Analysis

Is a Deeper Correction Ahead for ETH?

Credit : coinpedia.org

In current days, the cryptomarkt has seen robust income, with the worth of Bitcoin creating a brand new all time. However this turnout led to a worthwhile sentiment, in order that the market briefly peaked. Ethereum particularly had issue staying above the current excessive, whereas giant buyers began withdrawing their cash. In consequence, there is usually a short-term correction for ETH prize for the bow.

Ethereum struggles to satisfy the shopping for of demand

A market-wide rebound, powered by Bitcoin that hit new all-time highlights and higher general financial situations, helped push the worth of Ethereum to an eight-week excessive of $ 2,731. Nevertheless, it now has issues attracting a robust buy rate of interest, as a result of many quick -term buyers have already bought to extend revenue.

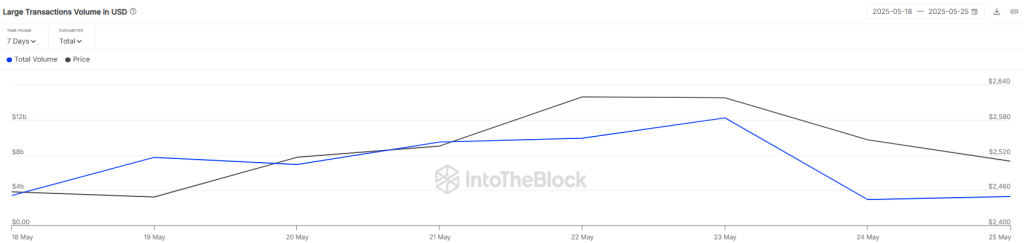

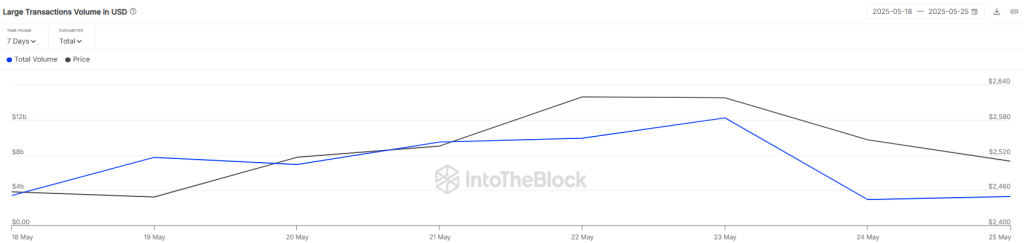

Based on Coinglass, greater than $ 40.66 million had been liquidated in Ethereum positions within the final 24 hours. Of those, 15.12 million from consumers and $ 25.54 million from sellers. Within the meantime, information from Intotheblock has a pointy fall within the giant transaction quantity, which falls from $ 12.24 billion to $ 3.28 billion in simply three days.

This means that enormous buyers take a step again, which weakens the upward momentum within the value of ETH. With whales that withdraw, sellers can get the higher hand within the quick time period, presumably result in a value correction.

Regardless of some current value wrestle, Ethereum’s Defi activity continues to develop. The overall worth in Ethereum rose from $ 50.63 billion on 26 April to $ 62.7 billion by 26 Might, a soar of greater than 25% in just below a month.

Additionally learn: What’s the subsequent step for Ethereum Value? Will the ETH -Prijsmarking a brand new ATH in June 2025 a brand new ATH?

A few of the greatest income got here from platforms reminiscent of Pendle, the place deposits elevated by greater than 50% and Ether.fi and Eigenlaer, each of which noticed 48% development. Ethereum nonetheless leads all block chains in TVL, with 54% of the market. For comparability, Solana has 8% and BNB chain has 5% below Layer-1 networks.

This robust Defi development might help help the worth of ETH and scale back the probabilities of a giant lower, as a result of many buyers stay bullish a couple of rebound.

What’s the subsequent step for ETH value?

Ether Not too long ago confronted with resistance round $ 2,731, leading to a lower below the rapid FIB ranges. As bears strengthen their dominance, consumers wrestle to activate a restoration rally. From writing, ETH value acts at $ 2,535 and greater than 0.6percenthas fallen over the previous 24 hours.

The ETH/USDT couple can fall to the 100-day EMA (round $ 2,456), which is a crucial stage of help to have a look at. If the worth bounces again strongly from that second, consumers could make one other try to push $ 2,750. In the event that they succeed, the worth can rise to $ 3,000. There may be some resistance round $ 2,870, however it should most likely not maintain lengthy.

Nevertheless, if the worth falls under the 100-day EMA, this bullish prospect can change. In that case, the couple might fall additional within the route of the falling pattern line at $ 2,329. Whereas the glider below the center line, the probabilities of a Bearish rise for a rise in correction for ETH value.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024