Altcoin

BTC demand for short positions indicates volatility and FUD

Credit : ambcrypto.com

- BTC has been closely shorted over the previous three days, however the latest value surge has elevated liquidation.

- Bitcoin traders’ FUD and doubts concerning the rally will push costs greater, signaling volatility.

Bitcoin [BTC]the biggest cryptocurrency by market capitalization, has not too long ago made a average restoration on its value charts. On the time of writing, BTC was buying and selling as excessive as $57110, after gaining 4.27% over the previous day.

As costs recovered, buying and selling quantity rose 53.38% over the day to $33.57 billion. Furthermore, BTC’s market capitalization elevated by 4.24% to $1.13 trillion.

Earlier than this rise, BTC was in a robust downward trajectory, falling 6.54% over the previous 30 days. Subsequently, regardless of the latest features, the value remained comparatively low from the latest excessive of $65103 and down 22.8% from the ATH.

Present market circumstances are giving BTC indicators of life, with analysts exhibiting optimism. For instance, Santiment evaluation urged additional value will increase, citing Bitcoin’s market worth.

What market sentiment says

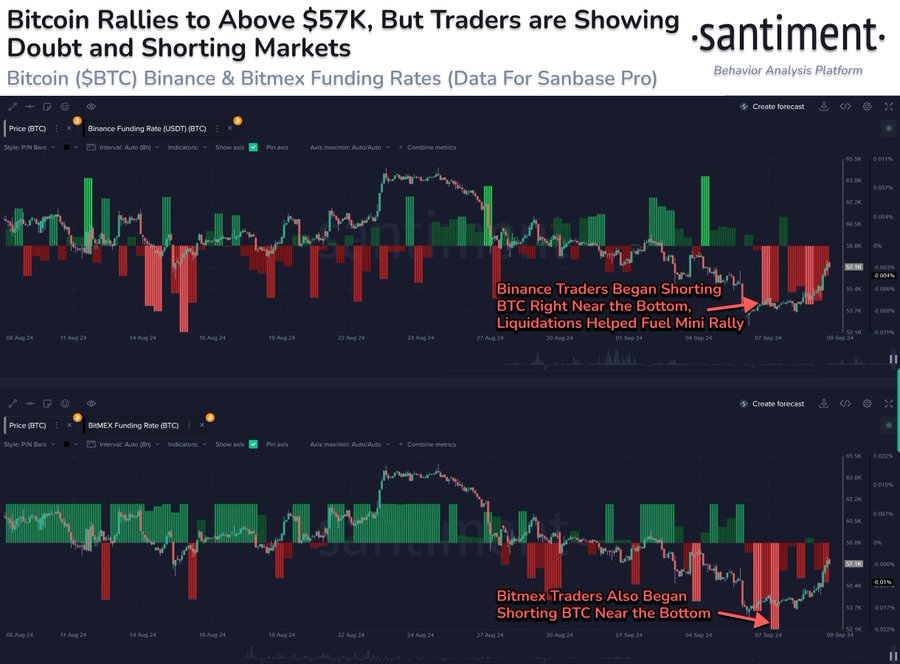

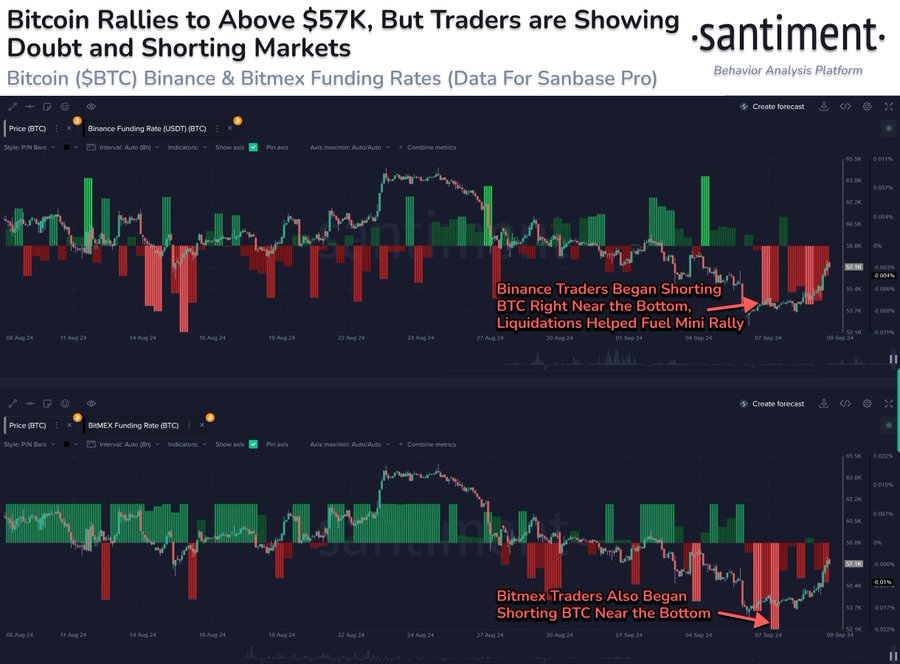

Santiment famous that the worth of BTC has elevated over the previous 24 hours, though it has been shortened over the previous 4 days on main exchanges equivalent to Binance and Bitmex.

Supply: Santiment

On this context, many merchants are betting that BTC costs will fall. Sometimes, shorting happens when merchants borrow and promote BTC, with the intention of shopping for it once more at decrease costs.

So the heavy brief positions since Saturday suggest that many merchants expect costs. This market sentiment is normally pushed by FUD, as traders lack confidence within the value route and count on a pullback.

Nonetheless, if costs don’t fall as brief sellers count on and rise, they’ll come below stress.

These traders are pressured to purchase again the property they borrowed to cowl their positions, particularly when there’s a threat of better losses. As famous by the features over the previous 24 hours.

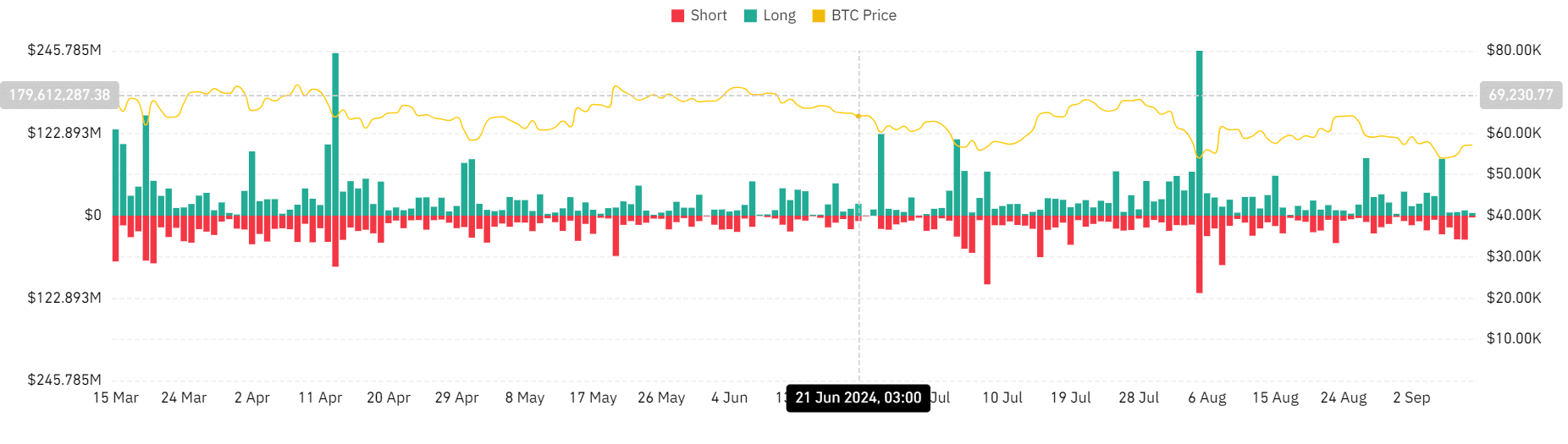

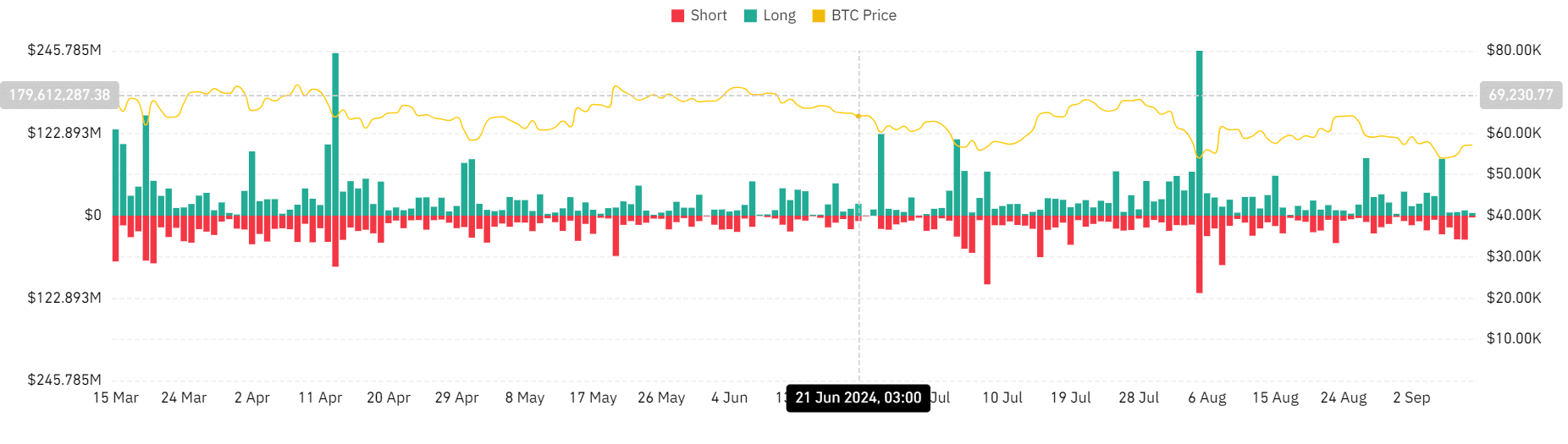

Supply: Coinglass

Thus, the value enhance has resulted in elevated liquidation of brief positions, indicating market volatility. This pressured shopping for leads to elevated demand, which causes costs to rise, leading to a brief squeeze.

Bitcoin value charts

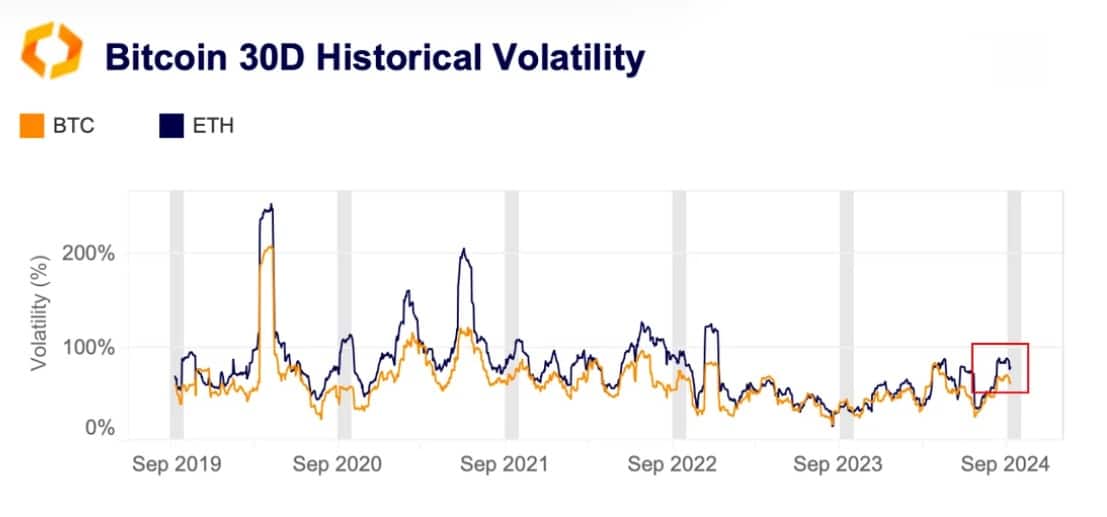

As famous by Santiment, the Bitcoin market is experiencing better uncertainty, leading to better volatility. Usually, September is traditionally related to volatility, with BTC’s 30-day volatility surging 70% this 12 months.

Supply: Kaiko

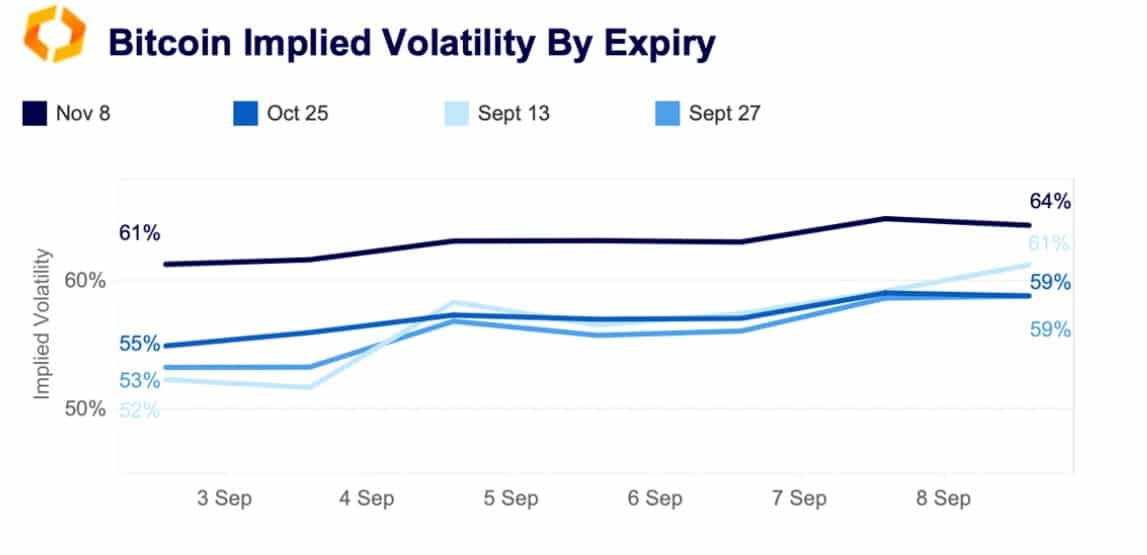

So indicators equivalent to implied volatility have risen because the starting of September, after falling in August. Brief-term choices particularly are up 60% from 52%.

Supply: Kaiko

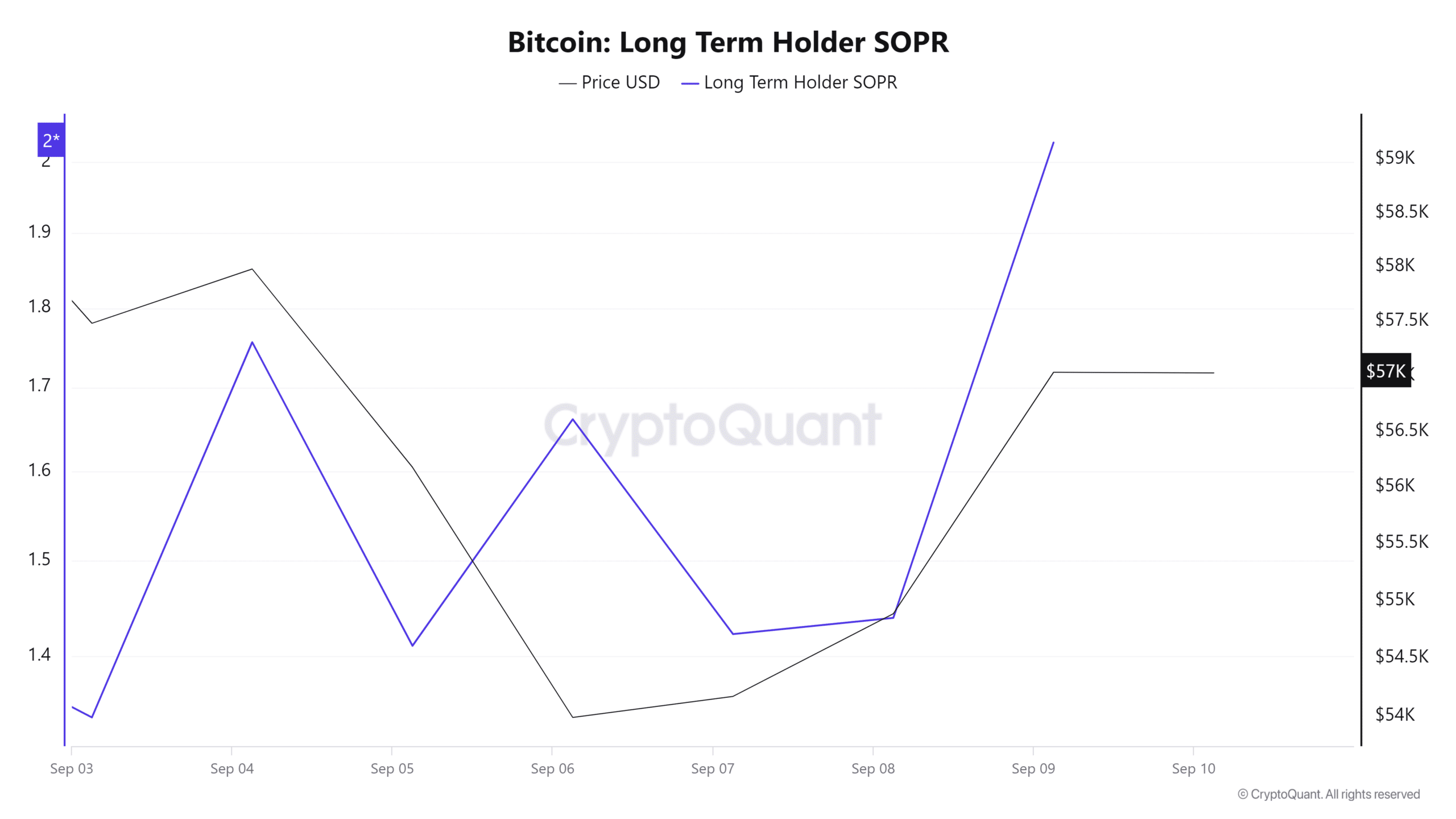

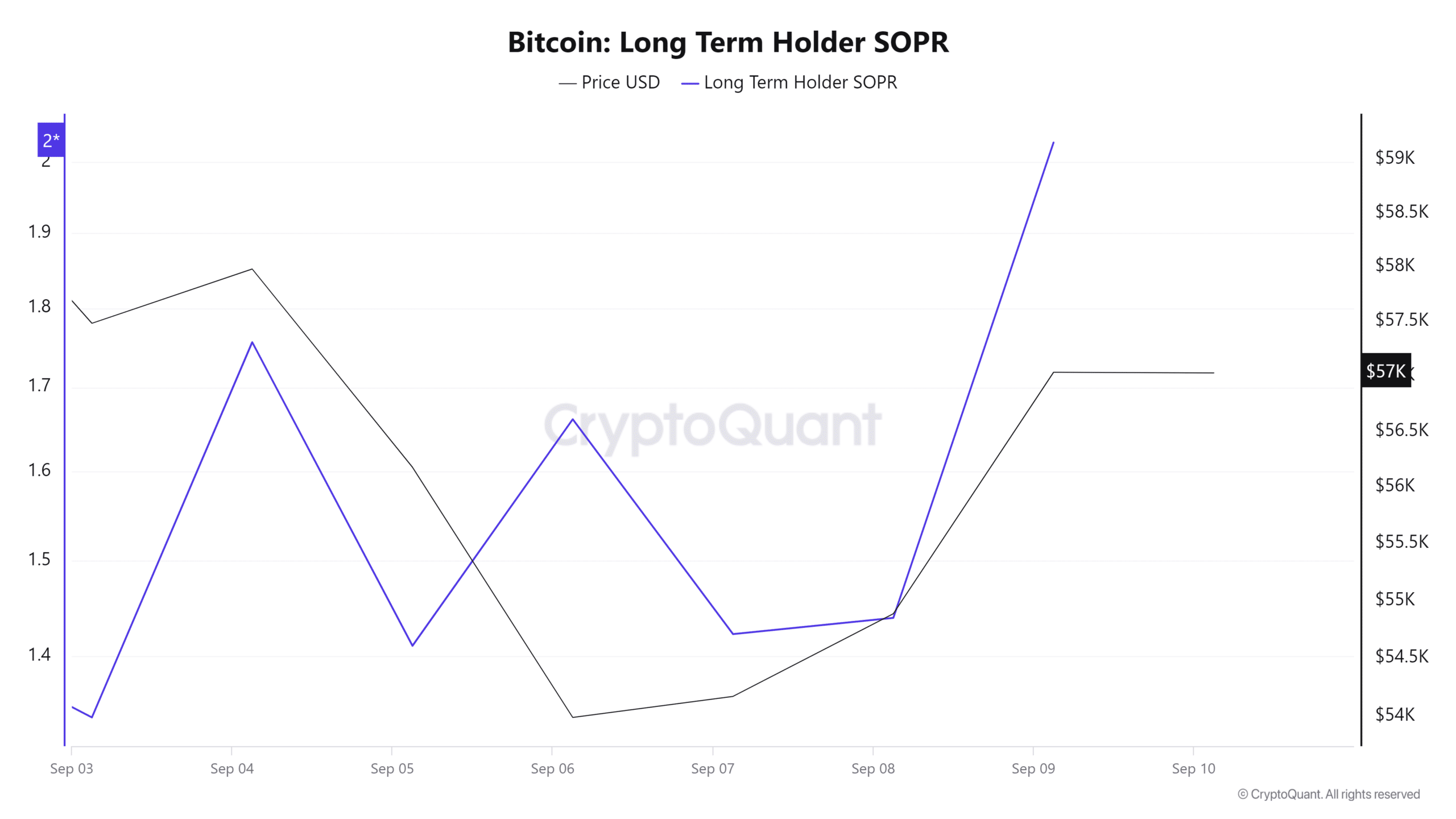

As well as, the upcoming US presidential elections are contributing to the present market uncertainty. This FUD is additional supported by a sudden enhance within the Lengthy Time period Holder SOPR from 1.4 to 2.0.

So despite the fact that costs rise, they might expertise a pullback in these gross sales to shut realized features.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Subsequently, the demand for brief positions implies that traders count on costs to fall. Nonetheless, the demand for brief positions can result in elevated demand, additional leading to additional value will increase.

If FUD pushes costs greater, BTC will problem and strengthen the USD 59363 resistance to cross the USD 60,000 mark.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024