Ethereum

Top 7 Reasons Why the Ethereum Price Rally is Coming Soon

Credit : coinpedia.org

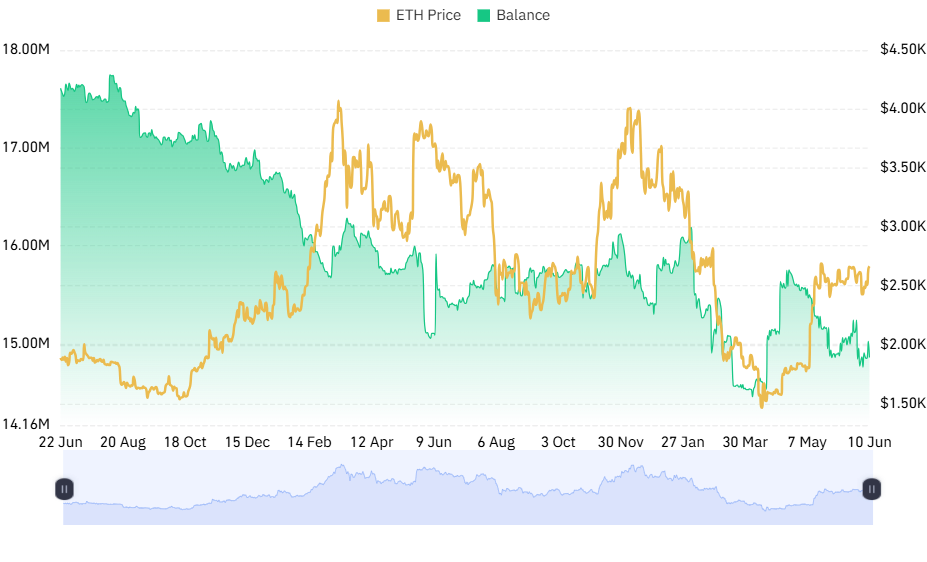

Ethereum might be beneath strain on the graphs, however bullish alerts accumulate behind the scenes shortly. Regardless of a lower of 1.82% at this time and a lower of 26.75% prior to now yr, a distinguished crypto analyst that is called UNIPCs – additionally known as “Bonk Guy“ – has set out a number of essential components that may trigger a strong ETH rally.

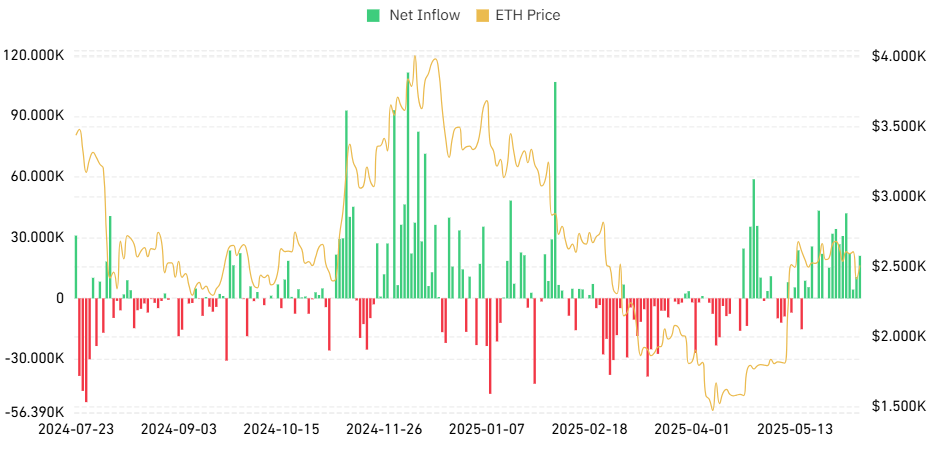

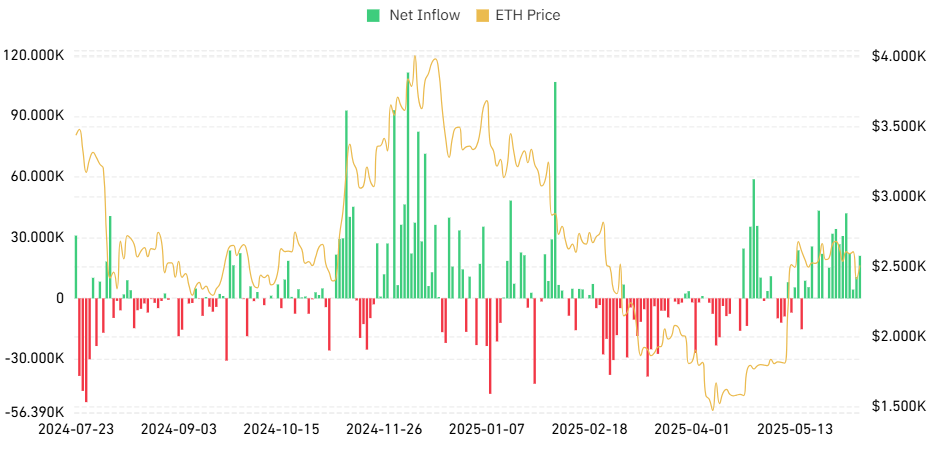

Ethereum ETFs see large influx

Some of the bullish traits quoted by Bonk Man is the constant consumption into Ethereum Alternate-Traded Funds (ETFs).

In response to Coinglass Knowledge, ETFs have now positioned 15 consecutive days of constructive influx.

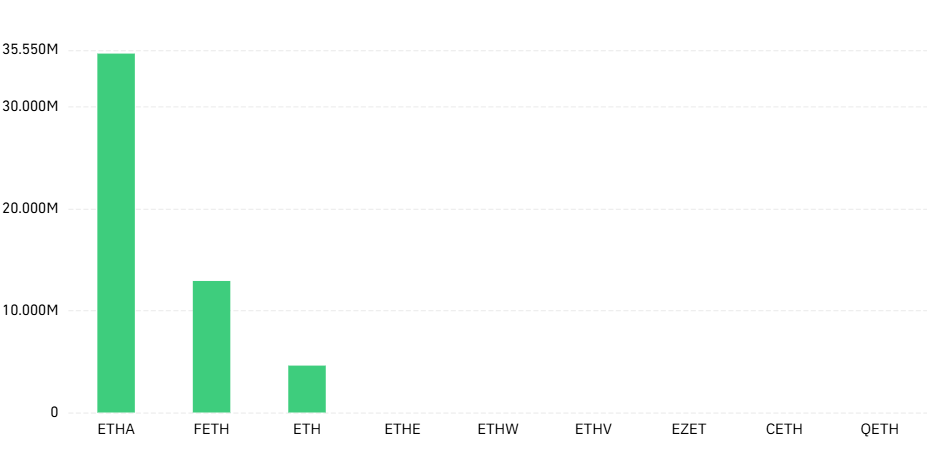

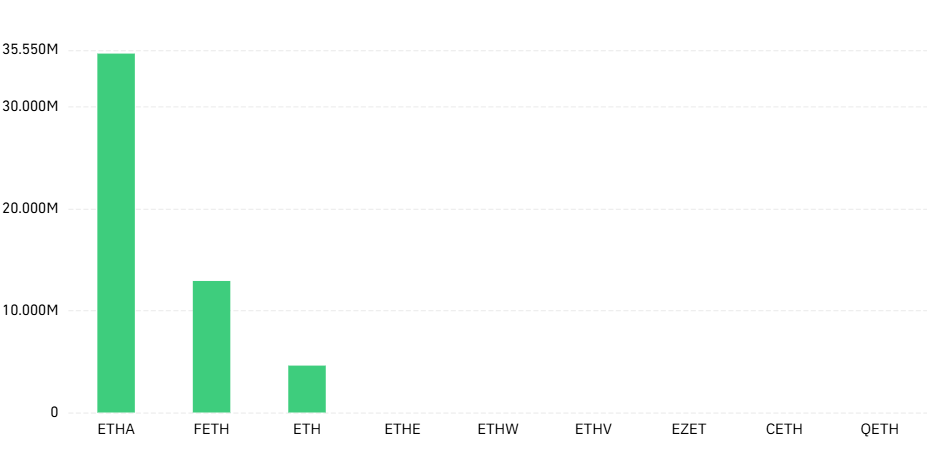

- BlackRock’s Ethha led with $ 35.2 million in at some point

- Constancy’s Feth adopted with $ 12.9 million

- Grayscale’s Eth $ 4.6 million added

On Solely June 3ETH ETFs registered an enormous $ 109.5 million Within the consumption marker the best infringement on at some point for Ethereum ETFs to this point this month.

Firms maintain Ethereum

Bonk Man notes a shift beneath establishments that take Ethereum as a treasury lively. In a head of the top, Sharplink Gaming Concluded a non-public placement of $ 425 million, led by Consensys Software program Inc, to implement one of many largest Ethereum Treasury methods in public markets.

This means that rising enterprise confidence in ETH is mirrored and the Bitcoin-oriented method displays with micro technique.

ETH removing approval in ETFs might be shut by

Regulatory alerts counsel that ETH STECK Could possibly be allowed quickly in ETF constructions. If accredited, the appreciable institutional influx can unlock and act as a massive bullish catalyst For Ethereum.

Brief squeeze within the entrance?

The analyst additionally identified that many funds and merchants are at the moment insufficient ETH. If the worth is reversed, it might be Activate a brief squeezeStrengthen revenue if merchants rush to cowl positions.

Within the meantime, Weekly lively Ethereum addresses have hit document heights, present the participating consumer involvement and strengthen the matter for lengthy -term progress.

- Additionally learn:

- Arthur Hayes predicts Bitcoin Surge as Financial institution of Japan enlighten the coverage

- “

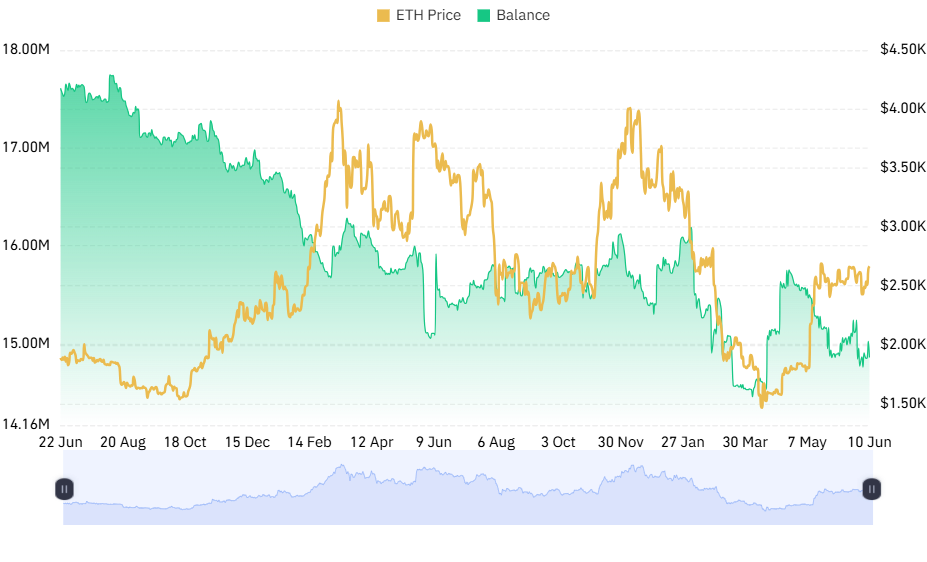

ETH providing exchanges is shrinking

Ethereum – providing for commerce festivals is falling quickly – an indication that merchants transfer property to chilly storage or deployment, lowering gross sales strain.

Outstanding 30-day ETH outflows embody:

- Bitfinex: -572,946 ETH

- Coinbase Professional: -2,149 ETH

- OKX: -13,627 ETH

- Crack: -6,428 ETH

- Bithumb: -19.572 ETH

In complete, Topchairs Together with Binance and Coinbase noticed a mixed Lower of greater than 261,000 ETH.

Excessive strike of all time and low 2 tree

The Ethereum Ecosystem can be increasing, with Greater than 34.6 million ETH has now been arrangelocking a substantial a part of the supply.

Furthermore, Low 2 networks akin to base present explosive progress, pointing to growing scalability and mainstream acceptance.Backside Line: Though the worth efficiency of Ethereum seems disappointing within the brief time period, on-chain information, ETF influx, treasury acceptance and rising community exercise all to a possible Breakout -Rally On the horizon.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, knowledgeable evaluation and actual -time updates on the most recent traits in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

The value of Ethereum has risen at this time because of the fixed robust influx into ETFs (eg Blackrock, Constancy), growing institutional belief, a shrinking vary on exchanges and the overall constructive sentiment within the Crypto market with Bitcoin approaching $ 110,000.

The report of the US Client Worth Index (CPI), which owes this Wednesday, is essential. If the inflation information is greater than anticipated, this crypto -sentiment and ETH value might dampen. Conversely, decrease than anticipated CPI might trigger a revenue for ETH.

In response to our ETH value forecast 2025, the ETH value might attain a most of $ 5,925.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September