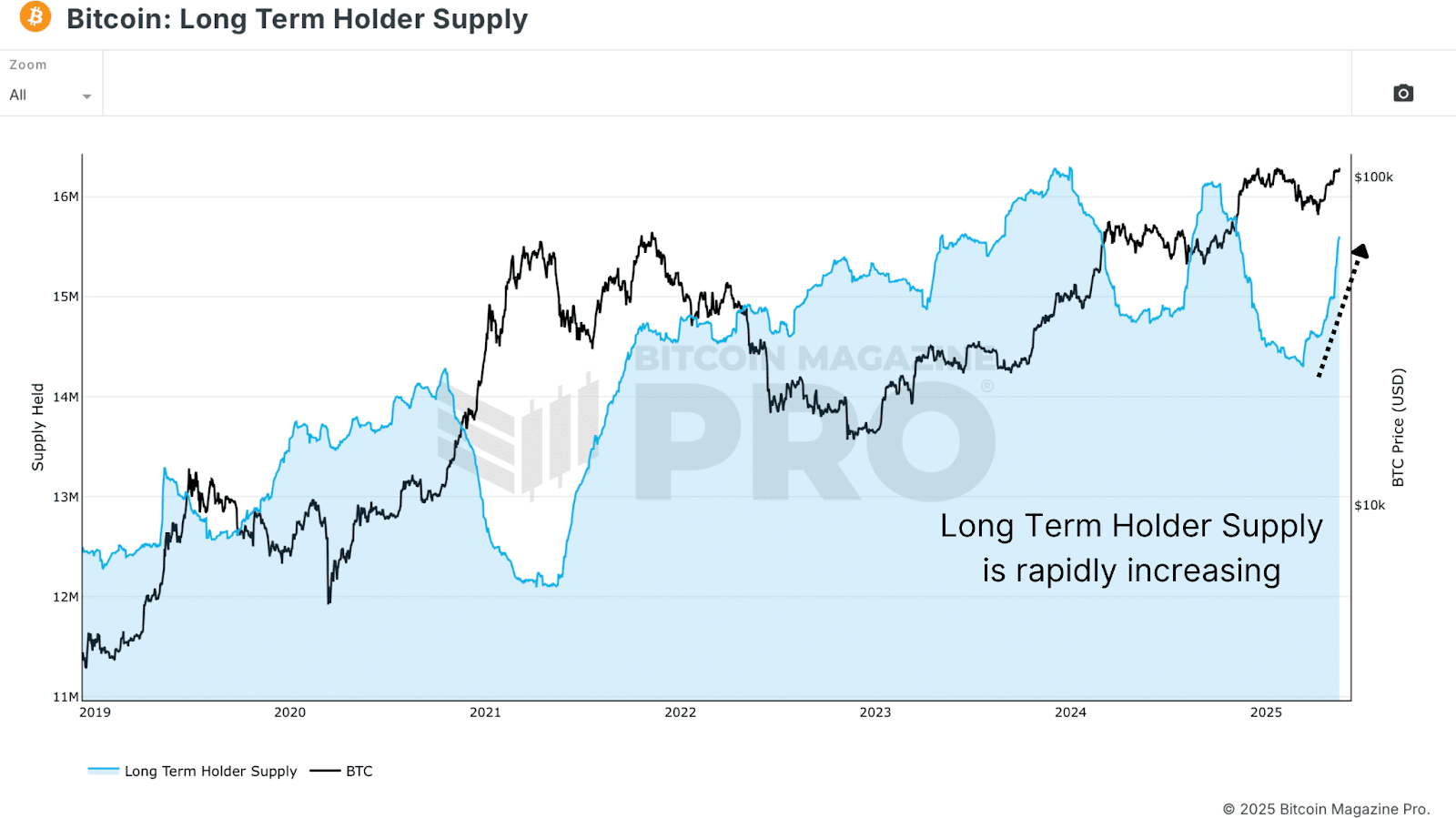

The Long -term offeringThe entire quantity of Bitcoin that’s saved by addresses for a minimum of 155 days continues to rise, even when costs rise. This statistics doesn’t essentially imply that new accumulation is now occurring, however fairly that cash are getting older within the lengthy -term standing with out being moved or bought.

In different phrases, many buyers who purchased on the finish of 2024 or early 2025 maintain robust and switch into lengthy -term holders. This can be a wholesome dynamic typical of the sooner to the middle of the bull markets, and never but a sign for widespread distribution.

HODL -GLAVEN DAALYSO

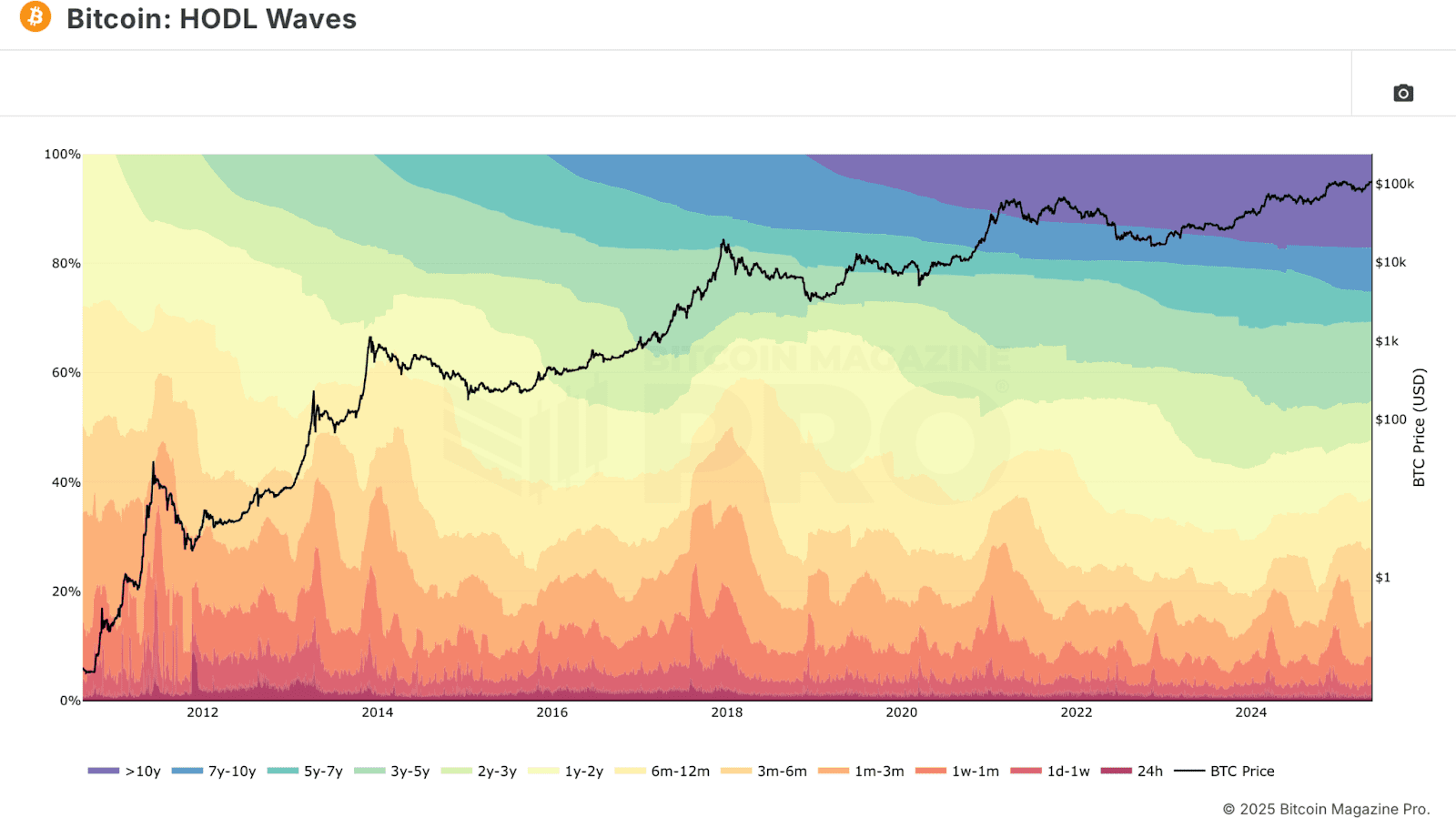

We use to dig deeper Hodl -waves Information, which BTC Holdings breaks down by Pockets Age Bands. When insulating portfolios that maintain BTC for six months or extra, we see that greater than 70% of the Bitcoin provide is at present being arrested by medium to long-term individuals.

It’s attention-grabbing that, though this quantity stays excessive, it has begun to lower considerably, indicating that a part of the lengthy -term holders sells attainable, even because the lengthy -term holder will increase. The first explanation for lengthy -term meals progress in the long run appears to be within the quick time period holders that age within the 155+ day bracket, no new accumulation or giant -scale purchases.

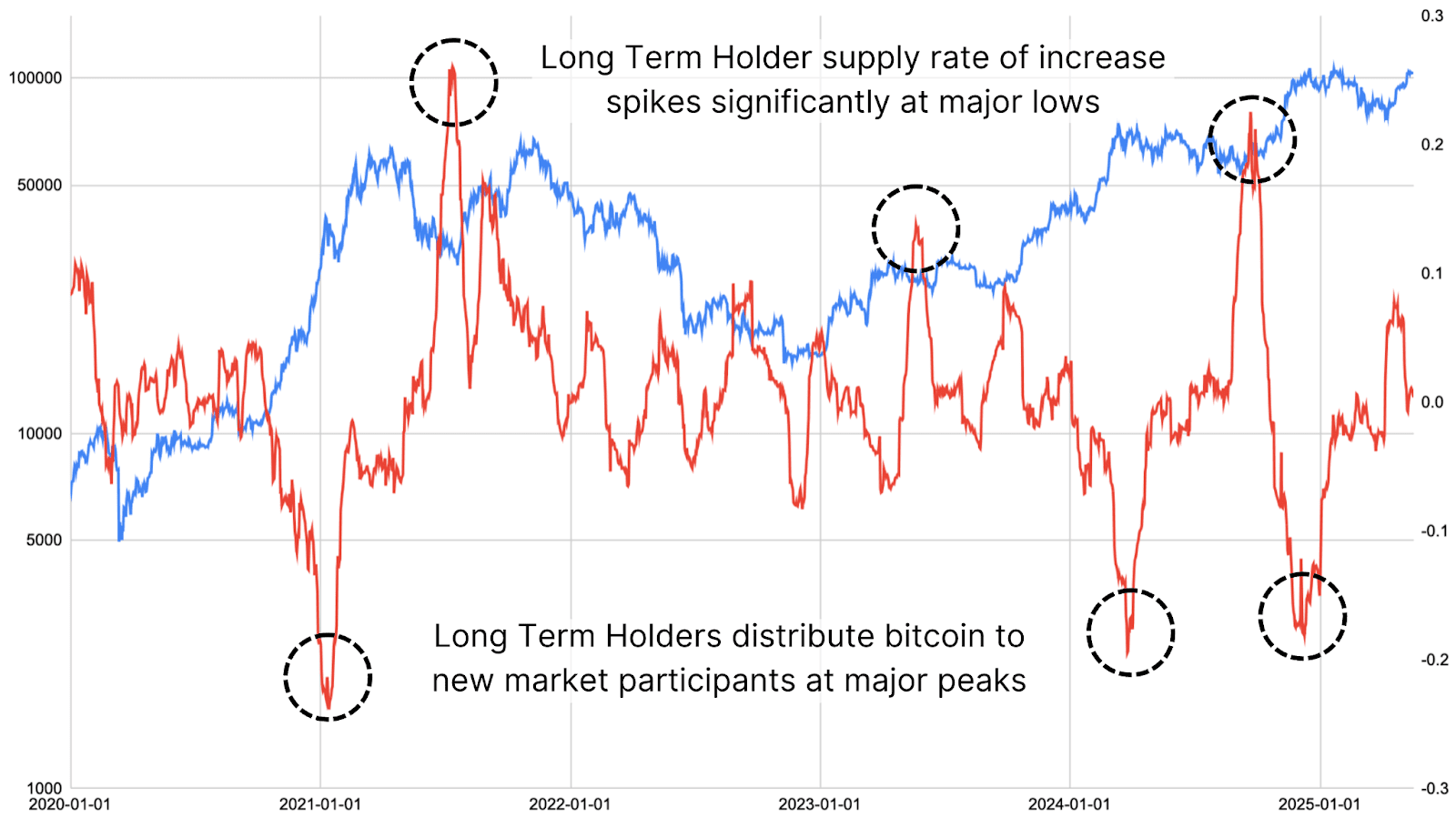

Use uncooked Bitcoin Magazine Pro API We’ve investigated the velocity of change within the stability in the long run, categorized by pockets age. When these metric tendencies down significantly down, it has been mixed traditionally with cycles. Conversely, when it goes up, it has typically marked market bases and intervals of deep accumulation.

Brief -term shifts and distribution relationships

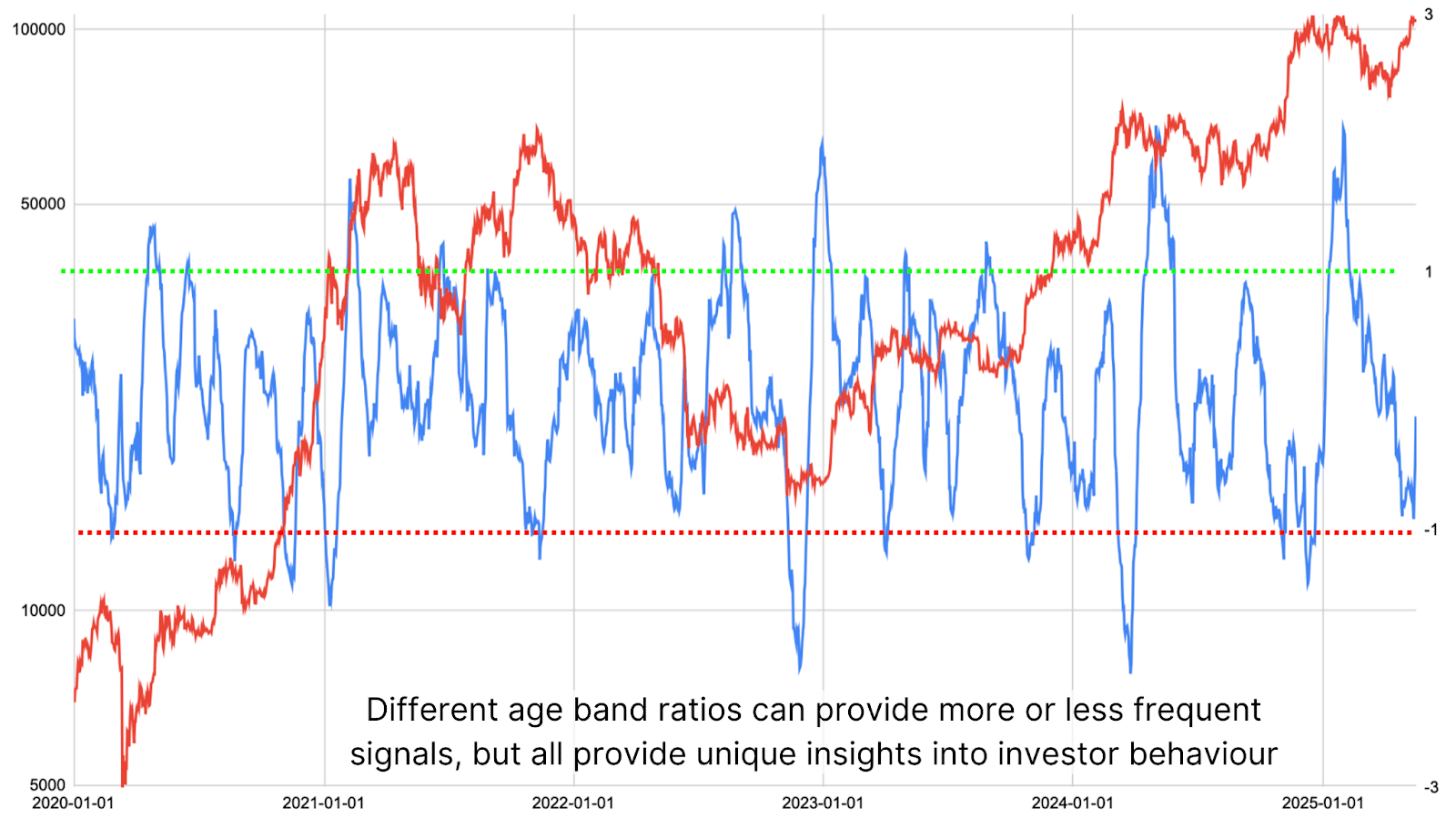

To enhance the accuracy of those indicators, the info will be minimize extra precisely by evaluating very latest individuals (0-1 month holders) with those that maintain BTC for 1-5 years. This age comparability presents extra frequent and actual -time insights into distribution patterns.

Determine 5: A distribution charge of the age dealer presents priceless market insights.

We imagine that sharp drops within the ratio of 1-5 -year -old holders in comparison with newer individuals are traditionally tailor-made to Bitcoin Tops, in the meantime a speedy enhance within the ratio sign that extra BTC flows into the fingers of seasoned buyers, typically a precursor of huge worth rallies.

In the end, the monitoring of lengthy -term habits for buyers is among the only methods to measure the market sentiment and the sustainability of worth actions. Lengthy -term holders carry out traditionally higher than quick -term merchants by shopping for throughout nervousness and protracted volatility. By investigating the aged distribution of BTC corporations, we are able to get a clearer image of potential tops and soils out there, with out solely counting on worth motion or short-term sentiment.

Conclusion

Because it seems now, there may be solely a small degree of distribution amongst holders in the long run, nowhere close to the size that indicators historic cycle tops. Taking a revenue takes place, sure, however at a tempo that appears utterly sustainable and typical of a wholesome market setting. Given the present part of the bull’s cycle and the positioning of institutional and retail individuals, the info that we’re nonetheless inside a structurally robust part counsel, with room for additional worth progress as new capital flows.

Go to a go to to a bigger research, technical indicators, actual -time market warnings and entry to a rising group of analysts Bitcoinmagazinepro.com.

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. At all times do your individual analysis earlier than you make funding selections.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024