Bitcoin

Bitcoin traders, here’s why you should brace for a pullback to $100k

Credit : ambcrypto.com

- Bitcoin noticed a excessive commerce quantity on the derivatives markets, however not on the spot markets.

- The development of liquidation ranges at $ 100k and decrease the costs might decrease.

Bitcoin [BTC] reached a report excessive of $ 111,980 on Binance on Thursday on 22 Could. It was reported that the open curiosity (OI) reached a report excessive of $ 74 billion. The inflow of capital into the derivatives market in latest days meant Bullish conviction.

On the similar time, numerous liquidations have been constructed up below the extent of $ 100k. This could appeal to the value to the south, as a result of the value is attracted by liquidity. Ought to merchants count on a withdrawal within the brief time period?

Information of Coinyze confirmed that the OI pattern was flattened after BTC has reached a brand new all time. The financing pace had been extremely optimistic, however within the final 24 hours it has fallen to impartial ranges.

Merchants should put together for a withdrawal within the brief time period

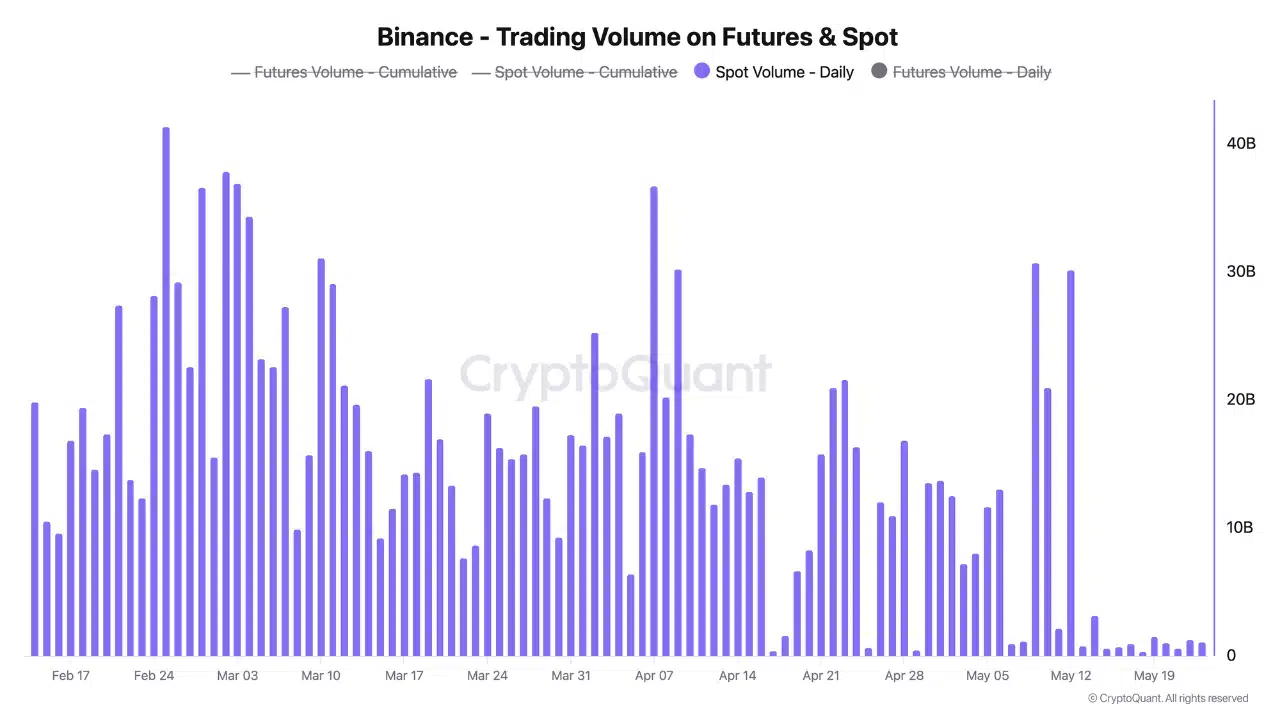

In a message about cryptoquant insights, person Darkfost Be it that the spot demand decreased. The futures buying and selling quantity went sturdy and emphasised a excessive speculative significance. But the lower within the spot quantity was when Bitcoin entered his value discovery section a disappointment.

The shortage of spot demand urged that buyers had been cautious with shopping for BTC above the $ 94k $ 96k space. This area had earlier in Could as a resistance earlier than the value broke out to virtually contact the $ 112k marking.

A rally led by the derivatives market can run the danger of elevated volatility and deeper withdrawal.

Supply: BTC/USDT on TradingView

The 1-day graph of Bitcoin zooms out to cowl the value motion of the previous six months, emphasised a potential vary (white). Two routes had been potential within the coming weeks- a persistent uptrend, or a reset to $ 100k and even $ 93k.

When shapes attain, value motion inside attain causes the liquidation ranges to construct across the extremes of the vary. The retracement as much as $ 77.5K in March and the following restoration noticed brief liquidations constructed up at $ 99.6k, $ 108k and $ 113k.

The primary two ranges have been swept. The lowering spot demand urged {that a} market set was potential and that $ 113k is out of attain in the intervening time.

The three -month graph underlined the development of liquidation ranges at $ 100k and $ 92k as the subsequent potential targets.

Relying on the worthwhile exercise and whether or not the bulls can discover their toes once more, Bitcoin can once more give $ 106k to the bears.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now