Analysis

Is this a Calm of Maturity or Just the Eye Before the Next Storm?

Credit : coinpedia.org

The American Bureau of Labor Statistics has launched the CPI inflation of Could, rose to 2.5% yoj, matching expectations. With out surprises and apparently no shocks for the markets. Regardless of the rise, Bitcoin, shares and altcoins remained steady with out panic, not a rally, however merely quiet resilience. This means that the markets in gentle inflation are priced as the brand new regular, as a result of buyers are extra centered on velocity choices, ETF streams and wider macro tales than a CPI quantity.

Now that the BTC value has formally traded greater than $ 100,000 for 30 consecutive days for the primary time in historical past, the Upsswing will proceed to new highlights?

Bitcoin has skilled a persistent adoption of states, banks and corporations, which have marked a brand new period of institutional confidence in BTC. Like some reports116 public firms now have 809.1k Bitcoin, a rise of 312.2k a yr in the past. Furthermore, virtually 100k BTC has been added for the reason that starting of April alone, with 25+ firms that make new firms public. The information additionally reveals that micro technique and different establishments have intensified their accumulation since November 2024 when the market rose above the consolidation section.

Since then, the BTC value has maintained a robust rising development and it’s only 3% to 4% away from the ATH. Nonetheless, the whales stay optimistic and never fascinated by eradicating their revenue.

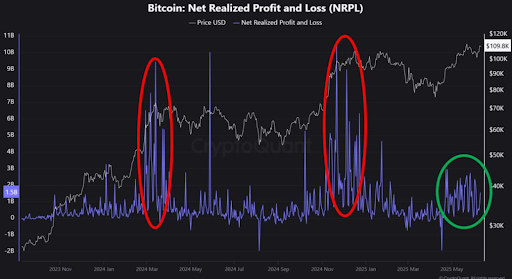

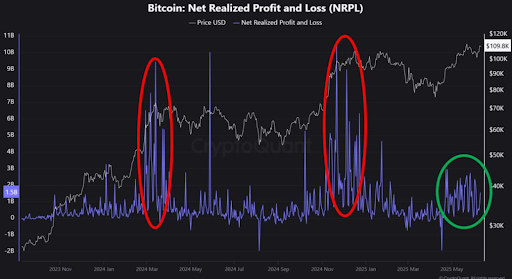

The graph above reveals the web realized revenue or loss, which each and every time the BTC value has risen above consolidation. This was geared toward extracting revenue such because the whales and the buyers could not place confidence in the approaching value motion. Nonetheless, the present breakout doesn’t appear to have attracted them to change off the win, as a result of the whales appear to be bullish on Bitcoin and count on the worth to retain a robust revival. This means that the BTC value could be retained a robust rising development and ultimately marks a brand new ATH quickly.

Bitcoin at present entered the final resistance zone previous to an ATH, however has nonetheless not damaged the barrier. Furthermore, the worth is a major improve in quantity of round $ 36 billion to virtually $ 60 billion. This means panic gross sales, however the query stays whether or not the worth will include a very powerful ranges about $ 106k after falling lower than $ 108k. If this occurs, a brand new ATH could be gone for a number of weeks; In any other case, the Bitcoin value (BTC) can get a deeper correction and attain ranges just below $ 100,000 and trigger a robust revival to mark a brand new ATH.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024