Bitcoin

Will Bitcoin reach $100K? Global liquidity push has the answer

Credit : ambcrypto.com

- World liquidity rose sharply, with an annualized price of greater than 6%

- Bitcoin seemed poised to hit a brand new all-time excessive.

Rising international financial liquidity, which stands at over 6% yearly, marked the quickest development since April 2022. This can possible impression Bitcoin. [BTC].

The uptrend follows a four-year cycle, much like that of April 2020. This rising liquidity is more likely to enhance the costs of dangerous property, together with Bitcoin, within the medium time period.

Central banks, together with the Federal Reserve and the ECB, are anticipated to chop rates of interest within the coming weeks, heralding the beginning of the worldwide easing cycle.

Nonetheless, near-term headwinds stay, primarily as a result of continued “unfavorable Fed liquidity setting” and a possible enhance in USD power.

The approaching weeks might deliver golden alternatives, particularly for Bitcoin.

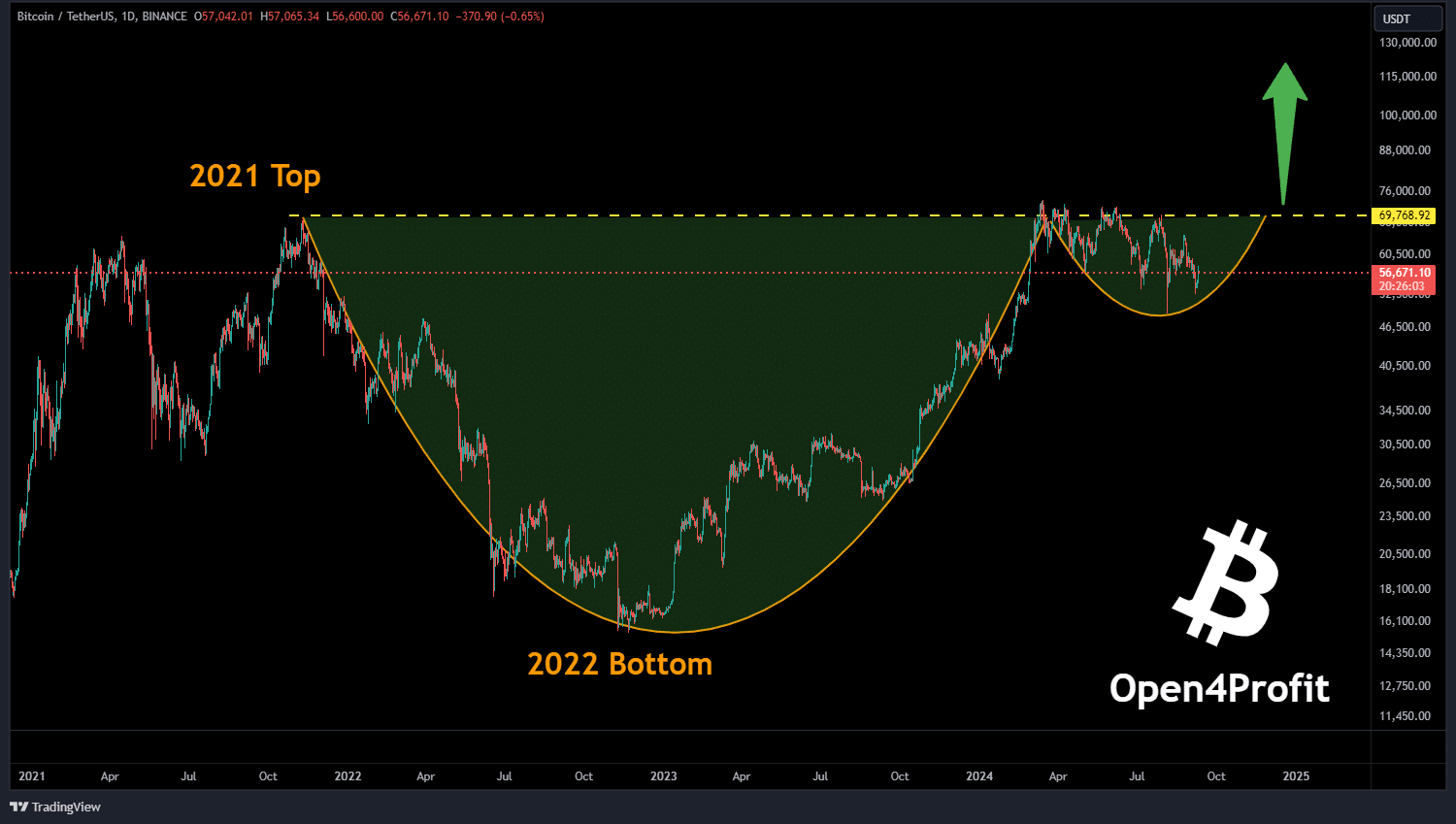

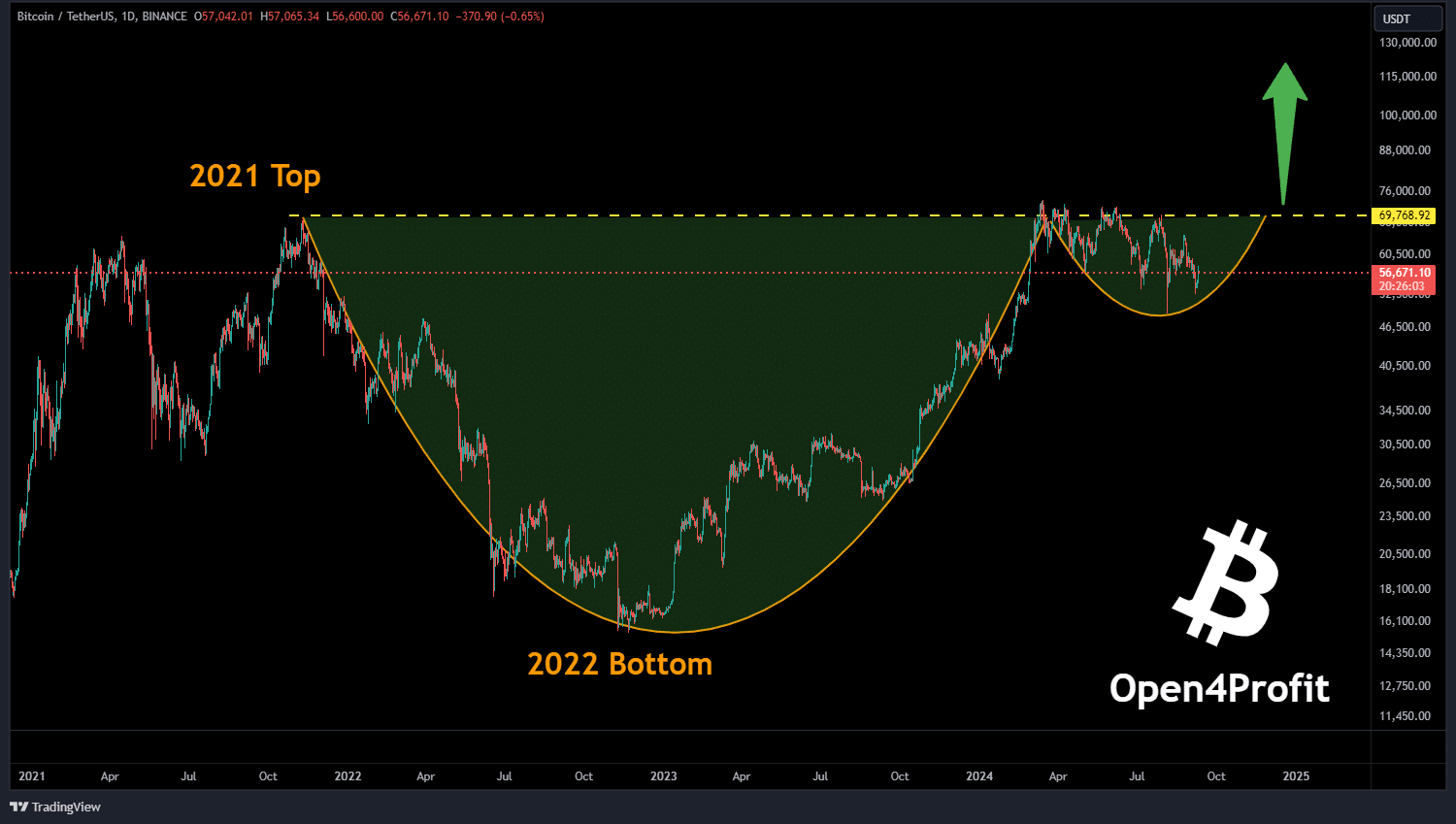

BTC’s cup and deal with sample

The rise in international liquidity can have a big impression on the value of Bitcoin. Bitcoin is forming an enormous cup-and-handle sample, with a breakout anticipated round mid-September, possible throughout or after the Fed assembly.

This might spark a serious rally, signaling the beginning of what analysts are calling the 2024-2025 Bitcoin bull run. Buyers are inspired to carry their BTC and put together for this upward momentum.

Supply: TradingView

If Bitcoin breaks its ATH, the value might rise to $100,000, particularly if political occasions like a Trump victory materialize, as some analysts counsel.

Nonetheless, if BTC encounters rejection close to its ATH, analysts might want to conduct additional evaluation, however the general bias stays bullish.

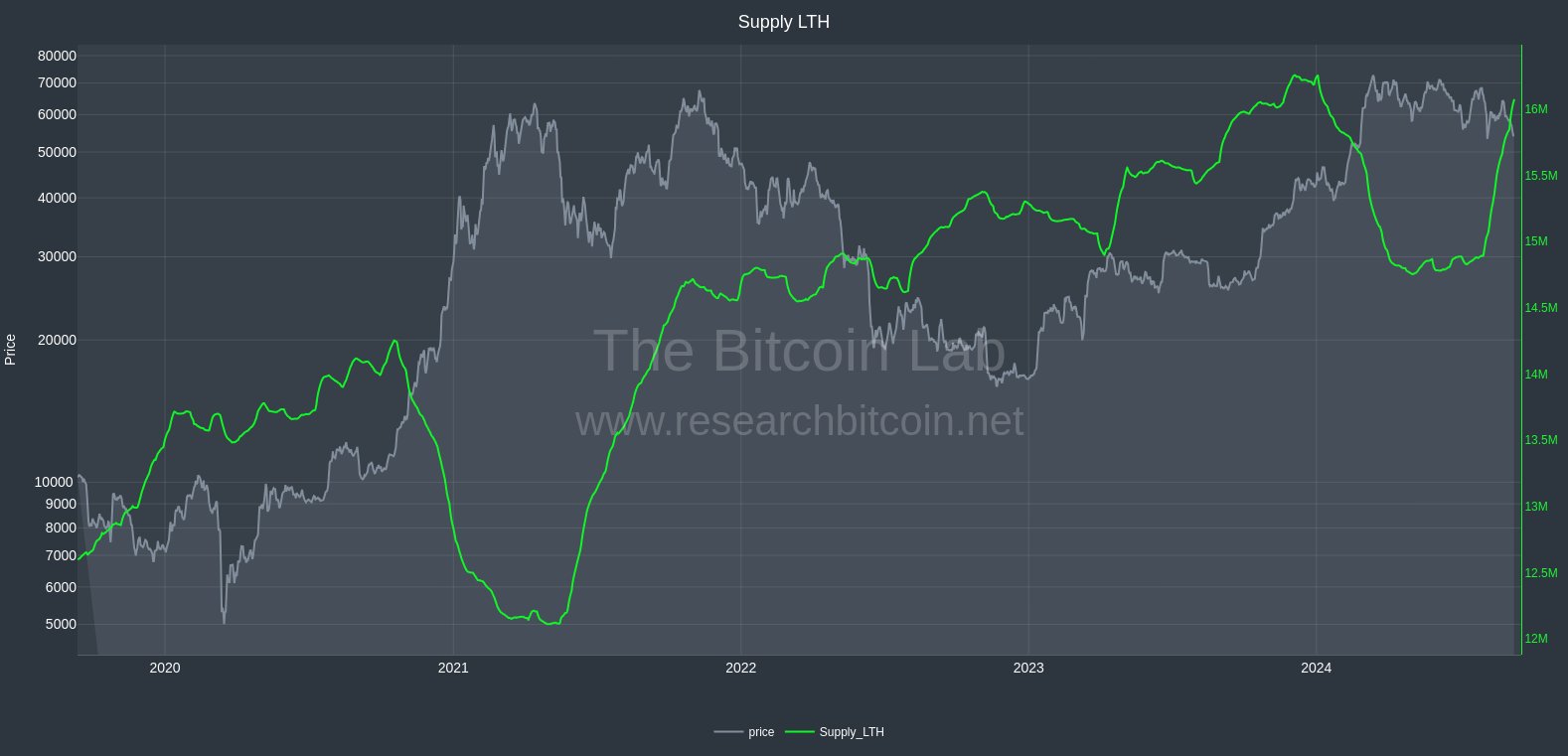

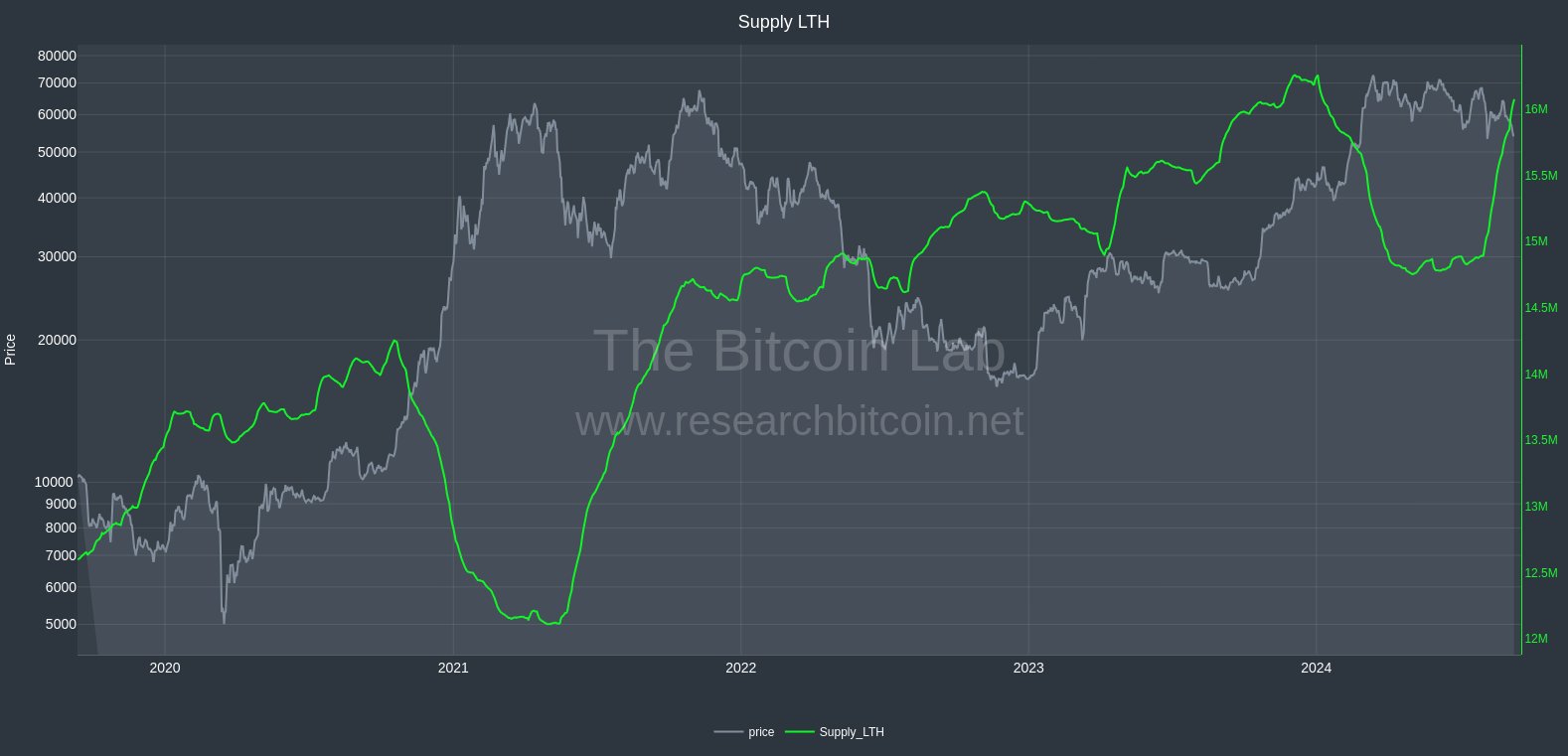

Lengthy-term retainer provide

One other bullish indicator is the availability of long-term Bitcoin holders, which is approaching a brand new ATH.

As much as the time of writing, long-term holders have held 16.13 million BTC for over 155 days, with the earlier ATH reaching 16.29 million BTC in December 2023.

This sturdy accumulation by long-term holders, together with establishments, signifies that key stakeholders stay engaged, growing the probability of BTC heading increased within the coming months.

Supply: The Bitcoin Lab

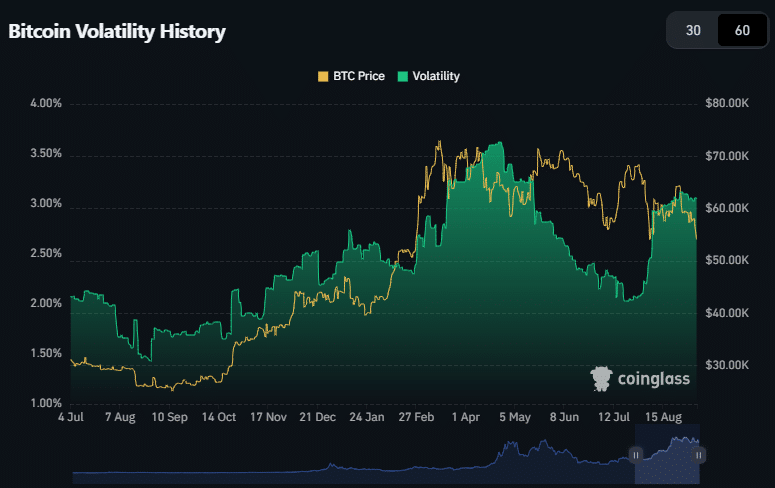

Bitcoin Volatility and Funding Charges

Bitcoin’s volatility ranges have additionally returned close to cycle highs, which might be both a constructive or a damaging for merchants.

Whereas leveraged merchants could face challenges, long-term buyers see this as a promising signal of coming worth actions.

Whereas volatility stays decrease than 2021 ranges, it’s more likely to enhance as institutional gamers reenter the market.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

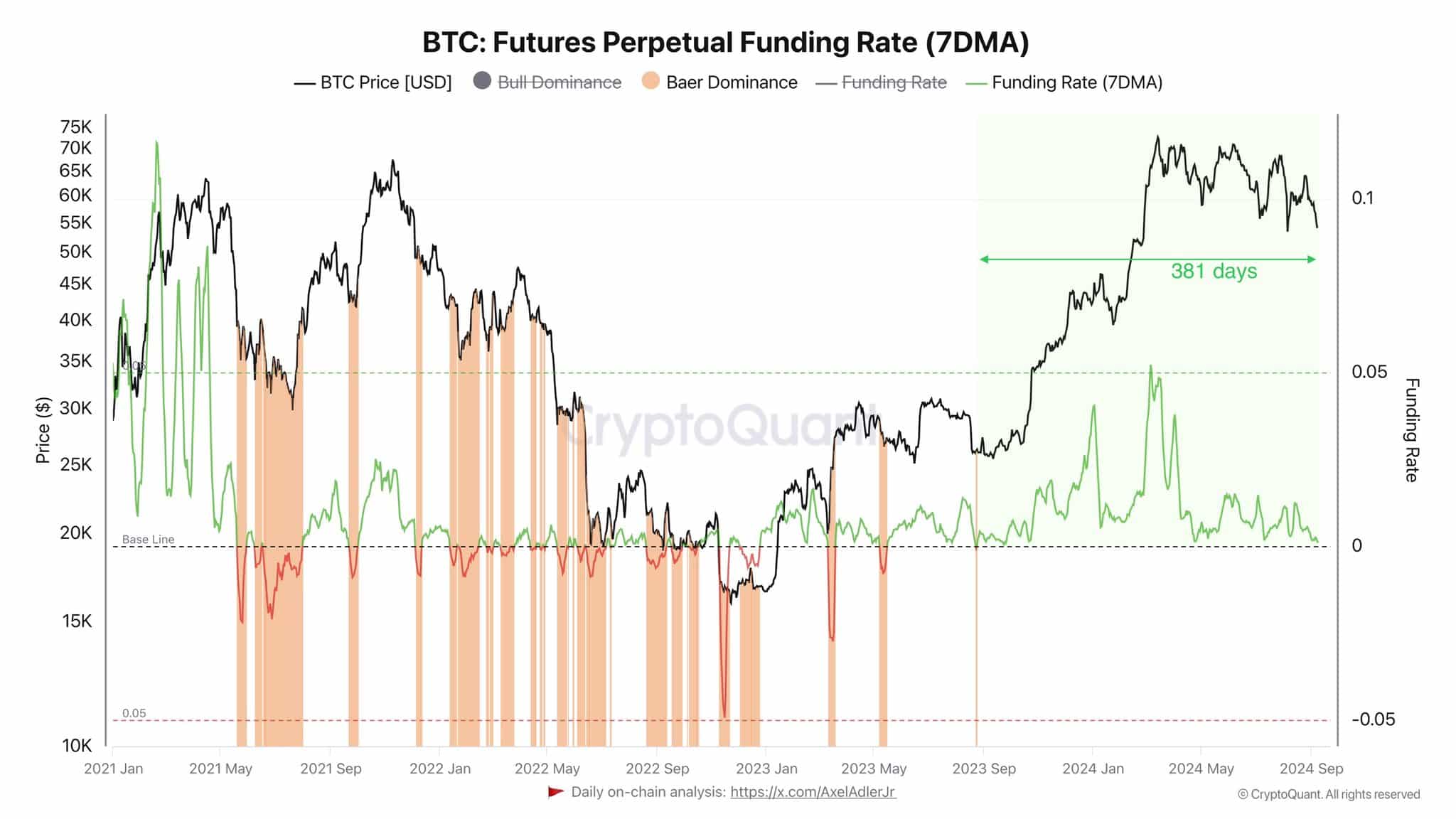

Bitcoin funding charges have remained bullish for over a 12 months, supporting expectations of a powerful worth enhance.

Bulls have dominated the futures marketplace for 381 days. Rising international liquidity will possible proceed to push Bitcoin’s worth increased for the foreseeable future.

Supply: CryptoQuant

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024