Ethereum

Will Ethereum Rally? Metalpha Dumps Another $51M in ETH

Credit : coinpedia.org

Within the ongoing uneven cryptocurrency market, Metalpha, an enormous asset administration agency primarily based in Hong Kong, is receiving vital consideration from crypto fanatics resulting from its ongoing Ethereum (ETH) dump. On September 11, 2024, on-chain analytics agency TheDataNerd posted on X (previously Twitter) that Metalpha had dumped one other 22,000 ETH price $51.16 million to Binance.

Buyers and merchants are interested by Metalpha’s latest trades as they’ve moved a big quantity of ETH over the previous week. In keeping with the information, the corporate transferred a big 56,188 ETH price $130.81 million to Binance.

Present value momentum

Nevertheless, the latest dump by Metalpha has not affected the ETH value. At present buying and selling close to the $2,360 stage, it has skilled a modest value improve of 0.30% over the previous 24 hours. In the meantime, ETH buying and selling quantity has elevated by 20% over the identical interval, indicating higher participation from buyers and merchants amid the continuing market confusion.

Ethereum value prediction

In keeping with skilled technical evaluation, ETH appears to be like bullish and is poised for fairly a rally within the coming days. After breaking the descending trendline over the four-hour time-frame, ETH is at the moment retesting the $2,320 breakout stage. Moreover, there’s a hurdle close to $2,400. If ETH closes a four-hour candle above that stage, there’s a good probability that it may rise to the $2,570 and $2,800 ranges.

As of now, ETH’s Relative Energy Index (RSI) is in oversold territory, indicating a possible pattern reversal from a downtrend to an uptrend.

Bullish statistics within the chain

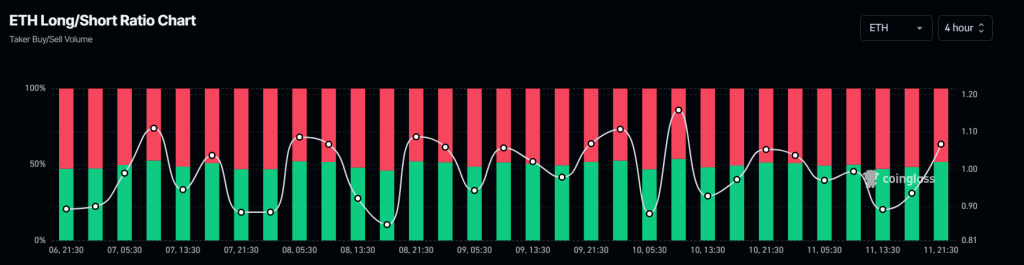

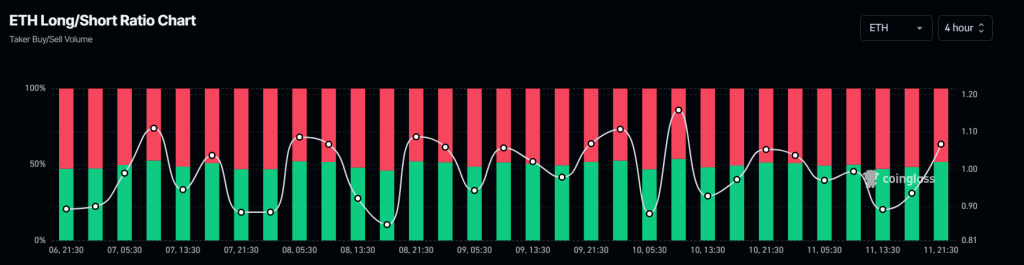

This bullish outlook is additional supported by on-chain metrics. Mint glass ETH long/short ratio at the moment stands at 1,067 in a four-hour span, indicating bullish market sentiment. Nevertheless, 51.84% of the highest ETH merchants have lengthy positions, whereas 48.16% have quick positions.

At present, this information means that bulls dominate property and have the potential to liquidate quick positions.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024