Policy & Regulation

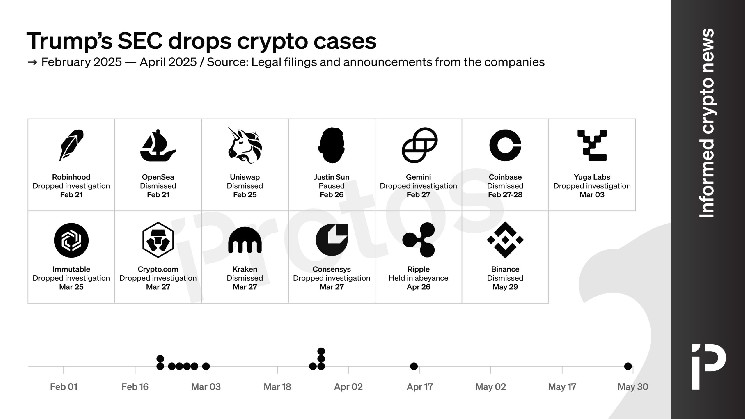

Crypto cases Trump’s SEC has paused and dismissed in 2025

Credit : cryptonews.net

The administration of Donald Trump has fully modified the scope of cryptocurrency regulation and enforcement, whereby the Securities and Trade Fee (SEC) completely different completely different actions which were set, particularly pauses, rejected and altered.

These modifications have come as a result of the SEC Commissioner Hester Peirce has designated to steer a crypto process drive for the aim “to make clear the applying of the federal securities legal guidelines on the crypto activa market.”

Protos has recognized the crypto-related lawsuits and investigations that the SEC has adjusted since Trump’s inauguration. You possibly can see them right here.

Justin Solar

Justin Solar, an adviser to Trump-Liederde World Liberty Monetary and Main Investor within the $ Trump Memecoin, was charged subsequent to the Tron Basis.

Learn extra: Justin Solar directed Wash-Buying and selling schedule of his American condominium, sec declare

The allegations on this lawsuit embrace that TRX and BTT have been provided as results with out registration and that solar -oriented market manipulation, together with washing commerce.

This lawsuit was paused in a joint movement on 26 February 2025.

Binance

Binance, the world’s largest crypto change, was charged by the sec as a result of accusations that it couldn’t register as a inventory change, washed tokens and mistaken buyer funds.

Learn extra: CFTC -Rechtszaak in opposition to Binance Claims CZ has been traded in opposition to customers

On 10 February there was a joint movement to remain the process and the case was rejected on 29 Could.

Ripple

Ripple Labs was the goal of a sec -right case that began within the first Trump administration that claimed it bought not -registered results.

Learn extra: Ripple to cease XRP stories after sec ‘used transparency in opposition to it’

On March 19, Ripple introduced that the SEC would reject its enchantment.

On April 16 this was mirrored in a joint movement to maintain the enchantment.

Unchangeable

Unchangeable, which describes itself as ‘your hub for web3 gaming’, introduced on March 25 that the SEC had dropped its investigation into invariably.

Immutable had beforehand revealed a notification on November 1, 2024 that publicly revealed that it had acquired a wells notification of the SEC with regard to the supply and sale of the IMX -Token.

Yuga Labs

Yuga Labs, the corporate behind the bored Ape Yacht Membership and different NFT tasks, introduced on March 3, 2025 that the “SEC formally concluded his analysis into Yuga Labs.

Crack

Kraken, a Crypto change primarily based within the US, had been the goal of a SEC rights case that claimed that it had provided unregistered results.

On March 3, 2025, Kraken introduced that the ‘SEC -employees had in precept agreed to reject his lawsuit in opposition to Kraken. “

On March 27, 2025, the events concerned submitted a joint provision to reject the case.

Learn extra: Kraken Exec says it has knowledgeable ‘Belief’ an hour earlier than SEC -SWEK -LEK

This go well with was separate from the earlier case that Kraken agreed to settle, which associated to the supply of setting a service.

Consensys

Consensys was the goal of a sec -right case associated to his Metamask portion and the Swaps perform constructed into the software program.

Learn extra: Consensys says that the SEC ETH has designated a safety, however is not going to say the place

On February 27, 2025, Consensys introduced that IT and the SEC “had agreed in precept that the enforcement case for securities Metamask must be rejected.”

The joint provision for dismissal was submitted on 27 March.

Twin

The SEC was aimed toward Gemini for analysis.

On February 27, 2025, Cameron Winklevoss, co-founder of Gemini, introduced that the SEC had closed his investigation and “no enforcement marketing campaign will pursue in opposition to us.”

In his lengthy X put up he additionally claimed that the company ought to now reimburse Gemini for its prices and that ‘Everybody who’s concerned in these actions should be fired instantly and in a public approach. Their names, roles and the actions through which they participated should be positioned on the SEC web site.‘

He additional mentioned that “there must be a course of that individuals like Gary Gensler are lacking … Van as soon as once more appointed or employed by a desk.”

It’s not clear how Winklevoss’s suggestion would give you the present approval technique of the congress for heads of companies.

OpenSea

OpenSea introduced on February 21, 2025 that the SEC closes its analysis into the NFT market.

Learn extra: OpenSea Hit with Wells Notification, says SEC -Rechtszaak will ‘Interpret the Act’

This was aside from the prison case aimed on the former head of product Nathanial Chastain for prior data commerce.

Coinbase

Coinbase had been the goal of a lawsuit by the SEC that claimed that it operated as a non -registered dealer, change and clearing company.

Learn extra: Why did the SEC Coinbase go public?

On 27 February, Coinbase introduced that the case needed to be rejected and a joint provision was submitted. A corrected model was submitted the subsequent day.

Crypto.com

Crypto.com revealed a press launch on March 27, 2025, which claims that the SEC “Crypto.com has knowledgeable that it formally concluded his analysis into Crypto.com and won’t submit enforcement measures in opposition to the corporate.”

Crypto.com acquired a wells data of the SEC on the finish of 2024, which resulted within the firm Select to sue the regulator.

Robinity

Robinhood introduced on 24 February that it had acquired steering three days earlier that the SEC “had closed its investigation and didn’t intend to proceed with an enforcement motion.”

This adopted a wells data that Robinhood had acquired in Could 2024.

Uniiswap

Uniswap Labs, the corporate that’s accountable for a big a part of the event of the Uniswap protocol, introduced on 25 February that “the SEC formally has formally closed its multi-year investigation into Uniswap Labs.

In April 2024, Uniswap had introduced that it had acquired a wells data of the SEC.

Pointers

On 29 Could, the SEC introduced that in response to her, the deportation actions in reference to proof-of-stake “the availability and the sale of securities should not involved.”

On the entire, these completely different circumstances and modifications counsel that the SEC is planning to convey many fewer circumstances in opposition to crypto firms throughout this time period.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024