Bitcoin

Bitcoin’s next move: Retail euphoria can push BTC to $112K, ONLY IF…

Credit : ambcrypto.com

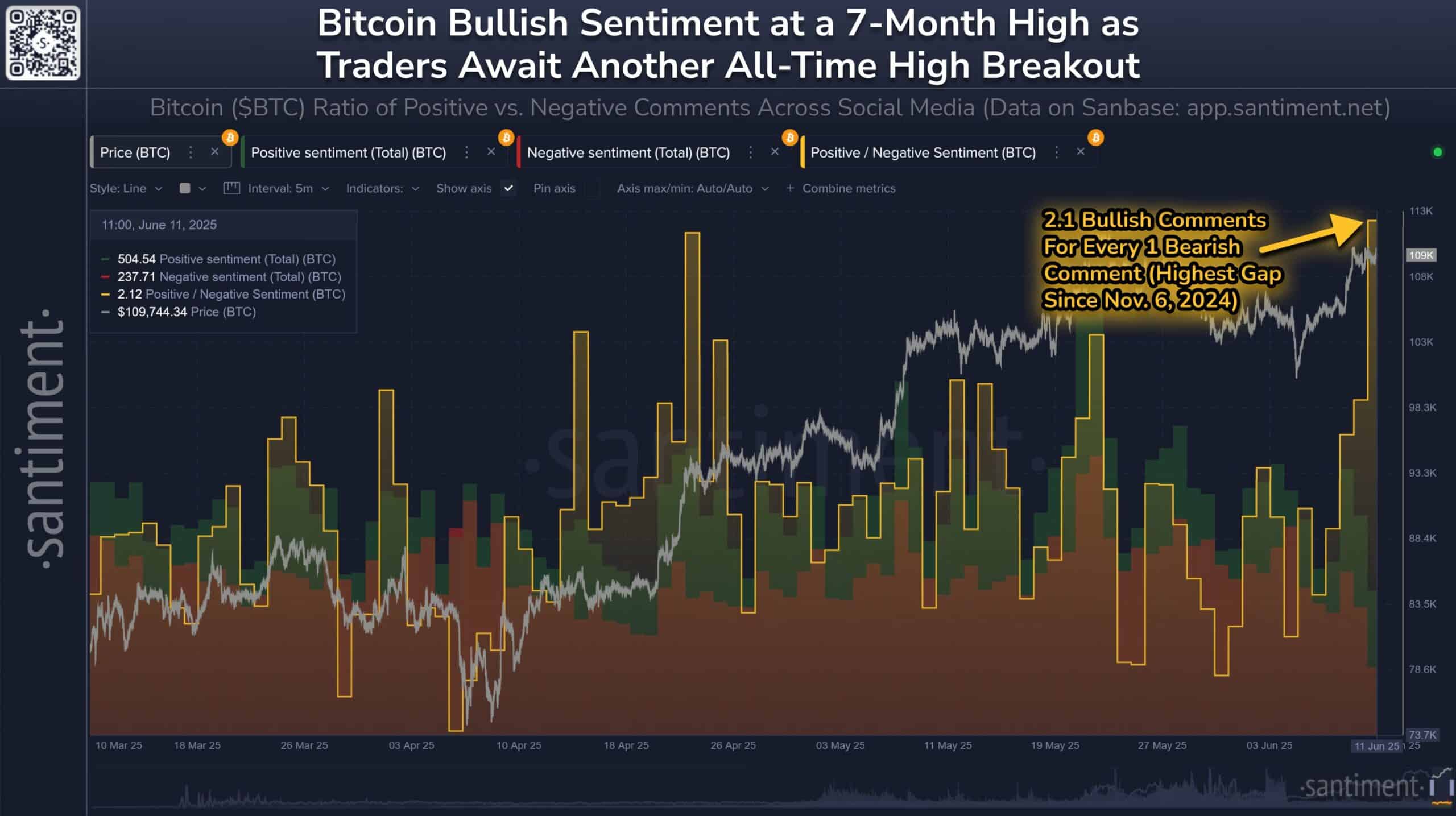

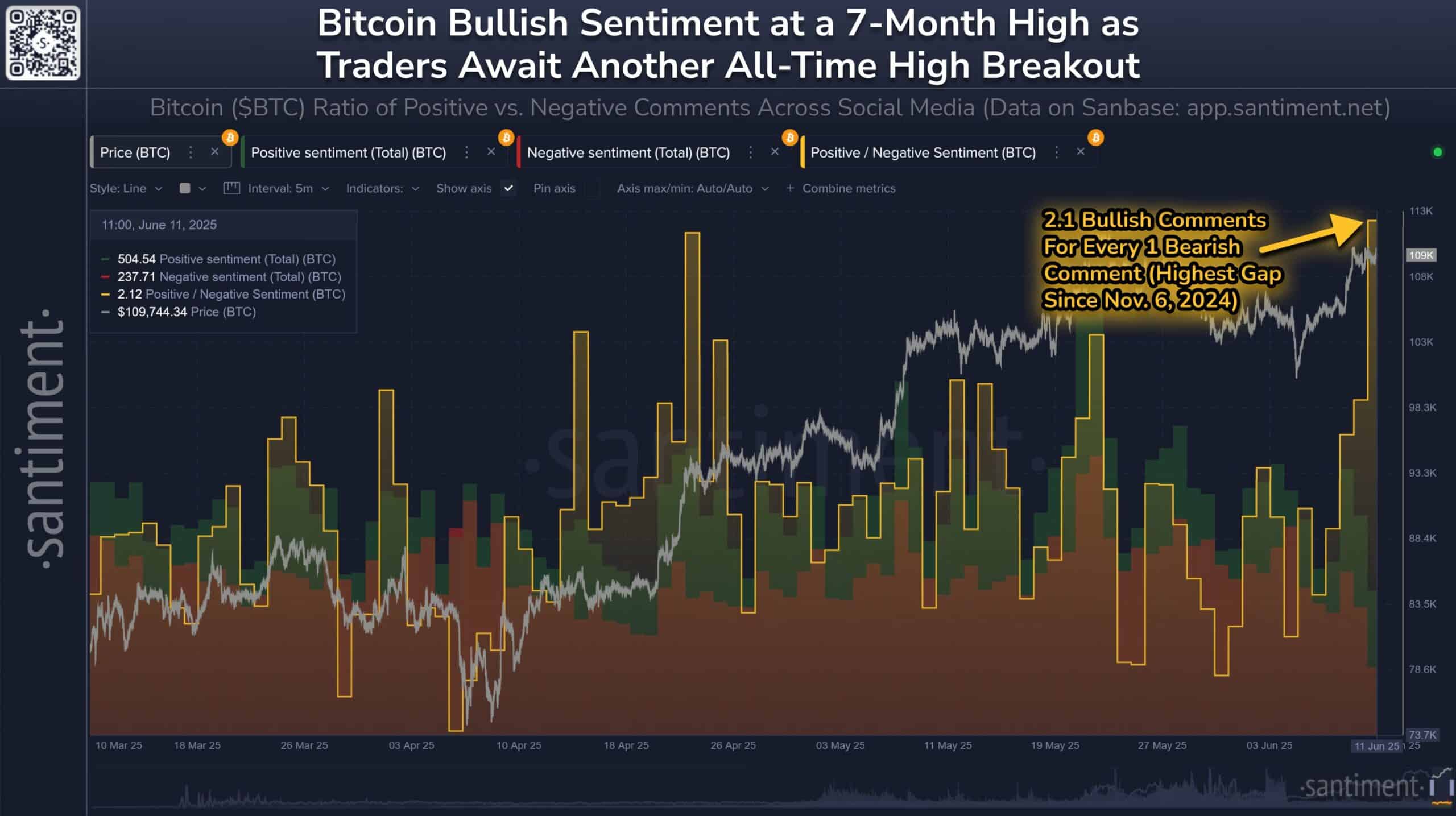

- The social sentiment of Bitcoin achieved a 2.1 bullish-to-bearable ratio, the best since November 2024.

- Evaluation of MVRV ratio, trade reserves and liquidation card revealed potential reversal triggers.

Bitcoin [BTC] Noticed a wave of retailers euphoria when the sentiment of social media hit a spotlight of seven months.

On the time of the press, BTC traded at $ 107,927-Slechts 3.6% shy of his earlier of all time.

After all, social information mirrored this momentum.

Santiment information shown The ratio of bullish to BEARISH BTC remarks has risen to 2.1 – the best since November 2024 – that reveals sturdy optimism.

Nonetheless, as the value clustered liquidation zones approaches, the subsequent step will most likely rely on how lifting tree positions react to this sentiment -driven momentum.

Supply: Santiment

Are BTC holders too deep revenue for this rally to proceed?

The MVRV ratio was 2.27 – NODB then above the hazard zone of two.0 that’s traditionally preceded the distribution phases.

Nonetheless, the autumn of 1.97% on this statistics over the past day suggests a slight discount in non-realized income, presumably because of gentle corrections or early worthwhile.

Though the sentiment stays sturdy bullish, this delicate dip in MVRV can point out that merchants are beginning to acquire the revenue, so {that a} low warning is added as Bitcoin inches nearer to $ 112k resistance.

Supply: Cryptuquant

Will Stablecoin Firepower feed the subsequent leg?

The stablecoin vitamin ratio climbed 0.98% to 18.21, which suggests that the rising of dry powder on the sidelines.

This means that merchants might put together for using capital, particularly if BTC knew $ 108k convincingly. That’s the reason recent capital can stimulate the upward momentum.

Nonetheless, the present average improve means that though Stablecoin is constructing ammunition, the tempo stays cautious, which emphasizes the necessity for sturdy convictions to interrupt over essential resistance ranges.

Supply: Cryptuquant

Are Falling Trade a hidden bullish set off?

Trade Reserve fell to $ 269.7 billion and fell 1.67percentwithin the final day.

This step usually signifies a bullish pattern, as a result of it means that merchants deduct cash from festivals for lengthy -term storage as an alternative of getting ready for promoting.

Consequently, this diminished supply may restrict gross sales strain within the brief time period.

Nonetheless, until accompanied by recent consumption or rising demand, the provision facet is just not sufficient to push Bitcoin excessive by giant liquidation zones close to the earlier all time.

Supply: Cryptuquant

Might aggressive lungs be liquidated above $ 112k?

In line with the liquidation warmth, Dense clusters of 50x and 100x lengthy positions are simply above the present value ranges.

If BTC is rejected there, a cascade of liquidations can rapidly calm down.

Alternatively, if the value cuts the value of $ 112k neatly by the $ 112k, it could actually flip a wave of brief liquidations and gas the other way up.

Supply: Coinglass

Will BTC Bullish Sentiment Barrières or counterproductive breaking above $ 112k?

BTC’s method of $ 112K is supported by Bullish Social sentiment, falling trade reserves and rising stablecoin energy.

Nonetheless, raised MVRV ranges and dense liquidation zones above present costs are actual dangers. If the shopping for of Momentum slows down or turns into lifting, the shops can rapidly change euphoria.

For now, market members should stay rigorously optimistic – however ready for volatility as a result of BTC challenges this psychological milestone.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now